Midea Group’s Global Expansion: Eyeing a Larger Market Share Post $4.6 Billion IPO, Targets Saudi Arabia, Brazil, and Africa

Midea of China is set on enlarging its worldwide market presence following a US$4.6 billion IPO. The appliance manufacturer is setting sights on Saudi Arabia, Brazil, and Africa in an effort to boost its global sales network by thirty-three percent.

Midea Group, known globally as the biggest seller of home appliances, has ambitious plans to significantly grow its sales network, aiming to cover 40 countries by 2025.

The business, garnering nearly 50% of its income from international markets, depends on external retail partners in certain areas. However, it intends to enlarge its worldwide activities and enhance the efficiency of its retail network, especially in developing markets that hold significant growth opportunities.

"At present, we have our own sales branches and groups in roughly 30 countries globally," Fu stated on a media tour on Thursday. "Moving forward, we aim to increase this number to over 40."

Fu stated that Midea intends to amplify its worldwide production capacities, set up additional R&D facilities, and enhance its visibility in the United States.

In the first half of this year, income increased by 10.3% compared to the same period last year, reaching 218.1 billion yuan (US31 billion). Meanwhile, profits saw a growth of 14%, amounting to 20.8 billion yuan.

Income from abroad rose by 13 per cent compared to last year, making up 42 per cent of the overall revenue, while domestic revenue saw an increase of 8.4 per cent.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Rising Luxury Property Market in 2025: A Ray of Hope for Hong Kong Celebrities like Chow Yun-fat

Could stars such as Chow Yun-fat from Hong Kong secure buyers for their high-end residences in 2025? Derek Chan from Ricacorp predicts a potential 5% increase in the prices of luxury properties next year, which is expected to coincide with a similar rise in rental rates.

Famous personalities such as Chow Yun-fat may have been compelled to cut down the costs of their lavish residences at The Peak, the most prestigious residential area in Hong Kong. However, experts are of the opinion that the downturn has hit rock bottom and there will be a resurgence in demand for upscale homes next year.

The just-concluded yearly gathering of China's main economic work committee, led by President Xi Jinping, suggested a more assertive and daring approach to policy easing to steady the country's real estate and stock markets in the coming year. This is likely to enhance trust in the city's property sector, according to sources.

"Derek Chan, the research leader at Ricacorp Properties, predicts a positive outlook for the high-end property market in 2025, stemming from a general bounce-back in the real estate industry. He adds that the projected overall economic growth in Asia and the continuous economic betterment in Hong Kong are factors that may boost the property market in the upcoming year."

Chan anticipates a surge in luxury real estate prices by up to 5 per cent in the coming year. Likewise, he predicts a comparable increase in rental rates for upscale properties.

Other market analysts have expressed similar views.

Martin Wong, who is the senior director and head of research and consultancy for Knight Frank in Greater China, also predicted a likely enhancement in transactions.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s Community Chest Grapples with Decreased Donations Amid Economic Strains: HSBC, Cigna Pledge Increased Support for Social Welfare

The economic downturn and market instability are affecting donations to Hong Kong's Community Chest. Companies such as HSBC and Cigna have committed to increase their support for social welfare initiatives in the coming year.

Recent economic instability has impacted the contributions received by the Community Chest of Hong Kong, an organization that raises money to assist a variety of social welfare initiatives in the city.

The charity organization garnered donations amounting to HK$220.3 million (US$28 million) in the fiscal year ending March 31, reflecting a 23% decline compared to the previous year, as per their yearly report. This also signifies a 43% drop from pre-Covid-19 times in 2019. The organization was compelled to delve into its savings to offset the shortfall.

Raising funds has been quite difficult in the last two years, according to a representative. The harsh financial climate has significantly influenced charity contributions, and corporate donations have been especially impacted due to reductions in their spending on corporate and social responsibility, he further explained.

The highest contributors throughout the year were HSBC, Cheung Kong Group, The Wharf Group, Bank of China (Hong Kong), and Sun Hung Kai Properties. Completing the top 10 lineup were Hang Seng Bank, Biel Crystal, Fuji Photo Products, Tencent Charity Foundation, and Microware.

One hour and twenty

HSBC is dedicated to the well-being of Hong Kong and is always prepared to assist those who require help.

Established in November 1968, the Chest collects money to support 167 member organizations that operate in six key service sectors – services for children and young people, senior citizens, family and child welfare, healthcare, rehabilitation and post-treatment care, and community growth.

Experts in economics have stated that the recent economic downturn and the two-year battle of the Hang Seng Index has negatively impacted both corporations and private citizens. The Hong Kong General Chamber of Commerce revealed on December 12 that nearly 44% of companies hold a bleak view of the city's economy for the coming year, marking the highest level of pessimism in half a decade.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

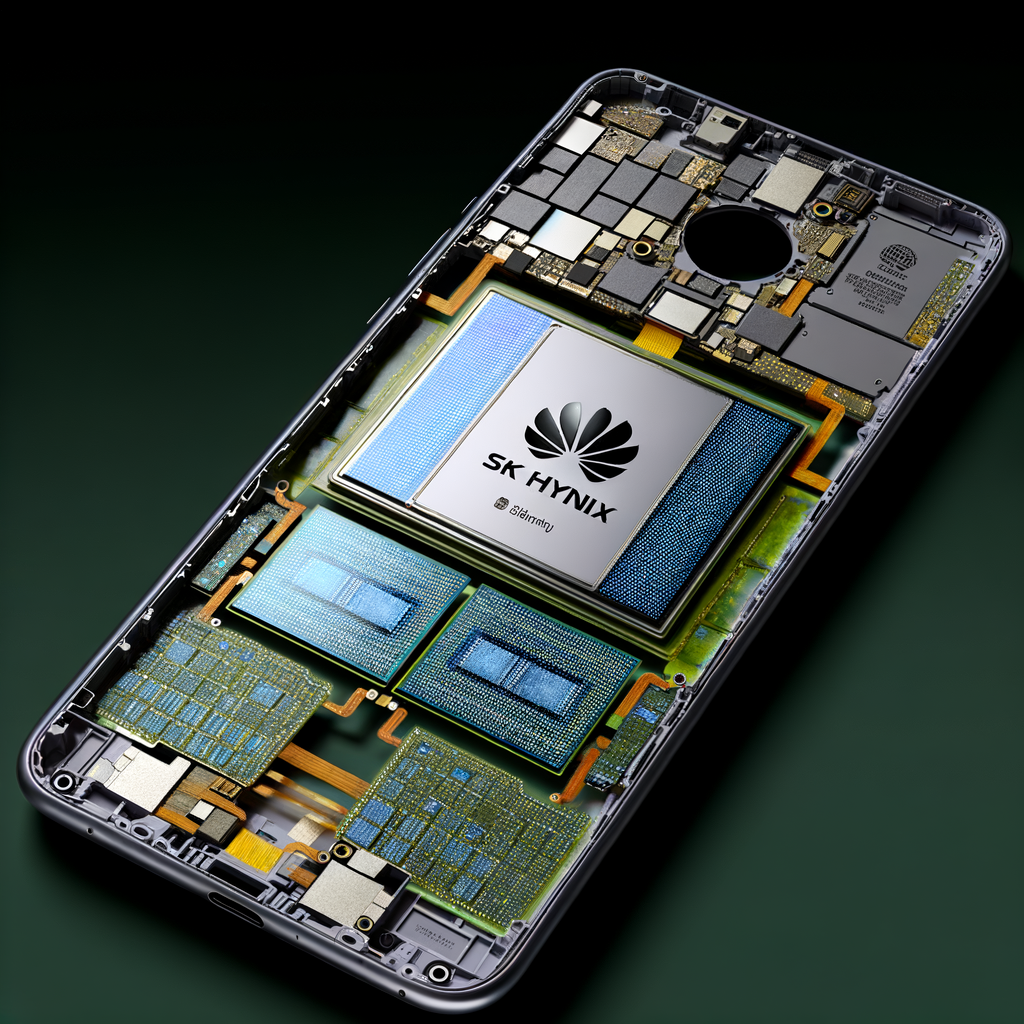

Huawei Shifts to South Korean Memory Chips: A Teardown Analysis of the Mate 70 Series Reveals Use of SK Hynix’s Advanced Products

Huawei's latest high-end smartphones are equipped with memory chips from South Korea, not China. Despite having Chinese memory chips in other models, the Mate 70 series incorporates products from SK Hynix, as displayed by a detailed examination.

Last week, a disassembly report was released by a Canadian company's analysts, revealing that they discovered a 12-gigabyte low-energy mobile DRAM and 512GB NAND in a Huawei Mate 70 Pro smartphone. The more advanced Mate 70 Pro Plus phone had the same NAND and an upgraded 16GB DRAM from SK Hynix.

Mobile DRAM devices were produced by SK Hynix using 14-nanometer tech and sophisticated extreme ultraviolet lithography, as stated by Senior Analyst Jeongdong Choe at TechInsights. NAND refers to a kind of memory used in flash storage, and DRAM, an acronym for dynamic random-access memories, is typically utilized in smartphones and computers.

Huawei chose not to respond. SK Hynix stated on Thursday that it has been rigorously adhering to the applicable policies ever since the limitations on Huawei were made public and has ceased all dealings with the company from that point forward.

In a shocking move in 2023, Huawei unveiled its Mate 60 Pro smartphone, equipped with a state-of-the-art chip manufactured domestically. However, TechInsights data indicates that a majority of the company's premium P and Mate series phones released the previous year still housed DRAM and NAND chips produced by SK Hynix.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s Stock Market Sees Slight Uptick Amid Anticipation of Government Stimulus and Policy Shifts

Shares in China experience a moderate increase as market participants anticipate clear direction on stimulus measures during the festive week. Chinese shares have remained fairly stable over the previous two months as investors prepare for the successful execution of stimulus policies.

The CSI 300 Index, a measure of the 300 biggest stocks in Shanghai and Shenzhen, increased by 0.1 per cent, closing at 3,987.48. Over the previous three days, the index had grown by 1.5 per cent. It's important to note that Christmas isn't recognized as a public holiday in China.

The Shanghai Composite Index also saw a slight increase of 0.1 per cent. Tech and telecommunications companies proved to be the strongest among the 10 industrial sectors in the CSI 300, while utility and energy shares fell short.

For the past two months, Chinese shares have remained fairly stable as market participants anticipate the successful execution of the government's economic boost strategies. Investors are predicting that Beijing will implement additional reductions in interest rates and increase the government's borrowing cap next year to stimulate growth, following a policy change by the capital's leading authorities.

The People's Bank of China chose not to reduce borrowing rates on Wednesday, leading experts to speculate that it's holding off on utilizing its policy measures until later to address the economic repercussions of the Trump administration. November's economic figures indicate that China's inconsistent economic rebound is still ongoing, with consumer expenditure remaining low and a continued trend of producer-price deflation.

"Although there have been prior efforts to stimulate the economy with financial relaxation and increased liquidity, they have not been very successful," stated Stephen Innes, the chief executive officer of SPI Asset Management in Bangkok. "As concerns about deflation are close behind, Beijing is ready to take decisive action."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Exploring the Multifaceted Applications of Stablecoins as Legislative Bill Advances in Hong Kong

The proposed stablecoin law is making progress in the Hong Kong legislature, with supporters highlighting its numerous applications. Industry specialists believe that stablecoins have the potential to extend their reach in the actual financial market.

People in Hong Kong are gradually moving towards the utilization of stablecoins for various purposes including local transactions and international trade settlements, as a legislation concerning this digital currency is being processed in the Legislative Council.

A possible application could be the automation of rewards, discounts, or loyalty points in digital wallets, similar to the Octopus scheme, through the use of stablecoins' programmability. This involves the capacity to integrate rules and data into the blockchain.

For instance, if a customer is part of a rewards scheme, their purchases could be directly added to their loyalty account and discounts could be implemented at the point of sale without the customer having to share their membership information.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s MPF Set to Deliver Best Returns in Four Years; US Stock Funds Lead with a 21.5% Gain – A Positive Outlook for 2025 Amid Calls for Portfolio Diversification

Hong Kong's MPF is poised for its highest yield in four years; the projection for 2025 appears 'favorable'.

MPF Ratings advises that 'members might be inclined to favor US stocks in their portfolio, but it's crucial to maintain a diverse investment mix'.

According to independent research firm, MPF Ratings, the MPF's 379 investment funds have seen a projected profit of around HK$102.8 billion (US$13.2 billion) this year, as of December 18. This marks the third occasion where the fund's earnings have surpassed the HK$100 billion mark.

Thus far this year, American stock funds have outperformed others with an impressive 21.5% increase. Japanese stock funds follow closely, having risen by 18.7%. Stock funds in China and Hong Kong are in third place with a 15.5% gain.

Instituted in the year 2000, MPF is a mandatory pension plan that includes 4.7 million existing and past employees.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Shanghai-Backed Fortera Capital Fuels AI Startup Stepfun’s Series B Funding, Bolstering Technological Innovation

A Shanghai-supported company assists AI startup Stepfun in securing 'hundreds of millions of dollars'

Fortera Capital, a private investment firm affiliated with the Shanghai State-owned Capital Investment Co, spearheaded the latest series B financing for Stepfun.

The recent series B funding for Stepfun was spearheaded by Fortera Capital, a private-equity company that operates under the Shanghai State-owned Capital Investment Co (SSCIC), as revealed in Fortera's WeChat message on Monday.

Stepfun, a startup based in Shanghai that was established in April of the previous year, plans to utilize its recent financial backing to create basic AI models. These models will concentrate on multifaceted abilities and intricate reasoning, the startup's post on Fortera's WeChat revealed. This will also aid in enhancing the firm's range of products targeted at consumers.

The most recent action from Shanghai's city government demonstrates the city's increasing endeavors to enhance technological advancement in key sectors.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

BOC Life, HSBC, Manulife Targeting Hong Kong’s Growing ‘Silver-Hair’ Economy: The Rising Demand for Retirement Protection Plans

Insurance companies BOC Life, HSBC, and Manulife are targeting a larger portion of Hong Kong's elderly market. As per government statistics, in 2023, individuals aged 65 and above accounted for roughly 22% of Hong Kong's total population of 7.5 million.

Individuals who are 65 years old or older constituted 22% of the city's population of 7.5 million last year, as reported by the department of statistics. From 1971, there's been a rise in the average lifespan in Hong Kong, reaching 82.5 years from 67.8 for males, and for females, it's risen to 88.1 from 75.3 as of 2023.

BOC Life is looking to expand its "RetireCation" program, which was introduced last month. This scheme permits policy holders to utilize the monetary value of their retirement plans to fund their accommodation in properties offered by their partners in significant cities on the mainland. The insurance company has plans to extend its services to Southeast Asia and Japan in the upcoming year.

"Previously, insurance firms primarily offered security to families in the event of the sudden demise of their primary earners," stated Wilson Tang, BOC Life's CEO, during an interview. "Currently, there's a growing need for retirement security due to the extended lifespan of individuals. Hence, it's crucial for them to begin retirement planning at an early stage."

Tang indicated that the company will also focus on creating products for affluent clients, particularly in the area of estate planning.

Edward Moncreiffe, the chief executive officer of HSBC's global insurance, stated that there is a high demand for products that enable wealth transfer to the succeeding generation.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Li Auto: From Tesla Rival to AI and Robotics Powerhouse – CEO Li Xiang Outlines Ambitious Expansion Plan

Li Auto, a Chinese competitor to Tesla, is looking to broaden its horizons to include AI and robotics. The luxury electric vehicle manufacturer's ambition is to create humanoid robots once they've mastered level-4 self-driving technology, according to their CEO Li Xiang.

Artificial Intelligence (AI) is integral to Li Auto's future, according to the company's founder and CEO, Li Xiang, in a video released on the luxury electric vehicle manufacturer's website on Wednesday. Li Xiang expressed the company's ambition for its core AI model to rank among China's top three, challenging not just automotive companies, but significant technology corporations as well, within a few years.

Li Auto is set to unveil a mobile application for its AI assistant, Lixiang Tongxue, which has been developed using its proprietary Mind GPT model, said Li.

The South China Morning Post is owned by Alibaba.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Shanghai-Backed Fortera Capital Fuels AI Start-Up Stepfun’s Series B Funding: A Move Towards Technological Innovation in Key Industries

Stepfun, an AI start-up, has garnered 'hundreds of millions of dollars' in funding with the assistance of Shanghai-supported company, Fortera Capital. This private-equity firm, which operates under Shanghai State-owned Capital Investment Co, spearheaded Stepfun's latest Series B financing round.

The private equity company, Fortera Capital, which operates under the umbrella of Shanghai State-owned Capital Investment Co (SSCIC), was the leader in the recent series B funding round for Stepfun, as revealed in a WeChat post by Fortera on Monday.

Stepfun, a Shanghai-based company established in April of the previous year, plans to utilize its recent funding to build foundational AI models. These models will concentrate on multimodal functions and intricate reasoning, aiming to enhance the start-up's product range targeted towards consumers. This information was relayed via a WeChat post by Fortera.

Shanghai's city administration's most recent project demonstrates the city's increasing endeavors to enhance technological advancement in key sectors.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s MPF Eyes Best Return in 4 Years, Maintains Positive Outlook for 2025: Diversification Key Despite Temptation for US Bias

Hong Kong's MPF is set to achieve its highest return in four years; the forecast for 2025 is optimistic. MPF Ratings underscores that while members could lean towards an American preference in their portfolio, it's crucial to maintain diversity. MPF Ratings reiterates the significance of diversification, despite the possible inclination towards a US-centric portfolio.

As of December 18, the 379 investment funds of the MPF reported an approximate profit of HK$102.8 billion (US$13.2 billion) for the current year. This is the third instance of the fund's earnings surpassing HK$100 billion, as per the independent research company, MPF Ratings.

US stock funds have topped the list this year with an impressive 21.5% increase, followed closely by Japanese stock funds which saw a 18.7% rise. China and Hong Kong's stock funds came in third, showing a 15.5% growth.

MPF, inaugurated in 2000, is a mandatory pension plan encompassing 4.7 million active and retired employees.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Li Auto, China’s Tesla Rival, Sets Eyes on AI and Robotics Expansion: Aims for Top-tier AI Model and Humanoid Robots Post Level-4 Autonomous Driving Achievement

Li Auto, a major competitor of Tesla in China, is planning to broaden its scope to include AI and robotics. The luxury electric vehicle manufacturer is set on manufacturing humanoid robots once they reach level-4 autonomous driving, according to CEO Li Xiang.

The future of Li Auto heavily relies on Artificial Intelligence, according to the company's founder and CEO, Li Xiang, in a video shared on the luxury electric vehicle manufacturer's website on Wednesday. He outlined the company's ambition for its core AI model to rank among the top three in China within the next few years, even going toe-to-toe with big technology companies outside of the automotive sector.

Li Auto is on the verge of releasing a mobile application for its AI assistant, Lixiang Tongxue, which is created based on its proprietary model, Mind GPT, according to Li.

Alibaba is the proprietor of the South China Morning Post.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI2 months ago

AI2 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations are Accelerating Sustainability and Connectivity on the Road

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology is Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoDriving into the Future: The Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Revolution

-

AI2 months ago

AI2 months agoGoogle’s NotebookLM Revolutionizes AI Podcasts with Customizable Conversations: A Deep Dive into Kafka’s Metamorphosis and Beyond