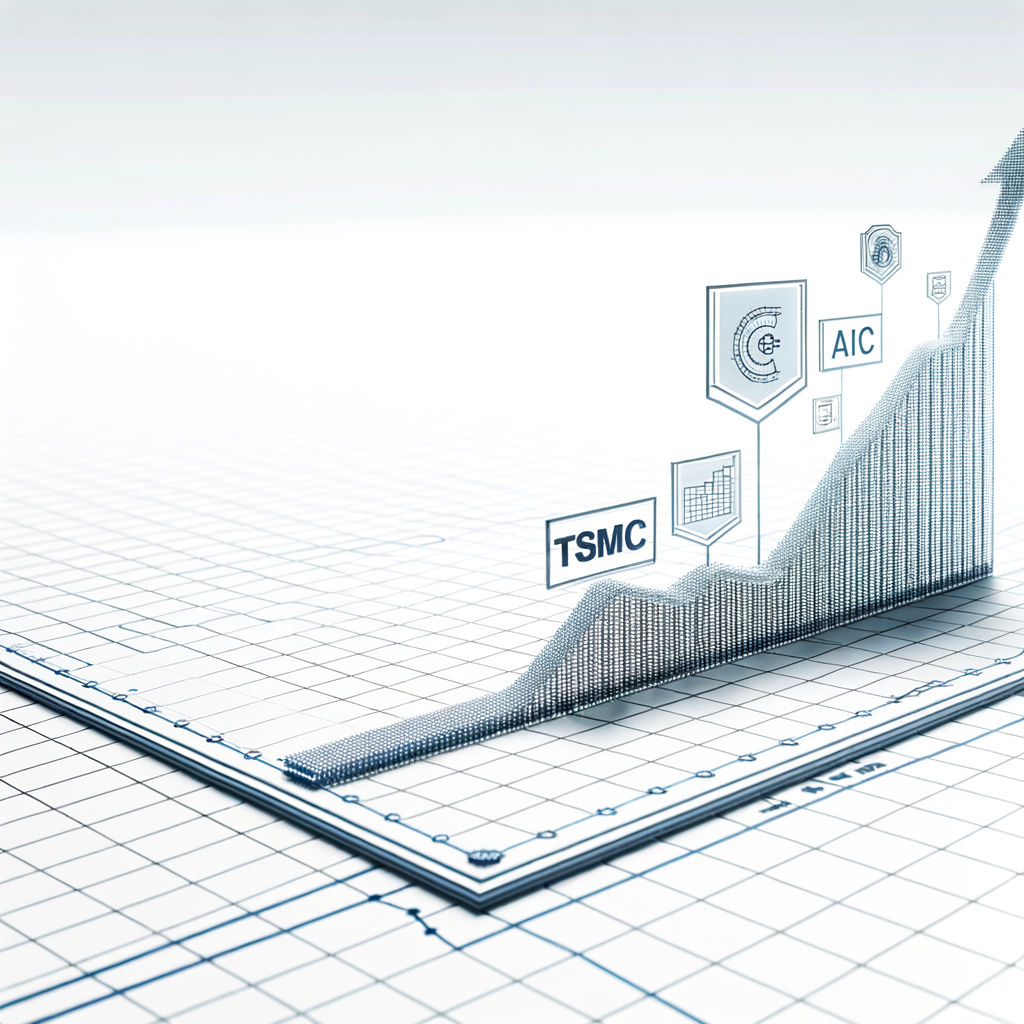

Surpassing Expectations: TSMC’s Sales Skyrocket, Propelling AI’s 2025 Prospects Amid Global Tech Race

TSMC, the chip provider for Apple and Nvidia, has exceeded sales predictions, enhancing the projected growth of AI by 2025. The leading global contract chip producer saw a 39% increase in revenue, earning US$26.3 billion from October to December.

TSMC experienced a boost in growth in December, concluding with a 34 per cent increase in revenue for 2024. This is greater than TSMC's initial goal of a 30 per cent yearly increase, which was stated in US dollars. As the world's top contract producer of high-tech chips, TSMC has significantly profited from the worldwide competition to advance AI.

Business

Accelerating Ahead: Mastering the Dynamics of Vehicle Manufacturing, Sales, and Aftermarket Success in the Automotive Industry

In the fast-paced Automobile Industry, success hinges on embracing key trends such as cutting-edge Automotive Technology, including electric vehicles and autonomous driving, which cater to environmental concerns and consumer desires for innovative transportation. The sector is undergoing a digital makeover, with Vehicle Manufacturing and Automotive Sales needing to adapt to these Market Trends and Consumer Preferences. Aftermarket Parts, Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services are all vital areas experiencing growth and transformation through enhanced Supply Chain Management, stringent Regulatory Compliance, and Industry Innovation. Automotive Marketing strategies are crucial for engaging customers and maintaining a top position in the competitive market. By investing in new technologies and prioritizing customer-centric services, businesses within the Automobile Industry can navigate the evolving landscape successfully, ensuring top performance and customer loyalty.

In the ever-evolving landscape of the automobile industry, businesses are constantly on the lookout for the latest trends, innovations, and strategies that can propel them ahead of the competition. From vehicle manufacturing to automotive sales, and aftermarket parts to car dealerships, the automotive sector is a vast and dynamic field that demands a keen understanding of market trends, consumer preferences, and regulatory compliance. As technology continues to reshape the way we think about transportation, automotive businesses must adapt to stay relevant and successful. This article delves into the heart of the automotive industry, exploring key areas such as automotive repair, car rental services, and vehicle maintenance, while highlighting the importance of supply chain management, industry innovation, and effective automotive marketing. Join us as we navigate the fast lane, examining the top trends and innovations that are driving the automobile industry forward and uncover strategies for revving up automotive sales, aftermarket growth, and customer satisfaction. Whether you're involved in vehicle manufacturing or operate a car dealership, understanding these elements is crucial for steering your business towards success in a competitive and ever-changing market.

- 1. "Navigating the Fast Lane: Top Trends and Innovations in the Automobile Industry"

- 2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Growth, and Customer Satisfaction"

1. "Navigating the Fast Lane: Top Trends and Innovations in the Automobile Industry"

In the rapidly evolving landscape of the Automobile Industry, businesses are constantly challenged to stay ahead of the curve, adapting to the latest market trends and consumer preferences. From Vehicle Manufacturing to Automotive Sales, and from Aftermarket Parts to Car Dealerships, every segment of the industry is witnessing a wave of innovation and transformation.

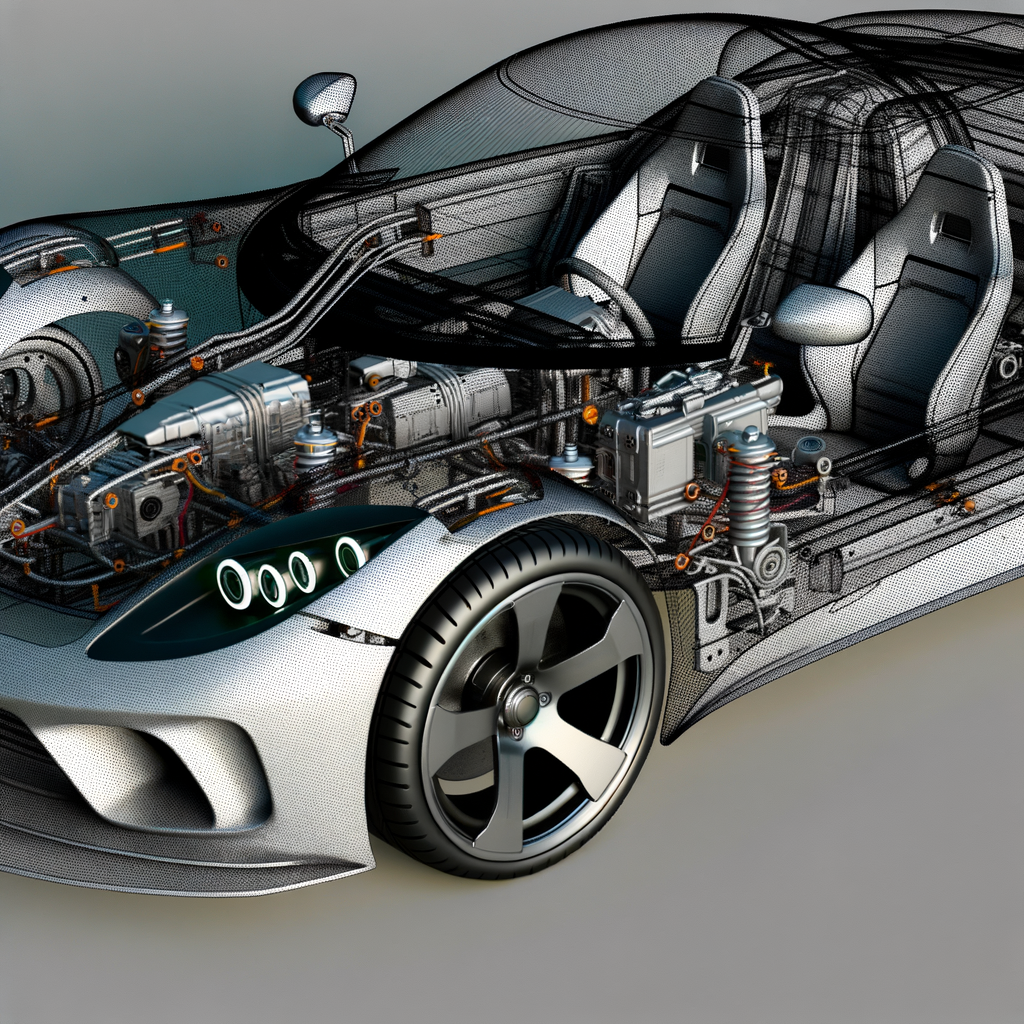

One of the top trends reshaping the Automobile Industry is the surge in Automotive Technology, particularly in electric vehicles (EVs) and autonomous driving systems. This shift not only responds to growing environmental concerns but also aligns with consumer preferences for more sustainable and technologically advanced transportation options. Vehicle manufacturers are investing heavily in research and development to pioneer new technologies that promise to redefine our driving experiences.

Moreover, the Automotive Repair and Vehicle Maintenance sectors are adapting to these technological advancements. With vehicles becoming more complex, these services are leveraging new diagnostic tools and software to ensure efficiency and precision, enhancing the overall customer experience. This evolution is crucial for maintaining trust and reliability in the face of increasingly sophisticated automotive technologies.

The integration of digital platforms in Automotive Sales and Car Rental Services is another noteworthy trend. E-commerce and online booking systems are becoming standard, enabling businesses to reach a broader audience while providing customers with the convenience of exploring, purchasing, or renting vehicles from the comfort of their homes. This digital shift is part of a broader trend towards more personalized and customer-centric services, driven by data analytics and digital marketing strategies that help businesses better understand and meet consumer demands.

Supply Chain Management has also emerged as a critical focus area, especially in light of recent disruptions caused by global events. Automotive businesses are reevaluating their supply chains, aiming for more resilience and flexibility. This includes diversifying sources, investing in supply chain technologies, and closer collaboration with suppliers to mitigate risks and ensure continuity in production and service delivery.

Regulatory Compliance remains a pivotal concern, with governments worldwide imposing stricter regulations on emissions, safety, and data protection. Automotive businesses must navigate these regulatory landscapes, ensuring their vehicles and operations comply with the latest standards. This is not only crucial for legal adherence but also for building consumer trust and safeguarding the environment.

Lastly, Industry Innovation and Automotive Marketing are at the heart of navigating the competitive automotive landscape. Innovative marketing strategies, including social media engagement, influencer partnerships, and experiential marketing, are becoming increasingly important for brands looking to stand out. Coupled with a commitment to innovation, from product development to customer service, these strategies are key to driving growth and securing a competitive edge in the fast-paced world of the Automobile Industry.

In conclusion, the Automobile Industry is at a crossroads of technological innovation and changing consumer expectations. Success in this dynamic sector requires a concerted effort across Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services to embrace new technologies, adapt to market trends, ensure regulatory compliance, manage supply chains effectively, and engage customers with innovative marketing. As the industry continues to evolve, staying informed and agile will be paramount for businesses aiming to thrive in the fast lane of the automotive world.

2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Growth, and Customer Satisfaction"

In the fast-paced world of the Automobile Industry, businesses are constantly seeking innovative strategies to drive Automotive Sales, expand in the Aftermarket Parts sector, and enhance Customer Satisfaction. Success in Vehicle Manufacturing and sales hinges on a multifaceted approach that balances market trends, consumer preferences, and regulatory compliance. Here, we delve into effective strategies that can propel automotive businesses to the forefront of the industry.

Understanding and adapting to Market Trends is vital for any player in the Automobile Industry. The shift towards electric vehicles (EVs) and autonomous driving technology is a clear example of how consumer preferences and regulatory compliance are shaping the future of Vehicle Manufacturing and Automotive Sales. Businesses that invest in Automotive Technology and align their offerings with these trends not only position themselves as industry leaders but also meet the evolving needs of their customers.

Another crucial area for growth is the Aftermarket Parts sector. With vehicles becoming more advanced, the demand for high-quality, innovative aftermarket solutions is on the rise. Supply Chain Management plays a pivotal role in ensuring the availability and timely delivery of these parts. Companies that can efficiently manage their supply chains while offering top-notch parts and accessories are more likely to capture a significant share of the market. Additionally, leveraging Industry Innovation to improve the quality and performance of aftermarket products can lead to increased customer loyalty and repeat business.

Car Dealerships and Automotive Repair shops are at the heart of the automotive customer experience. For these businesses, prioritizing Customer Satisfaction through superior service and transparent communication is key. Implementing Automotive Marketing strategies that emphasize the unique value propositions of their services, such as exceptional Vehicle Maintenance or reliable Automotive Repair, can attract more customers. Moreover, offering personalized experiences and fostering a sense of trust can turn one-time visitors into lifelong patrons.

Furthermore, Car Rental Services must not be overlooked. These services add valuable flexibility and convenience for consumers, especially in urban areas and during travel. By integrating the latest Automotive Technology into their fleets and offering user-friendly booking platforms, car rental companies can significantly enhance customer satisfaction and loyalty.

In conclusion, navigating the competitive landscape of the Automobile Industry requires a comprehensive approach that includes staying abreast of Market Trends, investing in Aftermarket Parts and Automotive Technology, ensuring Regulatory Compliance, and focusing on Customer Satisfaction. Through effective Supply Chain Management, Industry Innovation, and targeted Automotive Marketing, businesses can rev up their success and drive into the future with confidence.

In conclusion, the automotive business remains a cornerstone of the global economy, intricately linked to advancements in automotive technology, shifts in consumer preferences, and the ever-evolving regulatory landscape. As we've explored, thriving in this dynamic sector requires a multifaceted approach, encompassing a keen understanding of market trends, a commitment to industry innovation, and a relentless pursuit of customer satisfaction. From vehicle manufacturing to automotive repair, and from car dealerships to car rental services, every segment of the industry faces its unique challenges and opportunities. Success hinges not only on the quality of products and services offered but also on how effectively businesses can navigate the complexities of supply chain management, regulatory compliance, and automotive marketing.

The top trends and innovations in the automobile industry, including electric vehicles, autonomous driving, and digital integration, are reshaping the landscape of vehicle manufacturing and automotive sales. Moreover, the growing importance of aftermarket parts and the emphasis on superior vehicle maintenance services underline the need for businesses to adapt and evolve. As consumer preferences continue to shift towards more sustainable and technology-driven solutions, automotive businesses must stay ahead of the curve to remain competitive.

In essence, the future of the automotive industry is bright for those who are prepared to rev up their operations, from embracing automotive technology to refining automotive marketing strategies. By focusing on customer experience, embracing industry innovation, and ensuring regulatory compliance, businesses within the automotive sector can accelerate towards success. Whether it's through enhancing automotive sales, expanding aftermarket growth, or excelling in vehicle maintenance and automotive repair services, the roadmap for thriving in the automotive business is clear. It requires a blend of tradition and innovation, a deep understanding of the consumer, and an unwavering commitment to excellence in every aspect of the business.

Business

Driving Success in the Auto Sector: A Comprehensive Guide to Vehicle Manufacturing, Sales, and Maintenance Trends in the Automotive Industry

In the rapidly evolving Automobile Industry, success hinges on embracing top Industry Innovation and Automotive Technology. Businesses focusing on Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, and Car Dealerships must adapt to current Market Trends and Consumer Preferences, including the shift towards electric vehicles and digital features. Regulatory Compliance and effective Supply Chain Management are crucial for ensuring safety, environmental standards, and cost efficiency. By investing in R&D and integrating advancements in Automotive Technology, companies can enhance Vehicle Maintenance, Automotive Repair, and offer competitive Car Rental Services. Moreover, adopting modern Automotive Marketing strategies is essential for highlighting these innovations. Companies that strategically address these areas, ensuring compliance and focusing on consumer demands, will secure a competitive edge in the dynamic Automobile Industry.

In the rapidly evolving landscape of the automobile industry, businesses that are part of the vehicle manufacturing, automotive sales, aftermarket parts, and maintenance sectors are constantly navigating through a maze of challenges and opportunities. From car dealerships to automotive repair shops and car rental services, these entities are the backbone of a sector that not only drives economic progress but also fuels our daily lives. Understanding the dynamics of the automotive market—shaped by cutting-edge automotive technology, shifting market trends, consumer preferences, and stringent regulatory compliance—is more crucial than ever. As we delve into this comprehensive exploration, we will uncover the keys to success in the automotive business, spotlighting the top trends and innovations steering the future of the automobile industry, and revealing effective strategies for achieving excellence in automotive sales, aftermarket parts supply, and consumer satisfaction. Join us as we explore the essential components of navigating the road ahead, from industry innovation and supply chain management to automotive marketing techniques that rev engines and drive growth.

- 1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

- 2. "Revving up Success: Strategies for Automotive Sales, Aftermarket Parts, and Consumer Satisfaction"

1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

In the rapidly evolving landscape of the Automobile Industry, staying ahead requires a keen eye on the top trends and innovations shaping the future of vehicle manufacturing, automotive sales, and aftermarket services. As we navigate the road ahead, several key factors stand out, influencing every aspect from car dealerships to vehicle maintenance, automotive repair, and car rental services. Understanding these dynamics is crucial for businesses aiming for success in a competitive market.

**Technological Advancements in Automotive Technology:** The advent of electric vehicles (EVs), autonomous driving, and connected cars has dramatically shifted the paradigms of vehicle manufacturing. Automotive technology is not just enhancing the driving experience but also pushing the boundaries of what vehicles can achieve, impacting automotive sales and opening new avenues for aftermarket parts and services tailored to these advanced features.

**Consumer Preferences Leading the Way:** Today's consumers are more informed and have specific demands ranging from environmental sustainability to digital connectivity. This shift in consumer preferences dictates the development and marketing strategies of automotive businesses. Companies that align their offerings with these expectations, whether through eco-friendly vehicles or integrating advanced infotainment systems, tend to capture a larger market share.

**The Importance of Regulatory Compliance:** The automotive sector is heavily regulated to ensure safety, environmental standards, and fair competition. Businesses must stay abreast of the latest regulations to avoid hefty fines and legal challenges. This aspect is crucial in vehicle manufacturing, where compliance with emission standards and safety regulations can significantly impact production and, subsequently, automotive sales.

**Supply Chain Management as a Critical Factor:** The global automotive industry relies on a complex supply chain for the production and distribution of vehicles and parts. Efficient supply chain management can reduce costs, improve production times, and enhance product availability, directly influencing automotive sales and the availability of aftermarket parts.

**Embracing Industry Innovation:** From the design and production phases to automotive marketing, innovation drives growth and competitiveness. Companies that invest in research and development (R&D) to bring new products and services to market can establish themselves as leaders in automotive technology and industry innovation.

**Adapting to Market Trends with Effective Automotive Marketing:** As the market evolves, so too must the strategies businesses use to reach their customers. Automotive marketing plays a pivotal role in communicating the value of innovations, such as the benefits of electric vehicles or the convenience of new car rental services, to potential buyers.

In conclusion, the automotive industry is at a crossroads of technological innovation, changing consumer preferences, and regulatory shifts. Businesses that can navigate these complexities through strategic planning, customer-focused solutions, and adaptive marketing strategies are well-positioned to thrive. By focusing on automotive technology, market trends, and industry innovation, companies in the automobile sector can drive forward into the future with confidence.

2. "Revving up Success: Strategies for Automotive Sales, Aftermarket Parts, and Consumer Satisfaction"

In the fast-paced world of the Automobile Industry, businesses within the realms of Automotive Sales, Aftermarket Parts, and Car Dealerships must employ cutting-edge strategies to drive success and foster consumer satisfaction. The key to thriving in Vehicle Manufacturing and the broader automotive sector lies in navigating Market Trends, leveraging Automotive Technology, and ensuring Regulatory Compliance, all while maintaining a robust Supply Chain Management system.

One critical aspect for businesses to excel is to stay abreast of Industry Innovation and Consumer Preferences. As technology evolves, so do the expectations of consumers. Automotive companies that integrate the latest in Automotive Technology into their products and services, such as advanced safety features, electric vehicle (EV) capabilities, and digital interfaces, are more likely to capture the interest of tech-savvy consumers. This integration not only applies to new vehicles but also to Aftermarket Parts, where there is a significant opportunity to offer upgrades and customizations that enhance vehicle performance and user experience.

Furthermore, Automotive Sales strategies have transformed significantly with the digital age. Effective Automotive Marketing now requires a blend of traditional tactics and digital strategies. Online platforms, social media, and digital showrooms have become vital in attracting buyers and facilitating sales. A robust online presence helps dealerships and manufacturers showcase their offerings, engage with potential customers, and build brand loyalty. Virtual reality experiences and digital configurators allow consumers to customize and experience their vehicle before making a purchase, enriching the customer journey.

Vehicle Maintenance and Automotive Repair services also play a crucial role in consumer satisfaction. Offering warranty packages, routine maintenance deals, and excellent repair services can help in retaining customers and encouraging repeat business. Transparency in service offerings and costs, as well as the use of genuine parts, can further boost consumer trust and satisfaction.

In the aftermarket sector, Supply Chain Management is paramount. Efficiently managing the supply chain ensures that Aftermarket Parts are available when consumers need them, reducing wait times and improving customer experience. Moreover, navigating Regulatory Compliance with a focus on environmental and safety standards can serve as a competitive advantage, appealing to consumers who prioritize sustainability and safety.

Lastly, Car Rental Services must adapt to changing consumer preferences and market trends, such as the increasing demand for EVs and hybrid models, to remain relevant. Offering flexible rental terms, a wide range of vehicle options, and incorporating user-friendly digital booking systems can enhance customer satisfaction and loyalty.

In conclusion, businesses in the Automobile Industry must employ a multifaceted approach to succeed in Automotive Sales, Aftermarket Parts, and ensuring Consumer Satisfaction. By staying ahead of technological advancements, adapting to changing consumer preferences, and maintaining high standards of quality and service, automotive businesses can rev up their success in a competitive market.

In conclusion, the automotive business is a multifaceted sector that stands at the crossroads of tradition and innovation. From vehicle manufacturing to automotive sales, and from aftermarket parts to car dealerships, every facet of this industry plays a vital role in shaping our transportation landscape. As we have explored, navigating the road ahead in the automobile industry requires an agile approach, one that is responsive to market trends, consumer preferences, and technological advancements. Industry innovation, particularly in automotive technology, is not just about enhancing vehicle performance or efficiency; it's about redefining the very essence of mobility and customer experience.

Success in this dynamic and competitive market is not guaranteed by legacy alone but by how effectively businesses can adapt their strategies—whether it’s in vehicle maintenance, automotive repair, or car rental services—to meet evolving demands. This includes a deep dive into automotive marketing, supply chain management, and regulatory compliance, ensuring that operations are as streamlined as they are compliant.

Moreover, the continuous push towards industry innovation signals a future where the integration of advanced technologies and sustainable practices could not only redefine standards in vehicle manufacturing but also in how automotive sales and services are conducted. As businesses strive to meet and exceed consumer expectations, the emphasis on quality products, exceptional service, and customer satisfaction has never been more critical.

The journey through the automotive sector is one of constant evolution, where the keys to success lie in the ability to foresee changes in the landscape and adapt accordingly. For those in the automotive business, the path forward is clear: embrace industry innovation, understand and anticipate consumer needs, and remain flexible in the face of regulatory and market shifts. By doing so, businesses can not only rev their engines for today’s challenges but also accelerate towards the opportunities of tomorrow, ensuring a prominent place in the fast-paced world of the automobile industry.

Business

Shifting Gears for Success: Exploring the Future of Vehicle Manufacturing, Automotive Sales, and Aftermarket Growth in the Automobile Industry

The Automobile Industry is undergoing significant transformation driven by top trends in Automotive Technology, such as electric and autonomous vehicles, shifting Consumer Preferences towards sustainability and digitalization, and the necessity for Regulatory Compliance. These changes are impacting every sector from Vehicle Manufacturing and Automotive Sales to Aftermarket Parts, Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services. To stay competitive and lead in this dynamic environment, companies must embrace Industry Innovation, refine their Automotive Marketing strategies, optimize Supply Chain Management, and adapt to evolving market trends and consumer demands. The future success in the Automobile Industry hinges on comprehensive adaptation across all sectors, focusing on eco-friendly solutions, technological advancements, and customer-focused services.

In the fast-paced world of the automobile industry, businesses spanning vehicle manufacturing, automotive sales, aftermarket parts, car dealerships, and a myriad of service-oriented sectors such as vehicle maintenance, automotive repair, and car rental services, find themselves at the heart of a constantly evolving landscape. These enterprises are the backbone of transportation solutions, catering to a diverse array of consumer needs — from purchasing and customizing vehicles to their repair and upkeep. However, thriving in this dynamic and competitive market is no small feat. It demands a deep dive into the latest industry innovations, understanding market trends, consumer preferences, and staying ahead in technological advancements, all while ensuring regulatory compliance and mastering supply chain management.

As we delve into the intricacies of the automobile industry, our focus shifts to two critical aspects that promise to guide businesses towards success in this sector. The first, "Navigating the Road Ahead: Top Trends and Innovations Shaping the Automobile Industry," explores the cutting-edge developments and how they redefine what we expect from our vehicles and automotive services. The second, "Revving Up Success: Strategies for Automotive Sales, Aftermarket Growth, and Maintaining Market Leadership," offers an in-depth look at effective automotive marketing strategies, quality product offerings, and customer satisfaction approaches that can propel businesses to the forefront of the market.

This article aims to provide comprehensive insights into achieving excellence in the automotive business, emphasizing the importance of adapting to evolving market demands, leveraging industry innovation, and prioritizing customer needs. Whether you are involved in vehicle manufacturing, run a car dealership, offer automotive repair services, or manage a car rental enterprise, understanding these elements is crucial for navigating the complexities of today’s automotive sector and steering your business towards enduring success.

- 1. "Navigating the Road Ahead: Top Trends and Innovations Shaping the Automobile Industry"

- 2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Growth, and Maintaining Market Leadership"

1. "Navigating the Road Ahead: Top Trends and Innovations Shaping the Automobile Industry"

In the fast-paced world of the automobile industry, staying ahead of the curve is not just beneficial; it's essential for survival. As we navigate the road ahead, several top trends and innovations are significantly shaping the future of vehicle manufacturing, automotive sales, aftermarket parts, and the entire spectrum of the automotive sector. Understanding these elements is crucial for businesses aiming to thrive in this dynamic environment.

The rise of automotive technology is undeniably at the forefront of industry innovation. Electric vehicles (EVs) and autonomous driving capabilities are radically transforming consumer preferences, pushing manufacturers and car dealerships to adapt quickly. This shift not only changes the landscape of vehicle manufacturing but also impacts automotive repair, vehicle maintenance, and the aftermarket parts industry. As vehicles become more sophisticated, the demand for specialized maintenance and parts increases, offering new opportunities and challenges for businesses in these areas.

Another critical area influencing the automobile industry is regulatory compliance. With governments worldwide imposing stricter emissions standards and safety regulations, automotive companies are compelled to innovate and invest in cleaner, safer transportation solutions. This regulatory pressure is a driving force behind the surge in EV production and the integration of advanced safety features, which in turn affects automotive sales and marketing strategies.

Market trends also underscore the increasing importance of sustainability and digitalization. Consumers are more environmentally conscious and digitally savvy than ever, expecting eco-friendly vehicles and seamless online purchasing experiences. Automotive marketing strategies must now leverage digital platforms and social media to engage with consumers, offering detailed information, virtual test drives, and online sales options. This digital shift extends to automotive repair and maintenance services, where online appointment scheduling and service updates are becoming standard customer expectations.

Supply chain management has also emerged as a critical factor for success in the automotive industry. The recent global challenges, including chip shortages and logistic disruptions, have highlighted the need for robust and flexible supply chains. Companies are now prioritizing supply chain resilience to ensure uninterrupted vehicle manufacturing and delivery, which is vital for maintaining competitive advantage in automotive sales and aftermarket parts availability.

Lastly, car rental services are adapting to the changing landscape by integrating electric and autonomous vehicles into their fleets. This not only aligns with the growing consumer demand for sustainable and innovative transportation options but also opens new avenues for collaboration between car rental services and automotive manufacturers.

In conclusion, the automobile industry is at a pivotal juncture, with top trends and innovations in automotive technology, regulatory compliance, consumer preferences, supply chain management, and industry innovation steering its future direction. Companies that can effectively navigate these changes, embracing new marketing strategies and adapting to evolving market demands, will be the ones driving the lane of success in the dynamic automotive market.

2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Growth, and Maintaining Market Leadership"

In the fast-paced world of the Automobile Industry, staying ahead involves more than just keeping up with Vehicle Manufacturing advancements; it necessitates a robust approach to Automotive Sales, a keen eye for tapping into the potential of Aftermarket Parts, and a strategic plan for maintaining market leadership. The key to revving up success in this dynamic sector is to harness a combination of industry innovation, savvy automotive marketing, and an unwavering commitment to quality and customer satisfaction.

Automotive Sales form the engine of the industry, driving revenue and market presence for Car Dealerships and manufacturers alike. To excel in this arena, businesses must prioritize understanding Consumer Preferences, which are increasingly leaning towards vehicles equipped with the latest Automotive Technology and eco-friendly features. Tailoring sales strategies to highlight these aspects, alongside offering flexible financing options, can significantly enhance customer appeal and loyalty.

The Aftermarket Parts sector represents a lucrative avenue for growth, especially as consumers seek to customize and upgrade their vehicles post-purchase. Success in this domain requires a deep dive into Supply Chain Management to ensure the availability of high-quality parts, coupled with a strategy that aligns with the latest Market Trends in vehicle customization. Offering a range of parts that improve vehicle performance, aesthetics, or environmental footprint can set a business apart in a crowded marketplace.

Maintaining market leadership in the Automotive Industry is a multifaceted challenge that demands continuous Industry Innovation and adaptability to Regulatory Compliance. Businesses that lead the pack are those that not only anticipate future trends but also invest in Automotive Repair and Vehicle Maintenance services that meet the highest standards of quality. This not only builds trust among consumers but also establishes a reputation for reliability and expertise.

Furthermore, leveraging Automotive Marketing to communicate a brand's unique value proposition is crucial. Effective marketing strategies should encompass digital platforms, highlighting success stories in Automotive Repair, showcasing advancements in Automotive Technology, and underlining the company's commitment to sustainability and customer satisfaction. Engaging with customers through social media, offering insightful content, and utilizing SEO to enhance online visibility are all strategies that can boost a brand's profile and drive sales.

In conclusion, businesses within the Automobile Industry can accelerate their path to success by focusing on innovative automotive sales tactics, expanding their presence in the aftermarket parts market, and continuously evolving to meet the demands of the modern consumer. By integrating Industry Innovation, strategic Automotive Marketing, and a steadfast focus on quality and Regulatory Compliance, companies can not only achieve but sustain market leadership in this competitive landscape.

In conclusion, the automotive business, encompassing vehicle manufacturing, automotive sales, aftermarket parts, car dealerships, vehicle maintenance, automotive repair, and car rental services, stands at a crucial juncture of transformation and growth. As we have explored, navigating the road ahead in the automobile industry requires a keen understanding of the top trends and innovations, including advances in automotive technology, shifts in consumer preferences, and the importance of regulatory compliance. Industry leaders are leveraging these insights to rev up success through targeted automotive marketing strategies, supply chain management optimizations, and a focus on industry innovation.

The dynamic and competitive nature of the market demands that businesses in the sector remain adaptable, ensuring they not only meet but anticipate the evolving needs of their customers. From the factory floor to the salesroom, every aspect of the automotive business is being shaped by a commitment to quality, efficiency, and sustainability. Whether it's through enhancing automotive sales, expanding the availability of aftermarket parts, or ensuring excellence in vehicle maintenance and repair services, companies are finding new ways to maintain market leadership and drive customer satisfaction.

As we look to the future, it's clear that the automotive industry will continue to be propelled by a blend of technological advancements and strategic business practices. Businesses that stay informed about market trends, invest in automotive innovation, and prioritize customer needs will not only navigate the challenges ahead but will thrive, steering towards a future where mobility becomes more accessible, efficient, and sustainable for all.

Business

Shifting Gears for Growth: Mastering the Dynamics of the Automotive Business Through Innovation and Customer-Centric Strategies

The Automobile Industry is rapidly evolving, with key trends shaping Vehicle Manufacturing, Automotive Sales, and services like Car Dealerships, Aftermarket Parts, Vehicle Maintenance, Automotive Repair, and Car Rental Services. The drive towards digitalization and the rise of electric vehicles (EVs) reflect changing Consumer Preferences and the push for Regulatory Compliance. Advancements in Automotive Technology, such as autonomous driving and connected cars, are revolutionizing the market. Companies are leveraging Automotive Marketing innovations like digital showrooms to enhance the shopping experience. With Supply Chain Management gaining importance due to global disruptions, staying atop Market Trends and Industry Innovation is crucial for businesses aiming to thrive in the competitive Automobile Industry landscape.

In the fast-paced world of the Automobile Industry, staying ahead means more than just keeping the engine running. From Vehicle Manufacturing to Automotive Sales, and from Aftermarket Parts to Car Dealerships, businesses within this sector are constantly navigating a road filled with innovation, changing consumer preferences, and stringent regulatory compliance. As the industry accelerates towards a future driven by Automotive Technology and sustainable practices, understanding the dynamic landscape of market trends and industry innovation becomes crucial. This article delves into the various facets of the automotive business, highlighting how companies are steering towards success by adapting to new challenges and opportunities in Vehicle Maintenance, Automotive Repair, and Car Rental Services. Sections such as "Navigating the Road to Success: Top Trends and Innovations in the Automobile Industry" and "Driving Customer Satisfaction: How Vehicle Manufacturing and Automotive Sales Are Evolving to Meet Changing Consumer Preferences" will offer an in-depth look at how businesses are revolutionizing their strategies in Automotive Marketing, Supply Chain Management, and beyond to meet the ever-evolving demands of the market. Join us on this journey to explore how the automotive sector is shifting gears to provide advanced transportation solutions, ensuring customer satisfaction while navigating the complexities of regulatory compliance and market demands.

- 1. "Navigating the Road to Success: Top Trends and Innovations in the Automobile Industry"

- 2. "Driving Customer Satisfaction: How Vehicle Manufacturing and Automotive Sales Are Evolving to Meet Changing Consumer Preferences"

1. "Navigating the Road to Success: Top Trends and Innovations in the Automobile Industry"

In the fast-paced world of the Automobile Industry, staying ahead of the curve is crucial for businesses aiming for the pinnacle of success. Navigating this complex terrain requires a keen understanding of several key factors, including market trends, consumer preferences, and the latest in automotive technology. As we delve into the dynamics of Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services, several top trends and innovations emerge as beacons for businesses striving to outshine their competitors.

Firstly, the digital revolution has significantly transformed Automotive Marketing strategies. An online presence is no longer optional, with digital showrooms and virtual test drives becoming increasingly popular among consumers. This shift demands an innovative approach to marketing, emphasizing digital platforms and social media engagement to connect with a wider audience.

The rise of electric vehicles (EVs) stands out as a monumental shift in Vehicle Manufacturing, driven by consumer demand for more sustainable and eco-friendly transportation options. This surge is further bolstered by regulatory compliance measures aimed at reducing carbon emissions. Consequently, automotive businesses are investing heavily in EV technology and infrastructure, marking a significant pivot in industry innovation.

Another critical aspect shaping the sector is the advancement in Automotive Technology, particularly in autonomous driving and connected car features. These technologies not only promise to enhance safety and efficiency but also open new avenues for Automotive Sales and services, thus redefining consumer expectations and preferences.

Supply Chain Management has also emerged as a vital component of business strategy in the wake of global disruptions. Companies are now prioritizing resilience and flexibility in their supply chains to mitigate risks associated with material shortages, shipping delays, and fluctuating costs. This strategic shift is crucial in maintaining steady production rates and meeting consumer demand efficiently.

Furthermore, the Aftermarket Parts and Automotive Repair sectors are witnessing a surge in demand for high-quality, reliable parts and services. As vehicles become more technologically advanced, specialized knowledge and equipment are required for maintenance and repair, highlighting the importance of continuous training and investment in state-of-the-art tools.

Lastly, Car Rental Services are adapting to the changing landscape by incorporating a wider range of vehicle options, including EVs and hybrids, to cater to the growing consumer demand for flexible and environmentally friendly transportation solutions.

In conclusion, success in the dynamic and competitive automotive market hinges on a business's ability to adapt to evolving market demands, embrace industry innovation, and prioritize customer satisfaction. By staying attuned to the top trends and innovations in the Automobile Industry, businesses can navigate the road to success, ensuring longevity and relevance in a rapidly changing world.

2. "Driving Customer Satisfaction: How Vehicle Manufacturing and Automotive Sales Are Evolving to Meet Changing Consumer Preferences"

In the swiftly evolving landscape of the Automobile Industry, Vehicle Manufacturing and Automotive Sales are undergoing significant transformations to align with shifting Consumer Preferences. This dynamic shift is not just about staying ahead in the market but also about driving customer satisfaction to new heights. Today's consumers are more informed and have higher expectations, influencing every segment from car dealerships to aftermarket parts and vehicle maintenance.

Automotive Technology stands at the core of this evolution, reshaping everything from the design and functionality of vehicles to how they are sold and serviced. Innovations such as electric vehicles (EVs), autonomous driving features, and connected car technologies are not just trends but are becoming staples in the demands of consumers. These advancements have necessitated that businesses within the automobile sector, including vehicle manufacturing and automotive sales, stay abreast of Market Trends and Industry Innovation to meet these expectations.

Moreover, the rise of digital platforms has transformed Automotive Sales and marketing strategies. In response to this, car dealerships are now offering more personalized shopping experiences, both online and offline, including virtual showrooms and augmented reality (AR) applications. This approach not only enhances customer engagement but also aids in meeting the regulatory compliance standards that are becoming increasingly strict in terms of environmental impact and safety features.

Aftermarket Parts and Automotive Repair services are also adapting to these changes by offering high-quality, technologically advanced parts and maintenance services that cater to newer vehicle models and sophisticated consumer demands. The focus is on providing value-added services that enhance vehicle performance and longevity, which in turn, boosts customer satisfaction.

Supply Chain Management remains a critical backbone for the automotive industry, ensuring the timely delivery of vehicles and parts. Recent challenges, such as global supply chain disruptions, have highlighted the importance of resilient and flexible supply chain strategies. Companies are now investing in digital tools and analytics to optimize their supply chains, reduce risks, and ensure they can quickly adapt to changes in consumer demand or market conditions.

In the realm of Car Rental Services, businesses are expanding their fleets to include a wider variety of vehicles, including EVs and hybrids, to cater to the eco-conscious consumer. Additionally, flexible rental options and subscription models are being introduced to provide more tailored transportation solutions.

Ultimately, the Automobile Industry is witnessing a paradigm shift towards customer-centric approaches in both Vehicle Manufacturing and Automotive Sales. By prioritizing Automotive Technology, Market Trends, Consumer Preferences, and Industry Innovation, businesses are not only ensuring Regulatory Compliance but are also paving the way for enhanced customer satisfaction and loyalty. As the industry continues to evolve, staying ahead of these trends and adapting to the changing landscape will be key for businesses aiming for success in the competitive automotive market.

In conclusion, the path to success within the automotive industry, a sector characterized by its rapid pace of innovation and evolving market demands, requires a multifaceted approach. Businesses, ranging from car dealerships to vehicle manufacturing giants, must stay ahead of top market trends and consumer preferences, integrating advances in automotive technology and industry innovation into their operations. The key to thriving in automobile industry lies not only in understanding the dynamics of automotive sales, aftermarket parts, and vehicle maintenance but also in mastering the art of automotive repair and offering comprehensive car rental services that meet the modern consumer’s needs.

As we have explored, driving customer satisfaction in this competitive landscape involves more than just meeting basic expectations. It demands a deep commitment to quality, regulatory compliance, and a keen eye on supply chain management. Adjusting to the changing tides of automotive marketing strategies is also crucial, as is the ability to leverage industry innovation to stay relevant and appealing to a diverse client base.

Whether it's through embracing new automotive technology, refining the efficiency of vehicle manufacturing, or enhancing the customer experience at car dealerships, businesses in the automotive sector must remain agile and responsive. The future of automotive sales and service rests on the industry's capacity to adapt, innovate, and above all, keep the customer's evolving preferences at the heart of their operations. As we move forward, those who can navigate the complexities of consumer preferences, market trends, and technological advancements will undoubtedly lead the pack in the dynamic world of automotive business.

Business

Driving Success: Mastering the Automobile Industry with Top Trends, Innovative Strategies, and Market Insights

The Automobile Industry is experiencing transformative shifts across Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, and services like Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services, driven by top Market Trends and advancements in Automotive Technology. The push for Electric vehicles, digital sales platforms, personalized Aftermarket Parts, and tech-enhanced services are reshaping consumer experiences and business operations. Success in this competitive landscape requires a keen understanding of Consumer Preferences, Regulatory Compliance, and a commitment to Industry Innovation, efficient Supply Chain Management, and effective Automotive Marketing strategies. Embracing these changes and focusing on sustainability and customer satisfaction are key for businesses to navigate the dynamic Automobile Industry successfully.

In the ever-evolving world of the Automobile Industry, businesses that deal with Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, and even Car Rental Services find themselves at the intersection of innovation and consumer demand. With the pace of change accelerated by advancements in Automotive Technology, shifts in Market Trends, and evolving Consumer Preferences, staying ahead in this dynamic and competitive sector is no small feat. This article dives deep into the heart of the automotive business, exploring the multifaceted aspects that drive success from the factory floor to the showroom and beyond. From Regulatory Compliance to Supply Chain Management and Industry Innovation, we uncover the strategies that top automotive businesses employ to navigate the fast lane of market leadership. Whether it's mastering Vehicle Maintenance, excelling in Automotive Repair, or innovating in automotive marketing, the keys to revving up success in this industry are as diverse as they are complex. Join us as we explore "Navigating the Fast Lane: Top Trends and Innovations in the Automobile Industry" followed by "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance Mastery," providing a comprehensive guide for businesses striving to excel in the global automotive marketplace.

- 1. "Navigating the Fast Lane: Top Trends and Innovations in the Automobile Industry"

- 2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance Mastery"

1. "Navigating the Fast Lane: Top Trends and Innovations in the Automobile Industry"

In the rapidly evolving landscape of the Automobile Industry, businesses are continuously adapting to keep pace with top trends and innovations that are reshaping the way vehicles are manufactured, sold, and maintained. A deep dive into the current state of Vehicle Manufacturing reveals a strong push towards sustainability and efficiency, with electric vehicles (EVs) leading the charge. This shift is not only a response to Consumer Preferences but also to stringent Regulatory Compliance measures aimed at reducing carbon emissions.

Automotive Sales and Car Dealerships are also experiencing a transformation, largely driven by the digitalization of the sales process. Online platforms and virtual showrooms are becoming increasingly prevalent, offering customers a convenient and comprehensive way to explore and purchase vehicles. This digital shift is complemented by advanced Automotive Marketing strategies that leverage social media, digital advertising, and personalized customer engagement to drive sales.

The Aftermarket Parts sector continues to thrive, buoyed by the growing demand for vehicle customization and enhancement. Consumers looking to personalize their cars with high-performance parts, new technologies, or unique aesthetics find a robust market ready to cater to their needs. This trend underscores the importance of Supply Chain Management in ensuring the timely and efficient delivery of these components to both businesses and consumers.

Vehicle Maintenance and Automotive Repair services are embracing new technologies to enhance their offerings. Diagnostic software, mobile repair services, and predictive maintenance are just a few examples of how Industry Innovation is improving service efficiency and customer satisfaction. These advancements allow for quicker, more accurate repairs, and maintenance work, ensuring vehicles spend less time in the shop and more time on the road.

Car Rental Services are not left behind in this wave of innovation. The industry is seeing a surge in app-based rental platforms and the introduction of flexible, on-demand rental options. These services cater to the modern consumer's desire for convenience and flexibility, offering everything from short-term hourly rentals to subscription-based models for longer-term use.

At the heart of these transformations is Automotive Technology, which plays a pivotal role in shaping Market Trends and driving the industry forward. From autonomous driving systems and connected car technologies to advanced safety features and electric powertrains, the rapid pace of technological advancement is setting the stage for a future where vehicles are safer, more efficient, and more integrated into our digital lives than ever before.

In conclusion, navigating the fast lane of the Automobile Industry requires a keen eye on Market Trends, a commitment to Industry Innovation, and an agile approach to Automotive Marketing and Supply Chain Management. As Consumer Preferences continue to evolve and Regulatory Compliance tightens, businesses within the automotive sector must remain at the forefront of technology and innovation to thrive in this dynamic and competitive market.

2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance Mastery"

In the fast-paced world of the Automobile Industry, businesses involved in Vehicle Manufacturing, Automotive Sales, and the provision of Aftermarket Parts and services are continuously seeking innovative strategies to rev up their success. Mastering the art of thriving in these sectors requires more than just a fundamental understanding of cars—it demands a keen insight into Market Trends, Consumer Preferences, and the ever-evolving landscape of Automotive Technology.

One of the keys to success in Automotive Sales and running successful Car Dealerships lies in the ability to understand and adapt to Consumer Preferences. Today's consumers are more informed and have higher expectations than ever before. They are looking for not only quality vehicles but also value-added services that enhance their buying experience. Effective Automotive Marketing strategies, therefore, focus on creating personalized, engaging customer experiences through digital platforms, leveraging data analytics to tailor offerings to individual needs and preferences.

For those in the realm of Aftermarket Parts and Automotive Repair, Industry Innovation and Supply Chain Management are critical components. The aftermarket sector is highly competitive, and businesses that can offer unique, high-quality parts at competitive prices while ensuring timely delivery are the ones that stand out. This is where efficient Supply Chain Management comes into play, ensuring that logistics and inventory levels are optimized to meet customer demand without overburdening the cost structure.

Vehicle Maintenance and Automotive Repair services, on the other hand, bank on trust and reliability. Establishing a reputation for providing top-notch, reliable service is paramount. In this digital age, online reviews and word-of-mouth recommendations can significantly impact business. Incorporating the latest Automotive Technology in diagnostics and repair, offering transparent pricing, and ensuring customer satisfaction through excellent service can help in building a loyal customer base.

Regulatory Compliance also plays a significant role across all facets of the automotive business. From Vehicle Manufacturing to Car Rental Services, staying abreast of and adhering to industry regulations not only ensures legal compliance but also builds trust with consumers. Whether it's environmental regulations affecting vehicle emissions or safety standards impacting vehicle design and repair practices, businesses that proactively embrace regulatory compliance can leverage it as a competitive advantage.

Finally, an overarching strategy that encompasses all areas of the automotive business is the focus on sustainability and eco-friendliness. With increasing consumer awareness about environmental issues, businesses that adopt green practices in Manufacturing, Maintenance, and even in the operation of Car Rental Services are likely to gain favor with today’s eco-conscious consumers.

In conclusion, mastering the sectors of Automotive Sales, Aftermarket Parts, and Vehicle Maintenance in today's dynamic market environment requires a multifaceted approach. By focusing on understanding Consumer Preferences, leveraging Automotive Technology, ensuring Regulatory Compliance, and emphasizing sustainability, businesses can steer towards success in the competitive landscape of the Automobile Industry.

In conclusion, the automotive business encapsulates a vast and intricate ecosystem that plays a pivotal role in driving forward personal and commercial transportation solutions. From vehicle manufacturing to automotive sales, aftermarket parts, car dealerships, vehicle maintenance, and automotive repair, each segment contributes significantly to the industry's overall dynamism and resilience. The exploration of top trends and innovations in the automobile industry underscores the importance of staying abreast with automotive technology, market trends, consumer preferences, and regulatory compliance to maintain a competitive edge.

Moreover, mastering the art of automotive sales, leveraging the potential of aftermarket parts, excelling in vehicle maintenance, and embracing industry innovation are crucial strategies for businesses aiming to rev up their success in this fast-paced sector. With the added complexities of supply chain management and the need for effective automotive marketing, companies must be agile, customer-focused, and ready to adapt to the ever-changing landscape of the automotive world.

As we look to the future, the automotive industry is set to continue evolving, driven by technological advancements and shifting consumer behaviors. Businesses that can anticipate changes, invest in automotive technology, and commit to sustainable and efficient practices will likely lead the pack. With a keen eye on market trends and a solid strategy for engaging customers, automotive businesses can navigate the challenges and opportunities that lie ahead, ensuring their place in the fast lane of industry innovation and success.

Business

Driving Success: Mastering the Gears of the Automobile Industry from Manufacturing to Market Trends

In the Automobile Industry, top companies excel by blending cutting-edge Automotive Technology with a keen understanding of Market Trends and Consumer Preferences, driving Industry Innovation in Vehicle Manufacturing and Automotive Sales. The rise of Aftermarket Parts and the importance of Car Dealerships, Vehicle Maintenance, and Automotive Repair highlight the industry's focus on customer satisfaction and adaptability. Efficient Supply Chain Management and adherence to Regulatory Compliance are essential for minimizing disruptions and maintaining competitiveness. Furthermore, Car Rental Services and digital Automotive Marketing strategies showcase the sector's flexibility and customer-centric approach. Together, these factors underscore the industry's commitment to innovation, sustainability, and market leadership, positioning it for ongoing growth and technological advancement.

In the ever-evolving landscape of the automobile industry, top automotive businesses are constantly seeking innovative ways to accelerate their growth and stand out in a crowded marketplace. From vehicle manufacturing giants to bustling car dealerships, and from high-tech aftermarket parts suppliers to essential car rental services, these enterprises are the backbone of global transportation solutions. Their success hinges on a multifaceted approach that encompasses mastering automotive sales, leveraging the latest in automotive technology, and delivering unparalleled vehicle maintenance and repair services. This article delves into the dynamic world of the automotive sector, exploring how industry leaders navigate the fast lane of vehicle manufacturing and sales, and how they rev up innovation to shape consumer preferences and market trends.

Section one, "Navigating the Fast Lane: How Top Automotive Businesses Accelerate Success in Vehicle Manufacturing and Sales," explores the strategies employed by leading companies to dominate the automobile industry. It highlights the importance of understanding market trends, embracing industry innovation, and ensuring regulatory compliance to thrive in automotive sales.

Section two, "Revving Up Innovation: The Role of Automotive Technology and Aftermarket Parts in Shaping Consumer Preferences and Market Trends," examines the transformative impact of technological advancements and the growing market for aftermarket parts. It underscores the significance of automotive marketing, supply chain management, and adapting to changing consumer preferences in steering the future of the industry.

As we journey through the intricacies of the automobile industry, it becomes clear that the path to success in automotive business is paved with challenges and opportunities. By focusing on quality products, customer satisfaction, and the ability to adapt to the rapidly changing landscape, top automotive businesses continue to drive forward, shaping the future of transportation.

- 1. "Navigating the Fast Lane: How Top Automotive Businesses Accelerate Success in Vehicle Manufacturing and Sales"

- 2. "Revving Up Innovation: The Role of Automotive Technology and Aftermarket Parts in Shaping Consumer Preferences and Market Trends"

1. "Navigating the Fast Lane: How Top Automotive Businesses Accelerate Success in Vehicle Manufacturing and Sales"

In the fast-paced world of the automobile industry, top automotive businesses distinguish themselves through strategic agility and a keen focus on vehicle manufacturing and sales. These leading companies excel by leveraging advanced automotive technology, staying ahead of market trends, and deeply understanding consumer preferences. Their success is not just about offering vehicles but providing comprehensive solutions that encompass everything from innovative aftermarket parts to efficient vehicle maintenance and automotive repair services.

Key to accelerating success in vehicle manufacturing is an unwavering commitment to industry innovation. Top manufacturers invest heavily in research and development to introduce cutting-edge features that meet the evolving demands of consumers. This dedication to innovation extends to adopting sustainable practices and materials, reflecting a growing consumer preference for eco-friendly vehicles.

In automotive sales, excellence is achieved through a combination of high-quality products and effective automotive marketing strategies. Car dealerships play a crucial role in this equation, serving as the face of manufacturers to the end consumer. These dealerships are not just sales points but hubs of customer engagement and service, offering insights into the latest in automotive technology and trends.

Aftermarket parts and services also represent a significant aspect of the automotive industry's value chain. By providing customers with high-quality replacements and upgrades, businesses can enhance vehicle performance and longevity, fostering customer loyalty and repeat business. This sector thrives on understanding and anticipating the needs of vehicle owners, ensuring a supply of parts that align with consumer preferences and vehicle specifications.

Another critical factor in the success of automotive businesses is their ability to navigate the complexities of regulatory compliance and supply chain management. With regulations constantly evolving to address safety, environmental concerns, and technological advancements, companies must remain nimble and proactive. Efficient supply chain management ensures that the production and distribution of vehicles and parts proceed smoothly, minimizing disruptions and maintaining competitive pricing.

Car rental services also highlight the industry's adaptability, offering flexible transportation solutions that cater to varying needs, from temporary vehicle replacements to providing for travelers. The success of these services reflects an understanding of market dynamics and consumer behavior, further emphasizing the automotive industry's customer-centric approach.

In conclusion, top automotive businesses accelerate their success by embracing a holistic approach to vehicle manufacturing and sales. This includes a strong emphasis on automotive technology, a dynamic response to market trends and consumer preferences, a rigorous commitment to regulatory compliance, and a strategic approach to supply chain management. Coupled with effective automotive marketing and a deep commitment to customer satisfaction, these elements provide the blueprint for thriving in the competitive landscape of the automobile industry.

2. "Revving Up Innovation: The Role of Automotive Technology and Aftermarket Parts in Shaping Consumer Preferences and Market Trends"

In the fast-paced world of the Automobile Industry, the drive for innovation is more intense than ever, with Automotive Technology and Aftermarket Parts playing pivotal roles in steering Consumer Preferences and Market Trends. As Vehicle Manufacturing continues to evolve, fueled by advancements in technology, the ripple effects are felt across Automotive Sales, Car Dealerships, and Vehicle Maintenance sectors. This innovation-driven environment not only propels the industry forward but also significantly influences the strategic direction of Automotive Repair, Car Rental Services, and the broad spectrum of businesses operating within this dynamic sector.

The advent of cutting-edge Automotive Technology has reshaped the landscape of the Automobile Industry, setting new benchmarks for what vehicles can achieve. From electric powertrains and autonomous driving capabilities to advanced safety features and connectivity options, technology has become a top determinant of consumer buying decisions. This technological renaissance has compelled Vehicle Manufacturing giants and new entrants alike to continually push the boundaries of innovation, ensuring that their offerings align with the evolving expectations of today's tech-savvy consumers.

Aftermarket Parts, on the other hand, have emerged as a key factor in personalizing the driving experience, allowing consumers to enhance performance, aesthetics, or utility according to their unique preferences. This segment of the industry not only caters to the enthusiasts looking for upgrades but also supports the essential need for Vehicle Maintenance and Automotive Repair. The demand for high-quality Aftermarket Parts underscores the importance of Supply Chain Management in ensuring availability, affordability, and compatibility with a wide range of vehicle models.

Moreover, the surge in Automotive Technology and the flourishing Aftermarket Parts sector have necessitated a shift in Automotive Marketing strategies. Businesses are now leveraging digital platforms more than ever to showcase their latest innovations and aftermarket offerings, engaging with consumers directly to influence their preferences and buying decisions. This direct engagement also provides invaluable insights into Consumer Preferences, enabling businesses to tailor their products and services more effectively.

Regulatory Compliance also plays a crucial role in shaping the future of the Automobile Industry. As governments worldwide impose stricter emissions standards and safety regulations, Automotive Technology and Aftermarket Parts must align with these guidelines, further driving Industry Innovation. This regulatory landscape not only ensures that new vehicles and aftermarket solutions are safer and more environmentally friendly but also challenges manufacturers and suppliers to innovate within these constraints.

In conclusion, the symbiotic relationship between Automotive Technology and Aftermarket Parts is a testament to the industry's commitment to innovation, customer satisfaction, and regulatory compliance. By continuously adapting to and influencing Consumer Preferences and Market Trends, the Automobile Industry is set to navigate the road ahead with confidence, ensuring its position at the forefront of technological advancement and market leadership.

In conclusion, the automobile industry stands as a pivotal component of the global economy, driving forward with a blend of tradition and innovation. Top automotive businesses, from vehicle manufacturing giants to local car dealerships, continuously adapt to thrive in this dynamic sector. By embracing automotive technology and responding to market trends and consumer preferences, these entities not only contribute to the industry's growth but also set the pace for emerging developments. The importance of aftermarket parts, vehicle maintenance, automotive repair, and car rental services cannot be understated, as they provide essential support to the primary market, ensuring customer satisfaction and fostering loyalty.

Moreover, regulatory compliance and supply chain management emerge as critical factors that businesses must navigate adeptly to sustain success. Industry innovation, powered by a deep understanding of automotive marketing strategies, propels businesses to the forefront of the automotive sales arena, enabling them to capture and maintain a competitive edge.

As the landscape of the automobile industry continues to evolve, influenced by technological advancements and shifting market dynamics, the future holds promising opportunities for those ready to adapt and innovate. From enhancing product offerings to refining service delivery, the key to enduring success in the automotive business lies in a company’s ability to align with industry trends while remaining steadfast in delivering quality and value to consumers. In this high-speed race, staying ahead means not just keeping pace with current changes but also anticipating the curves ahead, ensuring that businesses in the automotive sector not only survive but thrive in an ever-changing market environment.

Business

Driving Success in the Automotive Sector: Mastering Vehicle Manufacturing, Sales, and Service in a Changing World

In the competitive Automobile Industry, businesses are harnessing top Industry Innovation and Automotive Technology to excel in areas like Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, and Car Dealerships. The shift towards electric vehicles and the advancement in Autonomous and Connected Vehicles are shaping Consumer Preferences and redefining Vehicle Maintenance and Automotive Repair. Digitalization has transformed Automotive Marketing with e-commerce and digital showrooms becoming vital for Car Rental Services. Emphasizing sustainability, the industry is moving towards a Circular Economy, affecting everything from production to services. Effective Supply Chain Management is crucial in navigating global disruptions, while delivering exceptional Customer Experience and personalization through data analytics is key. Staying updated with Regulatory Compliance and prioritizing customer satisfaction are essential in adapting to Market Trends and securing a competitive edge.

In the fast-paced world of the automobile industry, businesses that span from vehicle manufacturing to automotive sales, and from aftermarket parts suppliers to car rental services, are constantly navigating a terrain that is as dynamic as it is demanding. The automotive sector, pivotal in driving transportation solutions for both individuals and organizations, encompasses a broad array of services including car dealerships, automotive repair, and vehicle maintenance. These businesses are at the heart of ensuring mobility and convenience, but achieving success in this competitive market is no small feat. It requires a keen insight into top industry innovation, an adeptness at automotive marketing, and an unwavering commitment to customer satisfaction and quality service.

This article dives deep into the engine room of the automotive business, exploring the "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry" to understand how technological advancements, market trends, and consumer preferences are shaping the future. Furthermore, we shift gears to focus on "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance," providing a roadmap for businesses to accelerate their growth amidst challenges such as regulatory compliance, supply chain management, and evolving market demands. Whether it's the latest in automotive technology, strategies for thriving in automotive sales, or insights into the supply and demand of aftermarket parts and car dealerships, this article aims to fuel your knowledge and drive your business forward in the ever-evolving landscape of the automobile industry.

- 1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

- 2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance"

1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

In the ever-evolving landscape of the automobile industry, businesses are constantly adapting to new challenges and opportunities. The key to thriving in this competitive market lies in staying ahead of top trends and embracing innovations that redefine the way we think about mobility. Here are several pivotal areas shaping the future of the automobile sector.

**Automotive Technology and Electrification**: A significant shift toward electric vehicles (EVs) is underway, driven by consumer preferences for more sustainable and eco-friendly transportation options. This shift is not only influencing vehicle manufacturing but also impacting automotive sales, aftermarket parts, and car dealerships. Companies are investing heavily in EV technology and infrastructure to meet regulatory compliance and consumer demand.

**Autonomous and Connected Vehicles**: The rise of autonomous driving technology and connected vehicles presents a new frontier for the automobile industry. These innovations promise to improve safety, efficiency, and comfort, transforming the automotive landscape. Automotive businesses are exploring ways to integrate these technologies into their offerings, from manufacturing to vehicle maintenance and automotive repair services.

**Digitalization and E-commerce**: The digital transformation has revolutionized automotive sales and marketing strategies. Online platforms and digital showrooms are becoming increasingly popular, offering a convenient way for consumers to explore and purchase vehicles. This trend extends to car rental services and aftermarket parts sales, emphasizing the importance of a strong online presence and efficient supply chain management.

**Sustainability and Circular Economy**: Sustainability is becoming a central focus for the automobile industry, affecting everything from vehicle manufacturing to automotive repair. Businesses are adopting greener practices, such as recycling and remanufacturing of parts, to minimize environmental impact and appeal to eco-conscious consumers. This shift towards a circular economy is reshaping industry innovation and consumer preferences.

**Adaptive Supply Chain Management**: The global nature of the automobile industry requires robust supply chain management to navigate disruptions and maintain steady production and delivery schedules. Automotive businesses are leveraging advanced analytics and technologies to enhance supply chain resilience, ensuring timely automotive sales and the availability of aftermarket parts and services.

**Customer Experience and Personalization**: In the competitive automotive market, delivering exceptional customer experience and personalized services is crucial for retention and growth. Car dealerships, vehicle maintenance services, and car rental agencies are focusing on customer satisfaction more than ever, utilizing data analytics to tailor their offerings and marketing strategies to individual needs and preferences.

**Regulatory Compliance and Safety Standards**: As regulatory landscapes evolve, automotive businesses must stay abreast of changes to ensure compliance. This includes adopting safer vehicle designs, reducing emissions, and meeting stringent safety standards, which are critical for maintaining consumer trust and avoiding costly recalls.

In conclusion, the road ahead for the automobile industry is paved with challenges and opportunities. By embracing automotive technology, prioritizing sustainability, adapting to market trends, and focusing on customer satisfaction, businesses can navigate the dynamic landscape of vehicle manufacturing, automotive sales, and service provision. Staying informed and agile will be key to leveraging industry innovation and securing a competitive edge in this rapidly changing sector.

2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance"

In the fast-paced world of the automobile industry, staying ahead of the curve is not just beneficial—it's essential. Businesses focusing on automotive sales, aftermarket parts, and vehicle maintenance sectors must employ innovative strategies to ensure sustained success. Embracing industry innovation, understanding market trends, and adhering to regulatory compliance are pivotal in driving growth and achieving customer satisfaction.

For businesses in automotive sales, including car dealerships, the key to revving up sales figures lies in leveraging automotive marketing techniques that resonate with evolving consumer preferences. Today's customers are looking for more than just a vehicle; they seek a buying experience that is seamless, personalized, and tech-savvy. Employing digital marketing strategies, such as virtual showrooms and interactive online platforms, can significantly enhance the customer's journey. Additionally, understanding the importance of automotive technology, such as electric vehicles (EVs) and hybrid models, allows dealerships to cater to the environmentally conscious consumer, tapping into a growing market segment.

The aftermarket parts sector thrives on customization and quality. Vehicle owners looking to enhance performance or aesthetics rely on aftermarket parts for their specific needs. Success in this area requires a robust supply chain management system to ensure the availability of top-quality parts. Staying informed about the latest trends in automotive technology and incorporating them into the product lineup can set a business apart from the competition. Furthermore, offering exceptional customer service, including knowledgeable advice and installation services, can significantly boost customer loyalty and word-of-mouth referrals.