Xiaomi’s Revenue Skyrockets by 30.5% as EV Production Hits Milestone, Exceeding Analysts’ Forecasts

Xiaomi's earnings skyrocketed by 30.5% as its electric vehicle sector started to boom. The company raked in a hefty $12.8 billion in the quarter that concluded in September, achieving its target of manufacturing 100,000 EVs within this year.

The firm's earnings for the quarter ending in September amounted to 92.5 billion yuan (US$12.8 billion), exceeding the 90.3 billion yuan prediction by analysts polled by Bloomberg.

The revised net income for the period increased by 4.4% year on year, reaching 6.3 billion yuan, which surpassed the projected 5.9 billion yuan.

The company has expressed its unwavering dedication towards its new objective for the decade 2020-2030. The goal is focused on pumping funds into essential base technologies while also aspiring to be a worldwide pioneer in the ever-advancing field of high-tech innovations, as per the company's statement.

Xiaomi's business division of "intelligent electric vehicles and other new endeavors" amassed a revenue of 9.7 billion yuan, with the company witnessing continued favorable response to its first electric vehicle, the SU7 sedan, which was launched earlier this year. The company reported that it sold 39,790 units of the SU7 series in the third quarter.

Xiaomi's CEO, Lei Jun, disclosed on Weibo last week that the company has reached its target of manufacturing 100,000 cars this year. In a new post on Monday, he stated that the company now aims to deliver 130,000 vehicles.

The main business of the company based in Beijing, which involves smartphones and "artificial intelligence of things" (AIoT) – a classification encompassing Internet of Things and lifestyle items – generated 82.8 billion yuan in the quarter. This indicates a yearly growth of 16.8 percent.

Business

China’s Tech War: The Race Towards AI Self-Sufficiency with DeepSeek’s Latest Models

Tech battle: Chinese chip companies turn to DeepSeek for AI independence push

China's top chip creators, from Moore Threads to Iluvatar Corex, are swiftly integrating the newest models from DeepSeek.

The semiconductor company stated that DeepSeek's open-source V3 and R1 models have significantly advanced AI development and served as a source of motivation for developers.

In order to advance the growth of the local AI environment, Moore Threads plans to make its exclusive KUAE GPU smart computing cluster available to completely back the distributed implementation of DeepSeek's V3 and R1 models. This is the company's statement, pointing to its comprehensive solution for AI data hubs that are built on its own chips.

Huawei's Ascend cloud service depended on its proprietary Ascend solution for computing capabilities. This could include a range of hardware such as the firm's own server clusters, AI modules, and accelerator cards, as per their website.

Business

DeepSeek vs Trump Tariffs: Navigating the Uncertain Waters of China’s Market in the Year of the Snake

DeepSeek versus Trump's import charges: what will be the reaction of China's markets in the Year of the Snake?

There's a high probability that investors will proceed with caution as trading begins in the Year of the Snake, while they anticipate the results of discussions between Trump and Xi.

The future of the market is still uncertain due to tense relations between the US and China, but analysts predict that tech firms specializing in AI will benefit from advancements made by DeepSeek. They further noted that businesses in export-heavy industries like textiles, household appliances, electronics, and chemicals could potentially suffer losses.

Investors might opt to remain uninvolved while they anticipate the result of a conversation between US President Donald Trump and Chinese President Xi Jinping this week. The aim of this discussion is to prevent the escalation of a trade war between the two biggest global economies.

Investors are expected to welcome technology companies with enthusiasm due to the arrival of DeepSeek, according to Ivan Li, a portfolio manager at Loyal Wealth Management in Shanghai, who spoke on Tuesday. However, he cautioned that a surge in tech shares alone won't guarantee a strong opening for the comprehensive market post-holiday.

One hour and eighteen

Trump: Chinese AI company DeepSeek's impressive performance is a 'reality check' for the US technology industry.

DeepSeek, headquartered in Hangzhou, unveiled two potent large language models last month, which were constructed utilizing significantly less resources and computational power than their American counterparts. The efficacy of these models was evidenced by their comparable performance with ChatGPT, a generative AI chatbot engineered by the internationally renowned company, OpenAI.

Following the Trump administration's introduction of a 10% tax on Chinese exports during the weekend, Beijing responded on Tuesday. They imposed a 15% tariff on American coal and liquefied natural gas, and a 10% tariff on crude oil, agricultural equipment, high-polluting cars, and pickup trucks.

Business

Chinese Markets Stumble Amid Trade Tensions; Tech Stocks Shine as DeepSeek Effect Captivates Investors

Shares in China drop in both Hong Kong and the mainland due to uncertainty over tariffs

Tech stocks excel as the allure of the DeepSeek effect attracts investors

Tech stocks excel as the allure of the DeepSeek effect attracts investors

Stock markets in Mainland China and Hong Kong experienced a decline on Wednesday. This was mainly due to investors considering the ongoing trade disputes with the US and the increasing excitement concerning the local artificial intelligence (AI) industry.

The Hang Seng Index experienced a 0.9 per cent decrease, closing at 20,597.09, thus giving up a portion of Tuesday's most significant rise in three months. Meanwhile, the Hang Seng Tech Index saw a 1 per cent drop.

The primary indices on the mainland began strong but eventually fell, as the CSI 300 Index dropped by 0.6 per cent and the Shanghai Composite Index decreased by 0.7 per cent. Tech stocks in both indices showed superior performance.

On the domestic market, Beijing Kingsoft Office Software saw a dramatic increase of 18.2 per cent, reaching 371.11 yuan. Additionally, Kunlun Tech rose by 18 per cent, hitting 43.51 yuan, while iFlyTek experienced a 7.4 per cent growth, reaching a value of 54.43 yuan.

Within the Hang Seng Index, clothing manufacturer Shenzhou International Group Holdings plummeted by 6.5 per cent, falling to HK$58.80. Concurrently, Nongfu Spring also experienced a decrease of 6.9 per cent, dropping to HK$34.85.

Technology shares generally performed poorly, with JD.com experiencing a 3.5 per cent decline to HK$156.50 and Trip.com seeing a 6.4 per cent drop to HK$534. Additionally, the Beijing-based computing platform, Kingsoft Cloud, saw a 4.4 per cent decrease to HK$8.20.

US elimination of duty-free status for less expensive or "de minimis" items has impacted Chinese online retail firms. "The effects have become evident following the recent surge in technology stocks," explains Dickie Wong, executive director at Kingston Securities.

Business

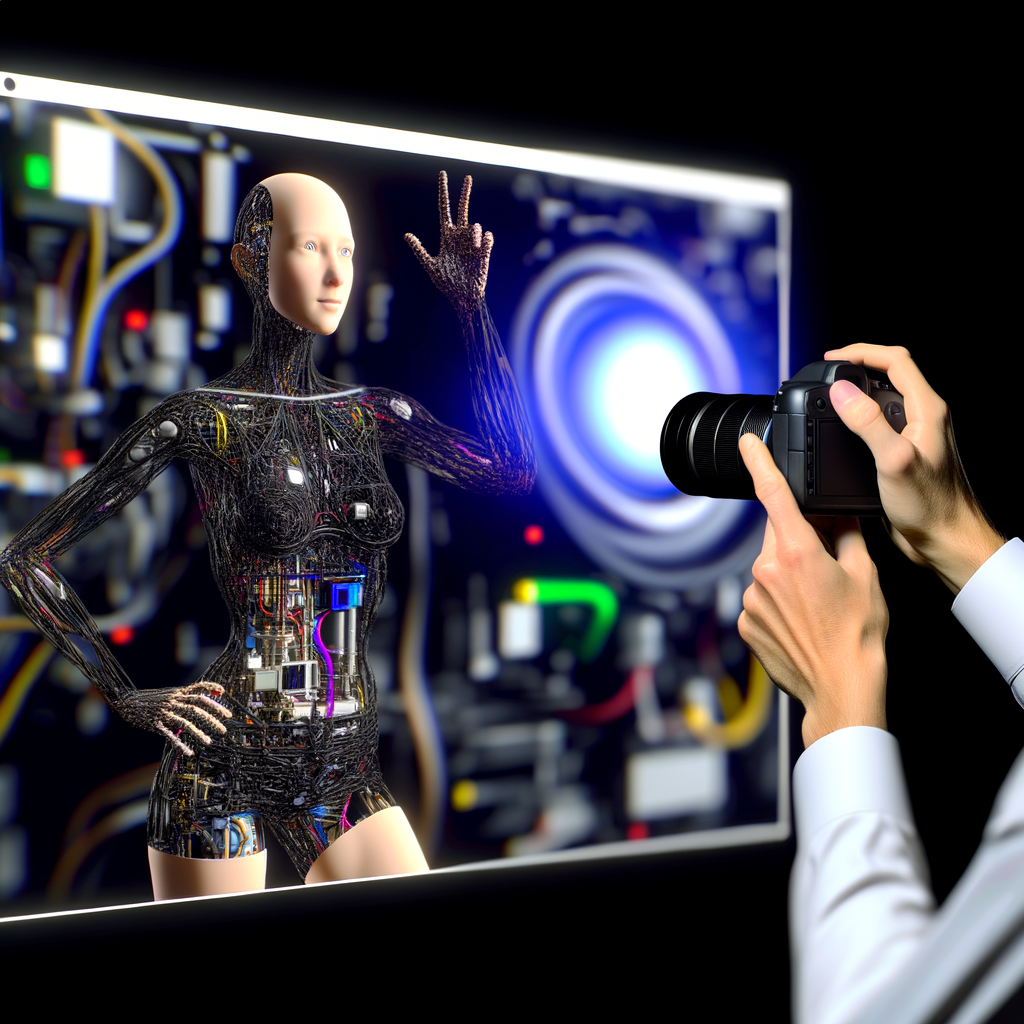

Hollywood Studios Resist OpenAI’s Video Generation Tool Amid Data Privacy and Labour Strife: The Sora Dilemma

Hollywood is pushing back against OpenAI's video creation tool, Sora, due to data and labor issues. OpenAI has been in discussions for months with major studios like Disney and Warner Bros, but the 2023 labor strikes make it a tough proposition.

OpenAI has been in communication for several months with top-tier production houses such as Walt Disney, Universal Pictures owned by Comcast, and Warner Bros Discovery. These talks have centered around the artistic and business possibilities of Sora, as per sources privy to these discussions. OpenAI has contemplated developing a customized variant of the AI tool for a studio's exclusive use in its projects, according to these sources who chose to remain anonymous due to the sensitive nature of the discussions.

Despite ongoing discussions, no agreements have been reached yet. Film studios are hesitant to collaborate with an AI firm, apprehensive about potential misuse of their data and risk of upsetting the labor unions they interact with daily. Fears surrounding the application of artificial intelligence played a significant role in two labor strikes that brought Hollywood to a standstill in 2023. Both scriptwriters and performers persistently encourage Hollywood studios to monitor tech firms and safeguard their work from unauthorized usage.

Quarter to Two

Cartoon series created by Chinese artificial intelligence aired on national TV

OpenAI has expressed that it might be too early to hastily enter into business collaborations for the product.

"Brad Lightcap, the Chief Operating Officer of OpenAI, commented at a January conference, 'We are still in the initial stages with Sora.' He believes that to ensure success, it's not enough to simply announce, 'We have a model, let's push for a partnership.' Lightcap highlighted that the company is actively involved with the industry, and views their feedback as extremely beneficial."

Business

Xiaomi’s Market Value Soars to HK$1 Trillion: A Deep Dive into China’s Self-Driving EV Revolution

Xiaomi's market worth exceeding a trillion Hong Kong dollars and autonomous driving elements in China's latest vehicles: 5 key updates on electric vehicles

Xiaomi's market cap exceeding a trillion Hong Kong dollars and the introduction of autonomous driving capabilities in new Chinese cars are among the five electric vehicle updates you might have overlooked.

1. Xiaomi's market worth exceeds HK$1 trillion due to optimistic outlook on EV sector

For the first time, Xiaomi's market worth has surpassed HK$1 trillion (US$128.4 billion), as its shares soared to a record high. The third-largest smartphone producer in China is experiencing the advantages of branching out into the production of electric vehicles (EVs).

2. China plans to introduce 15 million self-driving EVs this year

Approximately 15 million new vehicles, including those priced less than 100,000 yuan (US$13,914), are slated to hit Chinese roads this year, equipped with basic self-driving capabilities. This development is due to the decreasing costs of this technology, as per industry projections.

3. Long-distance routes prove more cost-effective with electric trucks than diesel ones, says specialist.

Business

Iconic Restaurants Eggslut and The Ark Close Hong Kong Outlets Amid Retail Shift: A Glimpse at the Evolving Dining Scene

Eggslut and The Ark, popular eateries, are set to close their locations in Hong Kong amidst retail turmoil. The Ark, a renowned burger spot, is expected to shut down its Russell Street location by the end of this week. It aims to move to Shenzhen in response to changing consumer spending habits.

A growing number of restaurant owners in Hong Kong are either closing up shop or relocating their businesses due to a progressively difficult retail landscape. This comes as local citizens choose to spend their money outside the city, and mainland Chinese tourists are becoming more frugal with their shopping and dining expenses.

"Eggslut is profoundly thankful to both Hong Kong and its citizens for their backing," the company expressed in an Instagram post, promising to "reorganize and make a comeback" when the time is right. "The extensive lines, the happiness displayed by our patrons, and every virtual thumbs-up and share – these instances will always hold a special place in our hearts."

Four thirty-six

Residents of Hong Kong are searching for deals on items such as roast chicken and soap at a US bulk goods store located in mainland China.

The only Eggslut branch in Hong Kong, which started its operations in June 2023 and quickly became popular with its fashionable menu, announced it would shut down on February 23.

Business

Steady Yuan amidst US Tariffs: China’s Strategic Move in the Trade War and Its Implications

China maintains yuan's steadiness against the US dollar: implications for the trade conflict

China has the ability to let its currency depreciate to counterbalance the effect of US duties on its exports, however, it has thus far chosen not to do so.

The People's Bank of China established a higher than anticipated rate for the yuan compared to the US dollar on Wednesday. This indicates that China does not intend to mitigate the effects of US tariffs by permitting its currency to depreciate.

On Wednesday, the People's Bank of China established the exchange rate for the yuan at 7.1693 against the US dollar. This is slightly lower than the rate of 7.1698 that was set in late January.

The adjustment rate, also referred to as the midpoint rate, is vital in setting the domestic yuan's exchange rate, since the PBOC permits trading to increase or decrease by only 2 per cent from its established rate daily.

Several experts had predicted that the PBOC would establish a reduced rate for the yuan this year, as a devaluation of the Chinese currency could lessen the effects of US tariffs on Chinese exporters. The US administration increased tariffs on Chinese goods by 10 per cent on Tuesday.

The established rate today was higher than what the market had predicted. This indicates that China probably won't offset tariff effects by devaluing the yuan," stated Ding Shuang, the head economist for Greater China at Standard Chartered Bank.

Discussions on trade between the US and China have yet to commence. Establishing a robust exchange rate could aid in fostering a positive environment for negotiation, with the US also not in favor of a drastic devaluation of the yuan.

Business

End of a Potential Historic Partnership: Nissan Pulls Out of Proposed Merger Talks with Honda, Nikkei Reveals

Nissan plans to withdraw from a significant partnership with Honda, according to Nikkei.

The two companies were in discussions about a merger where Honda would take over Nissan, resulting in both brands being owned by one parent company in 2026.

The pair of rivals couldn't agree after seven intense yet brief weeks of negotiations, as per the publication, quoting unnamed sources. This sudden conclusion put a halt to what might have been a groundbreaking alliance for the Japanese car sector.

Trading of Nissan's stocks was halted on the Tokyo Stock Exchange following the report. Meanwhile, Honda's stocks experienced a surge of up to 12 per cent, whereas Nissan saw a decrease of up to 6.4 per cent.

Representatives from both firms clarified that the report was not grounded on any official statements from either side and that a blueprint for continuing negotiations is set to be revealed, although already postponed once, in mid-February. Tensions arose between the two this week following media claims that Honda suggested a full takeover, an idea that was firmly resisted within Nissan.

Business

Tesla and Xpeng Ignite China’s EV Market with Unprecedented Insurance and Loan Subsidies: A Response to BYD’s Price Reduction

Tesla and Xpeng reignite the electric vehicle price battle in China by providing subsidies on insurance and loans

In response to BYD's December price reduction, Tesla and Xpeng are offering discounts on car insurance and loans in February.

Tesla and Xpeng are extending discounts on car insurance and loans this February, as a counter to BYD's price reduction in December.

Purchasers of the Model 3 sedans manufactured in Shanghai will be granted a subsidy of 8,000 yuan (equivalent to US$1,098) towards vehicle insurance, according to a statement released by the US electric vehicle manufacturer on Wednesday, as operations resume post-Lunar New Year holiday. The company also promised a five-year, zero-interest loan to qualifying customers, resulting in savings of around 20,000 yuan.

Tesla announced that the incentives were the most significant promotional offer for all its Model 3 variants, which are priced between 227,500 and 331,500 yuan, since the end of 2019. This was when its Gigafactory located just outside Shanghai began its operations.

For the first time, the company announced that Chinese customers will be provided with insurance subsidies and interest-free loans simultaneously. The proposal is set to expire on February 28, the firm further clarified.

Two minutes past one

China intensifies support for swapping traditional vehicles for electric ones.

Business

Alibaba’s Qwen AI Model Surpasses DeepSeek’s V3 in Global Chatbot Ranking, Yet Trails Behind DeepSeek-R1

Alibaba's newly improved Qwen AI model surpasses DeepSeek's V3 in the chatbot hierarchy. Ranking seventh in the Chatbot Arena, Alibaba Cloud's Qwen2.5-Max outperforms DeepSeek-V3 which stands at the ninth position, however, it still lags behind DeepSeek-R1 that holds the third place.

The Chinese start-up, known as DeepSeek-V3, surprised the international tech world when it was launched in late December and is currently holding the ninth position.

Twenty past one

Alibaba from China launches a fresh AI model, reportedly surpassing rival entities Deepseek and OpenAI's GPT-4o.

Business

Revamping Hong Kong’s Residency Scheme: Midland Chief Freddie Wong Advocates for Property-Friendly Changes to Bolster Real Estate Market

The head of Midland proposes alterations to Hong Kong's monetary residency program to benefit the property sector. Freddie Wong Kin-yip believes these modifications will bolster the faltering real estate market in Hong Kong.

On Wednesday, Wong suggested that those applying to the new Capital Investment Entrant Scheme (CIES) should be permitted to count a greater portion of their real estate purchases towards their investment obligation for the residency program. Currently, the CIES mandates that applicants must invest a minimum of HK$30 million (US$3.9 million) in assets such as funds, stocks, bonds or other forms in return for family residency.

Initially, real estate was not included in the list of sanctioned assets. However, in October, the government announced that investments in properties purchased for a minimum of HK$50 million would be considered in an application, with a maximum limit of HK$10 million.

Wong also proposed that payment of stamp duties should be deferred until homebuyers have moved into their new homes. He believes this would alleviate financial strains and provide an opportunity for investors to sell off properties if they encounter financial troubles.

"In the present scenario, with a large number of unsold properties, these steps will aid in clearing the market," stated Wong. "The influx of immigrant investors can also contribute to economic expansion."

Business

DeepSeek’s Future Uncertain: AI Startup Remains Silent Amid Post-Holiday Accolades, Hints at Reinforcement Learning Advancements

What's on the horizon for DeepSeek? The AI startup remains silent despite post-holiday praises

A social media post from a researcher on February 1, now deleted, suggested the use of 'reinforcement learning' as a means to improve their AI systems.

The building's property management escorted all unexpected guests to a separate room to decline their visit requests. The doorway to DeepSeek's headquarters on the building's 12th floor was securely locked. A quick glance through the glass doors revealed holiday adornments strewn across the floor.

-

AI4 months ago

AI4 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Sustainability and Safety on the Road

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology is Driving Us Towards a Sustainable and Connected Future

-

Tech2 months ago

Tech2 months agoDriving into the Future: Top Automotive Technology Innovations Transforming Vehicles and Road Safety

-

Tech2 months ago

Tech2 months agoRevolutionizing the Road: Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoRevolutionizing the Road: How Top Automotive Technology Innovations are Driving Us Towards an Electric, Autonomous, and Connected Future

-

AI4 months ago

AI4 months agoGoogle’s NotebookLM Revolutionizes AI Podcasts with Customizable Conversations: A Deep Dive into Kafka’s Metamorphosis and Beyond