China’s Market Sees Best Day with 3.5 Trillion Yuan Traded as Hong Kong Plummets: CSI 300 and Hang Seng Indices Reflect Contrast

The best day for the Chinese market saw a trading volume of 3.5 trillion yuan in stocks, while Hong Kong's market was on pause. The CSI 300 Index reduced its gains after hitting an all-time high within the day, while the Hang Seng Index experienced its most significant drop since 2008.

The CSI 300 Index, that monitors the largest corporations in Shanghai and Shenzhen, ended up 5.9 percent higher, following an earlier intraday leap of 10.8 percent, marking its most substantial percentage increase. An unprecedented 3.5 trillion yuan (equivalent to US$500 billion) worth of stocks were traded on the mainland, which exceeded the peak recorded on September 30.

The stock market in Hong Kong experienced a significant drop, with shares valued at a historic HK$620 billion being traded. The Hang Seng Index, a key indicator of market health, saw a sharp decrease of 9.4 per cent, which is the most severe since 2008, erasing all progress made during the period when mainland markets were closed.

"Without a significant and immediate increase in expenditure, the positive outlook might quickly vanish, causing investors to hesitate in pursuing this surge," stated Stephen Innes, the managing director at SPI Asset Management. "There's a genuine possibility of letdown, and worries regarding China's cycle of rapid growth and sudden collapse are still the main focus."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Driving Success in the Fast Lane: Mastering the Dynamics of the Automobile Industry from Manufacturing to Market

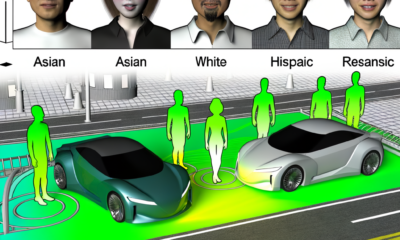

Top businesses in the Automobile Industry are propelling growth in Vehicle Manufacturing and Automotive Sales by closely aligning with Market Trends, Consumer Preferences, and technological advancements. Through investments in Automotive Technology and Industry Innovation, such as electric vehicles and autonomous driving, these companies are meeting eco-conscious demands and ensuring Regulatory Compliance. Effective Supply Chain Management and strategic Automotive Marketing are key in adapting to market shifts and highlighting vehicles' unique features. The Aftermarket Parts sector and Car Rental Services are expanding, offering significant opportunities by catering to diverse consumer needs and preferences. Additionally, the digital transformation in Automotive Sales, the rise in Electric Vehicles (EVs), and the evolving concept of mobility are reshaping the landscape, requiring businesses to adapt to stay ahead. Success hinges on prioritizing customer satisfaction, embracing innovation, and adapting to the evolving demands of the Automobile Industry.

In the high-speed lane of the global economy, the automobile industry stands out as a pivotal force driving advancements in technology, shaping consumer preferences, and steering economic growth. Within this vast and intricate sector, automotive businesses – spanning from vehicle manufacturing giants to nimble aftermarket parts suppliers – are the engines propelling society forward, ensuring that individuals and organizations alike stay mobile and connected. Whether it's through the sale of the latest electric car model, the meticulous art of automotive repair, or the convenience offered by car rental services, these businesses touch nearly every aspect of daily life. Yet, thriving in the automotive sector is no leisurely cruise. It demands an acute understanding of market trends, an unwavering commitment to customer satisfaction, and the agility to navigate the ever-evolving landscape of automotive technology, regulatory compliance, and consumer expectations. This article will shift gears to explore how top automotive businesses are not just surviving but accelerating in this dynamic environment. From "Revving Up Success: How Top Automotive Businesses Drive Growth in Vehicle Manufacturing and Sales" to "Navigating the Road Ahead: Trends and Innovations Shaping the Future of Car Dealerships and Aftermarket Parts," we'll take a closer look at the strategies fueling their journey, the innovations setting them apart, and the roadblocks they're overcoming. Join us as we delve into the core components of success in the automobile industry, highlighting the key players and practices in vehicle manufacturing, automotive sales, aftermarket parts, car dealerships, vehicle maintenance, and beyond.

- 1. "Revving Up Success: How Top Automotive Businesses Drive Growth in Vehicle Manufacturing and Sales"

- 2. "Navigating the Road Ahead: Trends and Innovations Shaping the Future of Car Dealerships and Aftermarket Parts"

1. "Revving Up Success: How Top Automotive Businesses Drive Growth in Vehicle Manufacturing and Sales"

In the fast-paced world of the automobile industry, top automotive businesses have mastered the art of driving growth in vehicle manufacturing and sales by closely aligning with market trends, consumer preferences, and technological advancements. These industry leaders understand that success hinges on more than just the quality of their vehicles; it's about delivering a comprehensive automotive experience that resonates with consumers across the globe.

A key factor in the acceleration of growth within the vehicle manufacturing sector is the emphasis on automotive technology and industry innovation. Top manufacturers are investing heavily in research and development to introduce electric vehicles (EVs), autonomous driving features, and enhanced connectivity options, catering to the eco-conscious consumer and those who prioritize cutting-edge tech in their rides. This forward-thinking approach not only sets the pace for automotive sales but also plays a crucial role in maintaining regulatory compliance, as environmental standards become increasingly stringent worldwide.

Supply chain management is another critical area where top automotive businesses excel. By streamlining operations and adopting just-in-time inventory practices, these companies can reduce costs, improve efficiency, and respond more swiftly to shifts in consumer demand. This agility is particularly important in a market characterized by rapid changes in consumer preferences and the ongoing global chip shortage impacting vehicle production.

In the realm of automotive sales, car dealerships remain at the frontline, serving as the critical link between manufacturers and consumers. Successful dealerships leverage automotive marketing strategies that emphasize the unique value proposition of their vehicles, whether it's superior performance, safety features, or fuel efficiency. Through digital marketing, social media, and personalized customer service, dealerships can enhance their visibility and attract a broader customer base.

The aftermarket parts segment also presents a lucrative opportunity for growth, as vehicle owners seek to customize and maintain their cars post-purchase. Offering high-quality aftermarket parts, coupled with exceptional vehicle maintenance and automotive repair services, allows businesses to tap into a market of enthusiasts and consumers looking to extend the lifespan of their vehicles.

Additionally, car rental services have adapted to changing consumer preferences by including electric and luxury vehicles in their fleets, catering to both environmentally conscious drivers and those seeking a premium driving experience. This adaptability not only boosts rental service appeal but also encourages the trial of new vehicle technologies among a wider audience.

Lastly, automotive businesses that excel in this competitive landscape are those that prioritize customer satisfaction above all. By ensuring a seamless customer journey—from the initial vehicle search and purchase process to ongoing maintenance and support—businesses can foster loyalty and encourage repeat business, which is invaluable in driving long-term growth.

In conclusion, top automotive businesses achieve growth in vehicle manufacturing and sales by staying ahead of market trends, embracing technological innovations, optimizing supply chain management, and ensuring high levels of customer satisfaction. As the automotive industry continues to evolve, these key strategies will remain pivotal for businesses aiming to rev up their success in an ever-changing market.

2. "Navigating the Road Ahead: Trends and Innovations Shaping the Future of Car Dealerships and Aftermarket Parts"

In the fast-paced world of the Automobile Industry, car dealerships and aftermarket parts suppliers are at a pivotal juncture. As they navigate the road ahead, several key trends and innovations are reshaping their futures. From advancements in Automotive Technology to shifts in Market Trends and Consumer Preferences, these entities are adapting to thrive in an ever-evolving landscape.

One significant trend affecting both car dealerships and aftermarket parts suppliers is the increasing emphasis on digital transformation. Automotive Sales are no longer confined to traditional showrooms. Online platforms and digital showrooms are becoming top choices for consumers, offering convenience and a broader selection. This shift necessitates a robust online presence and effective Automotive Marketing strategies for businesses looking to stay competitive. Digital tools and platforms are also streamlining Supply Chain Management, allowing for more efficient operations and inventory control.

Another area of rapid development is the integration of advanced Automotive Technology into Vehicle Manufacturing and maintenance. Electric vehicles (EVs), autonomous driving features, and connected car technologies are becoming more prevalent, influencing Consumer Preferences and the types of vehicles and parts in demand. Car Dealerships and Aftermarket Parts suppliers must stay abreast of these innovations, ensuring they can cater to the maintenance and customization needs of these modern vehicles.

Sustainability and regulatory compliance are also shaping the industry. With environmental concerns on the rise, there is a growing demand for eco-friendly vehicles and parts. This shift is driving innovation in the sector, with companies investing in sustainable Vehicle Manufacturing processes and eco-friendly aftermarket parts. Regulatory Compliance related to emissions and vehicle safety standards further necessitates that businesses adapt their practices to meet these evolving requirements.

Furthermore, the rise of Vehicle Maintenance and Automotive Repair services tailored to the needs of newer, more technologically advanced vehicles is evident. As vehicles become more complex, specialized knowledge and tools are required for maintenance and repair, offering opportunities for businesses in these areas to differentiate themselves through specialized services.

Lastly, the concept of mobility is undergoing a transformation, impacting Car Rental Services and the broader automotive market. The rise of car-sharing and subscription models offers consumers flexible alternatives to vehicle ownership, prompting dealerships and rental services to innovate and diversify their offerings.

In conclusion, the future of Car Dealerships and Aftermarket Parts suppliers is being shaped by a combination of technological advancements, evolving consumer expectations, and a shifting regulatory landscape. Success in this dynamic environment requires a forward-thinking approach, embracing Industry Innovation, and adapting to the changing preferences and needs of consumers. By staying informed and agile, businesses within the automotive sector can navigate the road ahead, capitalizing on new opportunities and driving towards continued growth and success.

In conclusion, thriving in the competitive landscape of the automobile industry demands more than just a passion for vehicles; it necessitates a comprehensive grasp of vehicle manufacturing, automotive sales, aftermarket parts, and the entire spectrum of services that make up the automotive business. From car dealerships focused on enhancing customer experience to repair shops investing in the latest automotive technology, success hinges on several pivotal factors. These include staying abreast of market trends, understanding and catering to consumer preferences, ensuring regulatory compliance, and optimizing supply chain management.

As we've explored, industry innovation and automotive marketing play crucial roles in driving growth within vehicle manufacturing and sales. The future of car dealerships and aftermarket parts will undoubtedly be shaped by these trends and innovations, making it imperative for businesses to adapt and evolve. Vehicle maintenance and automotive repair services must also rise to meet the challenges of new technologies and changing consumer demands.

Moreover, car rental services and other facets of the automotive industry must continuously refine their operations and offerings to stay competitive. The ability to anticipate and respond to the dynamic needs of the market, coupled with a commitment to quality and customer satisfaction, will set the top automotive businesses apart.

In this era of rapid technological advancement and shifting market dynamics, those within the automotive sector must leverage every tool at their disposal—from automotive marketing strategies to cutting-edge industry innovations—to secure their place on the road ahead. By doing so, they will not only contribute to the vibrant ecosystem of the automobile industry but also ensure their growth and sustainability in an ever-evolving landscape.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

2024 FBS Summit: Deciphering ASEAN Opportunities, Advancements in Science, European Security, and US-China Relations

The 2024 FBS gathering concluded with discussions on ASEAN, scientific studies, Europe, and US-China relations. The second session of the exclusive event started with a conversation about potential prospects in ASEAN, with Malaysia leading the way.

The 2024 Family Business Summit (FBS) in Hong Kong has wrapped up, with key representatives from over 100 affluent families engaging in discussions on a variety of subjects with esteemed speakers from diverse sectors.

The invite-only event's second day commenced with a conversation on possibilities within the Association of Southeast Asian Nations (Asean) as Malaysia gears up to take on the rotating leadership of the regional group. The discussion was led by Zuraidah Ibrahim, the Executive Managing Editor of the Post, and included prominent figures such as Anthony Loke, Malaysia's Minister of Transport, and Tony Fernandes, the CEO of Capital A Berhad, the company behind AirAsia, Southeast Asia's leading airline.

Two pioneering scientists from the Chinese University of Hong Kong's Medical Faculty led a discussion regarding Hong Kong's contribution to advanced scientific research. Both are globally recognized experts in their individual specialties.

A discussion concerning Europe's future safety was held prior to lunch. The conversation was led by Filippo Gori, who co-heads global banking at JPMorgan. The panel consisted of former European Commission president, Jose Manuel Barroso, former Spanish Foreign Affairs Minister, Arancha Gonzalez, and Maurice Gourdault-Montagne, who has served as the French ambassador to China, Japan, the UK, and Germany in the past.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s First-Generation Tycoons: A Retirement Wave and the Succession Challenge Ahead

The initial group of wealthy business people in China are beginning to retire. Is the next generation prepared to take over?

As the pioneers of Chinese entrepreneurship enter their twilight years, their businesses are facing challenges related to leadership transition and a changing commercial environment.

The passing of Zong Qinghou, once China's wealthiest individual, in February at the age of 79, sparked a rapid and intense struggle for control over his Hangzhou Wahaha Group. The ensuing conflict mirrored the plot of the popular HBO series, Succession.

Kelly Zong had to defend herself against opposition from others in Wahaha, in a complex conflict that kept the public in suspense for weeks.

The event highlighted the impending dilemma that China's business families are grappling with. The pioneer generation of Chinese entrepreneurs is now aging, and their offspring are faced with the intimidating responsibility of stepping into their parents' shoes – managing some of the globe's most prosperous businesses in the world's second biggest economy.

From 2017 to 2022, approximately 75% of the nation's family-run businesses have experienced problems with succession, as per studies conducted by a research group affiliated with the All-China Federation of Industry and Commerce.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Decade of Stock Connect: From Tablecloth Notes to a $10 Trillion Market Gateway – An In-Depth Review and Future Outlook

Stock Connect's 10th Anniversary: Initiated with scribbles on a tablecloth – what does the next decade hold?

The trading connection between Shanghai and Hong Kong became operational on November 17, 2014.

The humble beginnings on the teahouse tablecloth have now transformed into a gateway for global investors to tap into China's US$10 trillion domestic stock market. Similarly, it also provides an opportunity for their mainland counterparts to broaden their investment horizons by dealing in stocks listed in Hong Kong.

The connection is particularly crucial as, unlike Hong Kong and other global developed markets, China's capital accounts are not completely accessible, with limitations on both incoming and outgoing security investments.

Despite several triumphs since 2014, investors wagering on Chinese stocks via the programme would have seen more financial gains had they invested in the S&P 500 in the last ten years. Additionally, the Stock Connect is confronting multiple challenges due to Donald Trump's re-election as US president.

The trading connection, activated on November 17, 2014, has surpassed the Qualified Foreign Institutional Investor (QFII) scheme, establishing itself as the main mechanism for international traders to access China's yuan-based stocks. The QFII program, launched in 2002 when China's market was starting to become globally accessible, necessitates extensive documentation and burdensome government authorizations before investments can be initiated.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Beijing Invests US$4.6 Billion in State-Backed Semiconductor Project: Yandong Microelectronics and BOE Technology Take Key Stake in New 12-Inch Wafer Fab Facility

Beijing is set to establish a 12-inch wafer fabrication facility, investing $4.6 billion in a government-supported chip initiative. Beijing Yandong Microelectronics is expected to hold a dominant role with a 25 percent share. Additional investors encompass display manufacturer, BOE Technology.

Beijing plans to invest 33 billion yuan (around US$4.6 billion) in constructing a 12-inch wafer fabrication plant. This project, spearheaded by state-run businesses and financial resources, signifies further progress in China's mission to enhance local semiconductor manufacturing.

Prominent companies participating in the new facility encompass Beijing Yandong Microelectronics (YDME), a firm listed on the Shanghai Star Market, and BOE Technology, the leading display producer in China.

On Saturday, YDME announced its plans to inject 4.99 billion yuan into Beijing Electronics IC Manufacturing, a subsidiary of the government-owned Beijing Electronics Holding responsible for the wafer fab project. As per a corporate document, this investment will grant YDME a dominant role in the project, possessing a 24.95% stake, backed by a cooperative agreement.

On the same day in a different report, BOE, listed in Shenzhen, revealed that they would contribute 2 billion yuan to gain a 10% share in the project.

Additional contributors encompass associates of Beijing Yizhuang Investment, Beijing State-owned Capital Operation and Management, and ZGC Group. Altogether, the stakeholders will chip in 20 billion yuan, while the rest of the funds will be procured through debt financing.

YDME indicated in its documentation that it anticipates China's combined circuit (IC) industry to expand its local production capacity to 21.2 per cent by 2026, a notable increase from 16.7 per cent in 2021. It also foresees a notable gap between supply and demand for mature nodes, particularly those with features sized 28 nanometres or larger, and a monthly production capacity of 370,000 wafers by 2027.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Global Family Business Titans Converge at 2024 Hong Kong Summit: AI, Geopolitics, and Market Strategies in Focus

2024 Family Business Summit: Hong Kong meeting focuses on AI, global politics, and markets

Over the weekend, the exclusive 2024 Family Business Summit in Hong Kong saw a gathering of more than 100 business proprietors.

Over 100 of the globe's richest entrepreneurs convened in Hong Kong over the weekend, with the city intensifying its efforts to become the premier wealth management and family office center in the Asia-Pacific area.

Entrepreneurs from the United States, Europe, the Middle East, Southeast Asia, and mainland China converged with their colleagues in Hong Kong at the exclusive 2024 Family Business Summit. The event was coordinated by the South China Morning Post and Blue Pool Capital, with JPMorgan taking the lead as the main sponsor.

"Family enterprises serve as the pillar of Asia's economy and significantly contribute to the region's growth," stated the Post's CEO Catherine So at the Island Shangri-La Hotel.

"As a worldwide news company with a wealthy monthly readership of 35 million, we believe it's our duty to offer a unique platform for leading family business owners to interact and share knowledge with each other for the continued prosperity of these generational dynasties."

The private meeting, lasting one and a half days, commenced on Friday with a dinner at the Four Seasons Hotel. Attendees were indulged with a seven-course meal crafted by the triple Michelin-starred eatery, Lung King Heen.

The inaugural day of the conference was filled with dialogue sessions showcasing leading specialists in diverse domains, ranging from artificial intelligence to the South China Sea.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Declining EV Prices in Hong Kong to Lower Insurance Premiums, but High Third-Party Liability Costs Persist

The cost of electric vehicle insurance in Hong Kong is expected to decrease, although third-party liability could stay elevated. As the prices of electric vehicles go down, insurance premiums are projected to follow suit. However, due to the frequency of accidents and the cost of repairs, third-party liability insurance is likely to stay high.

An industry executive has indicated that as the costs of electric vehicles (EVs) in Hong Kong decrease, the insurance premiums for these vehicles will also reduce. However, this might not necessarily result in a reduction in the cost of coverage for third-party liability.

Eric Hui, the CEO of Zurich Insurance in Hong Kong, advises EV owners in both China and Hong Kong to consider purchasing more than the minimum legally required insurance coverage in mainland China to match the standard in Hong Kong.

Full coverage auto insurance provides protection against third-party claims and pays for the policyholder's medical costs in the event of an accident. Additionally, it covers the cost of repairs, damages not caused by a collision, and theft.

According to legislation in Hong Kong, every car owner is legally required to have insurance that includes third-party liability coverage for a minimum of HK$100 million (US$12.8 million). In contrast, the legal requirement in mainland China is just 200,000 yuan (US$27,745). Typically, those who own older, less valuable cars choose to purchase only third-party coverage.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Geely’s Billion-Dollar Reorganization: Zeekr and Lynk & Co Restructuring Amid Market Challenges and Internal Competition

Geely intends to restructure Zeekr and Lynk divisions as the founder and investors withdraw $2 billion. Zeekr's value dropped by 24% in New York's market following the announcement of Geely Auto's restructuring strategy.

Geely Auto has consented to purchase an 11.3% share in Zeekr Intelligent Technology, which is listed on the New York Stock Exchange, at a cost of $806.1 million or $26.87 per share, as revealed in a stock market filing on Thursday. This acquisition will elevate its share to 62.8%. The entity selling is ultimately controlled by Li and his partners.

In a separate announcement, Zeekr revealed its plans to acquire a 50% share in the automobile manufacturer Lynk & Co. The deal, worth 9 billion yuan (approximately US$1.24 billion), will be purchased from two organizations connected to a prominent business magnate. Additionally, Zeekr plans to purchase more new shares in Lynk, increasing its ownership to 51%, which will subsequently reduce Geely Auto's stake to 49%.

Shares in Geely Auto dropped 5.2% to HK$13.18 last Friday, resulting in a significant loss of HK$7.3 billion (US$931.6 million) in its market valuation. Zeekr, which became publicly traded through a stock listing in May, saw a steep decline of 23.7% to US$22.24 in overnight trading in New York, trimming US$1.7 billion from its market cap.

According to their latest financial statements, Zeekr and Lynk continue to be in the red.

"Zeekr and Lynk have comparable product offerings and pricing structures, which will unavoidably result in [unwanted] rivalry, internal disputes, and capital wastage if not consolidated," stated Gui Shengyue, Geely Auto's CEO, during a profit report discussion on Thursday. "Inter-brand competition obstructs Geely's progress."

The purchase of Zeekr demonstrates the group's backing for the brand, according to a statement by Geely Auto. This move will streamline Zeekr's ownership framework, strengthen the group's sway over its business trajectory, and aid in the distribution of strategic resources and forthcoming plans, the statement further elaborated.

Li is restructuring his business empire based in Hangzhou, Zhejiang due to an over-supply in the market and fierce pricing competition among local EV manufacturers. Attempts to broaden his global reach have been hindered by heavy duties imposed on China-produced EVs in both the US and Europe. The win of Donald Trump in the US elections has increased the strain on Chinese exports.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

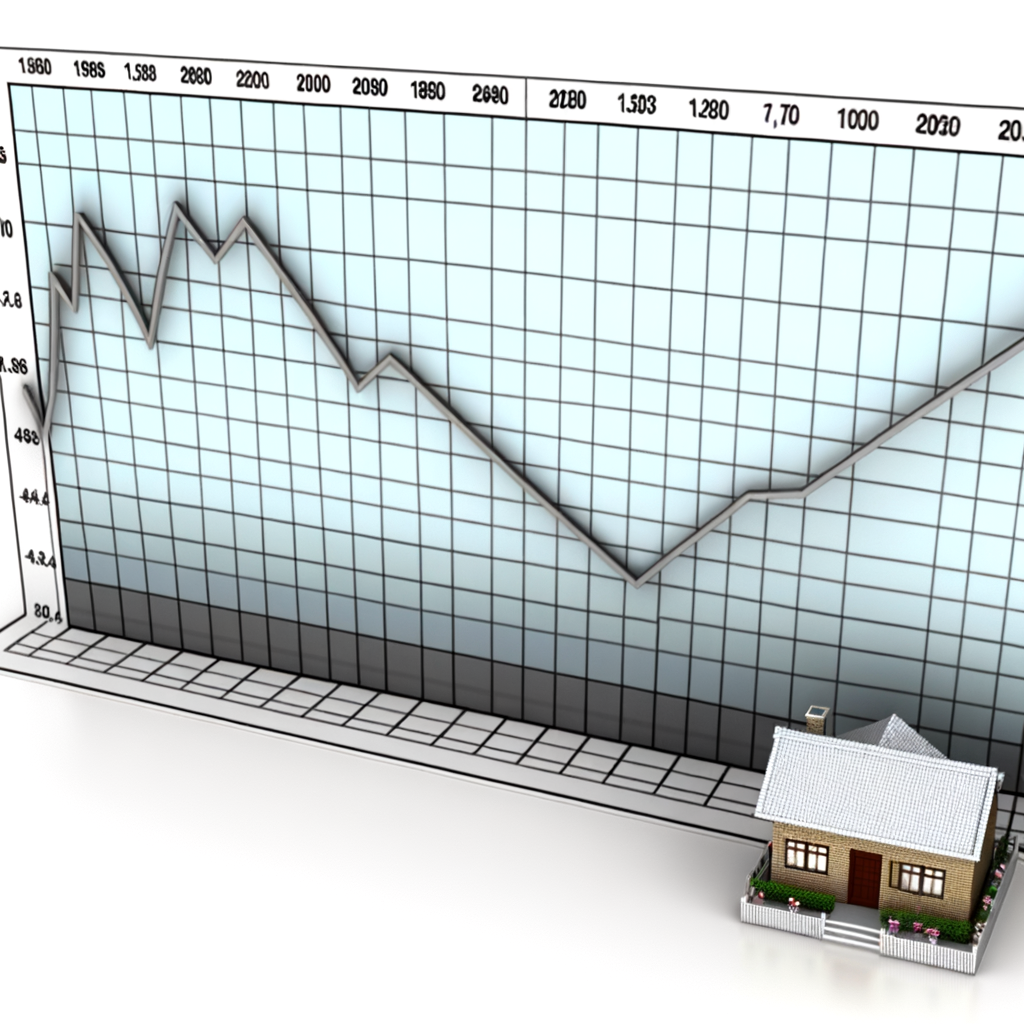

Hong Kong Stocks Continue Downward Trend Despite Positive Chinese Retail and Housing Data

Hong Kong shares end a six-day decline even with Chinese statistics on retail sales and housing prices

Despite a 4.8 percent increase in retail sales and a less rapid drop in housing prices, investor sentiment remained low.

The Hang Seng Index slightly dipped by 0.1 per cent to settle at 19,426.34, negating a potential rise of up to 0.9 per cent. Over the week, the main index suffered a 6.3 per cent decline, marking the largest drop in a month. Meanwhile, the Hang Seng Tech Index saw a marginal increase of 0.2 per cent.

Indices on the mainland also fell. The CSI 300 Index decreased by 1.8 per cent, and the Shanghai Composite Index went down by 1.5 per cent.

An earlier report issued by the agency on Friday indicated that the prices of new homes in 70 cities decreased by 0.5 per cent on a monthly basis in October, marking the smallest decrease in the past seven months.

The positive shift in economic figures has been overshadowed by Beijing's inability to sanction fiscal incentives aimed at enhancing consumption and employment during a legislative session last week. This is further complicated by the anticipated increase in tariffs by the incoming Trump administration. The Hang Seng Index has seen a 16 per cent decline from its peak in October. Initially, stocks had surged when Beijing implemented a variety of financial relief strategies and steps to support the real estate market, such as lowering mortgage rates, deed taxes, and removing restrictions on home purchases.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s New Home Prices Stabilise After 17-Months of Decline: The Impact of Support Measures

The decrease in China's new housing prices shows signs of slowing after 17 months, following the implementation of supportive measures. In October, the prices in 70 cities dropped for the 17th consecutive month, however, the rate of decline was slower, indicating that market stabilization might be due to these supportive actions.

The cost of new homes in China dropped for the 17th consecutive month in October, albeit at a reduced rate. This indicates that the capital, Beijing, might be nearing a point of market stability following a series of supportive interventions.

In 70 primary cities, the price of new homes saw a 0.5 per cent decrease from September, marking the most gradual drop in seven months, as revealed by the data put out by the National Bureau of Statistics on Friday.

The decrease in prices was 6.2 per cent compared to the previous year, a slightly steeper drop than the 6.1 per cent fall observed in September of the same year.

The prices in the four major cities – Beijing, Shanghai, Guangzhou, and Shenzhen – experienced a decrease of 0.2% in October on a monthly basis, which is less than the 0.5% drop observed in September, as indicated by the data.

Secondary cities like Tianjin, Wuhan, and Chengdu, along with tertiary cities such as Dali, Xuzhou, and Huizhou, experienced a 0.5% decrease in the cost of new homes last month, which is slightly less than the 0.7% reduction seen in September.

The average cost of previously owned houses in top-tier cities increased by 0.4% in October, following a 1.2% decrease in September. This marks an end to a 13-month downward trend.

In tier-2 cities, the cost of previously owned homes decreased by 0.4 percent, which is lower than the 0.9 percent decrease from the month before. Similarly, in tier-3 cities, the prices saw a decline of 0.5 percent, compared to a 0.7 percent drop in the preceding month.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

US Congress Questions Amazon Over TikTok E-Commerce Deal: A Strategic Alliance or a National Security Threat?

US lawmakers have raised questions about Amazon's partnership with TikTok for e-commerce. Certain individuals perceive this alliance, which enables customers to purchase Amazon products directly via the ByteDance-controlled application, as a strategy to complicate the process of prohibiting TikTok.

In September, the Select Committee on China from the House called upon Amazon to converse about a notable retail collaboration that both the companies made public in August, as per several sources knowledgeable about the situation. This meeting has not been undisclosed before.

The group, tasked with handling assumed dangers from China's government, expressed worry about a prominent U.S. firm, integral to the economy, collaborating with a Chinese-owned business on the brink of prohibition due to national security issues.

"The Select Committee communicated to Amazon the risks and imprudence associated with collaborating with TikTok, citing the serious national security risks posed by the app," a representative for the Select Committee on China informed Bloomberg.

An Amazon representative communicated through email, stating "We, like numerous other American companies, keep ongoing dialogue with authorities at all tiers of government to talk about matters concerning policymakers, our staff, and our patrons." TikTok, on the other hand, did not furnish a reply to a request for their statement.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Lenovo Expands Global Factory Network Amid Second Quarter AI-Boosted Sales Surge and Looming US Tariffs

Lenovo is set to increase its worldwide manufacturing presence as AI boosts its second quarter sales. The top global PC manufacturer intends to establish additional factories outside China, in response to potential 60% tariffs threatened by incoming US President Trump.

Chairman Yang Yuanqing announced that Lenovo is set to broaden its supply chain and is planning to establish more production sites outside of China due to the unpredictable global political climate.

Lenovo, the leading global manufacturer of personal computers, owns the majority of its factories in China, a typical scenario in the electronics sector that exposes potential risks as US president-elect Donald Trump plans to levy a 60 per cent tax on imports from China.

Yang conveyed to Reuters that although it's premature to forecast the strategies of the new US government, Lenovo holds a superior position compared to its rivals when it comes to mitigating such uncertainties. This is due to its wider range of manufacturing sources and procurement tactics, as well as evenly distributed regional income sources.

Although China continues to be the primary production hub, Lenovo runs over 30 production plants across nine distinct markets. The firm intends to establish operations in Saudi Arabia as a result of a significant investment agreement with the kingdom's Public Investment Fund, according to Yang.

The tech firm from China announced a quarterly revenue of $17.9 billion as of September 30, surpassing the anticipated $16.0 billion as per the data from LSEG.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology Trends are Electrifying and Steering the Future of Transportation

-

Tech4 weeks ago

Tech4 weeks agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

AI4 weeks ago

AI4 weeks agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: The Drive Towards a Sustainable Future with Top Automotive Technology Advancements

-

Tech1 month ago

Tech1 month agoRevolutionizing the Road: How Top Automotive Technology Innovations Are Paving the Way for Sustainability and Safety

-

Tech1 month ago

Tech1 month agoRevving Up the Future: How Top Automotive Technology Innovations are Accelerating Sustainability and Connectivity on the Road

-

Tech4 weeks ago

Tech4 weeks agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology is Shaping Electric Mobility and Autonomous Driving