Redefining Economic Success: The Urgent Need for Eco-Friendly Alternatives to GDP

Commentary | The argument for a green replacement to GDP

There's a necessity for fresh measures that acknowledge the complete worth of biodiversity and the ecosystem, along with innovative fiscal instruments that incentivize preservation.

The consequences of diminishing biodiversity are not only affecting the environment but also making a substantial impact on the worldwide economy. The World Bank's study underlines a possible loss of $2.7 trillion in global GDP by 2030, resulting from the breakdown of ecosystem services provided by biodiversity, such as natural pollination, oceanic fisheries, and timber from original forests.

Researchers from Oxford University have suggested a higher projection that nature-based threats could lead to a global economic impact surpassing $5 trillion.

The world has been working together for some time to address these problems. In 2001, specifically in June, the United Nations initiated the Millennium Ecosystem Assessment, resulting in a number of reports. This initiative has had a substantial impact on public policy by offering a scientific basis for comprehending the connection between services provided by ecosystems and human welfare.

Even though significant strides have been made, we still face difficulties in correctly determining the financial worth of these services and turning that worth into solid investments. Overcoming these hurdles is vital for guaranteeing the enduring well-being of our world and the wealth of upcoming generations.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Credit Suisse’s Dark Past Unveiled: US Senate Panel Discovers New Evidence Linking Bank to Nazi Accounts

Additional evidence ties Credit Suisse bank to Nazi accounts, says US committee

A massive amount of paperwork provides further evidence of accounts associated with the Nazis, the Senate Budget Committee announced on Saturday.

A U.S. Senate committee's inquiry has discovered that the beleaguered investment bank, Credit Suisse, hid details in earlier probes concerning bank accounts controlled by the Nazis during World War II.

The ongoing investigation has unearthed a multitude of documents, offering fresh evidence of account holders associated with the Nazis, according to a statement issued by the Senate Budget Committee on Saturday.

The committee stated that the bank had failed to disclose the presence of these accounts in past probes, particularly those conducted in the 1990s.

The Senate panel announced on Saturday that they have unearthed a batch of new files, comprising 3,600 hardcopy documents and 40,000 microfilms, which were found to be significantly linked to the Nazis.

The information has been traced back to a preliminary report by ex-prosecutor Neil Barofsky. He was previously dismissed from his role as an "independent ombudsperson" by the bank in 2022, under pressure to restrict his investigative duties.

Barofsky was reappointed to his position in 2023, following the Committee's inquiry and subsequent acquisition of Credit Suisse by UBS.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

New Evidence Ties Credit Suisse to Concealed Nazi Accounts: A Deep Dive Investigation by US Senate Panel

US committee uncovers additional evidence tying Credit Suisse bank to Nazi accounts

An abundance of documents have been discovered that further substantiate the presence of account holders with Nazi connections, announced the Senate Budget Committee on Saturday.

A US Senate committee's probe has revealed that the beleaguered investment bank, Credit Suisse, had hidden details in past investigations concerning bank accounts controlled by Nazis during World War II.

A comprehensive review has unearthed a plethora of documents, which according to a statement from the Senate Budget Committee released on Saturday, offer fresh evidence about the presence of account holders with ties to the Nazis.

The committee indicated that the bank had failed to disclose the presence of these accounts in past inquiries, particularly those conducted in the 1990s.

The Senate panel announced on Saturday that they found a set of newly uncovered records, comprising 3,600 hard copy documents and 40,000 microfilms, which were identified to have significant links to the Nazis.

The information reportedly comes from a preliminary report by ex-prosecutor Neil Barofsky, who was terminated from his position as an "independent watchdog" by the bank in 2022, following pressure to restrict his investigative activities.

In 2023, Barofsky was reinstated to his position due to the Committee's investigation, following UBS' acquisition of Credit Suisse.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Alibaba and RayNeo Pioneer AI Smart Glasses Development in Hong Kong: A Deep Dive into the Future of Augmented Reality

Alibaba intensifies its advancement into AI smart glasses in collaboration with Hong Kong's RayNeo. The partnership is set to have Alibaba Cloud create tailored AI models for RayNeo products, according to the companies.

"This alliance signifies a fresh utilization of the Qwen LLM in the realm of intelligent eyewear," stated Zhou Jingren, the head of technology at Alibaba Cloud. This also denotes the inaugural comprehensive partnership between a developer of LLM and a producer of AI eyewear in China, as per Alibaba Cloud.

Alibaba is the proprietor of the South China Morning Post.

Two twenty-one

Augmented reality glasses that provide live transcriptions enable hearing-impaired individuals to visually follow dialogues

Intelligent eyewear, which is more compact and sleeker than Augmented Reality and Virtual Reality headsets, has experienced a renewed curiosity due to new features brought about by generative AI.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

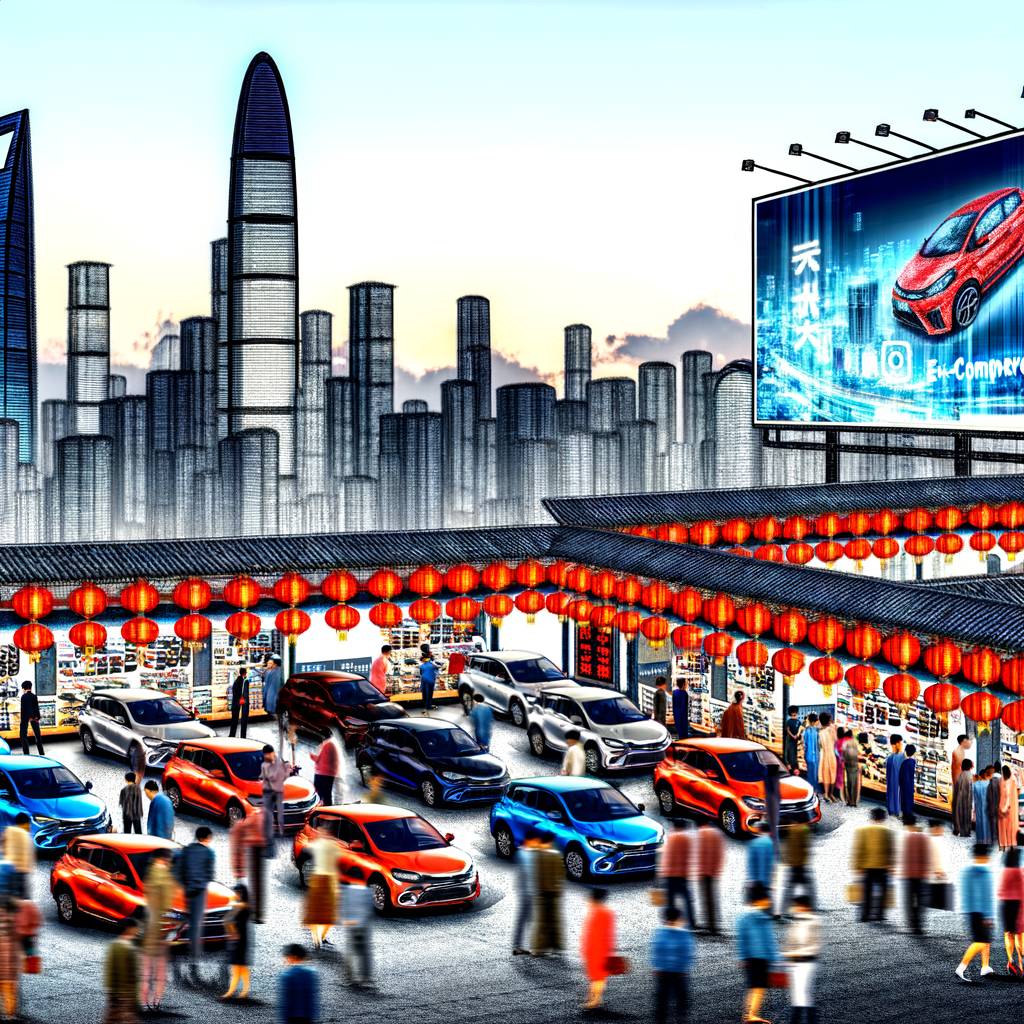

China’s Car Dealers Face Dire 2025: Price Wars and E-Commerce Onslaught Propel $24 Billion Losses Despite Rising Sales

A grim future in 2025 is in store for China's 30,000 car dealers as the escalating price conflict contributes to losses amounting to US$24 billion. While there was a 4.7 per cent increase in car sales across the country, around 4,000 car dealerships have had to shut their doors due to financial pressures.

Over 30,000 automobile retailers in mainland China are bracing for another challenging year in 2025. The previous two years have seen many of these businesses go from being profitable to being financially failing entities due to intense price competition and the rise of e-commerce.

The China Automobile Dealers Association (CADA) reported at the end of December that over 50% of industry players didn't meet their sales goals for 2024. The report further added that most of them are either grappling with significant financial losses or facing a capital shortfall.

Approximately 27% of merchants across the country failed to reach even 70% of their expected sales the previous year, as stated by CADA. Additionally, around 4,000 dealers, which equates to 10%, have been forced to close due to financial difficulties, they further added.

The group anticipates a dubious forecast for the car industry in the future, as stated in the report. It also suggests that diminished car deliveries in January are probable due to the impending eight-day Lunar New Year holiday starting on January 28. The report further advises all car dealerships to sensibly evaluate market demand in their business activities.

The typical cost of a fully electric vehicle dropped by 10 per cent, equivalent to a decrease of 20,000 yuan, and the prices of hybrid cars were brought down by 4.3 per cent, the report mentioned. On average, buyers saved around 10,500 yuan for each car. Industry statistics showed that there was a 4.7 per cent increase in car sales across the country, hitting 20.3 million vehicles in the first 11 months of last year.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

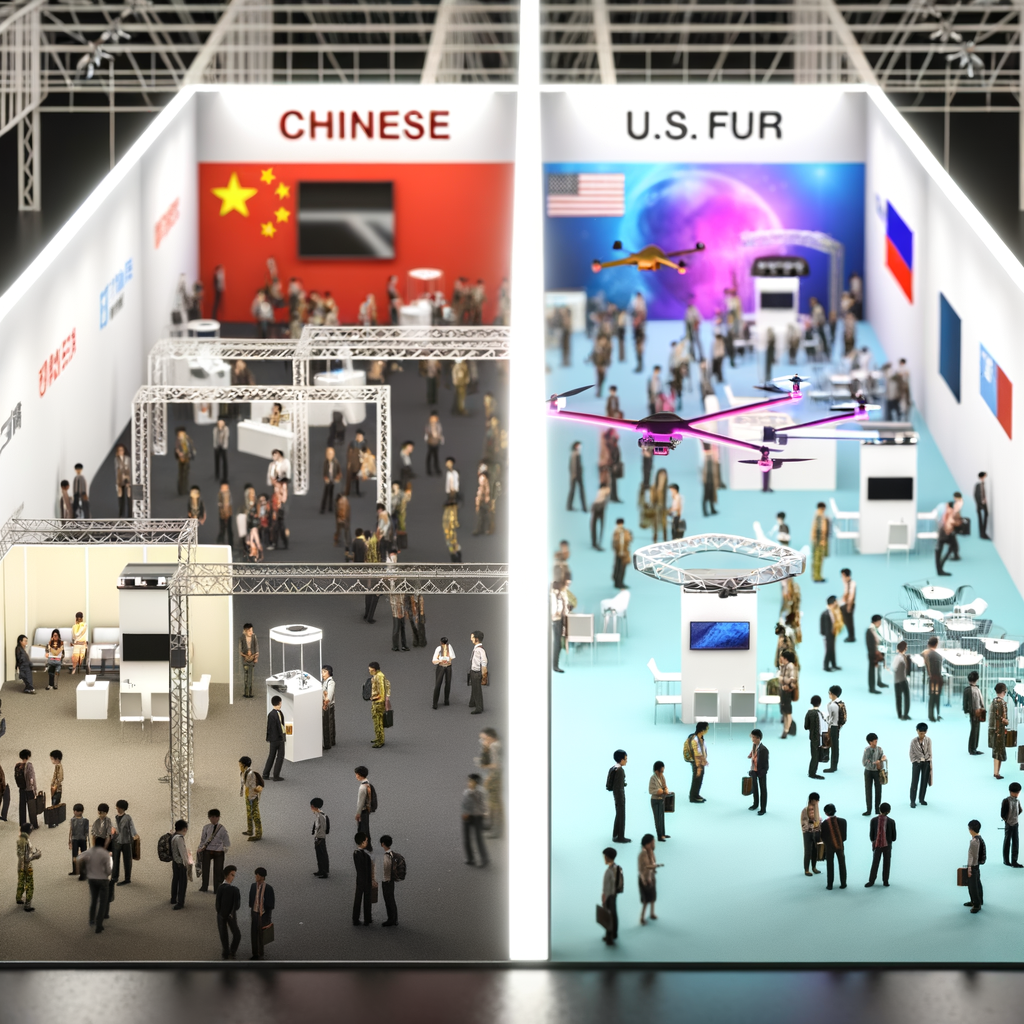

CES 2025: Surge in Chinese Exhibitors Amid Notable Absence of US Tech Giants, Tensions Linger

CES 2025: Major players missing as Chinese firms make a comeback in Las Vegas despite US tech conflict

Despite Chinese businesses making up more than 25% of registered participants, the absence of numerous tech heavyweights is conspicuous.

Over 1,300 firms from China, with 1,212 originating from the mainland and 98 from Hong Kong, are preparing to display their newest products at a significant exhibition put together by the Consumer Technology Association (CTA), as per the event's website. Collectively, they make up over one-fourth of the 4,500 signed up exhibitors, crowning China as the biggest international participant this year.

This marks a rise from the 1,115 Chinese firms that attended CES in 2024 and the 493 noted in 2023, a year when Covid limitations hindered global travel. However, this year's count still doesn't surpass the highest ever 1,551 Chinese exhibitors in 2018, who constituted more than one-third of all attendees.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Apple and International Smartphone Brands Face Significant Decline in China Amidst Huawei’s Resurgence

Apple and other smartphone companies are seeing a decline in the Chinese market due to Huawei's resurgence. There's been a significant drop, by 47.3%, in the delivery of handsets by foreign manufacturers in China as of November, as per the data from a government agency.

The percentage of the Chinese smartphone market dominated by foreign brands, particularly Apple, has seen a significant drop of almost half compared to the previous year, based on government statistics. This decline comes as Apple faces growing rivalry from local manufacturers like Huawei Technologies.

Foreign phone manufacturers dispatched 3.04 million devices to China in November, marking a 47.3% drop from 5.77 million in the same month of 2023, as per a study released on Friday by China's government-operated China Academy of Information and Communications Technology (CAICT).

Data from CAICT revealed that the total number of smartphones shipped by foreign suppliers from January to November of the previous year was 42 million, marking a 22% annual decrease.

CAICT didn't mention any particular brands. The majority of foreign smartphones purchased in China are iPhones.

The study underscores the escalating difficulties Apple is encountering in China's mobile phone market, where rivalry has heightened due to Huawei's resurgence in the high-end sector.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Shanghai’s Lived-in Home Sales Soar to Four-Year High Amid Discounts and Incentives, But Bearish Economic Forecast Looms

Residential property sales in Shanghai hit a four-year peak in December due to the implementation of incentives. Despite this, house owners were compelled to provide price reductions to finalize transactions, while experts caution that this surge might be temporary given the pessimistic economic forecast.

Residential property sales in Shanghai reached a four-year peak last month following the easing of buying regulations in October by mainland China's business and financial center to stimulate its dormant real estate market.

Nonetheless, property owners had to provide a discount between 5 and 10 percent to finalize transactions due to a pessimistic economic forecast.

In December, a sum of 29,711 second-hand homes were sold throughout the city, reflecting a 9.8 per cent increase compared to the previous month, as reported by the online property advisory firm, Fangdi.com.cn. This was the highest sales figure since January 2021, during which over 40,000 properties were purchased.

Zhu Xinhai, a sales manager at Shanghai's 5i5j Real Estate Brokerage, commented that government incentives have unleashed a backlog of housing demand. He noted that most potential buyers are still wary and wouldn't commit to buying unless the sellers are willing to reduce their prices by as much as 10%.

Homebuyers on the mainland are now facing annual mortgage rates between 3.5 and 3.9 percent, following the rate reduction.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Driving Success: Mastering the Automotive Business Landscape with Innovation and Customer-Centric Strategies

The Automobile Industry is undergoing a pivotal transformation, driven by shifts towards electric vehicles (EVs), advanced Automotive Technology, and innovative Supply Chain Management strategies. To stay ahead, businesses are adapting to Consumer Preferences for sustainability, Regulatory Compliance, and leveraging Industry Innovation. The focus is on integrating new technologies, optimizing Automotive Sales and Marketing with digital tools, and ensuring resilient supply chains for Aftermarket Parts. Vehicle Manufacturing, Automotive Repair, Vehicle Maintenance, and Car Rental Services are all evolving to meet changing Market Trends and consumer demands for eco-friendly options and enhanced service quality. Top Car Dealerships are utilizing advanced Automotive Marketing strategies to enhance customer experiences. Overall, success in the competitive Automobile Industry hinges on a blend of innovation, customer-centric approaches, and staying informed on Market Trends and Regulatory Compliance.

In the fast-paced world of the automobile industry, businesses ranging from vehicle manufacturing giants to local automotive repair shops are constantly navigating through a labyrinth of challenges and opportunities. The automotive sector, a critical cog in the global economic machinery, encompasses a wide array of activities including automotive sales, vehicle maintenance, the supply of aftermarket parts, and car rental services. As we delve deeper into this intricate industry, it's clear that success hinges on more than just the nuts and bolts of car production. It requires a keen understanding of market trends, consumer preferences, automotive technology, and regulatory compliance, not to mention a robust strategy for automotive marketing and supply chain management.

This article aims to explore the dynamic landscape of the automotive business, shedding light on the "Navigating the Future: Top Trends and Innovations Shaping the Automobile Industry" and "Revving Up Success: Strategies for Automotive Sales, Repair, and Aftermarket Parts in a Competitive Market." From the drawing boards of vehicle manufacturing to the front lines of car dealerships, and the intricate workings of vehicle maintenance and automotive repair, we will uncover how industry innovation and strategic foresight are driving businesses towards a future marked by efficiency, sustainability, and unparalleled customer satisfaction. Join us as we gear up to explore the engines of growth and the roadmap to success in the ever-evolving automobile industry.

- 1. "Navigating the Future: Top Trends and Innovations Shaping the Automobile Industry"

- 2. "Revving Up Success: Strategies for Automotive Sales, Repair, and Aftermarket Parts in a Competitive Market"

1. "Navigating the Future: Top Trends and Innovations Shaping the Automobile Industry"

In the rapidly evolving landscape of the Automobile Industry, businesses are constantly seeking ways to stay ahead of the curve. Navigating the future of this sector involves a keen understanding of the top trends and innovations that are currently shaping it. From Vehicle Manufacturing to Automotive Sales, and from Aftermarket Parts to Car Dealerships, every facet of the industry is being transformed by technology and changing consumer preferences.

One of the most significant trends in the industry is the shift towards electric vehicles (EVs), driven by consumer demand for more sustainable transportation solutions and stringent regulatory compliance on emissions. This has prompted Vehicle Manufacturers to rethink their production lines and invest heavily in EV technology, influencing everything from Automotive Repair to Automotive Marketing strategies. The rise of EVs is not only reshaping the landscape of vehicle manufacturing but also impacting the Aftermarket Parts sector, as these vehicles require different maintenance and servicing needs compared to traditional combustion engine cars.

Another key trend is the integration of advanced Automotive Technology into vehicles. Features such as autonomous driving capabilities, connected car services, and enhanced safety systems are becoming standard, altering Consumer Preferences and setting new benchmarks for Industry Innovation. This technological leap is fostering new opportunities for businesses in the realms of Vehicle Maintenance, Car Rental Services, and even in the way Automotive Sales are conducted, with a greater emphasis on digital platforms and virtual showrooms.

Supply Chain Management has also emerged as a critical focus area. The global automotive industry has faced significant challenges due to supply chain disruptions, highlighting the need for more resilient and flexible supply chain strategies. Companies are now prioritizing end-to-end visibility, diversifying their supplier base, and embracing digital tools to predict and mitigate risks, ensuring a steady flow of parts and materials.

In terms of Automotive Repair and Maintenance, there is a growing trend towards using data analytics and predictive maintenance. This approach not only enhances service quality but also improves customer satisfaction by reducing downtime and unexpected repair needs. Similarly, Car Rental Services are innovating with flexible rental models and integrating more EVs into their fleets, responding to the growing demand for short-term, eco-friendly vehicle solutions.

Lastly, Automotive Marketing is witnessing a paradigm shift with the adoption of digital marketing strategies. Social media, SEO, and content marketing are becoming crucial in attracting and retaining customers in a highly competitive market. Personalization and engaging digital experiences are key to winning over today's tech-savvy consumers.

In conclusion, the Automobile Industry stands at the cusp of a major transformation, driven by technological advancements, changing consumer preferences, and the need for sustainability and regulatory compliance. Success in this dynamic environment requires businesses to stay abreast of Market Trends, embrace Industry Innovation, and remain flexible in their strategies. Whether it's Vehicle Manufacturing, Automotive Sales, or Car Rental Services, every segment of the industry needs to adapt to these evolving demands to thrive in the future.

2. "Revving Up Success: Strategies for Automotive Sales, Repair, and Aftermarket Parts in a Competitive Market"

In the fast-paced world of the Automobile Industry, achieving success in Automotive Sales, Repair, and Aftermarket Parts requires a blend of innovation, customer-centric strategies, and a keen eye on Market Trends. With Vehicle Manufacturing at the core, businesses are expanding their horizons to encompass a full spectrum of automotive services, including Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services. The key to thriving in this competitive market lies in understanding the dynamics of Automotive Technology, Consumer Preferences, and Regulatory Compliance.

To begin with, Automotive Sales strategies have evolved significantly. Top Car Dealerships now leverage advanced Automotive Marketing techniques, incorporating digital platforms to reach a wider audience. They focus on creating an immersive online experience for potential buyers, offering virtual tours of vehicles, online consultations, and streamlined digital purchasing processes. This online shift not only caters to the modern consumer's preference for convenience but also broadens the dealership's market reach.

In the realm of Vehicle Maintenance and Automotive Repair, customer trust and satisfaction are paramount. Successful businesses in this sector are those that offer transparent services, fair pricing, and quick turnaround times. They invest in ongoing training for their technicians to ensure expertise in the latest Automotive Technology and Industry Innovation. Additionally, effective Supply Chain Management plays a crucial role in minimizing downtime for repairs, by ensuring that necessary parts and tools are always available.

The Aftermarket Parts segment presents a unique set of opportunities and challenges. With a growing demand for customization and upgrades, businesses that offer high-quality, innovative parts at competitive prices are seeing success. However, staying ahead requires a deep understanding of current and emerging Market Trends in vehicle customization, as well as a robust supply chain to support timely delivery of parts.

Regulatory Compliance cannot be overlooked, as it directly impacts all areas of the automotive business. From Vehicle Manufacturing to repair services, businesses must stay updated on changing regulations to ensure compliance. This not only helps avoid legal pitfalls but also builds trust with consumers who are increasingly concerned about environmental and safety standards.

Lastly, Industry Innovation is the fuel that drives success in the automotive sector. Whether it's the integration of green technology in Vehicle Manufacturing, the adoption of AI and IoT in Automotive Repair services, or the use of big data analytics for understanding Consumer Preferences, innovation is what sets leading businesses apart.

In conclusion, navigating the competitive landscape of the Automobile Industry requires a multifaceted approach. By focusing on Automotive Marketing, embracing Industry Innovation, maintaining a commitment to quality and customer service, and ensuring Regulatory Compliance, businesses can rev up their success in Automotive Sales, Repair, and Aftermarket Parts, securing their place in the market's fast lane.

In conclusion, the automobile industry stands at the crossroads of innovation and tradition, where the latest trends in automotive technology, consumer preferences, and regulatory compliance are reshaping the landscape of vehicle manufacturing, automotive sales, aftermarket parts, and service offerings. Businesses operating within this dynamic sector, including car dealerships, vehicle maintenance and automotive repair services, and car rental services, must stay ahead of market trends and industry innovations to remain competitive and successful.

By embracing advancements in automotive marketing, supply chain management, and industry innovation, companies can navigate the future with confidence, offering top-notch products and services that meet the evolving needs of consumers. Whether it's adopting new sales strategies, enhancing the quality of aftermarket parts, or integrating cutting-edge automotive technology, the path to success in the automotive business requires a deep understanding of the market, a commitment to customer satisfaction, and the flexibility to adapt to changing market demands.

As we look ahead, it's clear that the automobile industry will continue to be driven by a combination of technological advances, shifting consumer preferences, and the ongoing need for regulatory compliance. By focusing on these key areas, automotive businesses can not only rev up their success but also ensure a sustainable and profitable future in the ever-expanding world of vehicle manufacturing and services.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Pony.ai Pursues Robotaxi Services in Hong Kong: Autonomous Tech Firm Eyes Airport Staff Commuting Solutions

Pony.ai, a Chinese company specializing in autonomous driving technology, is considering launching self-driving taxi services in Hong Kong. Their initial plan is to offer these 'robotaxi' services to the staff of Hong Kong International Airport.

The firm, having showcased its sixth-generation autonomous taxi at the Hong Kong airport the previous month, stated that the location was already prepared to, or intending to, implement self-driving vehicles.

The firm, presently managing over 250 autonomous taxis and 190 automated trucks, did not provide an immediate response to a comment request on Friday.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

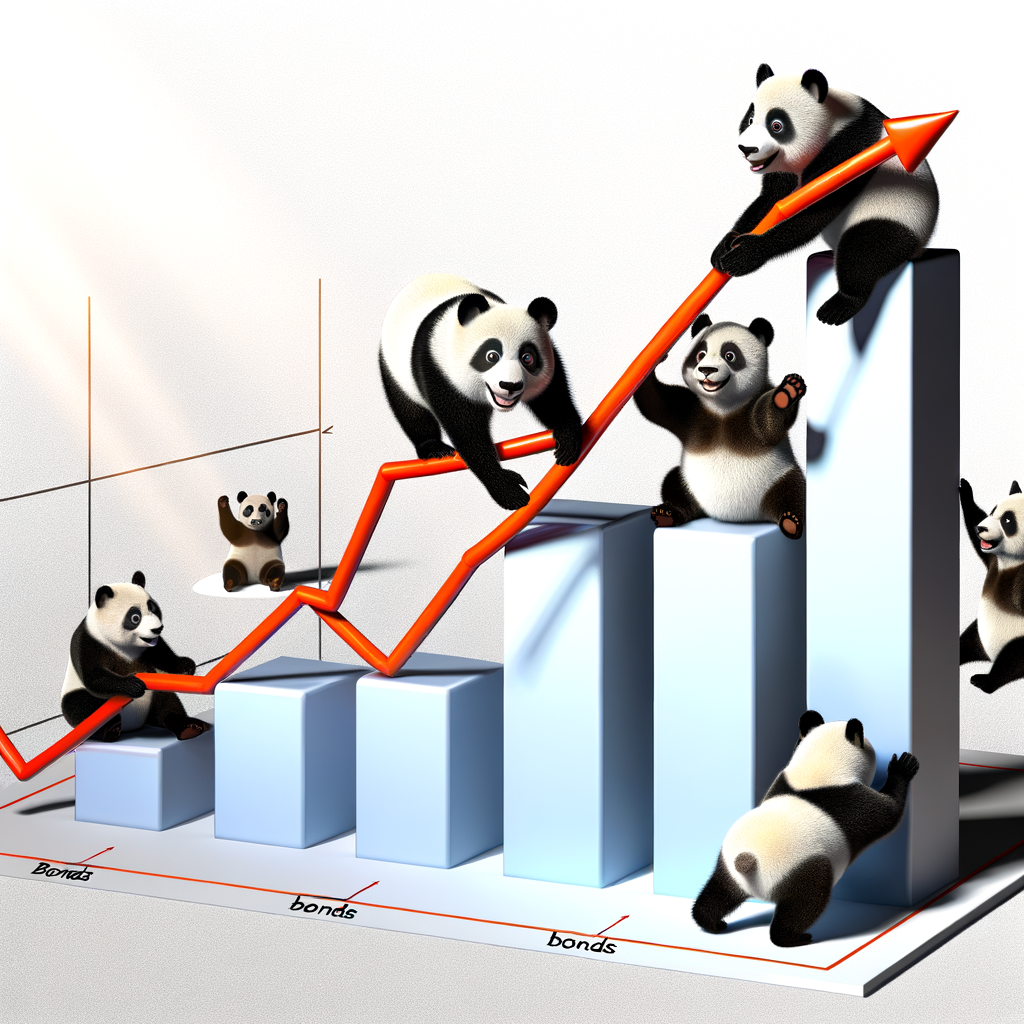

Record Panda Bond Issuance in China 2024: Analysts Optimistic for Further Growth in 2025 Amid Economic Stabilization Efforts

In 2024, China reached an all-time high in the issuance of panda bonds, and experts predict a more robust performance in 2025. Analysts forecast an increase in the issuance of these yuan-denominated panda bonds, surpassing last year's record.

Experts predict further expansion this year, considering the nation's necessity to bolster its economy and an ongoing strategy to increase the usage of the yuan for global transactions.

Last year, 109 panda bonds were issued in China, totaling 194.8 billion yuan (US$26.7 billion), as per the data provided by Wind, a Chinese financial data firm. This signifies a 16% growth in the number of issued bonds and a 26% annual increase in their value.

"The main factor influencing the yield gap between China and the rest of the world is the prior shift in utilizing profits for repatriation," stated Gary Ng, a leading economist at Natixis.

"Furthermore, an increasing number of sovereign issuers are looking to broaden their foreign exchange funding risk."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

E-commerce Titans Alibaba and JD.com Lead the Charge in China’s Renewed Home-Appliance Subsidy Programme Amid Intense Market Competition

Major e-commerce companies are participating in China's newest trade-in initiative due to intense rivalry. Alibaba and JD.com are some of the first to partake in this revamped discount scheme aimed at customers purchasing home appliances.

On Wednesday, Alibaba's high-end shopping platform, Tmall, which predominantly features recognized brands, initiated fresh discounts for consumers purchasing household gadgets.

On the same day, competitor JD.com initiated a comparable initiative that enables customers in certain provinces such as Hubei, Hunan, and Jiangsu to buy suitable home appliances with the help of government subsidies.

Alibaba is the proprietor of the South China Morning Post.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Forecasting the Dragon’s Flight: Global Investment Banks Weigh In on China’s Market Volatility and 2025 Equity Predictions Amid Policy Uncertainties

Interpreting the signs: A shaky year awaits China's market due to policy unpredictability

Following a lackluster year, firms like Morgan Stanley, UBS, and Goldman Sachs, among others, are presenting their forecasts for Chinese stocks in 2025.

Other entities like JPMorgan Asset Management and T. Rowe Price Group are keen on seeing additional proof of economic and corporate earnings stability before they invest further.

Goldman Sachs stands out from the crowd. The American investment bank is the most optimistic in comparison to its international counterparts, predicting at least a 13 percent increase in China's primary equity index. This confidence is based on the anticipation of faster earnings growth and better value assessments due to policy backing.

"Unless there are clearer plans about the execution of more forward-thinking strategies by the government, the market will continue to remain restricted and likely to fall short of expectations," stated Aaron Costello, the chief of Asian operations at Cambridge Associates, during an interview. "In order for Chinese stocks to significantly surpass others, we need to witness the policy proclamations leading to a real reduction of deflationary effects and a resurgence in business profits, both of which are going to require time."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI3 months ago

AI3 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech1 month ago

Tech1 month agoRevolutionizing the Road: Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Driving

-

Tech3 months ago

Tech3 months agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road

-

Tech3 months ago

Tech3 months agoRevving Up the Future: How Top Automotive Technology Innovations are Accelerating Sustainability and Connectivity on the Road

-

Tech3 months ago

Tech3 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology is Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoDriving into the Future: The Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Revolution