Driving Forward: Mastering the Road to Success in the Automotive Industry through Market Trends, Technological Innovation, and Strategic Management

The Automobile Industry is undergoing significant changes with the rise of electric vehicles, driven by Market Trends and Consumer Preferences focused on environmental sustainability and Regulatory Compliance. The integration of Automotive Technology is improving vehicle performance and the driving experience, altering Automotive Repair and Vehicle Maintenance services. The demand for personalized and digital purchasing methods is transforming Automotive Sales and Car Rental Services, while the Aftermarket Parts sector adapts to customization needs. Success hinges on effective Supply Chain Management, adherence to Regulatory Compliance, and continuous Industry Innovation in areas like Vehicle Manufacturing, Automotive Marketing, and Car Dealerships, ensuring companies stay competitive in meeting the evolving needs of consumers.

In the ever-evolving world of the Automobile Industry, businesses that operate within this sector—spanning from Vehicle Manufacturing to Automotive Sales, and extending to Aftermarket Parts suppliers, Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services—are at the forefront of driving progress and meeting the diverse needs of consumers globally. As these businesses navigate through a dynamic and competitive landscape, marked by rapid advancements in Automotive Technology, shifting Market Trends, and ever-changing Consumer Preferences, the importance of staying ahead cannot be overstated. This article delves deep into the intricacies of the automotive sector, highlighting the key factors such as Supply Chain Management, Regulatory Compliance, and Industry Innovation that play pivotal roles in steering companies toward success. From "Navigating the Fast Lane: Top Market Trends and Consumer Preferences Shaping the Automobile Industry" to "Revving Up Success: The Crucial Role of Supply Chain Management, Regulatory Compliance, and Industry Innovation in Vehicle Manufacturing and Automotive Sales," we explore how effective Automotive Marketing strategies, a deep understanding of market demands, and the ability to adapt swiftly to regulatory changes are essential in powering the wheels of progress in the automotive world. Join us as we shift gears to understand the core components that fuel the growth and sustainability of businesses within this vital sector, ensuring they not only meet but exceed customer expectations in an era of remarkable transformation.

- 1. "Navigating the Fast Lane: Top Market Trends and Consumer Preferences Shaping the Automobile Industry"

- 2. "Revving Up Success: The Crucial Role of Supply Chain Management, Regulatory Compliance, and Industry Innovation in Vehicle Manufacturing and Automotive Sales"

1. "Navigating the Fast Lane: Top Market Trends and Consumer Preferences Shaping the Automobile Industry"

In the rapidly evolving landscape of the Automobile Industry, businesses are constantly adapting to stay ahead in the fast lane, driven by shifting Market Trends and Consumer Preferences. From Vehicle Manufacturing to Automotive Sales, and from Aftermarket Parts to Car Dealerships, every facet of the industry is being reshaped by innovation and customer demand.

One of the top Market Trends influencing the industry today is the increasing shift towards electric vehicles (EVs). This movement is not just a nod to environmental concerns but also a response to Regulatory Compliance measures aimed at reducing carbon emissions. Automotive businesses are thus focusing on the development of EVs and hybrid models, which has also spurred a transformation in Vehicle Manufacturing processes and Supply Chain Management strategies to accommodate the new technologies.

Another significant trend is the integration of Automotive Technology into vehicles, enhancing both their performance and the driving experience. This includes everything from advanced driver-assistance systems (ADAS) to connected car technologies, pushing Industry Innovation to new heights. Consequently, Automotive Repair and Vehicle Maintenance services are evolving to cater to the more sophisticated needs of modern vehicles, highlighting the importance of skills upgrading and technological adaptation in these sectors.

Consumer Preferences have also seen a shift towards more personalized and convenient Automotive Sales and Car Rental Services. The rise of online platforms and digital showrooms has revolutionized how consumers research, select, and purchase vehicles, making Automotive Marketing more critical than ever. Businesses are leveraging data analytics and digital marketing strategies to reach potential customers, enhance customer engagement, and increase sales conversions.

The Aftermarket Parts sector is not left behind, with consumers increasingly seeking customization and upgrades for their vehicles. This demand for personalized options has led to growth in the aftermarket industry, driving companies to offer a wider range of parts and accessories, alongside innovative solutions to meet the specific needs of vehicle owners.

Supply Chain Management has emerged as a pivotal aspect of the automotive business, with companies striving for efficiency and resilience amid global disruptions. Efficient supply chains enable manufacturers to reduce production costs, ensure timely delivery of vehicles and parts, and maintain competitive pricing.

In conclusion, navigating the complex terrain of the Automobile Industry requires businesses to stay attuned to the latest Market Trends and Consumer Preferences. Success hinges on their ability to embrace Industry Innovation, ensure Regulatory Compliance, and adopt effective Automotive Marketing strategies. As the industry continues to evolve, those who can adeptly manage these dynamics will likely lead the pack, offering cutting-edge solutions that meet the ever-changing demands of consumers.

2. "Revving Up Success: The Crucial Role of Supply Chain Management, Regulatory Compliance, and Industry Innovation in Vehicle Manufacturing and Automotive Sales"

In the fast-paced world of the Automobile Industry, achieving top performance in Vehicle Manufacturing and Automotive Sales demands more than just a sleek design or a powerful engine. The backbone of success lies in the meticulous management of Supply Chain Management, unwavering adherence to Regulatory Compliance, and the relentless pursuit of Industry Innovation. These elements are the gears that drive the industry forward, ensuring that businesses not only meet but exceed the evolving expectations of the market and consumers.

Supply Chain Management (SCM) plays a pivotal role in the Automobile Industry, acting as the critical link between the production of vehicles and their delivery to the market. Efficient SCM ensures that Automotive Manufacturers and Aftermarket Parts suppliers can reduce production costs, improve product quality, and accelerate time-to-market. This is particularly vital in an era where Consumer Preferences are rapidly changing, and the demand for sustainable, technologically advanced vehicles is on the rise. A streamlined supply chain enables businesses to swiftly adjust to these Market Trends, ensuring a steady flow of materials and parts that are essential for the production of cutting-edge vehicles.

Regulatory Compliance is another cornerstone of success in the Automobile Industry. With governments around the world imposing stricter emissions, safety, and quality standards, Automotive businesses must navigate a complex web of regulations to stay competitive. This extends from Vehicle Manufacturing to Automotive Repair and Car Rental Services, where safety and environmental regulations play a significant role. Compliance not only mitigates legal risks but also enhances brand reputation, instilling trust among consumers and stakeholders alike.

Lastly, Industry Innovation remains the driving force behind the Automobile Industry’s evolution. Advancements in Automotive Technology, such as electric vehicles (EVs), autonomous driving, and connected car features, are reshaping Consumer Preferences and opening new horizons for Automotive Marketing. Car Dealerships and Automotive Sales strategies are increasingly relying on digitalization to cater to the tech-savvy consumer, leveraging online platforms for sales, virtual showrooms, and digital service appointments. Meanwhile, in the realm of Vehicle Maintenance and Automotive Repair, new technologies are introducing more efficient, cost-effective service models, enhancing customer satisfaction and loyalty.

In conclusion, the triumvirate of Supply Chain Management, Regulatory Compliance, and Industry Innovation forms the engine that propels Vehicle Manufacturing and Automotive Sales toward success. For businesses in the Automotive sector, mastering these elements is not just a strategy for staying competitive; it's a roadmap for navigating the future of transportation, ensuring they remain at the forefront of an industry marked by constant change and boundless opportunities.

In conclusion, the automotive business remains a cornerstone of global economic activity and personal mobility, intricately woven into the fabric of daily life. As we've explored, success in this competitive landscape is multifaceted, resting on a keen understanding of market trends, consumer preferences, and the agility to navigate regulatory compliance while embracing industry innovation. Top players in the automobile industry, from vehicle manufacturing giants to local automotive repair shops, recognize that the road ahead is paved with both challenges and opportunities. The integration of automotive technology has become a pivotal aspect of staying ahead, influencing everything from automotive sales strategies to the efficiency of supply chain management.

Furthermore, aftermarket parts providers, car dealerships, and car rental services are finding new ways to enhance customer experiences, ensuring satisfaction and loyalty in an era where preferences can shift as quickly as the latest model rolls off the line. Vehicle maintenance and automotive repair businesses, too, are adapting to the demands of advanced technologies and the expectations of a more informed consumer base.

As the industry continues to evolve, propelled by factors such as environmental concerns and the rise of autonomous vehicles, those within the automotive sector must remain vigilant and innovative. The key to enduring success lies not only in mastering the current landscape of automotive sales, vehicle manufacturing, and service provision but also in anticipating the turns ahead. By prioritizing customer satisfaction, investing in automotive marketing, and staying attuned to the pulse of industry innovation, businesses in the automotive sphere can navigate the fast lane of progress with confidence and precision. The journey is complex, but for those prepared to adapt and excel, the possibilities are as expansive as the open road.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Zhenro Founder Ou Zongrong Faces Legal Action Amid Alleged Illegal Activities and Ongoing Property-Market Crisis

Legal action is being taken against Ou Zongrong, the founder of Chinese developer Zhenro, due to alleged unlawful activities. Following the expiration of a restructuring support agreement, Ou Zongrong has been subjected to mandatory legal procedures, as stated by the holding company.

The creator of Zhenro Properties Group, a developer based in Shanghai, has been subjected to mandatory legal actions. This comes as the heavily indebted home construction companies persist in battling the ongoing real estate market crisis in the country.

The real person in control at Zhenro, Ou Zongrong, is confronting obligatory legal measures "because of alleged unlawful activities," the development firm's parent company declared on Monday. The company highlighted that "Ou presently does not occupy any roles like director, monitor, or upper-level executive at the company."

The news broke merely a few days following Ou Guowei, Ou Zongrong's son, stepping down from his roles as a non-executive director and audit committee member of the developer's firm. Prior to this, on January 2, the developer revealed that a restructuring support agreement had lapsed after its definitive deadline had passed on the last day of December.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Deciphering Beijing’s $3.2 Trillion Puzzle: The Future of China’s Forex Reserves and Hong Kong’s Financial Status

My Perspective | The $3.2 trillion query from Beijing: What portion of China's foreign exchange reserves are channeled to Hong Kong?

The commitment from the central bank to boost its reserve of Hong Kong dollars underscores its dedication to maintaining the city's prominence as a financial hub.

The head of China's central bank, Pan Gongsheng, has vowed to allocate a larger portion of the nation's $3.2 trillion foreign exchange reserves to Hong Kong. This has sparked conjecture regarding how much additional funding Beijing can designate for the city's assets.

Beijing has consistently kept the specifics of its foreign exchange reserve portfolio confidential, leaving the exact quantity of reserve funds designated for Hong Kong markets a mystery. Pan, the former head of the State Administration of Foreign Exchange (Safe) until November 2023, indicated that Beijing would substantially boost the proportion of Hong Kong assets, but did not provide specific details.

Since 2018, Safe has been providing a restricted view into the makeup of China's foreign exchange reserves through its yearly reports. This began when they started revealing the percentage of assets held in US dollars with a delay of four years. In their report from 2023, which was published in October, Safe revealed the proportion of US dollar assets for the year 2019.

The officially released figures from 2014 to 2019 show that the proportion of US dollar assets in China's foreign exchange reserves remained between 55% and 59% during this period. In 2019, the percentage of US dollar assets dropped to 55%, with the balance made up of "other currencies". The specific breakdown of these other currencies was not provided by Safe. However, they had previously revealed that China's reserves not in US dollars comprised of euros, sterling, yen, won, and a minor percentage of Hong Kong dollars.

China is expected to retain approximately 50% of its holdings in US dollars for the sake of "security". After all, dollar-based assets, such as US treasuries, continue to be among the most readily available and reliable asset categories for Beijing.

Safe has been assessing the proportion of the dollar in China's foreign currency reserves compared to the worldwide average. The organization stated that China's reserves were already "more varied" than the international level of 61 per cent in 2019, implying that the country is not in a position to significantly reduce its US dollar holdings.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s Consumer Sentiment Poised for Significant Boost, Domestic Brands to Benefit: UBS Insights

Consumer confidence in China is nearing a 'critical juncture' where it could skyrocket following a series of stimulus measures, according to UBS. The Swiss bank has suggested that homegrown brands and private labels are likely to profit as Chinese households decrease their savings and increase their spending.

The consumer sector in China, which has been negatively affected by a prolonged property downturn that has stunted economic growth and lowered morale, may be approaching a critical juncture. This comes as consumers start to save less and increase their spending in response to the stimulus package introduced last September, according to analysts.

The rate of growth in surplus savings of households slowed down in 2024 and saw a decrease in the third quarter, while there was a 3 to 4 percent yearly rise in societal retail sales, as per a report by UBS revealed on Monday. The Swiss bank credited this turnaround to the lessening impact of the Covid-19 pandemic, along with favorable government measures.

Local brands are poised to gain advantages, and private brands could potentially become the main factor for this year's growth due to their limited market presence. However, what's more significant is that they could profit from a possible shift away from the "downtrading" trend observed in the previous year.

UBS suggests that due to enhancements in quality and accessibility of channels, customers might not view local brands or private labels as 'cheap alternatives' to internationally-branded products. Instead, they are increasingly selecting local brands or private labels, guided by a practical mindset.

An independent study released by the bank in October discovered that almost half of the participants transitioned to local brands and private labels within the past year, attributing this change to "greater worth for their money". This tendency was particularly prevalent among consumers in major and mid-sized cities.

Investor hopes for a rebound in consumption continue to be muted due to the possibility of increased US tariffs and ongoing strain on real estate prices. The Monday report forecasts that China's total real consumption growth will likely hover about 3.8 per cent in the period of 2025-2026.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Tourism Surge and Student Housing Demand Set to Boost Hong Kong’s Hotel Industry, Experts Predict

Industry professionals believe that tourism and student accommodation will boost the value of hotel properties in Hong Kong. They predict a prosperous year for hotel owners, as they anticipate a surge in tourism and the opportunity for proprietors to sell their assets at higher prices.

The hotel sector in Hong Kong has experienced significant transactions totaling HK$7.85 billion within the last two years, not only in 2024, as reported by Colliers. An altered statement from a high-ranking official at Colliers reads: "Even with difficulties, the hotel industry is set for a hopeful year in the future."

The number of tourists, which surged by 33% to 44.5 million in 2024, is expected to maintain its pace due to government initiatives aimed at enhancing its economic impact. Additionally, the city is grappling with a lack of student housing, which is driving the need for transforming hotels into student lodgings.

The hotel and tourism industry is projected to increase its contribution to the city's economy from 2.6% in 2023 to 5% by 2029, mirroring its importance last observed in 2018. According to a strategic plan revealed in December, Hong Kong aims to stimulate the economy with a HK$120 billion (US$15.4 billion) injection, creating 65,000 new employment opportunities within the coming five years.

"Even with obstacles, the hotel industry is set up for a hopeful year ahead," stated Shaman Chellaram, the leading director for Asia in valuation and advisory services at Colliers. He further added, "We also anticipate an increase in occupancy rates," considering the forthcoming events such as the Lunar New Year fireworks, the Rugby Sevens competition in March, and the Coldplay concert in April.

The planned 23-floor hotel is set to feature eight suites and 91 rooms, in addition to a commercial hub, boasting approximately 138,000 square feet of space for retail stores, eateries, and event spaces. This information was disclosed in a recent submission by Miramar to the Hong Kong stock exchange.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Trump Wields Tariff Threats Amid TikTok Deal Negotiations: Extends Ban Deadline by 75 Days

Trump authorizes executive order postponing TikTok prohibition, warns of imposing duties

Trump lengthens the deadline by 75 days, cautioning China with potential tariffs if Beijing fails to sanction a deal related to the brief-video application.

"Whether or not I proceed with the agreement is undecided. TikTok has no value whatsoever. If I don't give it the green light, it needs to shut down. I gathered this information from the proprietors," Trump stated on Monday.

"On TikTok, I possess the authority to either auction it off or shut it down, and we'll arrive at that decision… We might also need endorsement from China, I'm not certain, but I'm confident they'll give it the green light," he further stated.

Trump hinted that if there was an opportunity to strike a beneficial agreement with TikTok and China disapproved, he believes they would eventually give their consent due to the threat of imposing tariffs on China.

"Perhaps, I'm not confirming that I'd do it, but it's definitely a possibility. If we were to declare that 'it won't get approved', that could be perceived as a definite aggression. In response, we might impose tariffs ranging from 25, 30, 40, 50 per cent, or even up to 100 per cent."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong Stocks Surge Amidst Trump’s Tariff Threats on TikTok Deal; US-China Relations Remain Key Factor

Shares in Hong Kong surge despite Trump's tariff threat to China over the TikTok agreement. The US president postpones TikTok's prohibition for 75 days and issues a tariff warning to China should Beijing reject a deal related to the brief-video application.

The Hang Seng Index saw an increase of 0.9 per cent, closing at 20,106.55 on Tuesday, and the Hang Seng Tech Index experienced a rise of 2.1 per cent. In mainland China, the CSI 300 Index had a marginal growth of 0.1 per cent, while the Shanghai Composite Index experienced a slight decline of 0.1 per cent.

The largest chip manufacturer in China, Semiconductor Manufacturing International Corporation, experienced a 6.4 per cent increase in its share price, reaching HK$41.90. Similarly, Sunny Optical, a producer of iPhone camera lenses, saw its shares rise by 7.3 per cent to HK$70.20. Additionally, car makers Li Auto and Geely Auto saw their share prices increase by 5.3 per cent to HK$94.10 and 3.1 per cent to HK$14.74 respectively.

The Hang Seng Index has been performing admirably in recent days, largely due to last week's encouraging economic figures from China and hopes for better US-China ties, says Kenny Wen, who leads the investment strategy at KGI Asia.

"He noted that the positive aspect is also due to the postponement of immediate tariffs on China," he said, suggesting that potential increases might be restricted in the lead-up to the Lunar New Year holiday next week.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

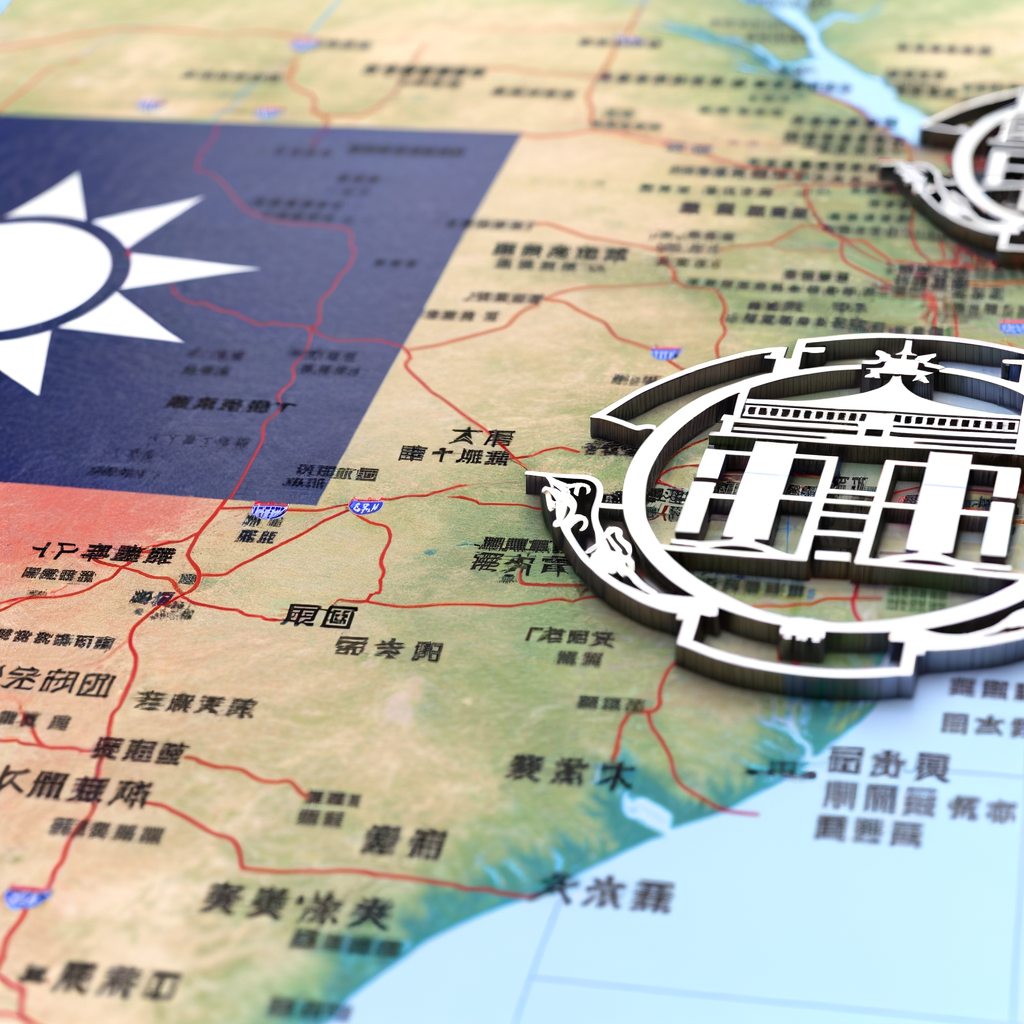

Nvidia CEO Jensen Huang’s High-Profile Taiwan Tour: Dining with Tech Titans and Celebrating Supply Chain Partnerships

Nvidia's CEO whirls through Taiwan: from Lunar New Year celebrations to night market trips

Jensen Huang engaged with leading figures in the industry, such as TSMC's originator Morris Chang and Foxconn's chairman Liu Young-way.

Huang held a notable lunch event in Taipei on Sunday, which saw the participation of 36 senior leaders from Taiwan's premier tech firms.

At the meal, Huang humorously commented on the group picture snapped post-lunch, in which he, along with a few others, were crouching in the front row. He playfully remarked, "The front row works out. The back row doesn't," which elicited chuckles from those present.

Huang underscored the vital role that supply chain partners play in Nvidia's tech advancements. He pointed out that 45 global factories are currently running round the clock to manufacture supercomputers equipped with Nvidia's Grace and Blackwell chips.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong and Macau Link Bond Clearance Systems: A Game-Changer for Cross-Border Investment and Fundraising

The bond clearance systems of Hong Kong and Macau have been interconnected to establish a more substantial market for raising funds. On the first day of this connection, four new bond issues totaling 3.2 billion patacas (US$401 million) were settled, along with 18 transactions in the secondary market.

On the initial day, Benjamin Chan, the chairman of the Monetary Authority of Macao (AMCM), announced that four fresh bond issues in Macau, valued at 3.2 billion patacas (equivalent to US$401 million), were cleared through Hong Kong's CMU. Additionally, 18 secondary-market dealings were carried out by investors from both Hong Kong and Macau.

"The inaugural day of linking the two clearing houses was a success," he stated during an event at the World Trade Centre in Macau. "We anticipate a rise in the involvement of institutional investors in the Macau debt markets following this association."

The link will establish an international investment and funding route, allowing investors from both markets to engage in each other's bond market more conveniently and effectively, according to the HKMA.

The immediate connection demonstrates Hong Kong's position as a "central hub" and signifies a significant progression in transforming the CMU into a global CSD in Asia, a statement from HKMA's CEO Eddie Yue Wai-man highlighted.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Taiwan’s Compal and Inventec Contemplate US Expansion Amid Trump Tariffs: Texas as Potential Hub Due to Power Infrastructure and Proximity to Mexico

Taiwanese companies Compal and Inventec are considering expanding to the United States as a response to Trump's tariffs, with Texas being a preferred location. The state's robust power infrastructure and close geographical distance to Mexico make it an attractive choice for the Taiwanese laptop industry.

Executives from Taiwanese laptop manufacturers Compal and Inventec are considering expanding their operations into the United States, with Texas being a prime potential location. This move is seen as a preparatory measure in response to the possible tariffs threatened by President Donald Trump.

Trump, who resumed his role as US president on Monday, has unsettled businesses and governments globally by promising to implement 10% tariffs on all goods imported into the US. Trade specialists have warned that such action would disrupt trade patterns, increase expenses and provoke countermeasures against US exports.

In a conversation with journalists prior to the firm's yearly closing celebration this month, Compal's President and CEO, Anthony Peter Bonadero, mentioned they had discussed potential investment opportunities with numerous southern American states. They are also keeping a close watch on how Trump's trade levies on Mexico are progressing.

Texas is a top contender primarily due to the energy capacity they've developed. Samsung is establishing a massive fabrication plant there, which has resulted in an increase in power and infrastructure. Unique to Texas is its own independent power grid, a feature not found in any other US state. We are still assessing this, but nothing has been finalized as of now.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Yuan Ascends as Trump Soft-Pedals on China in Inaugural Speech: Short-term Relief or Long-term Stability?

The Chinese yuan increased in value following a softer approach towards China in Trump's initial speech. As concerns about a trade war diminished, the Chinese currency experienced a rise against the US dollar. However, there is a concern that this uptick might not last long.

The Chinese yuan experienced a sharp increase on Monday night after US President Donald Trump adopted a more mild stance on China in his initial speech. Experts predict that the currency will maintain its stability for the foreseeable future.

The value of the offshore yuan steadily increased, moving from more than 7.31 to less than 7.27 against the US dollar. By Tuesday noon, the offshore yuan was approximately 7.269 per US dollar.

The People's Bank of China established the median rate, often referred to as the fixing rate, at 7.1703 against the US dollar on Tuesday. This is the most robust level it has reached since the beginning of November.

The president and chief economist of Pinpoint Asset Management, Zhang Zhiwei, linked the rise of the yuan mainly to Trump's omission of tariff policies against China in his inaugural address.

Worries in the market regarding the trade war have been sidelined, but they have not vanished. Individuals are still anticipating further signs from the US administration concerning tariff discussions," he stated.

Moving forward, Zhang anticipates that the yuan will mostly retain its stability, with minor variations primarily influenced by the changes in the US dollar.

In recent times, the yuan has continued to experience strain as the US dollar, seen as a safe bet, has fortified due to predictions that the US Federal Reserve will reduce the frequency of rate cuts this year.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s ‘Last-Mile’ Reform: Allowing Offshore Movement of Onshore Bonds to Bolster Global Investment and Reinforce Hong Kong’s Offshore Yuan Hub Status

China is set to permit overseas investors to move onshore bonds offshore through repurchase agreements and derivatives. This move is part of China's efforts to liberalize its markets and reinforce Hong Kong's role as an offshore center for the yuan.

China intends to provide international investors who own the nation's domestic bonds with additional fundraising alternatives, in a final-stage reform that further liberalizes the country's financial markets and bolsters Hong Kong's position as an offshore yuan center.

Domestic bonds provided by the Finance Ministry and the policy banks in mainland China, under the same scheme, will also serve as security for derivatives trades at OTC Clearing Hong Kong. This organization, a trading partner set up by Hong Kong's stock exchange, offers clearing and settlement services. This action is anticipated to take effect in the first quarter.

Up until recently, mainland Chinese bonds were seen as a "less adaptable investment choice" for foreign investors. This was because they couldn't be utilized as security in repos, collateral finance dealings, or as margin collateral for other operations, according to William Shek, who heads the markets and securities services in Hong Kong for HSBC Holdings.

"Shek stated that these fresh initiatives greatly enhance their functionality by permitting onshore bonds to be utilized as collateral in international markets for the first time. Further potential applications, such as cross-currency repos, may also come to light," he further explained.

Following the initiation of the Bond Connect program in July 2017, offshore investors' ownership of mainland China bonds has increased by 4.7 times, reaching 4.16 trillion yuan (US$568 billion) by 2024.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Towngas and Global Energy Join Forces to Develop Green Methanol Supply Chain in Asia

Hong Kong's Towngas and Singapore's Global Energy will collaborate to create a green methanol supply chain. The agreement will leverage Towngas' expertise in green methanol production and Global Energy's proficiency in managing the supply chain.

Towngas, the only gas supplier in Hong Kong and part of China Gas, has partnered with a marine fuel and logistics firm based in Singapore. Their aim is to establish a supply chain for green methanol. This is the most recent effort by the company to cater to the energy transition requirements of the region.

Towngas has entered into a formal agreement with Global Energy Trading with the intention of creating eco-friendly methanol supply chains throughout Asia, according to a statement released by the Hong Kong-based company on Monday.

"This collaboration marks a crucial progression in the eco-friendly transformation of marine fuel supply," was stated. "Through unifying Towngas' prowess in eco-friendly methanol production with Global Energy's proficiency in supply chain administration and market operational skills, we are establishing a solid framework to expedite the decarbonisation process in the shipping industry."

According to Towngas, Global Energy, a pioneer Singaporean company that owns and operates specialized methanol bunkering tankers, supplied 4.7 million tonnes of marine fuel in the previous year.

In the previous year, Towngas entered into a series of contracts to create environmentally friendly fuels for the aviation and marine sectors, which have committed to achieving zero net carbon emissions by the year 2050.

Towngas is dedicated to attaining zero carbon emissions by transitioning to energy sources that have a lower carbon footprint, such as green naphtha, green methane, green methanol, and green hydrogen. The company aims to reduce the carbon content of the gas it provides by 36% from the levels in 2019 by the year 2035.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI3 months ago

AI3 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevolutionizing the Road: Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Sustainability and Safety on the Road

-

Tech2 months ago

Tech2 months agoDriving into the Future: Top Automotive Technology Innovations Transforming Vehicles and Road Safety

-

Tech1 month ago

Tech1 month agoRevving Up Innovation: How Top Automotive Technology is Driving Us Towards a Sustainable and Connected Future

-

Tech3 months ago

Tech3 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

Tech3 months ago

Tech3 months agoDriving into the Future: The Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Revolution

-

Tech3 months ago

Tech3 months agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road