Hong Kong Stocks Surge in Anticipation of Key Economic Meeting in China: A Bull Run in Bond Market Continues

Shares in Hong Kong are on the rise as market participants anticipate information from China's economic gathering. The economic meeting in China is set to wrap up on Thursday.

The Hang Seng Index saw an increase of 1.2 per cent, closing at 20,397.05. Likewise, the Hang Seng Tech Index experienced a growth of 1.5 per cent. Over in China, the CSI 300 Index rose by 1 per cent, while the Shanghai Composite Index also improved, going up by 0.9 per cent.

China's bond market sustained its upward trend with the 10-year government note yield dropping for the seventh consecutive day to an all-time low of 1.818 per cent. This decline is fueled by the positive outlook regarding further monetary relaxation.

"China is faced with the delicate balance of dealing with immediate issues arising from distressed consumers within the country, while also bracing for potential tariff impositions from the US," noted Naomi Fink, the head global strategist at Nikko Asset Management.

Business

Driving Forward: Mastering the Road to Success in the Automotive Industry through Innovation, Market Trends, and Consumer-Centric Strategies

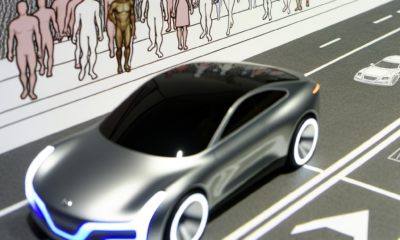

The Automobile Industry is experiencing dynamic changes, requiring businesses in Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, and Car Dealerships to adapt quickly to shifting Market Trends, Consumer Preferences, and Regulatory Compliance. Embracing Automotive Technology advancements like electric and autonomous vehicles, along with a strong focus on Automotive Marketing and an online presence, are key to staying on top. The rise in vehicle customization boosts the demand for Aftermarket Parts, while the importance of efficient Supply Chain Management and adherence to environmental and safety standards highlight the industry's shift towards sustainability and customer trust. Success hinges on Industry Innovation, robust Automotive Marketing strategies, and the ability to offer comprehensive services from Vehicle Maintenance to Automotive Repair and Car Rental Services, ensuring businesses remain competitive and exceed customer expectations in the ever-evolving Automobile Industry landscape.

In the ever-evolving landscape of the automotive industry, businesses at the heart of vehicle manufacturing, sales, and maintenance are steering through a period of significant transition. From top car manufacturers to local repair shops and car rental services, these enterprises are crucial in propelling individuals and organizations forward, fulfilling a myriad of transportation needs. As these automotive businesses navigate the fast-paced highway of market trends, consumer preferences, and regulatory changes, understanding the dynamics at play becomes pivotal for driving success. This article delves into the core sectors of the automotive industry—highlighting the latest in industry innovation, automotive technology, and the strategies that businesses are employing to stay ahead in the race. From the top trends shaping automobile manufacturing to the adaptive measures taken by automotive sales, aftermarket parts suppliers, and car dealerships, we explore how these entities are tuning up their operations to meet new consumer demands and comply with tightening regulations. Additionally, we'll shift gears to examine the critical role of vehicle maintenance, automotive repair, and car rental services in this comprehensive ecosystem. Engaging with the themes of supply chain management, automotive marketing, and the overarching impact of economic conditions, this article provides a roadmap for understanding the complex yet fascinating world of the automotive business.

- 1. "Navigating the Fast Lane: Top Trends Shaping the Automobile Industry and Vehicle Manufacturing"

- 2. "Revving Up Success: How Automotive Sales, Aftermarket Parts, and Car Dealerships are Adapting to New Consumer Preferences and Regulatory Compliance"

1. "Navigating the Fast Lane: Top Trends Shaping the Automobile Industry and Vehicle Manufacturing"

In the ever-evolving world of the automobile industry, staying ahead of the curve is paramount for businesses aiming to thrive. From vehicle manufacturing to automotive sales, aftermarket parts, car dealerships, vehicle maintenance, automotive repair, and car rental services, the landscape is constantly shaped by a myriad of factors. Understanding the top market trends, consumer preferences, and the importance of regulatory compliance is crucial for those navigating this dynamic sector.

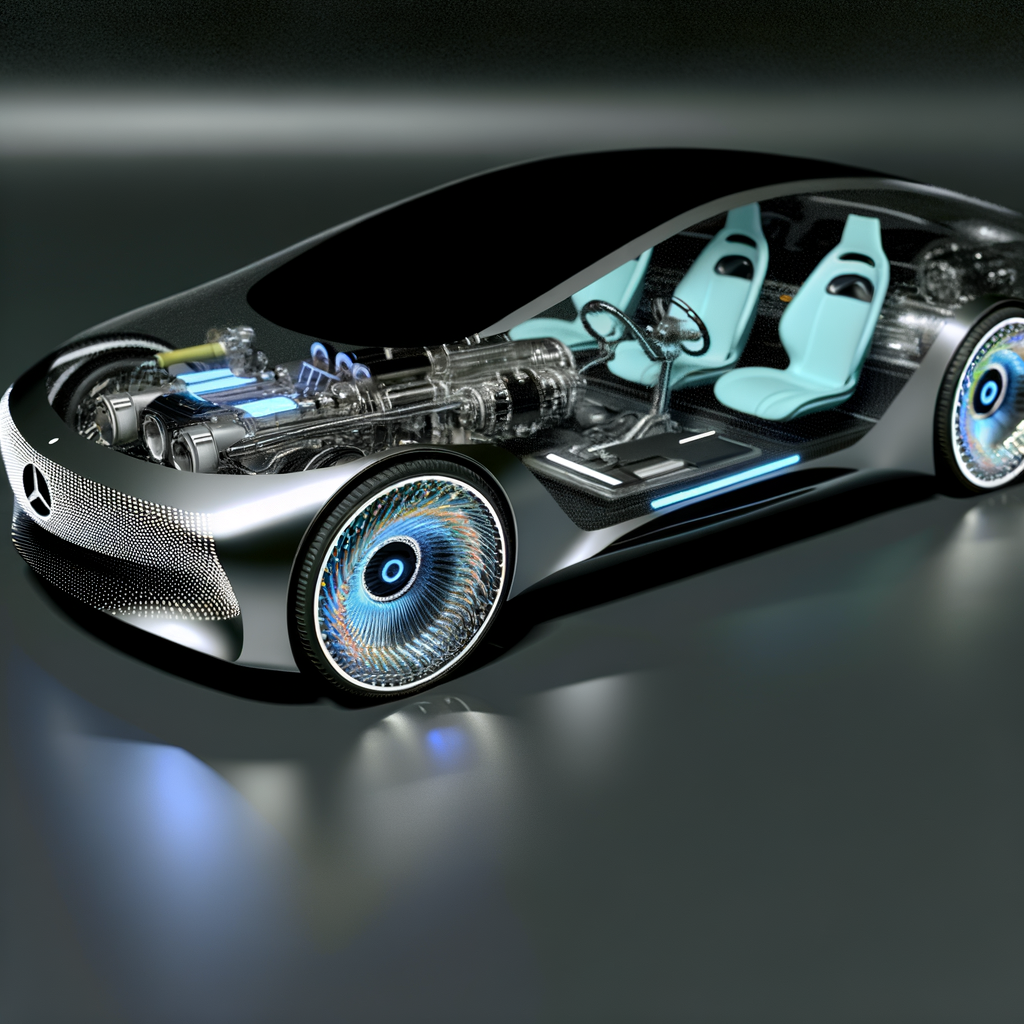

One of the most significant drivers of change within the automobile industry is the rapid advancement of automotive technology. This encompasses everything from electric vehicles (EVs) and autonomous driving capabilities to connected car features and advancements in battery technology. These innovations not only influence vehicle manufacturing but also have a profound impact on automotive sales, as consumers increasingly prioritize sustainability, safety, and connectivity.

Moreover, the rise of the digital era has revolutionized automotive marketing strategies. Today’s consumers begin their car buying journey online, making it essential for car dealerships and manufacturers to have a strong digital presence. Effective use of social media, digital advertising, and online customer engagement can significantly boost visibility and sales.

Another trend shaping the industry is the growing emphasis on aftermarket parts and customization. As consumers seek to personalize their vehicles, demand for high-quality aftermarket parts and accessories has surged. This trend offers lucrative opportunities for businesses specializing in vehicle customization and repair, highlighting the importance of staying abreast with the latest in automotive styling and technology.

Vehicle maintenance and automotive repair services are also experiencing transformation, driven by the shift towards more sophisticated vehicles. The complexity of newer models demands highly skilled technicians and advanced diagnostic tools, emphasizing the need for continuous training and investment in state-of-the-art equipment.

Furthermore, the automotive industry is not immune to the challenges and opportunities presented by global supply chain management. Delays, shortages, and the rising cost of materials have underscored the importance of robust supply chain strategies. Companies that can effectively manage these aspects through strategic partnerships and innovative logistics solutions are better positioned to navigate market uncertainties.

Regulatory compliance remains a top priority, with environmental standards and safety regulations becoming increasingly stringent worldwide. Adhering to these regulations is not only a legal necessity but also a way to build consumer trust and establish a reputation for quality and responsibility.

In conclusion, the automobile industry is at a crossroads, with technology, consumer preferences, and regulatory frameworks steering the direction of vehicle manufacturing and related services. Businesses that can adeptly manage supply chain complexities, embrace industry innovation, and tailor their automotive marketing strategies to meet the digital age will likely lead the pack. As the industry continues to evolve, staying informed and adaptable will be the keys to success in the fast lane of the automotive sector.

2. "Revving Up Success: How Automotive Sales, Aftermarket Parts, and Car Dealerships are Adapting to New Consumer Preferences and Regulatory Compliance"

In the fast-paced world of the Automobile Industry, businesses involved in Automotive Sales, Aftermarket Parts, and Car Dealerships are constantly navigating a road filled with new Consumer Preferences and Regulatory Compliance requirements. This dynamic landscape is driving significant adaptations and innovations, ensuring these sectors remain in the top gear of performance and customer satisfaction.

Understanding and responding to evolving Consumer Preferences is paramount for businesses aiming to lead in Vehicle Manufacturing and Automotive Sales. Today’s consumers are more informed and environmentally conscious, seeking vehicles that are not only fuel-efficient but also equipped with the latest Automotive Technology. This shift has prompted manufacturers and dealerships to prioritize the sale of electric and hybrid vehicles, incorporating advanced features such as autonomous driving capabilities and connected car technologies. Automotive Marketing strategies have evolved correspondingly, with a greater emphasis on digital platforms to showcase these technological advancements and engage with a tech-savvy audience.

The realm of Aftermarket Parts has also seen a significant transformation, driven by the demand for customization and Vehicle Maintenance services. Consumers are increasingly looking to personalize their vehicles for aesthetics, performance, or environmental reasons. This trend has spurred Industry Innovation, with companies offering a wider range of eco-friendly and high-performance parts. Supply Chain Management plays a critical role in ensuring the timely availability of these parts, necessitating a more agile and responsive approach to logistics and inventory management.

Regulatory Compliance is another accelerator of change in the Automotive sector. Stricter emissions standards and safety regulations have compelled Vehicle Manufacturing and Automotive Repair businesses to adopt more sustainable and safer practices. This adherence to regulation is not just about legal compliance but also serves as a key marketing advantage, appealing to consumers who value corporate responsibility and environmental stewardship.

Car Dealerships, in particular, have had to overhaul their sales approach and customer service. The traditional dealership model is being challenged by online sales platforms, prompting dealerships to enhance their in-person customer experience and offer more comprehensive Car Rental Services and Automotive Repair solutions. This shift aims to create a more customer-centric business model that combines the convenience of online shopping with the trust and reliability of traditional vehicle purchasing experiences.

In conclusion, the Automotive sector is witnessing a significant shift, influenced by Market Trends, Consumer Preferences, and Regulatory Compliance. Success in this competitive industry requires a holistic approach that encompasses innovative Automotive Technology, efficient Supply Chain Management, and effective Automotive Marketing strategies. By embracing these changes, Automotive Sales, Aftermarket Parts, and Car Dealerships are setting the stage for a future where they not only meet but exceed customer expectations, driving forward with resilience and adaptability.

In conclusion, the automotive business is undeniably a crucial pillar in the global economy, driving forward not only the Automobile Industry and Vehicle Manufacturing sectors but also influencing Automotive Sales, Aftermarket Parts, Car Dealerships, and a variety of service-oriented sectors like Vehicle Maintenance, Automotive Repair, and Car Rental Services. The journey through the fast-evolving lanes of automotive technology, market trends, consumer preferences, and regulatory compliance has shown that success in this competitive landscape requires more than just keeping pace; it demands foresight, innovation, and a customer-centric approach.

As we've explored, the top trends shaping the industry are not just about the latest in automotive technology or the push towards more sustainable manufacturing practices. They also encompass how businesses adapt their strategies in Automotive Marketing, Supply Chain Management, and Industry Innovation to meet the changing demands of consumers and regulatory bodies. The ability to navigate these changes, from embracing electric vehicles and autonomous driving technologies to adapting to new models of car ownership and use, is what will set apart successful automotive businesses in the coming years.

Moreover, the resilience of the automotive sector, despite the challenges posed by economic fluctuations and the global pandemic, speaks volumes about the importance of flexibility and adaptability. Businesses that can rev up their operations to match the pace of Industry Innovation, while ensuring Regulatory Compliance and focusing on enhancing Customer Satisfaction, are those that will thrive.

In essence, the future of the automotive business lies in the hands of those who are prepared to drive through the lanes of change with agility and vision. By staying informed about the latest trends, investing in Automotive Technology, and prioritizing the needs and preferences of consumers, businesses within the automotive sector can look forward to a journey marked by growth, innovation, and success.

Business

Driving Forward: Mastering the Road to Success in the Automobile Industry with Top Vehicle Manufacturing, Automotive Sales, and Cutting-Edge Services

In the rapidly evolving Automobile Industry, success hinges on a mix of passion and strategic planning, focusing on top strategies across Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, and more. Industry Innovation, efficient Supply Chain Management, and staying ahead of Automotive Technology and Market Trends are critical in meeting modern demands and Consumer Preferences for eco-friendly and advanced vehicles. Emphasizing Regulatory Compliance, leveraging Automotive Marketing on digital platforms, and excelling in Vehicle Maintenance, Automotive Repair, and Car Rental Services are key to thriving. The interconnectedness of these sectors, including the rise of Aftermarket Parts and digital Car Dealerships, is reshaping the market towards sustainability, efficiency, and a customer-centric approach, setting a trajectory for future growth and innovation in the Automobile Industry.

In the fast-paced world of the automobile industry, where vehicle manufacturing and automotive sales are constantly evolving, businesses must employ top strategies to stay ahead of the competition and meet the ever-changing demands of consumers. From aftermarket parts to car dealerships and vehicle maintenance, every facet of the automotive business plays a pivotal role in shaping the trajectory of industry innovation and influencing consumer preferences. As technological advancements surge and market trends shift, companies entrenched in automotive repair, car rental services, and more, find themselves at the crossroads of opportunity and challenge.

This comprehensive exploration delves into the heart of success within the automobile industry, unveiling the key strategies that drive vehicle manufacturing and automotive sales forward. It also casts a spotlight on how aftermarket parts, car dealerships, and vehicle maintenance are not just responding to, but actively molding, the future of automotive technology and consumer expectations. With a keen eye on regulatory compliance, supply chain management, and automotive marketing, this article provides an insightful look into the dynamic and competitive market that defines the automotive sector. Join us as we navigate the intricacies of industry innovation, consumer preferences, and the critical role of automotive businesses in providing essential transportation solutions.

- 1. "Navigating Success in the Automobile Industry: Top Strategies for Vehicle Manufacturing and Automotive Sales"

- 2. "Revving Up the Future: How Aftermarket Parts, Car Dealerships, and Vehicle Maintenance Are Shaping Industry Innovation and Consumer Preferences"

1. "Navigating Success in the Automobile Industry: Top Strategies for Vehicle Manufacturing and Automotive Sales"

In the fast-paced world of the Automobile Industry, achieving success requires more than just a passion for vehicles; it demands strategic planning, keen insight into market trends, and an unwavering commitment to customer satisfaction. Whether you're involved in Vehicle Manufacturing, Automotive Sales, or Aftermarket Parts supply, understanding and implementing top strategies are crucial for staying ahead of the competition.

First and foremost, Industry Innovation cannot be overstated. With the rapid advancements in Automotive Technology, businesses must invest in research and development to offer the latest features and efficiencies in their vehicles and services. This not only applies to new car models but also to Aftermarket Parts and Automotive Repair services, ensuring they meet the evolving needs of modern vehicles.

Supply Chain Management also plays a pivotal role in the success of automotive businesses. Efficient logistics and inventory management ensure that Car Dealerships and Aftermarket Parts providers can meet consumer demand without unnecessary delays. This aspect has become increasingly important as the industry faces global supply chain challenges, highlighting the need for flexible and resilient operations.

Understanding Consumer Preferences is another key factor. Today's consumers are more informed and have higher expectations than ever before. They value not only the quality and performance of their vehicles but also the environmental impact and technological features. Automotive Sales strategies must adapt to these preferences, offering a range of options from electric and hybrid models to vehicles equipped with the latest in connectivity and safety technologies.

Regulatory Compliance cannot be overlooked. With governments around the world imposing stricter emissions and safety standards, Vehicle Manufacturing and Maintenance businesses must ensure their products and services comply with these regulations. Staying ahead of these legal requirements not only avoids penalties but can also be a significant market differentiator, appealing to environmentally conscious consumers.

Lastly, Automotive Marketing plays a critical role in navigating success in this industry. Effective marketing strategies that leverage the latest digital platforms can significantly enhance visibility and attract potential customers. From social media campaigns highlighting the latest Vehicle Maintenance and Repair services to targeted ads showcasing the newest models available at Car Dealerships, a robust online presence is essential.

In conclusion, businesses in the Automobile Industry must adopt a multifaceted approach to succeed. By focusing on Industry Innovation, efficient Supply Chain Management, understanding Consumer Preferences, ensuring Regulatory Compliance, and implementing cutting-edge Automotive Marketing strategies, companies can thrive in the competitive landscape of Vehicle Manufacturing, Automotive Sales, Car Rental Services, and more. As the industry continues to evolve, those that can adapt and anticipate future trends will be the ones driving forward into success.

2. "Revving Up the Future: How Aftermarket Parts, Car Dealerships, and Vehicle Maintenance Are Shaping Industry Innovation and Consumer Preferences"

In the fast-paced world of the Automobile Industry, innovation and consumer preferences drive the market, significantly impacting Vehicle Manufacturing, Automotive Sales, and the services sector, including Aftermarket Parts, Car Dealerships, and Vehicle Maintenance. The dynamic interplay among these segments is not just shaping the present landscape but also revving up the future of the automotive sector.

Aftermarket Parts are becoming a cornerstone for industry innovation, offering consumers cost-effective, high-quality alternatives to OEM (Original Equipment Manufacturer) parts. This segment is crucial in promoting customization, enhancing performance, and improving vehicle longevity. The rise in consumer demand for personalized vehicles has led top Aftermarket Parts suppliers to invest heavily in R&D, pushing the boundaries of Automotive Technology and giving consumers unprecedented control over their vehicles' performance and aesthetics. This trend is also influencing Vehicle Manufacturing, as manufacturers are now considering more modular designs to accommodate the ever-growing aftermarket customization.

Car Dealerships, the traditional face of Automotive Sales, are undergoing a transformation, driven by evolving Market Trends and Consumer Preferences. The digitalization of the car buying process and the emphasis on customer experience have propelled dealerships to adopt more sophisticated Automotive Marketing strategies. They are not just selling cars; they are selling an experience, leveraging technology to offer virtual showrooms, augmented reality test drives, and seamless online transactions. This shift is not only enhancing customer satisfaction but is also setting new standards in Retail Supply Chain Management and Regulatory Compliance, ensuring a smoother, more transparent buying process.

Vehicle Maintenance and Automotive Repair services are also at the forefront of embracing change, as they adapt to the challenges and opportunities presented by new automotive technologies, such as electric and hybrid vehicles. The focus has shifted towards sustainability and efficiency, with top service providers investing in training their technicians on the latest Automotive Technology. This ensures that the maintenance and repair of modern vehicles meet the high standards expected by consumers, thereby improving customer trust and loyalty. Furthermore, the integration of advanced diagnostics and telematics has revolutionized Vehicle Maintenance, enabling predictive maintenance schedules and minimizing downtime for consumers.

In conclusion, the interconnection of Aftermarket Parts, Car Dealerships, and Vehicle Maintenance is not only shaping the current Automotive Sales and service landscape but is also pivotal in driving Industry Innovation. By responding to and anticipating Consumer Preferences, embracing new technologies, and adhering to Regulatory Compliance, these sectors are setting the stage for a more sustainable, customer-centric future in the Automobile Industry. As we look ahead, it is clear that the synergy among these sectors will continue to influence Market Trends, propelling the automotive sector towards new horizons of growth and innovation.

In conclusion, the automotive business encompasses a broad spectrum of activities crucial for the mobility and transportation needs of modern society. From vehicle manufacturing to automotive sales, aftermarket parts, car dealerships, vehicle maintenance, and automotive repair, each segment plays a vital role in the industry's ecosystem. As we have explored, achieving success in the automobile industry requires a multifaceted approach. Top strategies include staying ahead of automotive technology advancements, understanding market trends, catering to evolving consumer preferences, ensuring regulatory compliance, and optimizing supply chain management.

Industry innovation, driven by aftermarket parts suppliers and vehicle maintenance services, continues to shape consumer expectations and the competitive landscape. Car dealerships and automotive sales professionals must therefore embrace automotive marketing techniques that resonate with today's consumers, highlighting the importance of quality, sustainability, and technological features.

Car rental services, too, contribute to the industry's dynamics, offering flexibility and alternative transportation solutions that reflect changing consumer behavior. The future of the automotive business will undoubtedly be influenced by how well companies adapt to these shifts, leveraging industry innovation to meet the demands of an increasingly sophisticated market.

As we look ahead, the automobile industry stands at the precipice of a new era, marked by electrification, autonomous driving, and digitalization. Success will belong to those who not only navigate these changes with agility but also remain committed to delivering excellence in automotive sales, vehicle manufacturing, and all facets of automotive service. By embracing these challenges and opportunities, businesses within the automotive sector can drive forward into a future where mobility is not just about getting from point A to B, but about doing so in a way that is smarter, safer, and more sustainable than ever before.

Business

Navigating the Road to Success: Mastering the Automobile Industry through Strategic Vehicle Manufacturing, Innovative Aftermarket Solutions, and Dynamic Automotive Sales Tactics

In the dynamic Automobile Industry, achieving success requires a focus on Industry Innovation, effective Supply Chain Management, and strategic Automotive Marketing. Embracing top Automotive Technology, such as eco-friendly vehicles and autonomous driving, aligns with current Market Trends and Consumer Preferences. Enhancing the customer experience through digital platforms, and offering comprehensive services like Aftermarket Parts, Vehicle Maintenance, and Automotive Repair are essential for Car Dealerships and Car Rental Services. Additionally, maintaining Regulatory Compliance and leveraging a mix of traditional and digital marketing techniques are crucial. The shift towards greater integration of Aftermarket Parts and advanced technologies is driving major changes across Vehicle Manufacturing, Automotive Sales, and influencing Consumer Preferences towards customization and high-tech features. To thrive, businesses must adapt by showcasing technological advancements, meeting Consumer Preferences, and innovating in every aspect from Car Dealerships to Manufacturing, ensuring long-term success in the competitive landscape.

In the ever-evolving landscape of the automotive industry, businesses are constantly navigating through a maze of challenges and opportunities, aiming to secure their position in a market driven by innovation, consumer demands, and regulatory requirements. From vehicle manufacturing giants to bustling car dealerships, and from state-of-the-art automotive repair shops to the dynamic world of car rental services, each entity plays a pivotal role in shaping the transportation solutions of today and tomorrow. The automotive business is not just about selling cars—it's about delivering comprehensive mobility solutions that resonate with consumer preferences, adhere to stringent regulatory compliance, and leverage cutting-edge automotive technology.

In this comprehensive article, we delve into the strategies and innovations that are steering success in the automobile industry. Our exploration begins with "Steering Success in the Automobile Industry: Top Strategies for Vehicle Manufacturing and Automotive Sales," where we dissect the key components that drive growth and profitability in vehicle manufacturing and automotive sales. The journey continues as we shift gears to "Revving Up Innovation: How Aftermarket Parts and Advanced Automotive Technology Are Shaping Market Trends and Consumer Preferences," highlighting the transformative impact of aftermarket parts, industry innovation, and technological advancements on market dynamics and consumer choices.

Throughout, we will navigate the intricate web of supply chain management, automotive marketing, vehicle maintenance, and regulatory compliance, offering insights into how top players in the automobile industry are not just surviving but thriving by embracing change and fostering innovation. Join us as we explore the roads less traveled in the automotive sector, where the pursuit of quality products and services, customer satisfaction, and adaptive marketing strategies paves the way for success in a competitive and dynamic marketplace.

- 1. "Steering Success in the Automobile Industry: Top Strategies for Vehicle Manufacturing and Automotive Sales"

- 2. "Revving Up Innovation: How Aftermarket Parts and Advanced Automotive Technology Are Shaping Market Trends and Consumer Preferences"

1. "Steering Success in the Automobile Industry: Top Strategies for Vehicle Manufacturing and Automotive Sales"

In the rapidly evolving Automobile Industry, achieving success in Vehicle Manufacturing and Automotive Sales demands a multifaceted approach, meticulously integrating top strategies that address the core components of market trends, consumer preferences, and regulatory compliance. The key to steering success in this competitive arena lies in the adoption of innovative practices in Automotive Technology, effective Supply Chain Management, and forward-thinking Automotive Marketing strategies.

A primary focus for vehicle manufacturers is Industry Innovation, which encompasses the development of eco-friendly models and the integration of advanced technologies. These innovations not only respond to growing environmental concerns but also cater to the modern consumer's demand for vehicles equipped with the latest tech features. Embraining Automotive Technology advancements, such as electric powertrains and autonomous driving systems, places manufacturers at the forefront of the industry, making them more appealing to a tech-savvy market.

Automotive Sales, including Car Dealerships and Car Rental Services, hinge on understanding and adapting to Consumer Preferences. Today's consumers are looking for more than just a vehicle; they seek a buying experience that is as personalized and convenient as possible. Implementing digital sales platforms and virtual showrooms can significantly enhance customer engagement and satisfaction. Moreover, providing comprehensive Aftermarket Parts and Vehicle Maintenance services can foster customer loyalty and generate additional revenue streams.

Supply Chain Management plays a pivotal role in the efficiency and profitability of both Vehicle Manufacturing and Automotive Sales. In today's global economy, ensuring a seamless supply chain, from parts acquisition to the delivery of the final product, is crucial. This involves strategic planning to mitigate risks associated with supply chain disruptions, which can significantly impact production schedules and inventory levels.

Regulatory Compliance cannot be overlooked, as the automotive industry is one of the most heavily regulated sectors globally. Keeping abreast of and adhering to the latest regulations concerning vehicle safety, emissions, and consumer protection is fundamental. This not only avoids legal pitfalls but also demonstrates a commitment to responsible business practices, enhancing brand reputation.

Lastly, Automotive Marketing is essential for capturing market share and building brand loyalty. Employing a mix of traditional and digital marketing strategies can effectively reach a broader audience. Content marketing, social media engagement, and targeted advertising can help highlight unique selling propositions, from the superiority of Automotive Repair services to the convenience of Car Rental Services.

In conclusion, success in the Automobile industry requires a comprehensive strategy that embraces innovation, understands and predicts consumer behavior, ensures efficient supply chain operations, adheres to regulatory standards, and employs effective marketing tactics. By focusing on these areas, businesses within Vehicle Manufacturing and Automotive Sales can navigate the complexities of the market and steer towards long-term success.

2. "Revving Up Innovation: How Aftermarket Parts and Advanced Automotive Technology Are Shaping Market Trends and Consumer Preferences"

In the ever-evolving landscape of the Automobile Industry, where Vehicle Manufacturing and Automotive Sales are at the heart of economic activity, a significant shift is being observed towards the incorporation of aftermarket parts and advanced automotive technology. This shift is not only reshaping Market Trends but also profoundly influencing Consumer Preferences, steering the industry towards a future where innovation and customization take precedence.

The rise of Aftermarket Parts has been a game-changer in the realm of Vehicle Maintenance and Automotive Repair. These components, which are used to replace, enhance, or add extra features to vehicles after the original sale, have become a top choice for consumers looking to personalize their rides or improve performance without breaking the bank. The accessibility and variety of aftermarket options have empowered vehicle owners like never before, offering them the flexibility to tailor their vehicles to meet specific needs or tastes. This surge in aftermarket availability is closely linked to advances in Automotive Technology, which have made it easier for manufacturers to produce high-quality, compatible parts at competitive prices.

Car Dealerships and Car Rental Services are also feeling the impact of these technological advancements. With consumers increasingly favoring vehicles equipped with the latest tech features, these businesses are adapting their offerings to include models that boast cutting-edge technology, from enhanced safety systems to digital connectivity and autonomous driving capabilities. This evolution is a testament to the industry's shift towards Automotive Marketing strategies that highlight technological superiority and innovation as key selling points.

Moreover, the integration of advanced Automotive Technology extends beyond mere gadgetry, touching on crucial aspects such as Regulatory Compliance and Supply Chain Management. As governments around the world tighten regulations on emissions and safety, the automotive sector is responding with vehicles that are not only more environmentally friendly but also equipped with sophisticated safety features. This alignment with regulatory standards is further driving Industry Innovation, as manufacturers and aftermarket suppliers alike invest in research and development to meet these stringent requirements.

The interplay between consumer demand for high-tech vehicles and the industry's push for innovation has created a dynamic market environment. Automotive businesses are now prioritizing Industry Innovation in their strategies, aiming to stay ahead in a competitive landscape by offering products and services that reflect the top Consumer Preferences. From the development of electric and hybrid vehicles to the creation of smart, connected cars, the focus on advanced Automotive Technology is setting new benchmarks for what vehicles can achieve.

In conclusion, the integration of Aftermarket Parts and advanced Automotive Technology is significantly influencing Market Trends and shaping Consumer Preferences within the Automobile Industry. This shift towards customization and high-tech features is not only redefining the concept of vehicle ownership but also compelling Automotive Sales, Vehicle Manufacturing, and related services to adapt and innovate. As the industry continues to evolve, staying at the forefront of these changes will be crucial for businesses looking to thrive in the dynamic automotive landscape.

In conclusion, navigating the intricate landscape of the automobile industry demands a harmonious blend of innovation, strategic marketing, and an unwavering commitment to customer satisfaction. From vehicle manufacturing to automotive sales, and from aftermarket parts to car rental services, businesses operating within this sector are pivotal in driving transportation solutions forward. Success in this dynamic field hinges on a deep understanding of market trends, consumer preferences, and the ability to swiftly adapt to regulatory changes and technological advancements.

The top strategies highlighted for steering a successful path in vehicle manufacturing and automotive sales underscore the significance of industry innovation, effective supply chain management, and automotive marketing that resonates with target audiences. Moreover, the surge in demand for aftermarket parts and advanced automotive technology illustrates a shifting landscape, where customization and efficiency are at the forefront of consumer preferences.

Car dealerships, vehicle maintenance, and automotive repair businesses play an equally critical role in ensuring that the wheels of the automotive industry keep turning, offering indispensable services that maintain and enhance the lifespan and performance of vehicles.

As we look to the future, the automotive business sector is poised for further evolution, shaped by emerging trends in automotive technology, environmental considerations, and changing consumer demands. Embracing these changes, while maintaining a steadfast focus on quality, customer service, and regulatory compliance, will be key to thriving in the competitive arena of the automobile industry. In essence, the road to success in the automotive business is multifaceted, requiring a strategic approach to innovation, marketing, and operations.

Business

Driving Forward: Navigating Success in the Automobile Industry through Innovation and Market Trends

In the rapidly changing Automobile Industry, success is driven by staying ahead of Market Trends, embracing advanced Automotive Technology like electric and autonomous vehicles, and adapting to changing Consumer Preferences for sustainability and efficiency. Top sectors such as Vehicle Manufacturing, Automotive Sales, and Aftermarket Parts are experiencing significant growth and innovation. Emphasis on Regulatory Compliance, eco-friendly initiatives, and efficient Supply Chain Management is critical. Additionally, Car Dealerships and Car Rental Services are innovating with digital Automotive Marketing strategies and subscription-based models to meet consumer demands. Industry Innovation, focusing on customer satisfaction, and technological advancements are key for businesses to remain competitive in the global market.

In the fast-paced world of the Automobile Industry, staying ahead of the curve is not just an option; it's a necessity. From Vehicle Manufacturing to Automotive Sales, and from Aftermarket Parts to Car Rental Services, the spectrum of automotive business is vast and varied. Each segment, be it Car Dealerships, Vehicle Maintenance, or Automotive Repair, plays a pivotal role in shaping the transportation landscape, catering to the ever-evolving demands of consumers and the market. As we delve into the heart of this dynamic sector, it becomes evident that Industry Innovation, Market Trends, and Consumer Preferences are the driving forces propelling businesses towards success. This article, "Revving Up Success: Top Trends and Innovations in the Automobile Industry" coupled with "Navigating the Road Ahead: Strategies for Automotive Businesses to Thrive in a Changing Market," aims to explore the multifaceted world of automotive enterprises. It highlights how embracing Automotive Technology, ensuring Regulatory Compliance, and mastering Supply Chain Management can create unparalleled opportunities for growth and excellence. Moreover, we will uncover the secrets behind effective Automotive Marketing and the paramount importance of quality in securing customer satisfaction and loyalty. Join us as we journey through the latest advancements and strategic maneuvers that are setting the stage for a future where automotive businesses not only survive but thrive in a competitive and ever-changing market landscape.

- 1. "Revving Up Success: Top Trends and Innovations in the Automobile Industry"

- Explore how vehicle manufacturing, aftermarket parts, and automotive technology are driving the future of the automobile sector. This section delves into industry innovation, market trends, and the pivotal role of automotive sales in maintaining a competitive edge.

1. "Revving Up Success: Top Trends and Innovations in the Automobile Industry"

In the fast-paced world of the Automobile Industry, staying ahead of the curve is not just an option; it's a necessity for success. The landscape of Vehicle Manufacturing, Automotive Sales, and the broader automotive ecosystem is continuously shaped by emerging Market Trends, technological breakthroughs, and ever-changing Consumer Preferences. As businesses strive to navigate this dynamic environment, several key areas have emerged as pivotal to driving growth and innovation.

One of the most significant trends shaping the industry is the rapid advancement in Automotive Technology. From electric vehicles (EVs) to autonomous driving capabilities, technological innovations are not only redefining the products offered but also how they are manufactured, sold, and serviced. This evolution demands that businesses across the spectrum, from Car Dealerships to Aftermarket Parts suppliers, stay abreast of technological developments to meet the modern consumer's expectations.

Furthermore, the emphasis on sustainability and Regulatory Compliance has prompted Vehicle Manufacturing companies to invest heavily in research and development. This focus aims to reduce the environmental impact of vehicles through cleaner manufacturing processes and the development of eco-friendly vehicles. This shift not only responds to regulatory pressures but also aligns with a growing consumer demand for sustainable transportation options.

In addition to technology and sustainability, Supply Chain Management has become a critical focus area. The global nature of the automotive industry means that disruptions in one part of the world can have ripple effects across the entire supply chain. Effective management strategies are essential to mitigate these risks, ensuring the timely delivery of both vehicles and parts. This aspect is especially crucial for maintaining the reliability of Automotive Repair and Maintenance services, which are vital for customer satisfaction and loyalty.

The role of Automotive Marketing has also evolved, with a greater emphasis on digital platforms to engage with consumers. The rise of online car sales, virtual showrooms, and digital service bookings are testaments to the industry's adaptation to the digital age. These strategies not only enhance the buying experience but also create new opportunities for personalized marketing and customer relationship management.

Lastly, Industry Innovation extends beyond products and services to encompass business models. Car Rental Services, for example, have seen a shift towards subscription models, reflecting a broader trend towards 'mobility as a service'. This trend indicates a move away from vehicle ownership to providing flexible, on-demand transportation solutions.

In conclusion, success in the Automotive Business today requires a multifaceted approach. It involves a deep understanding of advancements in Automotive Technology, a commitment to sustainability and Regulatory Compliance, efficient Supply Chain Management, innovative Automotive Marketing strategies, and the agility to adapt to Industry Innovation. By staying attuned to these developments, businesses can not only survive but thrive in the competitive landscape of the Automobile Industry.

Explore how vehicle manufacturing, aftermarket parts, and automotive technology are driving the future of the automobile sector. This section delves into industry innovation, market trends, and the pivotal role of automotive sales in maintaining a competitive edge.

In the rapidly evolving landscape of the automobile industry, vehicle manufacturing, aftermarket parts, and cutting-edge automotive technology are collectively steering the sector towards an unprecedented era of innovation and growth. At the forefront of this transformation are industry leaders who are not only embracing but also driving market trends that cater to ever-changing consumer preferences and stringent regulatory compliance standards.

Vehicle manufacturing stands as the backbone of the automobile industry, with top manufacturers constantly pushing the envelope in terms of design, efficiency, and sustainability. This relentless pursuit of excellence is crucial for maintaining a competitive edge in a market that is increasingly influenced by concerns over environmental impact and fuel economy. The integration of advanced automotive technology into new vehicles, such as electric powertrains and autonomous driving systems, further underscores the sector's commitment to innovation and regulatory compliance.

The role of aftermarket parts cannot be overstated in this dynamic ecosystem. As vehicles become more technologically sophisticated, the demand for high-quality, innovative aftermarket solutions has skyrocketed. These products not only enhance vehicle performance and aesthetics but also play a critical role in vehicle maintenance and repair. Car dealerships and automotive repair shops are increasingly relying on top-notch aftermarket parts to meet customer expectations and ensure vehicle longevity. This trend is supported by effective supply chain management practices that ensure the timely availability of these essential components.

Automotive sales, including car dealerships and car rental services, are the public face of the industry, directly interacting with consumers and influencing their purchasing decisions. In this context, automotive marketing strategies are evolving to highlight the advanced features and environmental benefits of new models, addressing consumer preferences for more sustainable and technologically advanced transportation solutions. Sales professionals are increasingly knowledgeable about the latest automotive technology, enabling them to provide valuable insights to potential buyers and effectively communicate the benefits of innovative vehicle features.

Moreover, the rise of digital platforms has revolutionized automotive sales and marketing, allowing businesses to reach a wider audience and offer personalized shopping experiences. This digital transformation is also evident in the way car rental services are adapting to consumer demands for flexibility, convenience, and access to the latest vehicle models.

In conclusion, the future of the automobile sector is being shaped by a confluence of factors, including advancements in vehicle manufacturing, the growing importance of aftermarket parts, and the integration of state-of-the-art automotive technology. By staying attuned to market trends, prioritizing customer satisfaction, and adhering to regulatory standards, businesses within the automotive industry can navigate the challenges of an ever-changing landscape and thrive in the competitive global market.

In conclusion, the automotive industry stands at a crossroads of innovation and tradition, where the success of businesses hinges on their ability to navigate the complexities of vehicle manufacturing, automotive sales, and the myriad of services that support the lifecycle of a vehicle. From car dealerships to vehicle maintenance, automotive repair, and car rental services, businesses within this sector must stay ahead of market trends, embrace industry innovation, and adapt to changing consumer preferences to remain competitive. The exploration of top trends and innovations in the automobile industry reveals a landscape rich with opportunity for those ready to leverage advancements in automotive technology, maintain regulatory compliance, and optimize supply chain management. As we look to the future, the key to thriving in this dynamic and competitive market will undoubtedly be an unwavering commitment to quality products and services, effective automotive marketing strategies, and the foresight to anticipate and respond to the evolving needs of consumers. With these strategies in hand, businesses in the automobile industry are well-positioned to accelerate their growth, drive automotive sales, and continue providing essential transportation solutions to individuals and organizations around the globe.

Business

Driving Success: Mastering the Automotive Business Landscape from Vehicle Manufacturing to Car Rental Services

The Automobile Industry is undergoing a major transformation fueled by advancements in Automotive Technology, shifting Market Trends, and changing Consumer Preferences towards sustainable and smart mobility solutions. Key sectors such as Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, and Vehicle Maintenance are adapting to embrace electric vehicles, autonomous driving, and connected car features. This shift is also reshaping Automotive Repair and Car Rental Services, pushing for digital sales channels, personalized Automotive Marketing strategies, and compliance with Regulatory Standards. Industry Innovation, digitalization, and a focus on Supply Chain Management post-COVID-19 are critical for businesses aiming to thrive. Companies leading the charge are those leveraging top trends, focusing on customer-centric approaches, and ensuring Regulatory Compliance to meet the comprehensive needs of today’s automotive consumer.

In the fast-paced world of the automobile industry, businesses are constantly on the move, steering through the complexities of vehicle manufacturing, automotive sales, aftermarket parts, and the myriad services that keep our wheels turning. From car dealerships to vehicle maintenance, automotive repair, and car rental services, the automotive business is a vast ecosystem that fuels our journey towards mobility and convenience. As we shift gears into a future marked by groundbreaking automotive technology, understanding the market trends, consumer preferences, and regulatory compliance becomes paramount for companies aiming to lead the pack. This article delves into the heart of the automotive sector, exploring the top trends and innovations that are driving industry growth. By highlighting strategies for excellence in vehicle manufacturing, sales, and aftermarket services, we uncover the keys to success in a landscape shaped by evolving market demands and supply chain management challenges. Join us as we navigate the road ahead, revving up insights into industry innovation, automotive marketing, and the relentless pursuit of customer satisfaction in the dynamic world of the automobile industry.

- 1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

- 2. "Revving Up Success: Strategies for Excellence in Vehicle Manufacturing, Sales, and Aftermarket Services"

1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

In the fast-paced world of the Automobile Industry, staying ahead of the curve means keeping a keen eye on the top trends and innovations shaping the future. As we navigate the road ahead, several key factors are driving change and opportunity in Vehicle Manufacturing, Automotive Sales, and the broader ecosystem including Aftermarket Parts, Car Dealerships, and Vehicle Maintenance services.

One of the most significant shifts in the sector is the increasing focus on Automotive Technology. Innovations such as electric vehicles (EVs), autonomous driving capabilities, and connected car technologies are not just transforming how cars are built but also how they are sold and serviced. This technological evolution is closely tied to Consumer Preferences, with a growing demand for sustainable, efficient, and smarter mobility solutions. As a result, companies within the Automotive Repair and Car Rental Services are adapting by integrating advanced diagnostics, telematics, and mobile apps to enhance customer experience and operational efficiency.

Market Trends also indicate a strong movement towards digitization and online sales channels, reshaping Automotive Marketing strategies. The traditional model of car buying is being supplemented, and sometimes replaced, by digital platforms that offer virtual showrooms, online financing, and direct-to-consumer sales models. This shift requires dealerships to leverage digital tools and analytics to reach consumers, understand their preferences, and deliver personalized marketing messages.

Regulatory Compliance is another critical area impacting the industry. Stricter emissions standards, safety regulations, and policies supporting the adoption of green vehicles are pushing manufacturers and suppliers to innovate and rethink their supply chain management. This includes sourcing sustainable materials, optimizing manufacturing processes for reduced environmental impact, and ensuring products meet the latest safety and emissions guidelines.

Supply Chain Management, in itself, has emerged as a pivotal concern, especially in the wake of disruptions caused by global events such as the COVID-19 pandemic. Automotive businesses are seeking more resilient and flexible supply chain models, incorporating digital tracking, just-in-time manufacturing practices, and diversified sourcing to mitigate risks and maintain steady production flows.

Lastly, Industry Innovation is not limited to product design and technology. It also encompasses service offerings and business models. For instance, subscription-based models for vehicle usage and bundled services are gaining popularity, offering consumers more flexibility and convenience than traditional ownership or leasing arrangements.

In conclusion, the Automobile Industry is at a crossroads of technological innovation, changing consumer expectations, and regulatory pressures. Success in this dynamic environment requires businesses to stay informed about Automotive Market Trends, embrace Industry Innovation, and remain committed to delivering quality and satisfaction across all facets of the automotive experience—from Vehicle Manufacturing and Automotive Sales to Aftermarket Parts, Car Dealerships, Vehicle Maintenance, and beyond.

2. "Revving Up Success: Strategies for Excellence in Vehicle Manufacturing, Sales, and Aftermarket Services"

In the fast-paced world of the Automobile Industry, achieving and maintaining success requires a multifaceted approach that addresses the intricate aspects of Vehicle Manufacturing, Automotive Sales, and Aftermarket Services. Top players in the sector understand that excellence in these areas is not just about delivering quality products but also about how effectively they manage their supply chain, stay compliant with regulations, innovate, and market themselves.

To excel in Vehicle Manufacturing, it's imperative for companies to stay ahead of Market Trends and leverage Automotive Technology to its fullest. This includes investing in research and development to ensure that new models meet the evolving Consumer Preferences and environmental standards. Supply Chain Management also plays a crucial role, as streamlined logistics and procurement processes can significantly reduce production costs and improve efficiency. Moreover, Regulatory Compliance cannot be overlooked, as failing to meet industry standards can lead to severe penalties and damage to brand reputation.

In the realm of Automotive Sales, Car Dealerships must employ effective Automotive Marketing strategies to attract and retain customers. This involves understanding the target demographic's needs and preferences and offering tailored solutions that meet those needs. Establishing a strong online presence through digital marketing and social media platforms is also key, as more consumers are turning to the internet to research and make purchasing decisions. Additionally, providing exceptional customer service and fostering relationships can turn one-time buyers into lifelong patrons.

Aftermarket Parts and Automotive Repair services offer a significant opportunity for revenue generation after the initial vehicle sale. To tap into this market, businesses must ensure the availability of a wide range of high-quality parts and accessories that cater to the customization and maintenance needs of vehicle owners. Offering competitive pricing, warranty options, and expert advice can help in positioning a business as a go-to source for Vehicle Maintenance needs. Furthermore, embracing Industry Innovation, such as the use of diagnostic software and equipment, can enhance the efficiency and effectiveness of Automotive Repair services, thereby improving customer satisfaction.

Car Rental Services, too, must adapt to changing consumer behaviors and expectations by offering flexible leasing options, a diverse fleet of vehicles, and incorporating technology to streamline the booking and rental process. This sector benefits greatly from understanding and adapting to Consumer Preferences, offering competitive rates, and ensuring a hassle-free customer experience.

Ultimately, success in the automotive business hinges on a company's ability to understand and adapt to changing market dynamics, embrace innovation, and maintain a customer-centric approach across Vehicle Manufacturing, Automotive Sales, and Aftermarket Services. By focusing on these key areas and employing strategic marketing, companies can rev up their journey towards achieving excellence in the competitive landscape of the Automobile Industry.

In conclusion, the automotive business is an intricate ecosystem that spans from vehicle manufacturing to automotive sales, aftermarket parts, and comprehensive services such as maintenance and repair. This industry, essential for meeting the transportation needs of societies worldwide, is continually shaped by the convergence of top industry innovation, evolving consumer preferences, and the relentless pace of automotive technology advancements. As we have explored, navigating the road ahead in the automobile industry requires a keen understanding of market trends, a commitment to regulatory compliance, and a mastery of supply chain management. Businesses thriving in vehicle manufacturing, car dealerships, automotive repair, and car rental services share a common thread: they embrace change and leverage strategies for excellence that include robust automotive marketing efforts, a focus on quality and customer satisfaction, and an agile approach to adapting to the dynamic automotive landscape. As the industry moves forward, those positioned at the forefront will be those who not only anticipate the future of automotive sales and services but who also drive the innovation that will define the future of transportation.

Business

Driving Success in the Fast Lane: Mastering the Automotive Business from Vehicle Manufacturing to Aftermarket Services

The Automobile Industry, covering areas such as Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, and Vehicle Maintenance, requires a strategic approach to thrive amid intense competition and rapid changes. Success hinges on staying atop Market Trends, Consumer Preferences, Automotive Technology advancements, and ensuring Regulatory Compliance. Embracing Industry Innovation, like Electric Vehicles and digital platforms, is crucial for all sectors, including Automotive Repair and Car Rental Services. Efficient Supply Chain Management and data-driven Automotive Marketing strategies aligned with shifting consumer demands are essential. Moreover, a focus on customer satisfaction, transparency, and leveraging the latest in Automotive Technology can provide a competitive edge, making it imperative for businesses within the top echelons of the Automobile Industry to remain adaptable and informed to excel in Automotive Sales, Vehicle Maintenance, and beyond.

In the fast-paced world of the Automobile Industry, businesses that focus on Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, Vehicle Maintenance, and Automotive Repair are at the forefront of providing essential transportation solutions to both individuals and organizations. The dynamic nature of this sector, driven by Automotive Technology advancements, shifting Market Trends, evolving Consumer Preferences, and stringent Regulatory Compliance, poses unique challenges and opportunities for companies operating within it. As the industry continues to evolve, understanding the nuances of Supply Chain Management, Industry Innovation, and Automotive Marketing becomes crucial for achieving success and staying competitive.

This article delves into the intricate ecosystem of the automotive business, highlighting the pivotal role these companies play in catering to the diverse needs of their customers through vehicle sales, customization, repair, and Car Rental Services. We will explore the "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry" to uncover the latest developments shaping the future of automotive. Furthermore, "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance Mastery" will provide valuable insights into effective strategies for mastering various aspects of the automotive business, from enhancing sales to optimizing vehicle maintenance and repair services. Join us as we gear up to understand the key drivers of success in the competitive and ever-changing landscape of the automotive industry.

- 1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

- 2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance Mastery"

1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

In the fast-paced world of the Automobile Industry, staying ahead of market trends and technological advancements is crucial for businesses aiming for the pole position. As we navigate the road ahead, several key trends and innovations are steering the direction of Vehicle Manufacturing, Automotive Sales, and the entire sector. Understanding these developments is essential for businesses to thrive in an environment marked by intense competition and ever-evolving consumer preferences.

One of the most significant shifts we're witnessing is the increasing integration of Automotive Technology, which is transforming everything from vehicle design and functionality to how cars are sold and maintained. Electric vehicles (EVs) are at the forefront of this change, driven by a global push for sustainability and regulatory compliance aimed at reducing carbon emissions. This move towards electrification is not only reshaping Vehicle Manufacturing but is also creating new opportunities and challenges in Automotive Sales, Aftermarket Parts, and Vehicle Maintenance.

The rise of autonomous vehicles is another innovation that promises to redefine our driving experience. While fully autonomous cars are still on the horizon, advanced driver-assistance systems (ADAS) are becoming more common, enhancing vehicle safety and efficiency. This progress in automotive technology necessitates a new approach to Automotive Repair and Maintenance, as technicians must now be skilled in software diagnostics and electronic systems, in addition to traditional mechanical repairs.

Digitalization is revolutionizing Automotive Sales and Marketing, with online sales and digital showrooms becoming increasingly prevalent. This shift requires dealerships to adopt new Automotive Marketing strategies, focusing on digital platforms to reach potential buyers. Moreover, the importance of a seamless online-offline customer journey has never been more critical, pushing Car Dealerships to innovate in how they engage with customers.

In the realm of Aftermarket Parts and Accessories, customization and enhancement continue to be significant trends, fueled by consumer desire to personalize their vehicles. This sector must adapt to the changes in vehicle technology, ensuring compatibility with new models and systems, which requires sophisticated Supply Chain Management to handle the complexities of sourcing and distribution.

Car Rental Services are also adapting to changing consumer preferences and technological advancements. The emergence of car-sharing and ride-hailing services has expanded the market, while the integration of electric and autonomous vehicles presents new opportunities for innovation in service offerings.

Finally, effective Supply Chain Management has emerged as a linchpin of success in the Automotive Industry, more so in the wake of global disruptions. Companies are now focused on creating more resilient and flexible supply chains, utilizing data analytics and digital tools to forecast demand, manage inventory, and mitigate risks.

In conclusion, the Automobile Industry is undergoing a profound transformation, influenced by technological advancements, consumer preferences, and regulatory changes. For businesses within this sector, from Vehicle Manufacturing to Car Rental Services, staying abreast of these trends and innovations—embracing Industry Innovation, prioritizing Customer Satisfaction, and achieving Regulatory Compliance—is essential for navigating the road ahead successfully.

2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Vehicle Maintenance Mastery"

In the fast-paced realm of the Automobile Industry, businesses involved in Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, and Vehicle Maintenance are constantly navigating a highway of competition and innovation. Achieving mastery in these areas demands a multifaceted strategy that addresses market trends, consumer preferences, regulatory compliance, and the integration of cutting-edge Automotive Technology.

One of the top priorities for businesses striving for success in Automotive Sales and Aftermarket Parts is understanding and adapting to evolving Consumer Preferences. Today's consumers are more informed and have higher expectations regarding quality, sustainability, and technology. Thus, Automotive Marketing strategies must be data-driven and customer-centric, utilizing digital platforms to engage potential buyers and create personalized experiences.

Supply Chain Management also plays a critical role in the success of Vehicle Manufacturing and Aftermarket Parts supply. Efficient supply chains enable businesses to reduce costs, improve product availability, and respond swiftly to market demands. This is particularly important in a landscape where Industry Innovation and technological advancements can rapidly shift market dynamics.

For Car Dealerships and businesses specializing in Vehicle Maintenance and Automotive Repair, establishing trust and ensuring customer satisfaction are key. This means not only providing top-notch service but also staying ahead of the curve in Automotive Technology and repair techniques. Offering transparent pricing, high-quality parts, and warranties can differentiate a business in a crowded market.

Furthermore, Regulatory Compliance cannot be overlooked. The automotive sector is heavily regulated, with standards covering everything from vehicle emissions to safety features. Staying abreast of and complying with these regulations is essential not only for legal operation but also for building consumer trust and protecting the brand.

Lastly, embracing Industry Innovation offers a competitive edge, whether it's through the adoption of electric vehicle technology, the implementation of AI and machine learning in manufacturing processes, or the use of big data for market analysis. Innovation can improve operational efficiencies, create new revenue streams, and enhance the customer experience.

In conclusion, mastering the domains of Automotive Sales, Aftermarket Parts, and Vehicle Maintenance requires a comprehensive approach that blends adherence to regulatory standards, leverages the latest in Automotive Technology, and places the consumer at the heart of business strategies. By staying informed about Market Trends and being responsive to change, automotive businesses can drive ahead of the competition and secure their position in the market.

In conclusion, the automotive business landscape is as exhilarating as it is challenging, driven by a combination of industry innovation, market trends, and evolving consumer preferences. From vehicle manufacturing to automotive sales, aftermarket parts, car dealerships, vehicle maintenance, and automotive repair, businesses within this sector must navigate a complex matrix of technological advancements, regulatory compliance requirements, and shifts in the supply chain management. The future of the automobile industry hinges on its ability to embrace automotive technology, refine automotive marketing strategies, and deliver top-notch products and services that meet the discerning demands of today's consumers.

Car rental services, too, play a pivotal role in this dynamic ecosystem, adapting to changes in consumer travel behaviors and expectations. Success in this competitive domain requires a relentless focus on quality, innovation, and customer satisfaction. Companies that can effectively leverage trends, anticipate consumer needs, and navigate regulatory landscapes will likely lead the pack, setting new standards for excellence in the automotive industry.

As we rev our engines and look to the future, it's clear that the road ahead for the automobile industry is paved with opportunities for growth, transformation, and unprecedented success. Businesses that stay ahead of the curve in adopting cutting-edge automotive technology, mastering automotive sales, excelling in vehicle maintenance, and innovating in aftermarket parts and car dealership operations will not only survive but thrive. The key to winning in this ever-evolving market lies in understanding the intricate interplay between supply chain management, industry innovation, and automotive marketing, all while keeping a pulse on the global economic landscape and regulatory environment. With these strategies in hand, the automotive business is set to accelerate into a future marked by prosperity, sustainability, and unparalleled consumer value.

Business

Driving Forward: Mastering the Future of the Automotive Business Through Innovation, Strategy, and Market Adaptation

In the fast-paced Automobile Industry, staying ahead requires top companies to embrace Industry Innovation and adapt to Market Trends. This includes advancements in Automotive Technology like electric and autonomous vehicles, a shift towards online Automotive Sales and Car Dealerships, and a focus on sustainability and Regulatory Compliance. Key to success also involves investing in Vehicle Manufacturing, efficient Supply Chain Management for Aftermarket Parts, and expanding services in Vehicle Maintenance, Automotive Repair, and Car Rental Services. Automotive Marketing strategies are evolving to meet changing Consumer Preferences, making a comprehensive approach to quality, customer satisfaction, and embracing digital transformation essential for thriving in the competitive landscape of the Automobile Industry.

In the fast-paced world of the Automobile Industry, businesses are constantly challenged to keep up with top market trends, technological advancements, and shifting consumer preferences. From Vehicle Manufacturing to Automotive Sales, and extending to Aftermarket Parts, Car Dealerships, and comprehensive Vehicle Maintenance services, the scope of the automotive sector is both vast and varied. Companies within this dynamic sphere—be it in Automotive Repair, Car Rental Services, or the bustling market of accessories and customization—must steer through a landscape marked by stiff competition, regulatory compliance requirements, and an ever-evolving supply chain management system. This article delves deep into the intricacies of thriving in the automotive business, uncovering the secrets to success through industry innovation, cutting-edge Automotive Marketing strategies, and a relentless pursuit of customer satisfaction. We explore the key components that automotive businesses must master, from staying ahead in Automotive Technology to understanding the fine balance of catering to Consumer Preferences while navigating regulatory landscapes. Join us as we lay down the roadmap in "Navigating the Road Ahead: Top Trends and Innovations Shaping the Automobile Industry" and rev up insights with "Revving Up Success: Strategies for Vehicle Manufacturing and Automotive Sales in a Competitive Market," guiding businesses towards achieving pole position in the race for automotive excellence.

- 1. "Navigating the Road Ahead: Top Trends and Innovations Shaping the Automobile Industry"

- 2. "Revving Up Success: Strategies for Vehicle Manufacturing and Automotive Sales in a Competitive Market"

1. "Navigating the Road Ahead: Top Trends and Innovations Shaping the Automobile Industry"

In the fast-paced world of the automobile industry, staying ahead requires a keen eye on emerging trends and innovations that are reshaping the landscape. From vehicle manufacturing to automotive sales, and aftermarket parts to car dealerships, every facet of this sector is undergoing transformation. Understanding these shifts is crucial for businesses aiming to thrive in an environment marked by rapid technological advancements, changing consumer preferences, and stringent regulatory compliance requirements.

One of the top trends driving the automobile industry today is the surge in automotive technology, particularly in the development of electric vehicles (EVs) and autonomous driving systems. This shift not only responds to growing environmental concerns but also aligns with consumer preferences for more sustainable and innovative transportation solutions. Vehicle manufacturers are investing heavily in research and development to produce cars that are cleaner, smarter, and more connected than ever before.

In the realm of automotive sales and car dealerships, digitalization is revolutionizing the way vehicles are bought and sold. Online platforms and virtual showrooms are becoming increasingly popular, offering customers the convenience of exploring and purchasing new cars from the comfort of their homes. This digital transformation is supported by advanced automotive marketing strategies that leverage social media, digital advertising, and personalized customer engagement to drive sales and enhance customer satisfaction.

Aftermarket parts and automotive repair services are also witnessing significant changes, with a greater emphasis on quality and compatibility with the latest vehicle models. Supply chain management plays a pivotal role in ensuring the timely availability of parts, while industry innovation is leading to more durable and performance-enhancing components. Vehicle maintenance and repair shops are adopting new technologies to diagnose and fix problems with greater precision and efficiency, improving overall service quality for consumers.

Car rental services are not left behind in this wave of innovation. With the rise of car-sharing platforms and app-based rental systems, consumers enjoy more flexible and cost-effective options for short-term vehicle access. This trend reflects a broader shift towards mobility-as-a-service (MaaS), where the focus is on providing seamless transportation solutions rather than simply selling cars.

Finally, regulatory compliance remains a central theme in the automotive industry, with governments worldwide imposing stricter emissions standards and safety regulations. Businesses must navigate these legal requirements while balancing the demands for innovation and consumer satisfaction. This delicate balancing act is essential for maintaining competitiveness and ensuring long-term success in the market.

In conclusion, the automobile industry is at a crossroads, with top trends and innovations in vehicle manufacturing, automotive sales, aftermarket parts, car dealerships, vehicle maintenance, and automotive repair leading the charge towards a more sustainable, efficient, and customer-focused future. Embracing these changes, along with effective supply chain management and automotive marketing strategies, will be key for businesses looking to navigate the road ahead successfully.

2. "Revving Up Success: Strategies for Vehicle Manufacturing and Automotive Sales in a Competitive Market"

In the fast-paced world of the Automobile Industry, success hinges on a company's ability to navigate the complexities of Vehicle Manufacturing and Automotive Sales. The market is fiercely competitive, with top players constantly vying for consumer attention through innovation, quality, and service. To thrive, businesses must employ strategic approaches that encompass a deep understanding of Market Trends, Consumer Preferences, and Regulatory Compliance, while also ensuring robust Supply Chain Management and Industry Innovation.

A cornerstone of achieving success in Vehicle Manufacturing is a relentless focus on Automotive Technology and Industry Innovation. The integration of cutting-edge technologies not only enhances vehicle performance and safety but also aligns with the environmental standards imposed by regulatory bodies. This dual focus ensures compliance and appeals to the eco-conscious consumer, thereby broadening market reach. Moreover, efficient Supply Chain Management is vital to navigate the complexities of sourcing quality materials and components, often including Aftermarket Parts, which can significantly impact the final product's quality and cost.

On the sales front, Automotive Sales strategies must evolve to match the dynamic landscape of Consumer Preferences and market demands. Car Dealerships and online sales platforms are increasingly leveraging Automotive Marketing techniques that employ digital tools and data analytics to target potential buyers more effectively. Personalized marketing, virtual showrooms, and interactive online platforms are becoming indispensable in attracting and retaining customers.

Furthermore, the expansion into services such as Vehicle Maintenance, Automotive Repair, and Car Rental Services offers additional revenue streams while enhancing customer loyalty. Offering comprehensive service packages, loyalty programs, or partnerships with Aftermarket Parts suppliers can differentiate a business in a crowded market.

Finally, staying ahead in the Automobile Industry requires a keen eye on regulatory changes and a commitment to sustainability. Regulatory Compliance is not just about adhering to the law; it's about anticipating changes and innovating ahead of them. This proactive approach not only mitigates risks but also positions a company as a leader in sustainable practices, appealing to a growing segment of environmentally conscious consumers.

In conclusion, the keys to revving up success in the competitive landscape of Vehicle Manufacturing and Automotive Sales lie in the integration of advanced Automotive Technology, strategic Automotive Marketing, comprehensive service offerings, and a forward-thinking approach to Industry Innovation and Regulatory Compliance. These strategies, combined with an unwavering commitment to quality and customer satisfaction, pave the way for sustained growth and profitability in the ever-evolving Automobile Industry.