Tech Tremors: Anticipating Policy Shifts and Industry Impact with Trump’s Return to the White House

From semiconductor conflicts to TikTok prohibition: the possible technology outcomes from Donald Trump's comeback

With Donald Trump's potential return to the presidency, technology firms are preparing for a possible overhaul of tech regulations implemented by Joe Biden.

Musk's closeness to the incoming president puts him in a position to influence regulations related to his main businesses, such as Tesla and SpaceX. This could potentially put his rivals in the electric-car and space sectors at a disadvantage when it comes to contracts and government supervision.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Chinese Workers in ‘Slavery-Like Conditions’ at BYD Site in Brazil: A Case of Exploitation and Degrading Living Standards

Workers from China discovered in 'slave-like circumstances' at BYD construction location in Brazil. Authorities disclosed that employees were subjected to extreme work hours and maintained in 'humiliating conditions' within their living quarters.

The officials have stated that a different company employed the workers in China and then irregularly transported them to Brazil.

They were working extraordinarily long hours, beyond what is legally allowed in Brazil, often for a full week without a break. The living conditions they were subjected to were described by officials as extremely poor, among other breaches of labor laws.

The leading Chinese electric vehicle company has ended its association with Jinjiang Construction Brazil Ltd. and committed to safeguard the rights of its subcontracted employees, according to a company announcement on Monday. The company also stated that all workers would be relocated to hotels.

BYD Auto of Brazil reaffirms its dedication to entirely adhering to Brazilian laws, particularly those regarding the safeguarding of workers' rights and human dignity," stated Alexandre Baldy, the senior vice-president of BYD Brazil.

The employment regulators did not reveal the identities of the companies engaged in employing the workers.

One minute and eleven

BYD from China surpasses Tesla as the global leader in electric vehicle production.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China Maintains Top Spot in Car Exports Amid Slower Growth Predictions: Diversification Strategies and Hybrid Models to Counter EU’s EV Tariffs

Despite a slowdown due to the European Union's electric vehicle tariffs, China is expected to maintain its position as the leading car exporter in 2025. In order to mitigate the effects of trade restrictions, China's major automotive companies are poised to broaden their offerings by introducing gasoline vehicles and hybrid models.

Hua Chuang Securities projections suggest that the international exports of vehicles manufactured in mainland China may surpass 5.58 million units in 2025, reflecting a 14 per cent increase from the previous year. However, this growth pace is less rapid than the anticipated 29 per cent expansion this year and the 58 per cent upsurge in 2023, the year when China surpassed Japan to become the world's leading car exporter.

During the initial three-quarters of the current year, automobile manufacturers based on the mainland experienced a 27% increase in exports, hitting 3.1 million units, as per the analysis by research company Canalys.

"Europe continues to be a focal point in the international expansion plans of Chinese auto manufacturers," he stated. "SAIC Motor exemplifies this – they launched hybrid variants of their MG3 and MG ZS cars, intending to compete with the standing of Japanese brands in Europe."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

MetLife Acquires Hong Kong Tycoon’s PineBridge for $800 Million in Major Asset Management Expansion

MetLife is set to purchase PineBridge, owned by Hong Kong magnate Richard Li, as part of its asset management expansion. The subsidiary of the New York-based insurance company will shell out US$800 million for PineBridge, which oversees roughly US$100 billion in assets.

MetLife has confirmed its agreement to purchase assets of PineBridge Investments outside China, owned by Hong Kong's billionaire Richard Li's Pacific Century Group. This move is a part of the US insurance company's strategy to expand its asset management operations.

The asset management division of New York's insurance firm, MetLife Investment Management, has confirmed plans to purchase PineBridge for $800 million. PineBridge, which oversees roughly $100 billion in assets, was previously reported by Bloomberg News to be a target of MetLife. In addition to the purchase price, MetLife has committed to paying an extra $200 million if specific financial targets are met by 2025, and another $200 million based on a long-term earnout.

The agreement, slated to be finalized by 2025, does not include PineBridge's private equity funds or its joint venture in China with Huatai Securities, which oversaw over US$70 billion as of June's end.

Pacific Century will continue to maintain its business operations in mainland China and concentrate on expanding Huatai-PineBridge along with its private fund assets, as per a representative from the parent company. The collaboration with Huatai and Suzhou New District Hi-Tech Industrial is intended to satisfy the increasing need for investment goods in the country.

After the transaction is finalized, MetLife Investment, a company that specializes in asset classes such as fixed income, private credit and real estate, will manage over US$700 billion. The deal will enhance its international presence since over half of the client assets being purchased from Pinebridge belong to investors from outside the US and approximately one third are located in Asia.

"The purchase of PineBridge Investments advances our aim to speed up expansion in asset management," said MetLife's president, Michel Khalaf. He added, "MetLife Investment Management is well on its way to expanding its business naturally, with a focus on specific, compatible non-organic growth."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong Derivatives Trading Soars to Record High for Third Consecutive Year Amid Market Volatility

Trading in derivatives in Hong Kong reaches unprecedented levels for the third consecutive year due to market fluctuations. Over 377 million futures and options were traded on the exchange this year, marking a 14 per cent growth compared to the previous year.

Derivatives trading in Hong Kong has reached an unprecedented level for the third consecutive year.

Over 377 million futures and options have been traded on the city's stock exchange since the beginning of the year, marking a 14% increase from 2023, according to data from Hong Kong Exchanges and Clearing (HKEX). This surge occurred as stock market instability reached its peak in over two years in October.

The initial commitment from China to rejuvenate its economy sparked a surge of excitement among stock dealers, but this energy quickly faded due to the government's sluggish execution. Fluctuations in the stock market soared as trade volumes reached unprecedented heights, necessitating increased hedging. According to Frank Benzimra of Societe Generale, some investors employed derivatives to take a careful approach towards the market.

"In this scenario, the options market provides an excellent platform to voice some perspectives," said the strategist during a briefing last Thursday.

China's economic stimulus plan – encompassing reductions in interest rates, infusions of cash for banks, and backing for stocks – transformed previously underperforming shares from Hong Kong and mainland China into some of the top global performers for the year. However, a subsequent decline in optimism instigated a selling frenzy. According to data collected by Bloomberg, overall daily stock transaction volume increased by over 20% for both Hong Kong and China from 2023 onwards.

Half past nine

CEO of HKEX, Bonnie Chan, on developing a dynamic market in Hong Kong

This boosted the regional derivatives market. As the end of the year approaches, the volume of options in Hong Kong saw a rise of 15 per cent from 2023, reaching 209 million contracts by Friday, according to HKEX data. Concurrently, futures also saw an increase of 13 per cent, reaching 168 million.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hang Seng Index Surpasses 20,000 Mark: Mainland Purchases Bolster Sentiment Despite Below Average Turnover

The Hang Seng Index in Hong Kong has surpassed the 20,000 mark, bolstered by purchases from the mainland. The standard recorded a 1.1 per cent increase, the highest in almost two weeks, although the exchange's turnover was 14 per cent less than usual.

The Hang Seng Index saw an increase of 1.1 per cent, closing at 20,098.29, surpassing a significant benchmark for the first time since December 12. There was also a 1.1 per cent growth in the Hang Seng Tech Index.

The volume of trading was relatively low, with a 14% decrease from the 30-day average as per Bloomberg's data. Due to the Christmas holiday, the city's financial markets will remain shut until Thursday.

On the mainland, there was an increase in the CSI 300 Index and a 1.3 per cent rise in the Shanghai Composite Index at the close of trading.

Online retail behemoth Alibaba Group Holding and freight company Orient Overseas International were among the leading profit-makers in the blue chip market. CK Asset Holdings saw progress following an increase in shares by the Li Ka Shing Foundation in the giant corporation.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

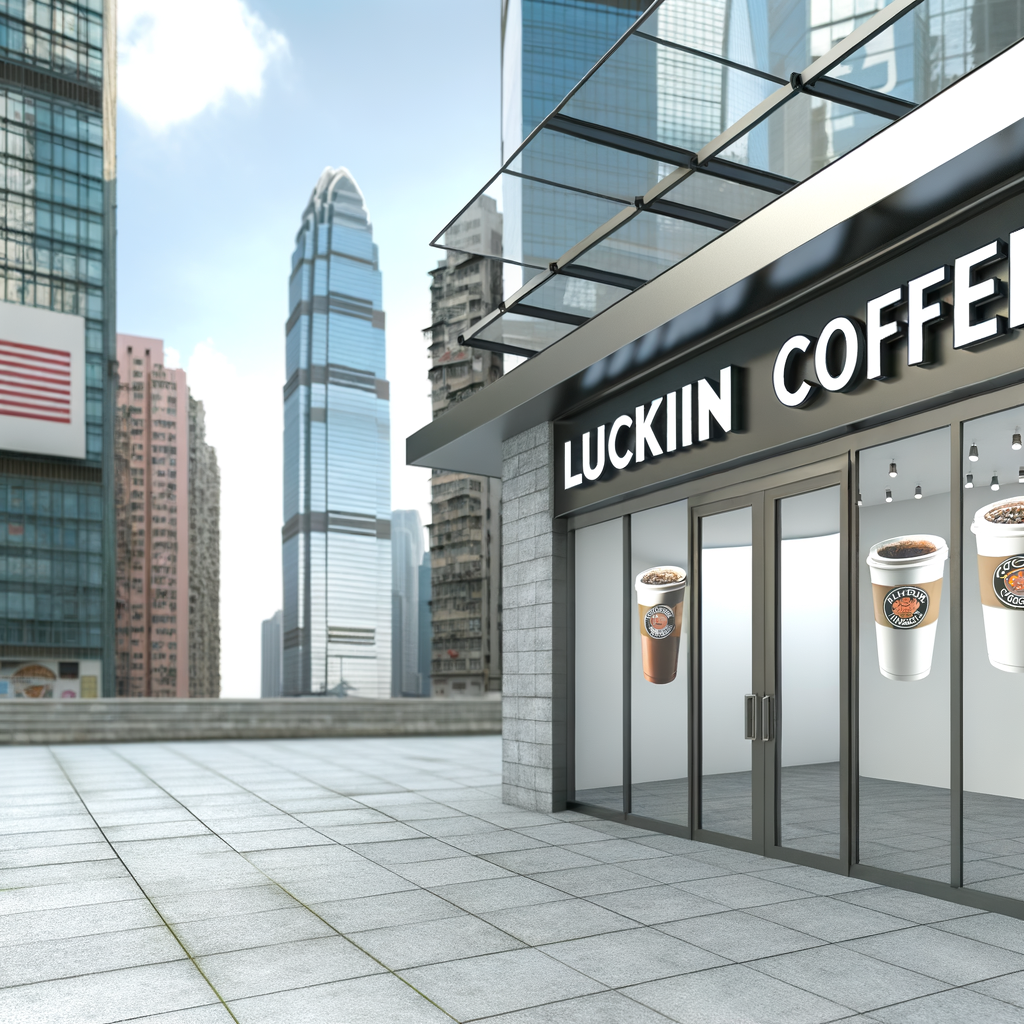

Mainland Invasion: Luckin Coffee’s Hong Kong Launch Signifies the Rising Dominance of Chinese Brands against US Competitors

The launch of Luckin Coffee in Hong Kong indicates the increasing influence of brands from mainland China. The leading coffee chain in China has opened its inaugural store in the city, taking on its American competitor, Starbucks.

Brands from mainland China are increasing their visibility in Hong Kong, utilizing the city as a testing ground prior to expanding internationally, as per experts' analysis.

Luckin has recently inaugurated its maiden store at Mira Place in Tsim Sha Tsui, thereby making its debut in a market that is primarily controlled by the American coffee company, Starbucks. Reports from local news suggest that the Chinese coffee brand is planning to establish another branch in Tseung Kwan O.

"Lawrence Wan, the head of advisory and transaction services for retail at CBRE Hong Kong, predicts that brands from the mainland will maintain their eagerness to branch out into markets in Hong Kong, Southeast Asia, and potentially Europe."

"Mainland brands would find Hong Kong a fascinating and tactical market, particularly as retail rental rates on the high street have seen a substantial decrease from their highest point in recent years."

Three thirty-nine

Store occupancy is bouncing back in Hong Kong, but empty shops can still be seen throughout the city.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Chinese Surveillance Firm Dahua to Exit Xinjiang Projects Following U.S. Blacklist Over Alleged Human Rights Abuses

Dahua, a Chinese monitoring technology company, withdraws from initiatives in Xinjiang. The firm was placed on a US trade embargo list in 2019 following accusations of assisting in human rights violations in Xinjiang.

Dahua stated in a report to the Shenzhen Stock Exchange that several of the projects granted during 2016 and 2017 have been prematurely ended, whereas some are still active.

The firm plans to stop running the ventures, and will move forward with selling off assets and settling debts, according to their statement. Dahua didn't provide an explanation for their pullout.

Dahua argued that the US decision had no "factual foundation."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Shimao Group Cuts Sheraton Hotel Price by 25% Amid Restructuring, Aims for Speedy Sale of Key Hong Kong Asset

Shimao has cut the price of the Sheraton hotel in Hong Kong by 25% to hasten its restructuring process. The developer from Mainland China is now seeking HK$4.5 billion (US$579 million) for the property, a decrease from HK$6 billion in March 2023, as per an informant.

The Shimao Group Holdings, a mainland Chinese developer that defaulted, has reportedly cut down the sale price of a Sheraton-branded hotel situated near Hong Kong's airport by 25%, based on a source close to the situation.

Shimao, previously a leading developer in China, is aiming to offload an 18-story building in Tung Chung for a minimum of HK$4.5 billion (US$579 million), according to an anonymous source. Shimao, recognized for creating iconic five-star hotels, launched this hotel in 2020.

The property, including the Sheraton and Four Points by Sheraton Tung Chung, was initially listed for sale in March 2023 with a minimum price tag of HK$6 billion, as per two informants. Housing over 1,200 rooms, the property ranks as the city's second-biggest hotel complex in terms of room capacity, as stated by real estate consulting firm Jones Lang LaSalle.

Shimao chose not to provide a statement when Bloomberg News reached out to them.

Shimao's recent actions represent a continued attempt to leverage its overseas assets amidst ongoing structural adjustments, following their default in 2022. Increasing interest rates and a deteriorating economic situation in China have triggered panic selling of certain properties in Hong Kong. Since 2019, the city's real estate market has seen a reduction of at least HK$2.1 trillion in property values, as reported by a Bloomberg Intelligence analysis in June.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Overcoming the Scale-Up Funding Hurdle: Strategies for Hong Kong’s Tech Ecosystem amid Global VC and IPO Slump

Opinion | The Achilles heel of Hong Kong's tech landscape? Expansion funding

In a world where venture capital and IPO growth is dwindling, startups need to fervently pursue global commercialization, harness marketing tactics and establish relationships with influential figures abroad.

Since the inception of Cyberport and Hong Kong Science Park several years ago, Hong Kong has made impressive progress. These have now developed into essential breeding grounds for innovative startups. Prominent early occupants like logistics firm GogoX (previously known as GoGoVan), artificial intelligence leading company SenseTime, and Animoca Brands, a blockchain video game company, have grown into formidable entities in their respective sectors.

Silicon Valley is recognized as a benchmark for fostering value in innovation, defined by a number of crucial elements: solid relationships with top-tier research institutions, government backing via contracts and funding, a significant concentration of industry-leading firms, availability of expansion capital, and prospects for buyouts and public listings. What is the situation like in Hong Kong in comparison?

Institutions such as the University of Hong Kong significantly contribute to Cyberport through their skilled graduates, research output, and innovative ideas. Similarly, the Hong Kong University of Science and Technology plays a crucial role in accelerating projects at the Science Park. Other leading institutions, including the Chinese University of Hong Kong, have an impact comparable to that of Stanford University in the Bay Area.

Six Nineteen

There are great expectations for China's Greater Bay Area, however, merging 11 cities will present obstacles.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Foxconn Diversifies with $82M Investment in China’s EV Battery Plant: A Strategic Move Beyond Apple’s iPhones

Foxconn has made a financial commitment in an electric vehicle (EV) battery factory in China, expanding its business operations beyond producing Apple's iPhones. The Taiwanese powerhouse's recent venture into the EV industry is signified by an investment of US$82 million.

The initial funding of 350 million yuan was provided via Foxconn New Business Development Group, which has complete ownership of the battery division, according to the statement.

This action signifies the most recent effort by the Taiwanese powerhouse to expand its income streams by venturing into electric vehicles, semiconductors, and robotics. The Foxconn New Business Development Group was set up in Zhengzhou in June of the previous year, backed by 1 billion yuan in registered capital, aiming to operate in the electric vehicle sales and battery manufacturing sectors.

A 70,000-square-meter facility serving as the main office for the new venture is currently being built in the city.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

CATL Unveils High-Speed Crash Resistant EV Chassis with Extended Battery Life: Avatr, Changan Auto and Huawei to Pioneer Use

CATL of China has introduced an electric vehicle chassis that is crash-resistant at high speeds. Avatr, Changan Auto, and Huawei are set to be the inaugural users of this chassis, equipped with a battery that has the potential to operate for roughly 1,000 kilometers.

On Tuesday, China's Contemporary Amperex Technology (CATL), the leading global producer of batteries for electric vehicles, unveiled a novel electric vehicle chassis. The company claims this new chassis can survive a frontal collision at speeds of up to 120km/h (75mph) without igniting or exploding, highlighting safety as a primary feature to attract customers.

The frame houses a battery that can operate approximately 1,000km on one charge, significantly cutting down the vehicle's mass production time to 12-18 months, compared to the conventional 36 months or more, according to CATL.

The business intends to market its new electric vehicle platform, known as "panshi" in Chinese (meaning "bedrock"), to high-end auto manufacturers looking to speed up development and cut expenses.

"Given the extraordinarily high speed and severity of the crash, there has been no prior occasion where a new energy vehicle has dared to confront a 120km/h frontal pole impact test," stated Ni Jun, the head of manufacturing at CATL.

The standard velocity for a head-on collision safety examination under the widely adopted China New Car Assessment Program is 56 kilometers per hour.

Avatr, a Chinese electric vehicle (EV) company jointly owned by CATL, Changan Auto, and tech behemoth Huawei, will be the pioneer in creating EV models using CATL's Bedrock chassis, according to Avatr's president Chen Zhao, who made the announcement during a press conference.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Amazon Warns Chinese Merchants Against Offering Lower Prices on Rival Platform, Temu: A New Chapter in Competitive Pricing

Amazon is requesting Chinese vendors to refrain from providing lower costs on Temu. With rising competition, the American retail giant has commenced monitoring product pricing on the competing platform, Temu, as stated by traders.

The regional branch of American company Amazon recently told the heads of several high-selling Chinese brands not to offer the same products at a cheaper rate on Temu, according to the merchants.

This follows after the American retail giant began monitoring product costs on Temu. Vendors who were discovered to have pricier Amazon listings were expelled from the Amazon Featured Offer scheme, as revealed by a furniture merchant who operates on both platforms and chose to remain anonymous due to apprehensions of retaliation.

A Highlighted Deal, also referred to as the Purchase Box, is easily noticeable at the top of an Amazon product page, next to the "Add to Cart" and "Buy Now" options, making it more convenient for consumers to buy the advertised product instead of the same item offered by different sellers.

In order to qualify for the program, sellers are required to establish a "competitive" price for their products, which implies it should be equal to or cheaper than the lowest price offered by major retailers not affiliated with Amazon, as per the company's guidelines.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI2 months ago

AI2 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations are Accelerating Sustainability and Connectivity on the Road

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology is Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoDriving into the Future: The Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Revolution

-

AI2 months ago

AI2 months agoGoogle’s NotebookLM Revolutionizes AI Podcasts with Customizable Conversations: A Deep Dive into Kafka’s Metamorphosis and Beyond