HSBC’s 4.5 Billion Yuan Panda Bond Fuels Chinese Currency Globalisation and Reinforces Hong Kong’s Offshore Yuan Centre Status

HSBC's panda bond worth 4.5 billion yuan is set to strengthen the international presence of the Chinese currency. The bank mentions that the bond, with an annual interest rate of 2.15%, further cements Hong Kong's position as the global hub for offshore yuan transactions.

The bank reported on Wednesday that the sale surged from an initial size of 3 billion yuan after the demand exceeded the supply by 1.88 times. This is a component of the bank's 10 billion yuan bond-sale initiative, authorized by the central bank of China to be released in stages until October 2026.

The bond yields a yearly return of 2.15% and received the top triple-A rating from China Chengxin Credit Rating Group.

This agreement marks the first issuance of its kind for the UK banking group since the Chinese authorities permitted the return of panda bond revenues in 2022. Before this, overseas businesses required authorization from the State Administration of Foreign Exchange. In 2015, HSBC generated 1 billion yuan from its initial panda bond issuance.

Panda bonds refer to securities denominated in yuan, which are issued by overseas companies in mainland China.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s Job Market Trends: Rising Demand for Relationship Managers, Data Analysts, and Customer Due Diligence Officers in 2022

Companies in Hong Kong plan to recruit additional relationship managers and data analysts in the coming year. HR experts also highlight the growing need for customer due diligence officers.

Positions such as relationship managers, customer due diligence officers, and data analysts are among the most in-demand jobs in Hong Kong for the upcoming year, say human resource experts.

Beyond the realm of private banking, relationship managers are aiding small and medium-sized businesses as well. These managers are instrumental in navigating these companies through the difficulties presented by Hong Kong's current economic climate, according to Lam.

This year, the bank from Singapore massively recruited new employees, bringing on board 106 additional staff members. Among these, 50 are relationship managers. The remaining personnel provide assistance to its private bankers, as stated by Lam.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Subsidy Speculation: Chinese Consumers Hold Off Purchases in Anticipation of Bigger Subsidies, Leaving Retailers in Jeopardy

Should they purchase now or hold off? Chinese shoppers are banking on additional financial aid to boost the economy. Retail businesses are worried over low sales as 'demanding' customers anticipate larger financial assistance from Beijing in the coming year.

Enthusiastic Chinese buyers, drawn by Beijing's massive 300-billion yuan ($41.1 billion) subsidy initiative in 2024, find themselves in a dilemma. A portion of them are hurrying to avail the monetary aid before its termination on December 31. Meanwhile, some are postponing their purchases with the anticipation of more substantial subsidies in the following year.

The trade-in program initiated by Beijing in March offers a 2,000 yuan discount to customers purchasing new home appliances like TVs or refrigerators. It is expected that retail sales in China for December and January will reflect this situation.

"Though the offer is already quite attractive, a lot of people seem to want more," commented Ma Tao, a salesperson in Shanghai for the Japanese company Sharp, which has fallen short of its sales targets. "They continue to focus on the subsidy issue. They believe the government will provide even more incentives to boost demand in 2025."

There might be some truth to their claim. From January to September, China's total economic output increased by 4.8 per cent, falling short of the official aim of approximately 5 per cent. According to the statistics bureau, retail sales saw an annual increase of 3 per cent in November, compared to 4.8 per cent in October. This is below the widely expected growth of 5.3 per cent.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s Leading Banks Reach Record Highs Amid Falling Government Bond Yields; Market Reacts to PBOC’s Interest Rate Decision

Chinese shares remain steady amid disappointment over rate reduction; ICBC reaches an all-time high due to dividend attractiveness

ICBC, Bank of China, and China Construction Bank achieve unprecedented levels due to a decrease in government bond yields enhancing the attractiveness of stocks that pay dividends.

The comprehensive CSI 300 Index increased by 0.1 per cent, closing at 3,985.63, which is close to the highest it's been in two weeks. Meanwhile, the Shanghai Composite Index experienced a slight decline of less than 0.1 per cent.

The market in Hong Kong will remain shut until Thursday due to the Christmas break.

ICBC and several other major government-owned banks reached new peaks following a swift drop in government bond yields, which increased the attractiveness of stocks with high dividends. On the CSI 300, energy and finance stocks outperformed, while companies in the material and consumer discretionary sectors saw the largest drops.

The People's Bank of China (PBOC) has maintained its one-year medium-term lending facility interest rate at 2 per cent. This particular facility is a financial resource for commercial lenders. This decision signals China's hesitation to relax its policy further in anticipation of possible new tariffs from the emerging Trump administration. Concurrently, the PBOC removed a net total of 1.15 trillion yuan (equivalent to US$158 billion) from the financial system through this facility, marking the largest amount since 2014.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

EU Tariffs Stifle Chinese EV Exports while Geely Plans Asian Expansion: An Overview of 7 Essential EV Stories

Chinese electric vehicle shipments stall due to European Union duties, while Geely aims for growth in Asia: A round-up of 7 EV news items

Covering the decline of Chinese EV sales overseas and Geely's plans to broaden its presence in the EU and Asia, here's a recap of seven electric vehicle narratives that might have slipped your attention.

1. Chinese electric car exports hit rock bottom in November due to EU duties

China's electric car exports saw a drastic drop last month, reaching their lowest since July 2022. This decline was fueled by tariff issues in Europe, significant reductions in deliveries to developing markets, and increased price slashes.

2. China set to maintain dominance in car exports by 2025, although EU EV tariffs could hinder growth

The future of China's automobile exports may face challenges in 2025, as major EV manufacturers could be hit with increased tariffs from the European Union. The EU is the largest international market where cars made in mainland China see significant profit margins.

3. China's auto parts and software sector projected to reach US$356 billion by 2030

The need for car components and software in China's car industry is estimated to reach a staggering 2.6 trillion yuan (US$356.2 billion) annually by 2030. This is primarily due to the increasing demand amongst Chinese consumers for intelligent vehicles equipped with autonomous driving systems and digital dashboards, despite the fierce pricing competition within the industry.

4. Will Chinese electric trucks be able to conquer worldwide tariffs to lead the market?

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Chinese Firms Eye European Expansion Amid Trade Tensions: CTP Forecasts Surge in Demand for Industrial Real Estate

Chinese companies are on the hunt for a European location for their factories due to ongoing trade disputes and tariffs. CTP, a developer of industrial properties in Europe, forecasts a surge in demand from Chinese businesses hoping to avoid the implications of the trade conflict.

A growing number of Chinese businesses are exploring the idea of establishing manufacturing facilities in Central and Eastern Europe. This strategy is seen as a way to avoid tariffs and business interruptions as geopolitical conflicts escalate, says a European industrial property developer.

CTP, a company listed in Amsterdam, is expecting a rise of 10 to 15 percent in its Chinese customer base in the coming year, as stated by the firm's Asia director, Jaromir Cernik. Owning 12.6 million square metres of space distributed over 10 nations, CTP is recognized as the biggest developer and overseer of logistics and industrial real estate in Europe, measured by gross rentable area.

The probable comeback of Donald Trump to the White House in January could potentially heighten the necessity to seek places beyond the mainland, acting as a safeguard against stricter actions that Washington is expected to enforce on Chinese exporters, he mentioned.

"Cernik mentioned that a significant number of Chinese providers collaborate with brands like BMW, Mercedes-Benz, Volkswagen, and Volvo. He further explained in an interview that most of these firms are privately held entities that are seeking growth and aiming to establish production units near their end consumers. This strategy, often referred to as 'near-shoring', is characterized by the motto 'produced in Europe, for Europe', which is the reason behind their presence in Hong Kong."

Despite the potential decrease in demand for Chinese-manufactured electric vehicles due to tariffs, the European Union continues to be a desirable market for Chinese automakers, says research company Canalys.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

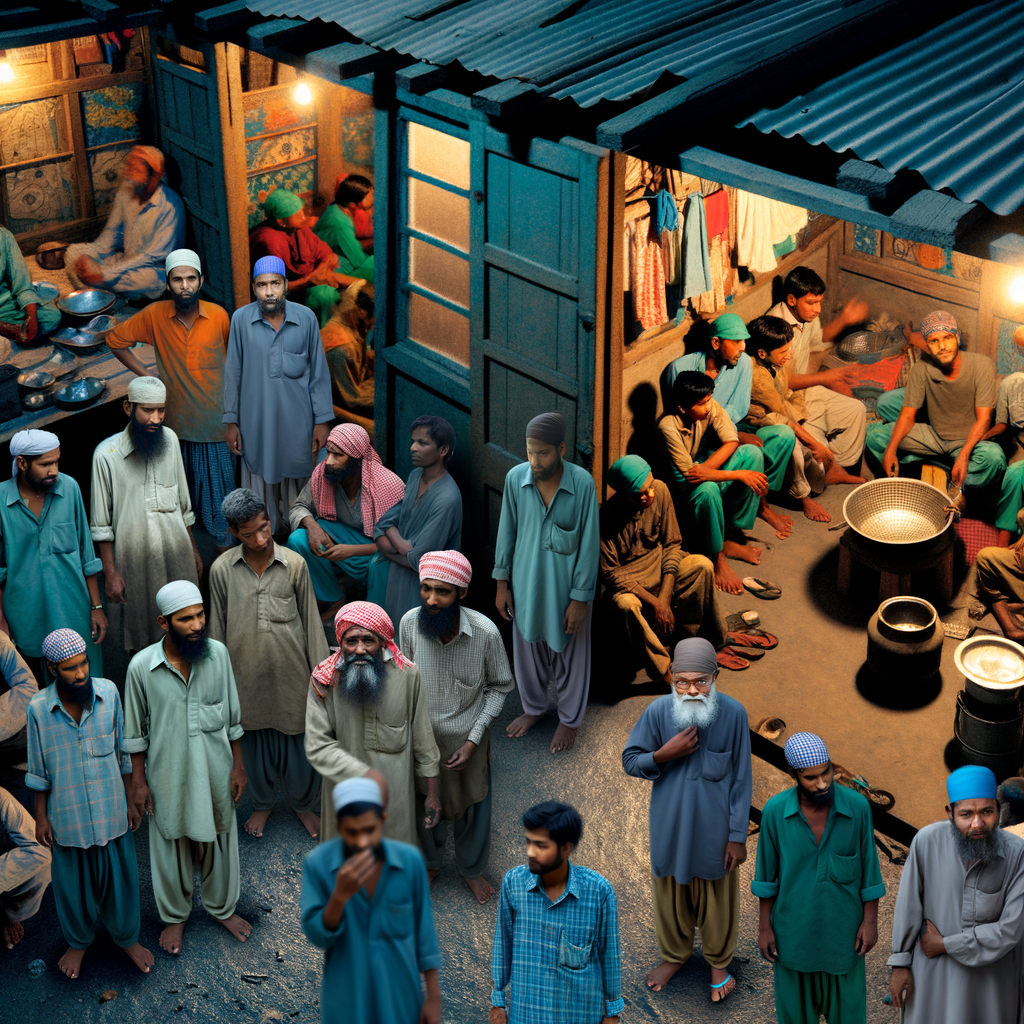

Chinese Workers in ‘Slavery-Like Conditions’ at BYD Site in Brazil: A Case of Exploitation and Degrading Living Standards

Workers from China discovered in 'slave-like circumstances' at BYD construction location in Brazil. Authorities disclosed that employees were subjected to extreme work hours and maintained in 'humiliating conditions' within their living quarters.

The officials have stated that a different company employed the workers in China and then irregularly transported them to Brazil.

They were working extraordinarily long hours, beyond what is legally allowed in Brazil, often for a full week without a break. The living conditions they were subjected to were described by officials as extremely poor, among other breaches of labor laws.

The leading Chinese electric vehicle company has ended its association with Jinjiang Construction Brazil Ltd. and committed to safeguard the rights of its subcontracted employees, according to a company announcement on Monday. The company also stated that all workers would be relocated to hotels.

BYD Auto of Brazil reaffirms its dedication to entirely adhering to Brazilian laws, particularly those regarding the safeguarding of workers' rights and human dignity," stated Alexandre Baldy, the senior vice-president of BYD Brazil.

The employment regulators did not reveal the identities of the companies engaged in employing the workers.

One minute and eleven

BYD from China surpasses Tesla as the global leader in electric vehicle production.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China Maintains Top Spot in Car Exports Amid Slower Growth Predictions: Diversification Strategies and Hybrid Models to Counter EU’s EV Tariffs

Despite a slowdown due to the European Union's electric vehicle tariffs, China is expected to maintain its position as the leading car exporter in 2025. In order to mitigate the effects of trade restrictions, China's major automotive companies are poised to broaden their offerings by introducing gasoline vehicles and hybrid models.

Hua Chuang Securities projections suggest that the international exports of vehicles manufactured in mainland China may surpass 5.58 million units in 2025, reflecting a 14 per cent increase from the previous year. However, this growth pace is less rapid than the anticipated 29 per cent expansion this year and the 58 per cent upsurge in 2023, the year when China surpassed Japan to become the world's leading car exporter.

During the initial three-quarters of the current year, automobile manufacturers based on the mainland experienced a 27% increase in exports, hitting 3.1 million units, as per the analysis by research company Canalys.

"Europe continues to be a focal point in the international expansion plans of Chinese auto manufacturers," he stated. "SAIC Motor exemplifies this – they launched hybrid variants of their MG3 and MG ZS cars, intending to compete with the standing of Japanese brands in Europe."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

MetLife Acquires Hong Kong Tycoon’s PineBridge for $800 Million in Major Asset Management Expansion

MetLife is set to purchase PineBridge, owned by Hong Kong magnate Richard Li, as part of its asset management expansion. The subsidiary of the New York-based insurance company will shell out US$800 million for PineBridge, which oversees roughly US$100 billion in assets.

MetLife has confirmed its agreement to purchase assets of PineBridge Investments outside China, owned by Hong Kong's billionaire Richard Li's Pacific Century Group. This move is a part of the US insurance company's strategy to expand its asset management operations.

The asset management division of New York's insurance firm, MetLife Investment Management, has confirmed plans to purchase PineBridge for $800 million. PineBridge, which oversees roughly $100 billion in assets, was previously reported by Bloomberg News to be a target of MetLife. In addition to the purchase price, MetLife has committed to paying an extra $200 million if specific financial targets are met by 2025, and another $200 million based on a long-term earnout.

The agreement, slated to be finalized by 2025, does not include PineBridge's private equity funds or its joint venture in China with Huatai Securities, which oversaw over US$70 billion as of June's end.

Pacific Century will continue to maintain its business operations in mainland China and concentrate on expanding Huatai-PineBridge along with its private fund assets, as per a representative from the parent company. The collaboration with Huatai and Suzhou New District Hi-Tech Industrial is intended to satisfy the increasing need for investment goods in the country.

After the transaction is finalized, MetLife Investment, a company that specializes in asset classes such as fixed income, private credit and real estate, will manage over US$700 billion. The deal will enhance its international presence since over half of the client assets being purchased from Pinebridge belong to investors from outside the US and approximately one third are located in Asia.

"The purchase of PineBridge Investments advances our aim to speed up expansion in asset management," said MetLife's president, Michel Khalaf. He added, "MetLife Investment Management is well on its way to expanding its business naturally, with a focus on specific, compatible non-organic growth."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong Derivatives Trading Soars to Record High for Third Consecutive Year Amid Market Volatility

Trading in derivatives in Hong Kong reaches unprecedented levels for the third consecutive year due to market fluctuations. Over 377 million futures and options were traded on the exchange this year, marking a 14 per cent growth compared to the previous year.

Derivatives trading in Hong Kong has reached an unprecedented level for the third consecutive year.

Over 377 million futures and options have been traded on the city's stock exchange since the beginning of the year, marking a 14% increase from 2023, according to data from Hong Kong Exchanges and Clearing (HKEX). This surge occurred as stock market instability reached its peak in over two years in October.

The initial commitment from China to rejuvenate its economy sparked a surge of excitement among stock dealers, but this energy quickly faded due to the government's sluggish execution. Fluctuations in the stock market soared as trade volumes reached unprecedented heights, necessitating increased hedging. According to Frank Benzimra of Societe Generale, some investors employed derivatives to take a careful approach towards the market.

"In this scenario, the options market provides an excellent platform to voice some perspectives," said the strategist during a briefing last Thursday.

China's economic stimulus plan – encompassing reductions in interest rates, infusions of cash for banks, and backing for stocks – transformed previously underperforming shares from Hong Kong and mainland China into some of the top global performers for the year. However, a subsequent decline in optimism instigated a selling frenzy. According to data collected by Bloomberg, overall daily stock transaction volume increased by over 20% for both Hong Kong and China from 2023 onwards.

Half past nine

CEO of HKEX, Bonnie Chan, on developing a dynamic market in Hong Kong

This boosted the regional derivatives market. As the end of the year approaches, the volume of options in Hong Kong saw a rise of 15 per cent from 2023, reaching 209 million contracts by Friday, according to HKEX data. Concurrently, futures also saw an increase of 13 per cent, reaching 168 million.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hang Seng Index Surpasses 20,000 Mark: Mainland Purchases Bolster Sentiment Despite Below Average Turnover

The Hang Seng Index in Hong Kong has surpassed the 20,000 mark, bolstered by purchases from the mainland. The standard recorded a 1.1 per cent increase, the highest in almost two weeks, although the exchange's turnover was 14 per cent less than usual.

The Hang Seng Index saw an increase of 1.1 per cent, closing at 20,098.29, surpassing a significant benchmark for the first time since December 12. There was also a 1.1 per cent growth in the Hang Seng Tech Index.

The volume of trading was relatively low, with a 14% decrease from the 30-day average as per Bloomberg's data. Due to the Christmas holiday, the city's financial markets will remain shut until Thursday.

On the mainland, there was an increase in the CSI 300 Index and a 1.3 per cent rise in the Shanghai Composite Index at the close of trading.

Online retail behemoth Alibaba Group Holding and freight company Orient Overseas International were among the leading profit-makers in the blue chip market. CK Asset Holdings saw progress following an increase in shares by the Li Ka Shing Foundation in the giant corporation.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Mainland Invasion: Luckin Coffee’s Hong Kong Launch Signifies the Rising Dominance of Chinese Brands against US Competitors

The launch of Luckin Coffee in Hong Kong indicates the increasing influence of brands from mainland China. The leading coffee chain in China has opened its inaugural store in the city, taking on its American competitor, Starbucks.

Brands from mainland China are increasing their visibility in Hong Kong, utilizing the city as a testing ground prior to expanding internationally, as per experts' analysis.

Luckin has recently inaugurated its maiden store at Mira Place in Tsim Sha Tsui, thereby making its debut in a market that is primarily controlled by the American coffee company, Starbucks. Reports from local news suggest that the Chinese coffee brand is planning to establish another branch in Tseung Kwan O.

"Lawrence Wan, the head of advisory and transaction services for retail at CBRE Hong Kong, predicts that brands from the mainland will maintain their eagerness to branch out into markets in Hong Kong, Southeast Asia, and potentially Europe."

"Mainland brands would find Hong Kong a fascinating and tactical market, particularly as retail rental rates on the high street have seen a substantial decrease from their highest point in recent years."

Three thirty-nine

Store occupancy is bouncing back in Hong Kong, but empty shops can still be seen throughout the city.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

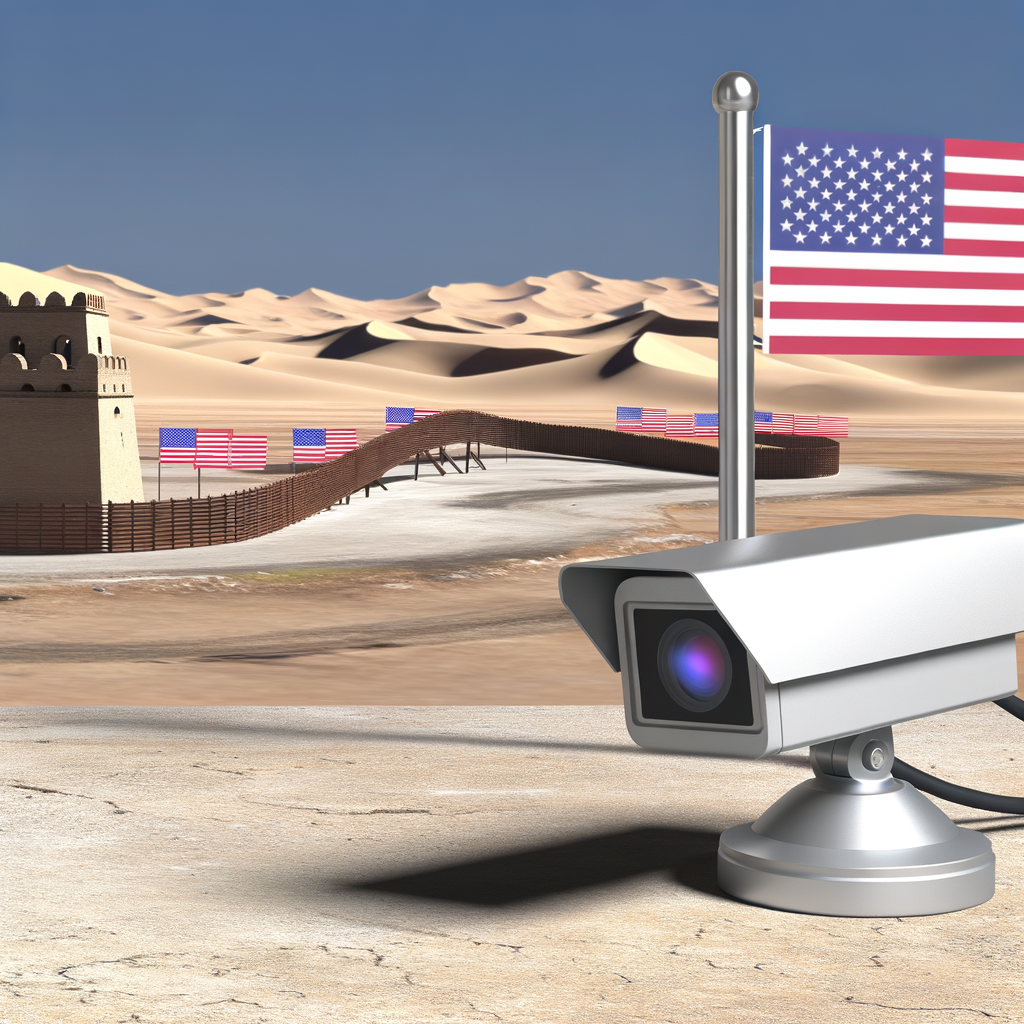

Chinese Surveillance Firm Dahua to Exit Xinjiang Projects Following U.S. Blacklist Over Alleged Human Rights Abuses

Dahua, a Chinese monitoring technology company, withdraws from initiatives in Xinjiang. The firm was placed on a US trade embargo list in 2019 following accusations of assisting in human rights violations in Xinjiang.

Dahua stated in a report to the Shenzhen Stock Exchange that several of the projects granted during 2016 and 2017 have been prematurely ended, whereas some are still active.

The firm plans to stop running the ventures, and will move forward with selling off assets and settling debts, according to their statement. Dahua didn't provide an explanation for their pullout.

Dahua argued that the US decision had no "factual foundation."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI2 months ago

AI2 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations are Accelerating Sustainability and Connectivity on the Road

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology is Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoDriving into the Future: The Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Revolution

-

AI2 months ago

AI2 months agoGoogle’s NotebookLM Revolutionizes AI Podcasts with Customizable Conversations: A Deep Dive into Kafka’s Metamorphosis and Beyond