Tencent and Bosch Deepen Partnership to Drive Smart Car Innovation: Expanding AI Services in EVs and Exploring New Cloud Computing Opportunities

Tencent extends alliance with Bosch for enhanced smart car cooperation

The Chinese tech powerhouse, Tencent, has inked fresh Memorandums of Understanding with the German auto supplier, aiming to widen the application of its AI technology in electric vehicles.

On Monday, Shenzhen-based Tencent and Bosch's Chinese division unveiled a fresh series of mutual agreements. These are aimed at investigating prospects in areas such as cloud computing, autonomous driving mapping, incorporating extensive language models into intelligent cockpits, and assisting Chinese auto manufacturers in their global expansion, among others.

The Memorandums of Understanding (MOUs) will further solidify the existing collaboration between the two companies in the areas of cloud computing and artificial intelligence, according to Tencent. The firms have set a goal to venture into new markets and enhance their operational efficiency.

Since the inception of their collaboration four years ago, Tencent has aided Bosch in becoming the first global parts provider to offer sophisticated smart driving solutions on a large-scale production basis by the close of 2023. This was achieved largely due to the technology company's private cloud services and computing clusters.

"In the last three years, both parties have engaged in a thorough collaboration that has yielded positive outcomes," stated Wang Weiliang, the head of Bosch Mobility Board China.

"Anticipating the next stage of strategic cooperation, we are eager to strengthen our alliance with Tencent… and aid the smart evolution of the automotive sector in China and globally."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

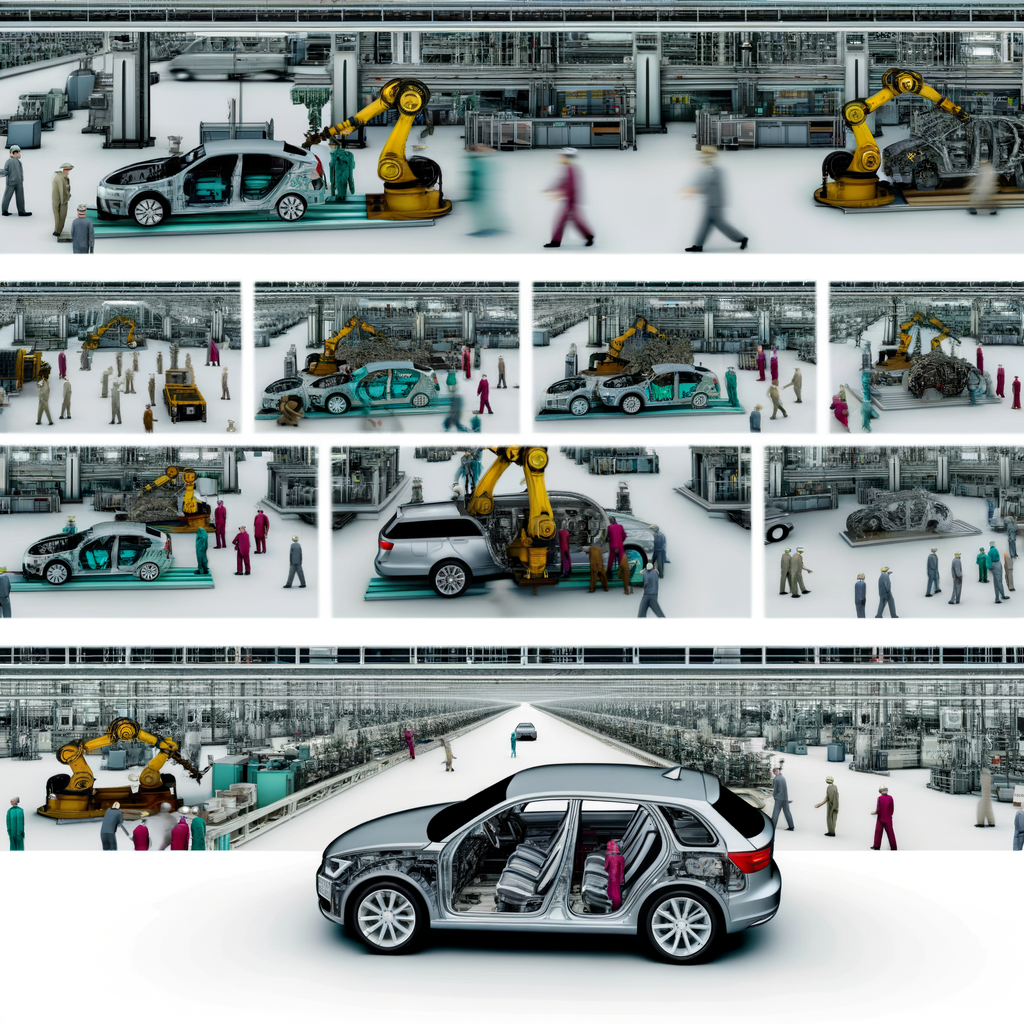

Accelerating Forward: Mastering the Curve in Vehicle Manufacturing, Sales, and Services Amid Automotive Industry Evolution

The Automobile Industry is undergoing a significant transformation, driven by Market Trends, Consumer Preferences, and advancements in Automotive Technology. This evolution impacts all facets, including Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, Vehicle Maintenance, Automotive Repair, and Car Rental Services. The shift towards electric vehicles and digitalization of sales channels are central changes, alongside growth in aftermarket customization and stringent Regulatory Compliance on emissions and safety. Success in this competitive landscape requires top businesses to integrate innovative practices in Supply Chain Management, Industry Innovation, and Automotive Marketing to meet the dynamic needs of consumers and stay ahead in the market.

In the fast-paced world of the automobile industry, staying ahead of the curve is not just an option—it's a necessity for survival and success. From vehicle manufacturing giants to local automotive repair shops, the landscape of automotive businesses is as diverse as it is dynamic. These entities form the backbone of a sector that not only fuels economies but also drives innovation, catering to a wide array of transportation needs across the globe. This article delves into the multifaceted world of automotive businesses, shedding light on how they thrive amidst challenges such as fluctuating market trends, ever-evolving consumer preferences, and stringent regulatory compliance.

We navigate through the "Top Trends and Innovations Transforming the Automobile Industry," exploring how cutting-edge automotive technology and industry innovation are reshaping the way vehicles are designed, manufactured, and serviced. From electric cars to autonomous driving features and digital showrooms, the automobile industry is at the cusp of a revolution, with automotive businesses at its helm.

In "Revving Up Success: How Automotive Businesses Excel in Vehicle Manufacturing, Sales, and Aftermarket Services," we delve into the strategies that propel automotive businesses to the forefront of the industry. Whether it's through meticulous supply chain management, savvy automotive marketing, or delivering unbeatable customer satisfaction, learn how leaders in vehicle manufacturing, automotive sales, car dealerships, and aftermarket parts navigate the complex terrain of the automobile sector.

With a special focus on car rental services, vehicle maintenance, and automotive repair, this article offers a comprehensive look at how automotive businesses are not just keeping pace with but accelerating beyond the current market demands. Join us as we explore the engines of growth driving the automobile industry forward, from innovative product offerings to transformative business models that ensure resilience and profitability in an ever-changing landscape.

- 1. "Navigating the Road Ahead: Top Trends and Innovations Transforming the Automobile Industry"

- 2. "Revving Up Success: How Automotive Businesses Excel in Vehicle Manufacturing, Sales, and Aftermarket Services"

1. "Navigating the Road Ahead: Top Trends and Innovations Transforming the Automobile Industry"

The automobile industry is currently undergoing a significant transformation, driven by a combination of top market trends, consumer preferences, and technological innovations. As we navigate the road ahead, understanding these shifts is crucial for businesses involved in vehicle manufacturing, automotive sales, aftermarket parts, car dealerships, vehicle maintenance, automotive repair, and car rental services. This evolution is not only reshaping the landscape of the industry but also redefining the strategies businesses must employ to thrive.

One of the pivotal forces behind these changes is the rapid advancement in automotive technology. Electric vehicles (EVs) are leading the charge, propelled by a growing consumer demand for sustainable and eco-friendly transportation solutions. This shift is compelling vehicle manufacturers to rethink their production lines and invest heavily in EV technology, affecting the entire supply chain management process. As a result, businesses in the automotive sector are also adjusting their offerings, from introducing new EV models in car dealerships to adapting automotive repair shops for electric vehicle maintenance.

Another significant trend is the increasing reliance on digital platforms for automotive sales and marketing. The digital revolution has transformed consumer buying behavior, with more customers preferring to research, customize, and even purchase vehicles online. This trend has necessitated an overhaul in automotive marketing strategies, pushing businesses to leverage online platforms, social media, and digital advertising to reach potential customers. Car dealerships are particularly feeling the impact, as they adapt to a sales model that blends physical showrooms with digital experiences.

The aftermarket parts sector is also experiencing a surge in demand, driven by consumers' desire to customize and enhance their vehicles' performance and aesthetics. This has opened up new opportunities for businesses specializing in aftermarket parts, requiring them to stay abreast of the latest industry innovations and consumer preferences to cater to the evolving needs of vehicle enthusiasts.

Regulatory compliance is another critical area shaping the future of the automobile industry. Governments worldwide are imposing stricter emissions standards and safety regulations, compelling vehicle manufacturers and businesses across the automotive sector to adapt their practices and products accordingly. This focus on regulatory compliance is pushing the industry towards safer, cleaner, and more sustainable transportation solutions.

Finally, the importance of efficient supply chain management in the automobile industry cannot be overstated. With the globalization of vehicle manufacturing, ensuring a smooth, uninterrupted supply chain has become more complex and challenging. Automotive businesses must now navigate a web of international suppliers and regulatory environments, making supply chain management a critical component of industry success.

In conclusion, the automobile industry is at a pivotal juncture, with innovations and market trends reshaping every facet of the business. From the surge in electric vehicle production and the digitalization of automotive sales to the focus on aftermarket customization, regulatory compliance, and supply chain management, businesses within the sector must stay informed and agile. Adapting to these changes is not just about survival but seizing the opportunity to lead in a rapidly evolving market.

2. "Revving Up Success: How Automotive Businesses Excel in Vehicle Manufacturing, Sales, and Aftermarket Services"

In the fast-paced world of the automobile industry, success hinges on a myriad of factors, from cutting-edge vehicle manufacturing processes to dynamic automotive sales strategies and comprehensive aftermarket services. Top automotive businesses distinguish themselves through a relentless pursuit of excellence across these domains, leveraging industry innovation and automotive technology to stay ahead of the curve.

Vehicle manufacturing stands as the backbone of the automobile industry. It is where the journey of excellence begins for top automotive businesses. These companies invest heavily in the latest automotive technologies and supply chain management strategies to ensure the production of high-quality, innovative vehicles that meet the evolving demands of consumers. Embracing industry innovation, these manufacturers are not just producing cars; they are crafting the future of mobility, ensuring that every vehicle off the production line is a testament to efficiency, safety, and sustainability.

Transitioning from the factory floor to the showroom, automotive sales are where manufacturers see their efforts bear fruit. Success in automotive sales is not just about moving inventory; it's about creating experiences that resonate with consumers. Top car dealerships understand the importance of aligning with consumer preferences, offering a range of vehicles that cater to various needs and lifestyles. These dealerships employ sophisticated automotive marketing strategies, utilizing digital platforms to reach potential buyers and providing personalized services that turn visitors into loyal customers. Their ability to adapt to market trends and maintain regulatory compliance further solidifies their position in the market.

The journey doesn't end with the sale of a vehicle. Aftermarket parts and services play a crucial role in the automotive ecosystem, providing vehicle owners with the means to maintain, customize, and enhance their vehicles long after the initial purchase. Top automotive businesses thrive by offering comprehensive aftermarket services, including automotive repair, vehicle maintenance, and a vast selection of aftermarket parts. These services not only ensure customer satisfaction but also foster long-term relationships between businesses and their clients. Car rental services, too, are an integral part of the automotive industry, offering flexible transportation solutions that cater to temporary needs, thereby expanding the industry's reach.

Excellence in the automotive business is not achieved in isolation. It requires a deep understanding of market trends, consumer preferences, and the ability to navigate the complexities of regulatory compliance. Through a combination of innovative vehicle manufacturing, strategic automotive sales, and extensive aftermarket services, top automotive businesses are able to rev up success, steering their way to prominence in a competitive market. Their success is a testament to the power of integrating automotive technology, supply chain management, and automotive marketing strategies, setting the stage for the future of the automobile industry.

In conclusion, the automotive business remains a pivotal and dynamic sector within the global economy, driving forward with industry innovation, technological advancements, and a keen eye on market trends and consumer preferences. From vehicle manufacturing to automotive sales, and from aftermarket parts to comprehensive car dealership services, each facet of this industry plays a crucial role in meeting the transportation needs of today's society. The importance of vehicle maintenance, automotive repair, and car rental services cannot be overstated, as they ensure reliability, convenience, and accessibility for consumers worldwide.

As we've explored, navigating the road ahead for the automobile industry involves staying abreast of top trends such as automotive technology integration, adapting to regulatory compliance, and excelling in supply chain management. Success in this competitive landscape requires automotive businesses to rev up their efforts in industry innovation, automotive marketing, and delivering quality products and services that resonate with customer needs.

Furthermore, the ability to adapt and respond to evolving market demands, from electric vehicles to autonomous driving capabilities, underscores the need for continuous learning and agility within the sector. Car dealerships, manufacturers, and service providers must work hand in hand to ensure a seamless and satisfactory customer experience, from the showroom floor to after-sales support.

In essence, the future of the automobile industry hinges on its capacity to blend tradition with innovation, ensuring that vehicle manufacturing, automotive sales, and aftermarket services not only keep pace with but also anticipate and shape the future of transportation. By focusing on customer satisfaction, embracing regulatory changes, and leveraging the latest in automotive technology, businesses within this sector can steer towards sustained growth and success. As we look to the horizon, the automotive industry is set to offer more exciting, efficient, and environmentally friendly transportation solutions, making it an ever-evolving and fascinating field to watch.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Chinese Recycling Giant GEM Eyes Hong Kong Listing for Global Expansion amid Uncertainty

GEM, a Chinese electronics recycling company, intends to list its shares in Hong Kong. The firm specializes in recycling batteries, electronic waste, discarded vehicles, and plastic waste and is seeking capital to accelerate its worldwide growth.

The firm stated that they intend to engage with pertinent middlemen to deliberate on strategies for progressing with the listing. Nonetheless, they cautioned that specifics are still under discussion, and a "substantial amount of uncertainty" persists concerning the procedure.

Established in 2001 in the city of Shenzhen, which is adjacent to Hong Kong, GEM is a company that focuses on the recycling of electronic waste, batteries, discarded vehicles, waste plastics, and other materials. In addition to recycling, the company also manufactures materials that are used in the production of power batteries. This has allowed GEM to position itself as a major player in the international new energy supply chain, as stated on their website.

State media, referencing informed sources, has reported that the firm's share release in Hong Kong is scheduled for April.

GEM's stock increased by 0.15 percent on Tuesday, reaching 6.54 yuan in Shenzhen.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Surge in Hong Kong Home Buyers Forfeiting Deposits Amid High Rates: A Trend Set to Continue into 2025

Real estate agents suggest that an increasing number of Hong Kong property buyers might abandon their buying deposits due to high rates. There was a 75% increase in defaults on home deposits last year, reaching 449, and realtors predict this pattern will persist through 2025.

According to a study by real estate firm Centaline, there was a significant rise in the number of first-time home buyers who abandoned their deposits last year. The figure reached 449, marking a 75% rise from the previous year and the largest number since 2019. In the last three months of the year alone, there were 104 such instances, almost three times the 40 recorded in the preceding quarter. The company did not disclose the total amount of the defaulted deposits, but industry insiders suggest that the initial deposit usually stands at around HK$100,000 (US$12,844).

Agents indicated that the count of default instances will remain elevated in the near future.

"Given the anticipated market activity following the Lunar New Year and the discounts offered by developers, we foresee a sustained high level of default rates on newly built properties," stated Yeung Ming-yee, a high-ranking associate director at Centaline. "We predict approximately 100 instances of this in the first three months of 2025."

Forfeits suggest that either purchasers are incapable of proceeding with their acquisitions, or they anticipate locating substantially improved offers.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Chinese Electric Vehicle Exports Surge Amid EU Tariffs: Escalating Sino-European Trade Tensions Anticipated in 2025

New trade data implies that EU duties are ineffective in halting the influx of Chinese electric vehicles. The surge in Chinese EV exports to the European Union in December has sparked concerns about a potential trade war in 2025.

Despite the newly implemented tariffs by the European Union, China's electric vehicle exports to the region saw an unexpected increase in December. This has led to concerns in the market that trade disputes between China and Europe could intensify further come 2025.

The amount of electric vehicles exported from China to the European Union increased to 32,849 units in December, marking an 8.3 per cent rise from the previous year, as per the Chinese customs data unveiled on Monday.

In 2024, the European Union continued to be the leading purchaser of Electric Vehicles (EVs) from China, accounting for almost 30% of China's EV exports. However, the annual total of Chinese EVs imported by the 27-member union experienced a 6% decline compared to the previous year.

Belgium, Germany, Spain, Netherlands, and Romania were the primary European purchasers of Chinese electric vehicles, as per the information.

A rise in quantity but a drop in worth indicates declining costs, which is the main worry for those setting policies in Europe. Experts cautioned that there is a significant chance for a continued decline in relations between the EU and China this year, with additional trade items possibly being affected by policies favoring local goods and services.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Tech Stocks Drive Hong Kong Market Downturn, Ending Six-Day Rally: Top Companies JD.com, Bilibili, NetEase, Alibaba, and New Oriental Education & Technology Record Losses

Technology shares spearhead the downfall in Hong Kong, breaking a six-day successful run. JD.com, Bilibili, NetEase, and Alibaba experience a dip, while New Oriental Education & Technology suffers a steep drop due to poor earnings.

The Hang Seng Index experienced a 1.6 per cent decrease, closing at 19,778.77, and the Hang Seng Tech Index saw a 2.4 per cent loss. Over on the mainland, both the CSI 300 Index and the Shanghai Composite Index dropped by 0.9 per cent.

Online retail behemoth JD.com saw a decrease of 4.3 per cent, falling to HK$151.60. There was a decrease of 6.4 per cent in the share price of the video-sharing service Bilibili, which landed at HK$129.20. Alibaba Group Holding also experienced a drop of 3.1 per cent to HK$82.20, while the gaming company NetEase saw its shares dip 1.7 per cent to HK$154.80. Finally, Tencent Holdings saw a decline of 1 per cent to HK$383.40.

Shares in New Oriental Education & Technology saw a significant drop of 24.2% to HK$35.40 due to its second-quarter profits not meeting the predicted figures by analysts. On Tuesday, the firm announced adjusted earnings of US$0.22 per American depository share for the second quarter, falling short of the anticipated US$0.32 consensus estimate.

Shares in Chinese firms that focus on domestic services and cater to daily necessities are favored choices to counter the fluctuations due to short-term downturns, says Kai Wang, a top stock analyst for Asia at Morningstar.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

HSBC Trustee’s Role in Navigating Asia-Pacific’s $5.8 Trillion Intergenerational Wealth Transfer Amid Succession Planning Gap

HSBC Trustee has been aiding families in protecting their wealth and inheritance for almost eight decades. It is estimated that a wealth transfer of around US$5.8 trillion is set to take place in the Asia-Pacific region. However, according to a report by HSBC, numerous families are without a plan for succession.

As economies in Asia keep progressing, the demand for efficient wealth transfer across generations among individuals of high and ultra-high net worth is also increasing.

McKinsey, a consulting agency, recently predicted that approximately $5.8 trillion is set to be passed down to the following generations in the Asia-Pacific area by 2030. Despite this, the 2024 HSBC Global Entrepreneurial Wealth Report disclosed that 66% of those surveyed in Hong Kong lack a plan for transferring their wealth, and 64% still don't have a succession strategy for their companies.

A notably larger proportion of Hong Kong business owners lack a plan for handing over their companies, compared to the global average of 52%, according to Christina Tung, the leader of trust and fiduciary services for HSBC Global Private Banking in North Asia. In addition, she notes, over one-third of these entrepreneurs anticipate leaving their businesses within the next half-decade, a figure that exceeds the worldwide average of 23%. These facts underscore the pressing need for these families to meticulously and strategically plan for their business transitions.

Planning for the transfer of wealth in contemporary families

Considering the intricacies of passing on wealth between generations in today's worldwide setting, financial planning has evolved to include more than just managing estates, holding assets, and setting up trusts for tax purposes.

"Contemporary trusts necessitate strong expert trustees who collaborate with families, professional consultants and private banking relationship managers to manage legal and regulatory demands," states Brent York, the global head of trust and fiduciary services at HSBC Global Private Banking. He further emphasizes that the bank's goal is to become the top global wealth manager and private bank for Asian and international customers and business owners.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Sunac’s Innovative Debt Deal: A Beacon of Hope for China’s Troubled Property Sector

Sunac's domestic debt agreement is a positive sign for China's struggling real estate industry, according to experts. This agreement could potentially serve as a beneficial example for other beleaguered Chinese property developers.

This arrangement also positions Sunac as the first mainland Chinese developer that defaulted to decrease its domestic debt.

In a document submitted to the Hong Kong stock exchange on Tuesday, the developer based in Tianjin announced that the repayment of the main amount and interest on the 10 bonds would be "modified." They also stated that they would examine several restructuring alternatives, including bond buybacks, cash tender proposals, payment through equity, and debt resolution with assets.

The firm announced that it would organize for the bondholders to choose their preferred repayment methods.

Market participants expressed that Sunac's agreement signals positive prospects for China's real estate industry.

"Domestic creditors are typically resistant to making concessions," stated Raymond Cheng, a director at CGS International Securities in Hong Kong. "If restructuring… can be extended to include developers' domestic debts, it could greatly alleviate the financial strain on developers."

The agreement might "serve as a feasible benchmark for other struggling Chinese real estate developers," stated Kenny Ng, a strategist from Everbright Securities International.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Trump’s Threats May Accelerate Global Shift Away from US Dollar, Davos Economists Warn

Economists at Davos caution that Trump's intimidations might push nations away from the US dollar. They contend at the World Economic Forum that the US president's warnings directed at countries considering other currencies could prove adverse over time.

Economists at the World Economic Forum in Davos, Switzerland, on Tuesday suggested that President Donald Trump's warnings to nations aiming to lessen their dependence on the U.S. dollar might instead speed up their departure from the American currency.

"Encouraging individuals to adopt your currency is tied to its ability to offer stability and a method of payment," commented Kenneth Rogoff, a Harvard University economics professor, as part of a panel discussion at the event.

"If you're under threat, I believe it only strengthens the motivation to strive for diversity."

Should they not comply, Trump cautioned, the US would retaliate by imposing tariffs of 100 per cent on their goods.

"There's absolutely no possibility of the BRICS supplanting the U.S. Dollar in global commerce, and any nation attempting to do so should bid farewell to the United States," he posted on his social media site, Truth Social, at that time.

For many years, the US dollar has reigned supreme in worldwide commerce and has been the principal reserve currency stored by global central banks. However, its prominence is progressively being contested, with nations such as China striving to lessen their reliance on the dollar and globally promote their own currencies.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Forecasting the Future of Marketing: Insights and Predictions for 2025 from Haymans Fung of Standard Chartered Bank

Haymans Fung of Standard Chartered Bank's 2025 Forecast for Marketing

Fung offers some guidance for marketers planning for the upcoming year: "Ensure your marketing plan genuinely corresponds with the business plan. Communicate with your stakeholders, comprehend the shortcomings and prospects, and confirm that your efforts are addressing the company's tangible issues.

12:48

Kevin Huang, the Chief Operating Officer at SCMP, and Haymans Fung, who serves as the Global Head of Wealth and Retail Bank Marketing, as well as the Head of Wealth and Retail Bank Marketing in Hong Kong for Standard Chartered Bank.

When the final moments of 2024 faded into history at the stroke of midnight, Haymans Fung, who holds the titles of global head of wealth and retail bank marketing, as well as head of wealth and retail bank marketing for Hong Kong at Standard Chartered Bank, probably let out a breath of relief. The year had been a roller coaster ride for the financial institution with a history spanning more than 165 years, filled with hurdles and impressive accomplishments.

"She remarks on how swiftly 2024 has passed, while taking a moment to look back on the year. She found it rewarding, especially managing Hong Kong and other significant markets. She's impressed by the tremendous work they've done and takes great pride in their achievements."

Without a doubt, 2024 was a year full of significant events for Standard Chartered Bank. Their first-ever Family Office Forum in Hong Kong was attended by 80 ultra-rich families from around the world, featuring the famous Rockefeller family. This prestigious occasion not only solidified the bank's relationship with the world's super-rich, but it also displayed its proficiency in catering to the unique requirements of the ultra-affluent segment.

Enhancing the community. However, Fung's attention isn't solely on expanding the business.

"She emphasizes the significance of our actions being truly motivational and beneficial for the community," she articulated. "We possess a powerful platform, and it's essential that we utilize it to contribute and create a positive difference."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

EU Tariffs Fail to Halt Chinese EV Invasion and BYD Faces Labor Controversy: A Deep Dive into EV Market Dynamics

European Union import duties fail to curb influx of Chinese vehicles, BYD impacted by labor allegations: 7 key stories on electric vehicles

These include news on Chinese auto manufacturers' global strategies and the US prohibiting Chinese technology in intelligent cars – seven electric vehicle narratives that might have escaped your attention.

1. Despite EU tariffs, influx of Chinese electric vehicles continues, according to recent trade data.

Despite new tariffs imposed by the European Union, there has been an unexpected increase in the number of Chinese electric vehicle (EV) deliveries in December. This has raised concerns in the market that trade disputes between China and Europe may worsen by 2025.

2. Chinese electric vehicle titan, BYD, faces hurdles in Brazil amid allegations of 'slave-like' working conditions

Extended work schedules, bare sleeping platforms, and a single bathroom used by a large group of people – these are typically standard circumstances for Chinese construction workers. However, in Brazil, these are seen as intolerable "slave-like conditions". Although Brazil's economy is nowhere near the scale of China's, it surpasses the latter in terms of worker protection.

3. In 2024, trade restrictions on China reached an all-time high due to concerns about overproduction.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Zijin Mining Rivals Glencore in Market Capitalisation after Record Profit Year, Despite Softened Output Targets

China's Zijin Mining competes with Glencore following a year of unprecedented profits. The gold and copper manufacturer's market value is equivalent to that of the worldwide commodity trading behemoth, Glencore.

The Chinese company, Zijin Mining Group, achieved an unprecedented yearly profit due to a surge in growth that put it on par with the international commodities behemoth, Glencore. However, the firm has decided to lower its production goals for the current year.

The company reported a 52% increase in net income for 2024, amounting to 32 billion yuan (approximately US$4.4 billion), according to a filing with the Hong Kong stock exchange late Tuesday. The company's market value is now roughly equivalent to Glencore, following an increase in copper production and benefiting from record gold prices last year.

However, indications of a decrease in the rapid rate of growth are evident, as Zijin reduces its copper production goal by approximately 6 per cent to 1.15 million tons. The venture into lithium has also stumbled, following its negligible production last year and a significant cut in its 2025 production target by roughly 60 per cent to 40,000 tons.

Shares of Zijin saw a decrease of 1.1 per cent, dropping to HK$14.84 in Hong Kong on Wednesday. Meanwhile, the standard Hang Seng Index experienced a 1.6 per cent decline.

Over the last ten years, the mining company has expanded rapidly, establishing itself as a significant international provider of copper. This was achieved by launching substantial new initiatives in the Democratic Republic of Congo and mainland China. Similar to its competitor, Rio Tinto Group, Zijin has identified lithium as a critical component of its future goals, with plans to become one of the largest global producers.

The surge in lithium has been hindered by a tumultuous market. Previous year, it delayed two new ventures in Argentina and Western China. A drastic drop of nearly 90% in the cost of the battery metal from 2022 has compelled a multitude of global companies to limit their growth strategies or reduce production.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong Banks Brace for Tougher Times: 9-Month Profit Growth Hits Three-Year Low Amid Narrowing Net Interest Margins

Banks in Hong Kong brace for challenging times as the growth in profits for the last nine months decelerates. The net interest margin shrank to 1.5 per cent in the initial nine months of the previous year, down from 1.67 per cent in 2023, based on data from the HKMA.

Banks in Hong Kong reported the weakest profit increase in three years, caused by reduced net interest margins and an increase in unpaid loans, which counterbalanced earnings from wealth management.

The data revealed that the difference in the interest rates for loans and deposits, known as the net interest margin (NIM), for banks dropped to 1.5 per cent in the initial nine months of the previous year. This is a decrease from 1.67 per cent in 2023. In previous years, the NIM was recorded at 1.31 per cent in 2022, 0.98 per cent in 2021, and 1.18 per cent in 2020.

Banks continued to be profitable, however, we need to shift our attention towards problems with bad debt and the rising occurrence of financial frauds this year," stated Arthur Yuen Kwok-hang, the deputy CEO of HKMA, during a press conference on Wednesday.

Yue indicated that the initial data gathered from banks in the last quarter mirrored the trend observed in the first three quarters, suggesting that the complete annual data might reflect the same trend.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI3 months ago

AI3 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevolutionizing the Road: Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Driving

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Sustainability and Safety on the Road

-

Tech2 months ago

Tech2 months agoDriving into the Future: Top Automotive Technology Innovations Transforming Vehicles and Road Safety

-

Tech1 month ago

Tech1 month agoRevving Up Innovation: How Top Automotive Technology is Driving Us Towards a Sustainable and Connected Future

-

AI3 months ago

AI3 months agoGoogle’s NotebookLM Revolutionizes AI Podcasts with Customizable Conversations: A Deep Dive into Kafka’s Metamorphosis and Beyond

-

Tech3 months ago

Tech3 months agoDriving into the Future: The Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Revolution

-

Tech3 months ago

Tech3 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving