Hong Kong’s Stalled Land Tender: A Telling Sign of Weak Market Outlook and Obstacle to Urban Renewal Efforts

The unsuccessful land bid in Hong Kong illustrates a bleak forecast and hampers city revitalization initiatives. Analysts suggest that high construction expenses and substandard profits might deter developers from partnering with the URA.

The inability of Hong Kong to auction off a business property in Kowloon City this week signifies a double setback for the real estate sector. CK Asset Holdings was the only company to place a bid, indicating a cautious attitude among developers towards future prospects. This has hindered the government's attempts to rejuvenate the city region.

"Vincent Cheung, the managing director of Vincorn Consulting and Appraisal, stated that the URA has already extended some leeway to prospective bidders, such as allowing payment in instalments. He added that it's not feasible for them to significantly lower the reserve price to align with the market bid."

The purchase price of the property could potentially increase due to expenses incurred in assembling all individual or strata-title units prior to proposing a joint development with other partners. Cheung also mentioned that the URA has to raise its own funds to carry out the project. The latest instance of this was a bond sale in August that generated HK$12 billion (US$1.5 billion).

The bid for the Kai Tak/Sa Po Road project attracted attention from 30 developers and business organizations even prior to the official commencement of the bidding process. The available space, measuring 5,307 square meters, has the capacity to accommodate 810 residential properties. The successful bidder will be required to construct a "sunken plaza" that will connect to a proposed subterranean shopping avenue.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s Industrial Robot Sales Dip for the First Time in Five Years Amid Sluggish Demand and Intensified Price War

For the first time in half a decade, sales of industrial robots in China have decreased due to 'diminishing demand'. It's projected that the total number of industrial robots delivered this year will be around 300,000, marking a 5 per cent decline from 2023.

According to recent findings from the Shenzhen Gaogong Industrial Institute (GGII), a market consultancy firm, the total distribution of industrial robots in the country for this year is projected to hit 300,000 units, a 5 per cent decline compared to 2023.

The dip in industrial robot sales, which is below the anticipated amount, signifies the initial decrease since 2020, as stated by GGII data. The institute had earlier predicted an unprecedented sale of 320,000 units this year.

The report indicates that industrial robot producers are undergoing a survival challenge. It highlighted the fact that sluggish demand has sparked a pricing battle within the sector.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s Foldable Smartphone Market Slows Amid Global Demand Dip, Huawei Retains Domestic Dominance

The surge in China's foldable smartphone deliveries experiences a slowdown as worldwide demand decreases. Huawei continues to be the top-selling vendor of foldable smartphones in China, contributing to approximately 50% of all nationwide shipments.

According to a recent market report released by Counterpoint on Friday, the delivery of foldable mobile phones in China, which holds the biggest smartphone market globally, is projected to hit 9.1 million units this year, a 2% increase from 2023.

This stands in sharp contrast to the three-digit yearly percentage increase observed in past years, such as 103 per cent in 2023, 191 per cent in 2022, and a staggering 442 per cent in 2020.

The projected decrease in China's foldable phone deliveries mirrors the recent global slump in demand.

According to a November report by Counterpoint, worldwide shipments of foldable phones experienced a 1% decrease year-on-year in the quarter ending September, following six straight quarters of increase.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s VisionFM AI Outperforms Doctors in Eye Disease Diagnosis: A Leap Forward in Ophthalmic Healthcare

An AI model from Hong Kong has demonstrated superior accuracy over medical professionals in identifying eye diseases. The VisionFM model, a free-to-use tool created by the Chinese University of Hong Kong, has shown equivalency to physicians in diagnosing eye-related conditions, according to a study.

VisionFM is a novel base model that successfully diagnoses and forecasts a range of eye diseases, according to a study published in the NEJM AI journal last month. This could encourage the use of more clinical applications as more data becomes available.

The model showcased a performance either equivalent to or surpassing that of mid-level eye doctors in identifying 12 eye conditions, as stated in the report. Additionally, it exceeded the capabilities of the eye-care field's initial benchmark model, RETFound, in forecasting the advancement of glaucoma, the scientists noted.

The creation of VisionFM emerges as an increasing number of medical experts and researchers investigate the potential of generative AI in assisting the healthcare sector.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hang Lung Advocates for Accelerated Decarbonisation in Hong Kong and China’s Construction Sector: The Push for Rapid Regulatory Progress and Low-Carbon Material Adoption

Hang Lung advocates for speedier decarbonisation in Hong Kong and China's construction sector. The developer is pushing for rapid regulatory advancements and trial initiatives to hasten the uptake of low-carbon materials, an essential move for the industry's decarbonisation.

Hang Lung Properties suggests that the building sector requires rapid advancement in rules and trial initiatives to encourage the adoption of low-carbon materials and technology. This is crucial to speed up the process of reducing carbon emissions in the construction industry in both Hong Kong and mainland China.

"The regulatory landscape is quite significant, as we can only depend on the sectors to progress at a certain speed," stated John Haffner, the assistant director of sustainability at the development company, which operates in both Hong Kong and mainland China.

China has set a goal to hit maximum carbon emissions by 2030 and aims to attain a balance of carbon emissions by 2060. The steel production industry is responsible for approximately 15 percent of the country's total emissions.

"Haffner stated that regulations can aid in assigning a cost to pollution and increasing the cost of materials and processes that emit high levels of carbon. As a result, it becomes simpler to switch to alternatives that produce less carbon,"

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Rosewood Hotel Group’s Strategic Pivot to Chinese Market: An In-Depth Look at Middle East Expansion Plans

Special Report | Rosewood Hotel Group sets sights on Chinese tourists in Abu Dhabi, plans additional expansion in Middle East

The Hong Kong-based Rosewood Hotel Group was one of the first hotel businesses to acknowledge the increasing importance of the Middle East.

Hospitality providers in Abu Dhabi, such as the Rosewood Hotel Group, are prioritizing China as their primary focus. The efforts made by the group to set up the required framework to penetrate the Chinese market confirms this, says the head of the group's Abu Dhabi division.

Remus Palimaru, the managing director of Rosewood Abu Dhabi, stated that their primary customers currently come from the United States, Europe, and the Middle East. He further mentioned that apart from these regions, their main focus and target market is China. This focus is not only for their establishment, but also reflects a similar interest from their competitors and the city as a whole.

Palimaru stated that local cultural and tourism authorities were strongly encouraging Rosewood to incorporate payment methods such as WeChat to cater to the needs of Chinese travelers.

"Our goal is to stay a step ahead, having invested considerable energy in conveying to China that our doors are open for business," he stated.

Radha Arora, President and Co-Chief Development Officer of the Hong Kong-established Rosewood Hotel Group, stated that their organization was one of the first in the hospitality industry to acknowledge the increasing importance of the Middle East. This includes the crucial part the region plays in accommodating major international events and drawing a substantial number of tourists and investors.

In July of 2011, New World Hospitality purchased Rosewood Hotels & Resorts for a sum of $229.5 million. Following this, they rebranded themselves as the Rosewood Hotel Group two years later. Sonia Cheng Chi-man has since stepped into the position of CEO.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Rosewood Hotel Group’s Strategic Shift towards Chinese Market in Abu Dhabi Amidst Middle East Expansion

Sole Coverage | Rosewood Hotel Group Aims to Attract Chinese Tourists in Abu Dhabi, Considers More Expansion in the Middle East

The Rosewood Hotel Group, headquartered in Hong Kong, was one of the trailblazing hotel businesses to acknowledge the increasing importance of the Middle East.

Hotel owners in Abu Dhabi consider China as their main focus, reflected in the measures taken by the Rosewood Hotel Group to establish the required facilities to penetrate the Chinese market, states the head of its branch in Abu Dhabi.

Remus Palimaru, the managing director of Rosewood Abu Dhabi, mentioned that their predominant clients currently come from the United States, Europe, and the Middle East. He also pointed out that China is their primary focus, as well as that of their competitors and the city itself.

Palimaru mentioned that regional culture and tourism authorities were strongly advocating for Rosewood to adopt payment methods such as WeChat, to be well-prepared for visitors from China.

"We aim to be at the forefront, having exerted significant efforts to convey to China that we are ready for business transactions," he stated.

The Rosewood Hotel Group, headquartered in Hong Kong, was one of the first hotel chains to acknowledge the increasing importance of the Middle East, says Radha Arora, the group's president and co-chief development officer. This recognition encompasses the region's crucial function in organizing major international events and drawing in a substantial number of tourists and investors.

In July 2011, New World Hospitality purchased Rosewood Hotels & Resorts for a sum of $229.5 million. Two years subsequent to that, they rebranded themselves as Rosewood Hotel Group. Sonia Cheng Chi-man has since assumed the position of CEO.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Nio Unveils Affordable Firefly EVs, Aiming to Trump Mini Cooper and Smart in a Global Market Push

Chinese electric vehicle manufacturer, Nio, has introduced its Firefly-branded cars to compete with Mini Cooper and Smart. This unveiling marks a significant step forward in Nio's expansion into global markets.

During the Nio Day event in Guangzhou on Saturday, William Li, who serves as the CEO and co-founder of the Shanghai-based auto manufacturer, announced that their latest smaller and less expensive vehicle, equipped with the newest electric vehicle technologies, is set to be within reach for a wider range of global customers.

"We believe it's our company's duty to pursue a sustainable and improved future," he conveyed to the 22,000 Nio owners present at the event. "Nio is committed to creating top-quality electric vehicles for customers around the world."

The initial model of the compact Firefly car is tagged at 148,000 yuan (equivalent to US$20,284) and they will start shipping in April, according to him.

Nio's battery swap technology, which enables users to switch out a depleted battery for a fully charged one in under three minutes, will support the car. The car also has the ability to park itself. Information about the car's driving distance and digital control panel was not disclosed.

Li stated that Firefly vehicles surpass Mini's in intelligence and, in terms of style, they outshine other cars equipped with smart features.

Last month, Deutsche Bank reported that the new model's total shipments would hit 8,000 units by 2025.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s Property Debt Crisis: A Five-Year Struggle with No Clear End in Sight

The ongoing turmoil in China's real estate sector continues into its fifth year

The persistent property debt issue in China is now in its fifth year, with no signs of struggling builders finding it easier to settle their debts.

A prominent Chinese developer is now under scrutiny by officials due to potential default risks. A significant construction company in Hong Kong is seeking extended loan terms from its lenders. Meanwhile, another similar industry player is offloading a famous yet mostly vacant shopping complex in Beijing.

The real estate debt crisis in China, now in its fifth year, shows little signs of easing, as struggling property developers continue to grapple with debt repayment amidst a persistent downturn in housing sales. These developers' dollar bonds remain noticeably devalued, while debt issuance is almost non-existent. Additionally, the real estate sector stands out as a significant underperformer in the stock markets.

Recently, there were renewed concerns when the banking regulator instructed leading insurance companies to disclose their financial risks associated with China Vanke. This was to determine the level of assistance needed by the country's fourth-largest developer by sales to prevent bankruptcy. Meanwhile, in Hong Kong, New World Development tried to postpone some loan repayments, and Parkview Group listed a notable commercial property for sale in Beijing.

Recent indications of strain are heightening worries that the housing industry, which was once a significant driver of growth and now a major hindrance to demand for products ranging from furniture to vehicles, is far from recovering. The problems faced by Vanke add to the anxiety as it demonstrates that the liquidity crunch is impacting one of the few major construction companies that have managed to stave off insolvency. Moreover, the difficulties experienced by its counterparts in Hong Kong signify that the ripple effects are being increasingly experienced abroad.

"Though the latest governmental strategies have slowed down the decline, the industry may need another year or two to reach its lowest point," stated Leonard Law, a senior credit analyst at Lucror Analytics. "Given these circumstances, there remains a chance for additional defaults in the coming year, though the total default rate is expected to be significantly less than previously."

In an attempt to mitigate the economic slowdown, Chinese officials have intensified their initiatives in the past few years. These measures include reducing interest rates, decreasing buying expenses and limitations, and providing government assurances for bond sales from more robust developers. During a significant economic conference held earlier this month, prominent leaders also vowed to stabilize the real estate market in the coming year.

Nonetheless, the implemented rescue strategies have primarily aimed at averting a crash in real estate values, safeguarding proprietors of incomplete apartments, and utilizing government funding to manage surplus inventory. Simultaneously, decision-makers decided to stand by and observe as once-industry giants China Evergrande Group and Country Garden Holdings failed to meet their financial obligations.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Plummeting Diamond Value: The Impact of China’s Falling Marriage Rates and Rise in Synthetic Alternatives

The value of diamonds is drastically decreasing globally. Could China be the culprit? The demand for natural diamonds in China has significantly diminished due to the decline in marriage rates. Simultaneously, China's factories are producing synthetic substitutes that are nearly 90 per cent less expensive.

In the current challenging financial climate in China, not all recently married couples can afford a high-end, genuine diamond. However, many of them are no longer interested in owning one.

The global value of natural gems has decreased, tarnishing their worth, even as their synthetic counterparts shine equally bright but come at a significantly lower cost.

Vivian Wu, a 40-year-old entrepreneur who established the diamond company Wei An Shang Mao in Shanghai, stated that there isn't a definite requirement for items from Tiffany's.

Wu continues to fulfill approximately 10 diamond requests weekly, a trend that has been consistent over the years. However, recently, customers are frequently seeking deals. More and more newly married couples are requesting her to source smaller diamonds to suit their decreasing budgets or opting for synthetic versions that can sometimes cost only a fraction, about one-tenth, of the price of a natural diamond.

Transformations occurring in China are swiftly altering the worldwide diamond industry, as Chinese consumers are reducing their spending on natural diamonds and their manufacturing sectors are increasing the production of more affordable synthetic options.

The cost of diamonds in bulk has seen a reduction of approximately 40% in the last two years, as stated by Bank of America Global Research. The Zimnisky Rough Diamond Price Index indicates a notably sharp decrease since reaching its peak in 2022.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

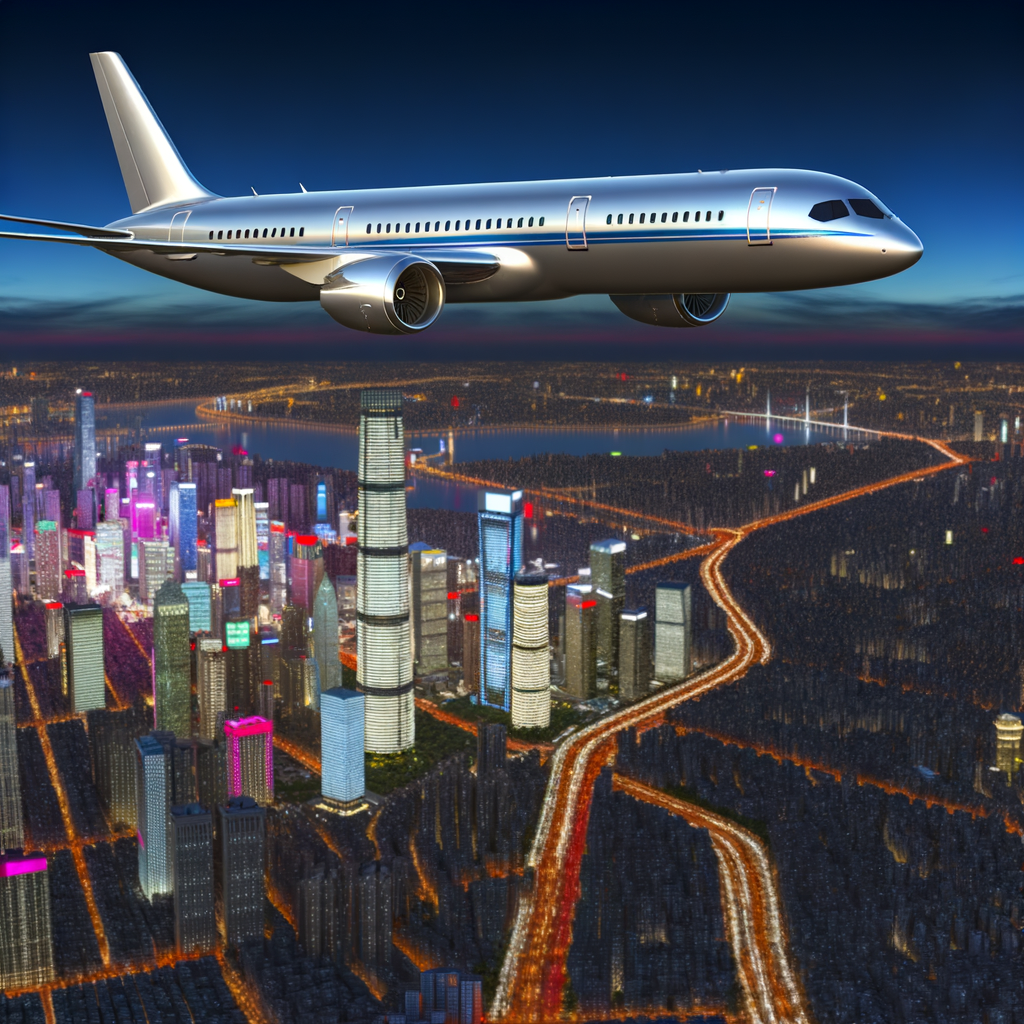

China’s C919 Jet Faces Key Reliability Test as Service Expands to Ten Major Cities Amid Rapid Network Growth

China's C919 jet is undergoing crucial trials as its network swiftly broadens. The Chinese commercial plane is currently operating flights to 10 prime cities in an effort to assure Western authorities of its dependability.

China's inaugural domestically-produced passenger plane, the C919, is currently operational in 10 leading cities throughout the nation, as local airline companies quickly integrate the new airplane into their fleets.

The airplane, viewed as a testament to China's accomplishments in technology and high-end production, reached a fresh high point on Thursday, having transported a sum of 1 million travelers since its first commercial journey in May 2023.

The swift deployment of the C919 will serve as a crucial examination of its capabilities, as it seeks to establish itself as a dependable choice against Boeing and Airbus' one-aisle models. The increased number of flights will present hurdles, ranging from implementation to upkeep.

"Increasing the number of flights across various cities not only serves as a genuine assessment for the jet, but it also enhances its visibility," stated Li Hanming, an aviation expert.

Eastern Airlines of China was the inaugural airline to utilize the new aircraft for its operations.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Driving Success: Mastering the Automotive Industry with Top Trends, Vehicle Manufacturing Insights, and Cutting-Edge Strategies for Sales and Services

The Automobile Industry is rapidly evolving with shifts in Market Trends, Consumer Preferences, and technological advancements driving changes in Vehicle Manufacturing, Automotive Sales, and services like Aftermarket Parts, Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services. Embracing Automotive Technology, especially in eco-friendly vehicles, alongside adapting to digital connectivity and sustainable practices, are key for businesses aiming for the top. Successful companies prioritize Regulatory Compliance, optimize Supply Chain Management, and innovate in Industry practices and Automotive Marketing strategies to stay competitive. The focus on eco-friendly products, efficient service delivery through tech like AI and virtual reality, and catering to evolving consumer demands ensures that businesses not only meet legal standards but also excel in customer satisfaction and market share growth in the dynamic Automobile Industry landscape.

In the fast-paced world of the automobile industry, staying ahead of the curve is not just advantageous; it's essential for survival and success. From vehicle manufacturing to automotive sales, and from aftermarket parts to car dealerships, businesses within this sector are continuously evolving to meet the shifting demands of consumers and to navigate the complex landscape shaped by technological advancements, market trends, and regulatory compliance. This article delves into the heart of the automotive business, shedding light on how companies across the spectrum—be it in vehicle maintenance, automotive repair, or car rental services—are driving towards innovation, efficiency, and customer satisfaction. With sections like "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry" and "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Service Excellence," we explore the key components that contribute to the flourishing of these businesses. By examining industry innovation, automotive marketing strategies, and the intricacies of supply chain management, this article provides a comprehensive overview of what it takes to excel in the dynamic and competitive world of the automotive sector. Whether you're an industry veteran or a newcomer, understanding these elements is crucial for anyone looking to make their mark and accelerate success in the realm of automotive businesses.

- 1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

- 2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Service Excellence"

1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

Navigating the rapidly evolving landscape of the automobile industry requires a keen eye on the latest trends and innovations shaping the future of vehicle manufacturing, automotive sales, and the broader sector. As we steer into an era marked by significant shifts in consumer preferences and technological advancements, businesses across the spectrum, including car dealerships, aftermarket parts suppliers, and car rental services, are adapting to stay ahead. Here, we explore the key forces driving change and how they're propelling the industry forward.

**Technological Advancements and Automotive Technology**

Innovation in automotive technology stands at the forefront of industry transformation. Electric vehicles (EVs) and hybrid models are gaining traction, reflecting a growing consumer demand for sustainable and eco-friendly transportation solutions. This shift is not only influencing vehicle manufacturing but also impacting automotive repair and maintenance practices, as businesses upskill to service a new generation of automobiles.

**Consumer Preferences and Market Trends**

Today's automotive market is increasingly shaped by consumer preferences for connectivity, convenience, and sustainability. Buyers are more informed and expect a seamless integration of digital technologies in their vehicles, driving automotive sales toward cars equipped with advanced infotainment systems, autonomous driving features, and IoT connectivity. These trends necessitate a fresh approach in automotive marketing, emphasizing the value of cutting-edge technology and eco-friendliness in vehicles.

**Regulatory Compliance and Environmental Considerations**

Regulatory changes aimed at reducing carbon emissions and promoting road safety are influencing every facet of the automotive business, from vehicle manufacturing to aftermarket parts. Compliance with these regulations is not just about adhering to legal requirements; it's a significant business strategy that aligns with consumer expectations for responsible brands. Thus, understanding and integrating these regulatory frameworks into business operations are crucial for success and sustainability in the industry.

**Supply Chain Management and Industry Innovation**

The automotive industry's supply chain is undergoing a transformation, driven by the need for efficiency, resilience, and sustainability. Innovations in supply chain management, including the use of AI and blockchain technology, are helping businesses optimize their operations, reduce costs, and improve transparency. These advancements are critical for maintaining a competitive edge in a market that demands high-quality products and services, delivered in the most efficient and environmentally friendly manner possible.

**Automotive Marketing and Customer Engagement**

In the age of digital transformation, automotive marketing strategies are evolving. Engaging with consumers through social media, leveraging data analytics for personalized marketing, and creating immersive online shopping experiences are becoming standard practices for car dealerships and rental services. Effective marketing now requires an intricate understanding of digital platforms, consumer behavior, and data-driven decision-making to attract and retain customers.

**Conclusion**

The road ahead for the automobile industry is paved with challenges and opportunities alike. From embracing automotive technology to meeting the demands of regulatory compliance and consumer preferences, businesses must navigate a complex landscape. Success will belong to those who prioritize innovation in vehicle manufacturing, adopt sustainable practices in automotive sales and aftermarket parts, and excel in automotive repair and vehicle maintenance services. As the industry continues to evolve, staying ahead of market trends, refining supply chain management, and reinventing automotive marketing will be key to driving forward in this dynamic sector.

2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Service Excellence"

In the fast-paced world of the Automobile Industry, businesses that focus on Automotive Sales, Aftermarket Parts, and Service Excellence are constantly seeking strategies to rev up their success and stay ahead of the competition. Given the critical role these sectors play in vehicle manufacturing, distribution, and maintenance, adopting innovative approaches is non-negotiable. Here, we delve into the gears that drive success in these areas, from leveraging automotive technology to mastering supply chain management.

**Embracing Automotive Technology**: In today’s digital age, the integration of the latest automotive technology is paramount for businesses across the sector. From Car Dealerships to Automotive Repair shops, adopting innovative solutions such as virtual reality showrooms or AI-driven diagnostics tools can significantly enhance operational efficiency and customer satisfaction. Furthermore, staying abreast of industry innovation helps businesses anticipate market trends and adapt to the evolving needs of consumers.

**Understanding Market Trends and Consumer Preferences**: The backbone of any successful automotive business strategy involves a deep understanding of market trends and consumer preferences. Whether it's the shift towards electric vehicles in Vehicle Manufacturing or the demand for eco-friendly Aftermarket Parts, businesses that can anticipate and cater to these preferences will likely outperform their competitors. Effective automotive marketing strategies that highlight a company’s commitment to innovation and customer needs can greatly improve market presence.

**Ensuring Regulatory Compliance**: In an industry as heavily regulated as the automotive sector, ensuring compliance with the latest regulations is crucial. From vehicle safety standards in Vehicle Manufacturing to environmental regulations affecting Aftermarket Parts, staying informed and compliant not only avoids legal pitfalls but also builds trust with consumers. Companies that prioritize regulatory compliance as part of their operational strategy often enjoy a more positive public image and customer loyalty.

**Optimizing Supply Chain Management**: The efficiency of Supply Chain Management cannot be overstated in the automotive industry. For sectors like Automotive Sales and Aftermarket Parts, a well-organized supply chain ensures the timely delivery of vehicles and parts, which in turn, boosts customer satisfaction and loyalty. Investing in supply chain innovations, such as predictive analytics for inventory management or blockchain for enhanced transparency, can provide a competitive edge.

**Fostering Industry Innovation and Automotive Marketing**: To truly excel in Automotive Sales, Aftermarket Parts, and Service Excellence, businesses must continuously seek out and foster innovation. This involves not only the adoption of new technologies but also the cultivation of a forward-thinking culture that encourages creative solutions to industry challenges. Coupled with smart automotive marketing strategies that effectively communicate these innovations to consumers, businesses can significantly enhance their brand reputation and market share.

In conclusion, the automotive business landscape is both challenging and rewarding. Companies that excel in Automotive Sales, Aftermarket Parts, and Vehicle Maintenance services share a common thread: they harness the power of automotive technology, understand their market and consumers, comply with regulatory demands, manage their supply chains efficiently, and constantly innovate in their practices and marketing approaches. By adopting these strategies, businesses in the automotive sector can navigate the road to success with confidence and agility, ensuring a top position in the dynamic and competitive automobile industry market.

In the rapidly evolving landscape of the automobile industry, businesses across the spectrum from vehicle manufacturing to automotive sales, including aftermarket parts suppliers, car dealerships, and car rental services, are steering towards a future that is heavily influenced by top industry innovation, automotive technology advancements, and shifting market trends. The journey through the realms of automotive repair, vehicle maintenance, and overall service excellence requires an intricate understanding of consumer preferences, rigorous regulatory compliance, and a strategic approach to supply chain management.

As we've explored in "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry," the propulsion towards electrification, autonomous vehicles, and connected services is not just reshaping the manufacturing landscape but is also opening new avenues for aftermarket customization and upgrades. Meanwhile, "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Service Excellence" underscores the importance of adopting innovative automotive marketing techniques, leveraging the power of digital transformation, and prioritizing customer satisfaction to stay competitive and profitable.

The key to success in this dynamic domain lies in the ability to anticipate changes, adopt flexible business models, and continuously invest in technology to enhance product offerings and service delivery. As the industry stands at the crossroads of traditional automotive practices and futuristic mobility solutions, businesses that can effectively harness the insights on consumer preferences, technological trends, and regulatory frameworks discussed will be better positioned to navigate the challenges and capitalize on the opportunities that lie ahead in the automotive sector. Ultimately, thriving in the automobile industry means staying ahead of the curve in every aspect, from automotive sales and vehicle manufacturing to aftermarket parts and car rental services, ensuring a smooth ride into the future of mobility.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Trump’s Tariff Tempest: The World Grapples with Unpredictable Trade Policies and the Shift Towards Bilateralism

Under the Open Sky | Global community needs to hold strong against Trump's flood of tariff warnings

A lot hinges on Trump's effectiveness in luring leaders away from collective policymaking and the steadfastness of China in resisting the tempting appeal of two-party agreements.

Initially, Donald Trump was seen as a "funny diversion", but it might be more apt to compare him to chaff – a storm of metal, glass or plastic ejected by fighter pilots to mislead and deter enemy chasers. For nearly ten years, this strategy of diversion has been crucial for Trump, with his steady flow of quick tweets and comments during campaigns ensuring he stays in the headlines and keeps his opponents unsettled.

Since his electoral win, the surge of distractions has been both characteristic and successful in maintaining a lack of stability among global leaders and media, regardless of whether they're from the US or abroad, ensuring their attention remains fixated on his policy objectives.

It's uncertain if and how these tariffs will be implemented and predicting it is just not feasible. It's highly likely that even Trump himself doesn't have a clear understanding. Given the number of tariff supporters he's appointed to his close-knit team, it's quite probable that tariffs will play a key role in his trade strategy – although, that's not the main issue.

Trump has managed to command media attention months prior to his inauguration, inciting a wave of intense activity among prominent global trade economists who are likely fruitlessly estimating the effects of potential tariffs.

40 minutes and

Trump returns: what lies ahead for China, Asia, and the globe? | Conversation Column with Yonden Lhatoo

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI2 months ago

AI2 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations are Accelerating Sustainability and Connectivity on the Road

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology is Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoDriving into the Future: The Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Revolution

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology Trends Are Shaping the Electric and Autonomous Era