China and Singapore Crucial to Hongkong Land’s $10 Billion Asset Disposal Goal: Analysts Weigh In on Strategy and Execution Challenges

Hongkong Land's US$10 billion asset liquidation goal hinges on China and Singapore.

Experts endorse the developer's decision to shift focus, while emphasizing that its effective implementation is crucial for success.

Last month, the developer, who is the largest commercial property owner in Central Business District of Hong Kong, announced its ambition to recycle a total of US$10 billion by 2035. This sum includes US$6 billion from development properties.

In order to achieve their objective, it's probable that Hongkong Land will put 37 of its residential schemes in mainland China up for sale, along with six in Singapore and over 14 throughout Southeast Asia, says Xavier Lee, a stock market analyst at Morningstar.

"Hongkong Land is expected to maintain a certain level of ownership over their high-end commercial properties. We suspect that they may repurpose some of their shopping centers as part of their 'The Ring' series, which caters more to the general public," stated Lee.

The Ring is known for creating premier shopping malls in Chinese metropolises like Chengdu and Chongqing, marking the developer's unique signature.

Business

Tesla and Xpeng Ignite China’s EV Market with Unprecedented Insurance and Loan Subsidies: A Response to BYD’s Price Reduction

Tesla and Xpeng reignite the electric vehicle price battle in China by providing subsidies on insurance and loans

In response to BYD's December price reduction, Tesla and Xpeng are offering discounts on car insurance and loans in February.

Tesla and Xpeng are extending discounts on car insurance and loans this February, as a counter to BYD's price reduction in December.

Purchasers of the Model 3 sedans manufactured in Shanghai will be granted a subsidy of 8,000 yuan (equivalent to US$1,098) towards vehicle insurance, according to a statement released by the US electric vehicle manufacturer on Wednesday, as operations resume post-Lunar New Year holiday. The company also promised a five-year, zero-interest loan to qualifying customers, resulting in savings of around 20,000 yuan.

Tesla announced that the incentives were the most significant promotional offer for all its Model 3 variants, which are priced between 227,500 and 331,500 yuan, since the end of 2019. This was when its Gigafactory located just outside Shanghai began its operations.

For the first time, the company announced that Chinese customers will be provided with insurance subsidies and interest-free loans simultaneously. The proposal is set to expire on February 28, the firm further clarified.

Two minutes past one

China intensifies support for swapping traditional vehicles for electric ones.

Business

Alibaba’s Qwen AI Model Surpasses DeepSeek’s V3 in Global Chatbot Ranking, Yet Trails Behind DeepSeek-R1

Alibaba's newly improved Qwen AI model surpasses DeepSeek's V3 in the chatbot hierarchy. Ranking seventh in the Chatbot Arena, Alibaba Cloud's Qwen2.5-Max outperforms DeepSeek-V3 which stands at the ninth position, however, it still lags behind DeepSeek-R1 that holds the third place.

The Chinese start-up, known as DeepSeek-V3, surprised the international tech world when it was launched in late December and is currently holding the ninth position.

Twenty past one

Alibaba from China launches a fresh AI model, reportedly surpassing rival entities Deepseek and OpenAI's GPT-4o.

Business

Revamping Hong Kong’s Residency Scheme: Midland Chief Freddie Wong Advocates for Property-Friendly Changes to Bolster Real Estate Market

The head of Midland proposes alterations to Hong Kong's monetary residency program to benefit the property sector. Freddie Wong Kin-yip believes these modifications will bolster the faltering real estate market in Hong Kong.

On Wednesday, Wong suggested that those applying to the new Capital Investment Entrant Scheme (CIES) should be permitted to count a greater portion of their real estate purchases towards their investment obligation for the residency program. Currently, the CIES mandates that applicants must invest a minimum of HK$30 million (US$3.9 million) in assets such as funds, stocks, bonds or other forms in return for family residency.

Initially, real estate was not included in the list of sanctioned assets. However, in October, the government announced that investments in properties purchased for a minimum of HK$50 million would be considered in an application, with a maximum limit of HK$10 million.

Wong also proposed that payment of stamp duties should be deferred until homebuyers have moved into their new homes. He believes this would alleviate financial strains and provide an opportunity for investors to sell off properties if they encounter financial troubles.

"In the present scenario, with a large number of unsold properties, these steps will aid in clearing the market," stated Wong. "The influx of immigrant investors can also contribute to economic expansion."

Business

DeepSeek’s Future Uncertain: AI Startup Remains Silent Amid Post-Holiday Accolades, Hints at Reinforcement Learning Advancements

What's on the horizon for DeepSeek? The AI startup remains silent despite post-holiday praises

A social media post from a researcher on February 1, now deleted, suggested the use of 'reinforcement learning' as a means to improve their AI systems.

The building's property management escorted all unexpected guests to a separate room to decline their visit requests. The doorway to DeepSeek's headquarters on the building's 12th floor was securely locked. A quick glance through the glass doors revealed holiday adornments strewn across the floor.

Business

ByteDance’s New AI Model OmniHuman-1: Unleashing Viral Deepfake Capabilities and Redefining Lifelike Animation

ByteDance's latest AI model is creating a buzz due to its deepfake features that bring photos to life. Viral clips from the TikTok creator's new OmniHuman-1 multimodal model showcase its realistic visuals and audio synchronization.

The OmniHuman-1 multimodal model from the company can produce high-quality videos featuring people talking, singing, and moving. According to the ByteDance team who developed the product, this model surpasses existing methods of generating human videos based on audio. Artificially created images, videos, and audio of actual people, often known as deepfakes, are increasingly being used, not only in fraud cases but also for harmless entertainment purposes.

ByteDance has emerged as a leading AI firm in China. Its application, Doubao, is presently the most sought-after AI app among Chinese consumers. Although the OmniHuman-1 has not yet been made available to the public, sneak peeks have already created a buzz online.

A standout demonstration includes a 23-second clip of Albert Einstein giving a talk. Kyle Wiggers from TechCrunch characterized the app's results as "astonishingly high-quality" and "possibly the most authentic deepfake videos thus far".

The highlighted model showcases the progress being made by Chinese developers in spite of Washington's attempts to hinder China's AI development. This comes after OpenAI expanded the distribution of its video-creation tool Sora, which became accessible to ChatGPT Plus and Pro users in December.

Business

Chinese Cross-Border Merchants Contemplate Price Hikes Amid New US Tariffs and Shipping Challenges

Merchants in China are considering raising prices to counterbalance US tariffs and shipping costs. The new US tariff policies and the elimination of de minimus exemptions pose new hurdles for Chinese traders.

Chinese vendors who sell online to American consumers are considering increasing their prices to counterbalance the new tariffs implemented by the Trump administration. This comes along with the escalating delivery costs following the temporary halt of package acceptance from mainland China and Hong Kong by the United States Postal Service (USPS) this week.

She was requested to shell out an additional 35% for fabric deliveries and a further 25% for other goods to compensate for duties and customs processing. Gu mentioned she was in talks with her business associates about the possibility of hiking their product prices.

The policy of de minimis, which permitted the duty-free entrance of small parcels valued under $800 in the US, significantly contributed to the expansion of China's international e-commerce sector. According to a report by the US congressional committee on China in June 2023, almost 50% of all parcels delivered under the de minimis rule originated from China.

Business

China’s Antitrust Investigation into Google: A Strategic Warning to the US with Android in Crosshairs

China's investigation into Google for potential antitrust violations appears to be a cautionary move towards the United States, with Android being the main focus. Analysts suggest that although the immediate repercussions seem minor, China might intensify its actions based on the progress and outcome of its talks with the US.

The action taken against Google demonstrates that "Beijing has essentially launched a cautionary message to Washington, indicating its preparedness to fight back," according to Angela Zhang, a legal academic at the University of Southern California and the writer of Chinese Antitrust Exceptionalism: How the Rise of China Challenges Global Regulation.

Although the brief announcement from China's market regulator lacked specific details about the probe, national media have hinted that it's associated with Android – the open-source operating system from Google.

Business

Gold Soars to Record High Amidst Safe-Haven Demand: Trump’s Tariffs Stoke Inflation Fears

Gold reaches an all-time high as Trump's tariffs drive purchases towards safe assets

The price of gold reached a peak of US$2,830.49 per ounce on Monday, fueled by the demand for secure investments amidst uncertainty caused by Trump's tariffs.

On Monday, the value of gold reached a record high, driven by investors seeking security following US President Donald Trump's imposition of tariffs on Canada, China, and Mexico. These tariffs have intensified fears of inflation, which could negatively impact economic expansion.

The price of spot gold increased by 0.8% to reach US$2,818.99 per ounce by Monday afternoon, having earlier set a new record at US$2,830.49 in the same session.

Gold futures in the US saw a settlement with a 0.8 per cent increase, closing at US$2,857.10.

The 25% duties enforced by Trump on imports from Canada and Mexico starting Tuesday, plus a 10% levy on products from China, sparked concerns of a potential trade conflict that could hinder worldwide economic progress and contribute to inflation.

Business

Shenzhen Pilot Programme Reveals Economic Advantage of Electric Trucks over Diesel on Long-Haul Routes

Battery-operated trucks prove more cost-effective than diesel-powered vehicles on extensive routes in Shenzhen trial: specialist

A test initiative in Shenzhen demonstrated that electrically powered trucks superseded diesel-run vehicles when considering the overall cost of ownership.

Electric trucks running on batteries are more economical for long-distance routes from Shenzhen compared to diesel-powered ones, as per a specialist from a research group.

He mentioned in an interview that due to a significant drop in battery prices, the purchasing costs for electric trucks have decreased by approximately 30% compared to 2023. This makes even some shorter routes more economically viable in competition with diesel trucks this year.

Earlier, the steep price of electric trucks wasn't balanced out by their energy cost savings, which deterred some potential purchasers.

"He stated that cargo trucks in Shenzhen, mainly operating routes to the manufacturing hubs of Dongguan and Huizhou, will be a crucial factor in accelerating the growth of vehicle electrification."

The government of Guangdong province is aiming to establish several freight paths with no emissions in the bay area scheme, as a component of its efforts towards decarbonization and promoting clean energy, according to him.

Business

Luxembourg Poised to Bridge the Divide: Finance Minister Advocates for Unfragmented Trade Amid Global Tensions

Luxembourg can serve as a bridge in discussions among the globe's major powers, according to the finance minister. Gilles Roth suggests that trade should remain unified even in the face of conflicts in Ukraine and the Middle East.

Global powerhouses ought to work together and Luxembourg is prepared to serve as a mediator, says the nation's finance minister.

Undeniably, it's crucial to maintain unity in global trade, particularly in light of the current geopolitical strains such as the conflict in Ukraine and the unrest in the Middle East," Gilles Roth stated during a conversation with the Post, held during the Asian Financial Forum (AFF) last month.

"China holds a position as one of the top three economic giants worldwide, so any growth in its economy can have positive repercussions on the global economic stage," Roth conveyed.

In 1979, the Bank of China marked its place as the first lender from the mainland to establish a branch in Luxembourg. Presently, Luxembourg For Finance, an entity that fosters and cultivates the financial services sector, reports that seven Chinese banks are operational within the nation. They cater to Chinese customers with an interest in European investments and also assist European clients seeking financial support for their ventures in China.

"As a major financial center, yet a small nation, it's crucial for us to steer clear of protectionism. We aim to act as a bridge, not just in financial areas but particularly in these matters," stated Roth.

Business

Hong Kong Stocks Soar on AI Boost Amid Hopes for US-China Trade Negotiation Progress

Shares in Hong Kong surge due to AI focus and potential for US-China tariff relief. Analysts suggest that investors are eagerly awaiting the possibility of the US resuming talks with China.

Hong Kong shares rose on Tuesday, as investors increased their investments in artificial intelligence (AI) companies, holding out hope that trade war talks could be avoided through negotiations.

The Hang Seng Index experienced a significant daily increase of 2.8 per cent, reaching 20,789.96, which is the largest since October 18. This blue-chip index trimmed its earlier gains, which were as much as 3.3 per cent, following China's announcement of countermeasures against the 10 per cent tariffs imposed by US President Donald Trump on Chinese products. Meanwhile, the Hang Seng Tech Index saw a substantial leap of 5.1 per cent.

Trading on the mainland stock exchanges has been paused for the Lunar New Year holiday and will recommence on Wednesday.

Shares in tech companies generally experienced an increase, particularly those engaged in AI. Xiaomi saw a rise of 4.2 percent, reaching a value of HK$39.55, while JD.com's stocks increased by 6.7 percent, hitting HK$162.10. Meanwhile, online retail behemoth Alibaba Group Holding saw a growth of 3.9 percent, reaching HK$97.65, and Tencent's shares went up by 4.1 percent to HK$420.80.

Li Auto, a manufacturer of electric vehicles, saw a significant increase of 8.7 percent, reaching HK$94.20 in value. Similarly, Geely Automobile's worth increased by 7.9 percent, hitting HK$15.94. Semiconductor Manufacturing International, also known as SMIC, experienced a boost of 8.5 percent, bringing its value up to HK$45.45. In the fashion industry, Shenzhou International Group Holdings also saw a rise, with an 8.7 percent increase to HK$62.90.

"There is growing anticipation in the market for the advancement of mainland's AI models, premium chips or innovative technologies, which is driving the Hong Kong stock market upwards today," stated Jason Chan, a top investment strategist at Bank of East Asia.

ENN Energy Holdings experienced a decrease in profits, dropping by 0.9% to HK$52.45 as a result of China's proposed 15% import tariff on US liquefied natural gas. This could potentially increase the cost of gas.

Business

China Retaliates with Antitrust Probe into Google Following US Tariff Imposition: An Examination of the Latest Trade Dispute

China has begun an antitrust investigation into Google following the imposition of Trump's tariffs. The State Administration for Market Regulation kick-started the inquiry into the web search behemoth after the US enforced a 10 per cent tariff.

The U.S. online search leader, which withdrew its search function from mainland China in 2010, is under investigation by the State Administration for Market Regulation (SAMR), as stated on the regulator's website on Tuesday. The Chinese agency suspects the company of breaking the nation's competition laws.

Six minutes and three

The Chinese ambassador has voiced criticism over Donald Trump's US tariff, Panama Canal, and AI strategies.

The SAMR did not specify the supposed infractions by Google. In mainland China, the majority of Google's services, such as search, Gmail, Google Maps, aren't accessible. However, the American technology behemoth has continued to run certain operations in the nation, primarily in the advertising sector.

-

AI4 months ago

AI4 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

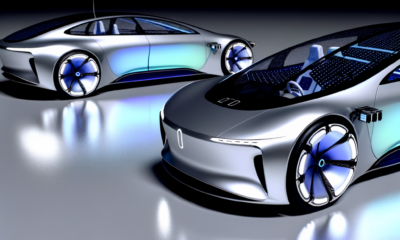

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Sustainability and Safety on the Road

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: How Top Automotive Technology is Driving Us Towards a Sustainable and Connected Future

-

Tech2 months ago

Tech2 months agoRevolutionizing the Road: Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoDriving into the Future: Top Automotive Technology Innovations Transforming Vehicles and Road Safety

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoRevolutionizing the Road: How Top Automotive Technology Innovations are Driving Us Towards an Electric, Autonomous, and Connected Future

-

AI4 months ago

AI4 months agoGoogle’s NotebookLM Revolutionizes AI Podcasts with Customizable Conversations: A Deep Dive into Kafka’s Metamorphosis and Beyond