Path to Innovation: Hong Kong’s Potential to Emerge as a Global Hub for AI Application Development – Insights from InnoTech Forum

InnoTech Summit: Hong Kong could turn into a hub for AI application creation

The InnoTech conversation shows the measures being implemented by the government and private companies to pave the way for the growth of AI in Hong Kong.

"In Hong Kong, the government has significantly increased its subsidies, which encompass the provision of GPUs (graphics processing units) and AI data centres," stated Tseng. She proposed the establishment of a "fund of funds" to attract more investment and funnel increased market capital towards the city's emerging AI ecosystem.

Yet, the need for creative AI solutions from individuals and businesses is something that should be progressively nurtured. Tseng queried: "Are individuals prepared for a world empowered by AI? Are businesses willing to invest in such applications?"

The conversations held at the InnoTech Forum on Friday indicate the measures being implemented by both the government and private entities to establish a roadmap for AI in Hong Kong, including crucial computing systems.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

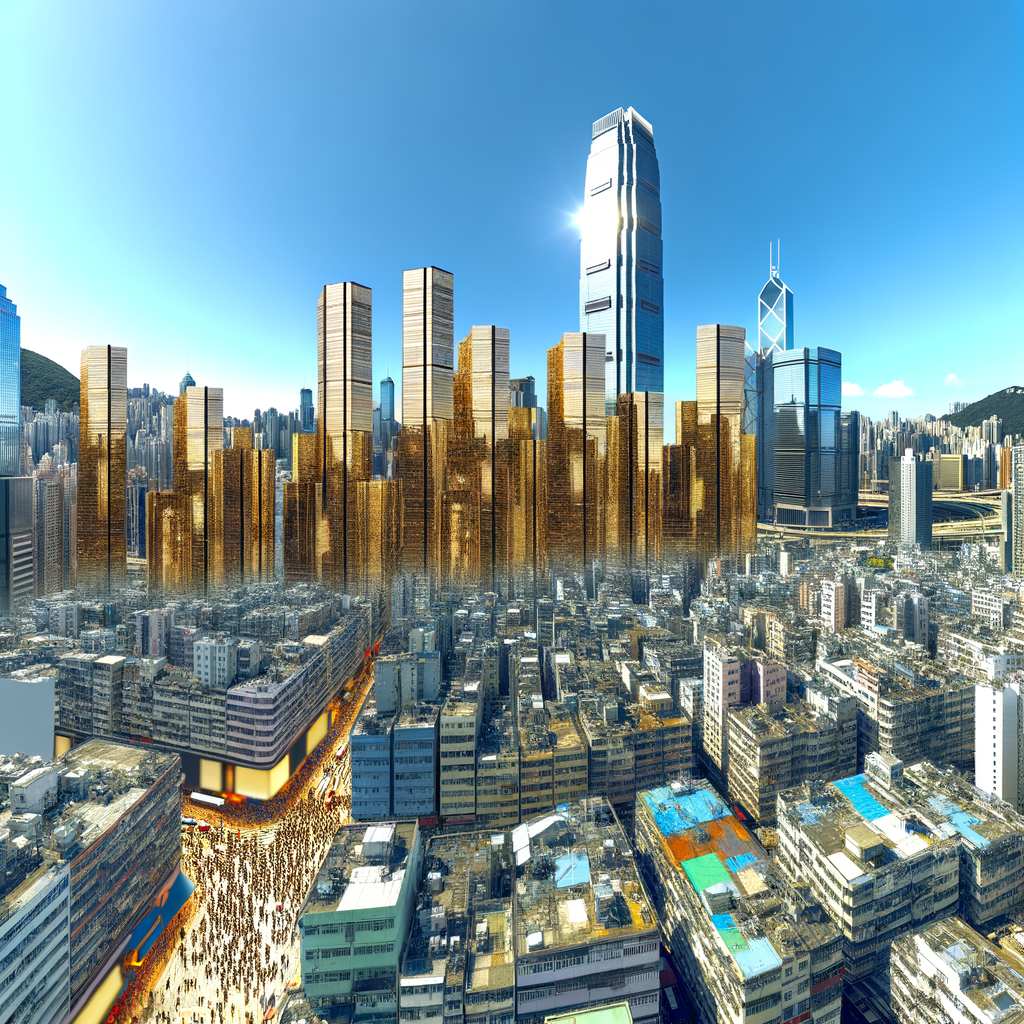

HKEX Bridges China, ASEAN, and Middle East Markets, Expanding Global Reach with Riyadh Office and Potential Hong Kong Metal Warehouse

Hong Kong serves as a link between China, Asean, and the Middle East as business relationships strengthen: says a representative from HKEX. The establishment of an office in Riyadh and the proposal for a metal warehouse highlight HKEX's importance, as stated by Vanessa Lau at the Asian Financial Forum.

After purchasing the London Metal Exchange (LME) in 2012, HKEX is now considering the construction of Hong Kong's first LME-approved storage site. This would enable the tangible trade of metals like aluminium and zinc between mainland China and other global locations. A similar establishment already exists in Jeddah, Saudi Arabia.

Numerous fresh endeavors are underway and we hold the conviction that both the Middle East and Asean [Association of Southeast Asian Nations] will offer crucial prospects for Hong Kong and its exchange," stated Lau.

Last year, Carlson Tong Ka-shing, the chairman of HKEX, stated that high-ranking authorities in Saudi Arabia have suggested that Middle Eastern companies are considering going public in Hong Kong to acquire financing for infrastructure initiatives.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

WeRide Accelerates Global Expansion with Third European Self-Driving Trial in Switzerland

WeRide from China commences its third autonomous driving experiment in Switzerland. The firm is intensifying initiatives in Southeast Asia, the Middle East, Europe, Japan, and South Korea, according to CEO Tony Han.

WeRide, a Chinese company specializing in autonomous driving technology, is accelerating its global growth with a pilot project in Switzerland. The project involves testing fully self-driving vehicles and is conducted in collaboration with Switzerland's national railway operator.

"He stated that the initiatives are not solely focused on penetrating the market with our associates. As a tech firm, we bear a societal obligation to foster local growth through autonomous services, which carry significant worth for the worldwide economy."

To start with, two self-driving cars equipped with WeRide's tech will be operational in the Furttal area of Switzerland. The national rail service of Switzerland, Schweizerische Bundesbahnen (SBB), is financially backing the project, with Swiss Transit Lab overseeing the operation of these autonomous vehicles. The fleet is projected to increase to eight vehicles, including minibuses, by 2026, with plans for additional expansion thereafter.

The SBB initiative marks the third venture WeRide has embarked on in Europe within the past eight months. Just a week prior, the firm announced the inauguration of Europe's pioneering commercial self-driving minibuses at Zurich airport. Earlier in June, WeRide teamed up with Renault to offer self-operating shuttle services at the French Open tennis tournament.

"Han anticipates that their international ventures will make up over fifty percent of their total enterprise down the line. He believes WeRide to be one of the limited tech firms capable of managing self-driving businesses on a global scale."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Luring Wealthy Investors: Hong Kong’s Low Tax Advantage and the Need for Non-Tax Revenue Strategies

Investors suggest that Hong Kong can attract family offices due to its low tax rates and stable currency. To prevent losing its charm to affluent families, Bonds Group suggests that Hong Kong should explore alternatives, besides tax hikes, to address budget deficits.

Some investors have suggested that Hong Kong should continue with its minimal tax system, keep its currency linked to the US dollar, and start dealing in digital assets in order to pull in more funding from international family offices.

"Hong Kong is a desirable place for family offices due to its favorable tax environment," stated Anson Chan, the CEO and chairman of his family-run real estate firm, Bonds Group of Companies. "The metropolis offers low corporate tax rates and doesn't levy any estate tax."

In order to maintain their edge, Chan stated that the Hong Kong government needs to explore alternatives to increasing taxes for boosting its revenue and minimizing its budget deficit. He made this statement at the Asian Financial Forum on Tuesday. The success of this will rely on the strategies implemented by Financial Secretary Paul Chan Mo-po to either balance the budget or prevent excessive withdrawal from its reserves.

12:40 PM

What strategies could Hong Kong implement to recover from its close to HK$100 billion shortfall?

In May 2023, the government declared tax incentives, incorporating a cash-for-residency scheme, to attract affluent entrepreneurs. Family offices aim for profitable investments, arrange inheritance plans, and engage in charitable activities. Last year, over 2,700 single-family offices were recorded in Hong Kong, as stated in a report by Deloitte.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s Low Tax Advantage: The Key to Enticing Global Family Offices, Investors Urge Fiscal Balance

Investors suggest that Hong Kong can attract family offices with its low taxes and stable currency.

The Bonds Group states that if Hong Kong wants to maintain its allure for affluent families, it should consider methods other than increasing taxes to manage budget deficits.

Some investors suggest that Hong Kong needs to uphold its minimal tax system, continue its currency affiliation with the US dollar, and welcome the exchange of digital assets to pull in more funding from worldwide family offices.

"Hong Kong appeals to family offices due to its minimal tax regulations," stated Anson Chan, head and CEO of his family's property business, Bonds Group of Companies. "The metropolis boasts of low corporate tax rates and does not impose an inheritance tax."

To maintain their edge, Chan expressed that the Hong Kong government must explore alternatives to raising taxes in order to replenish its treasury and cut down its budget deficit. He voiced this during the Asian Financial Forum on Tuesday. Whether this can be achieved will rely on the efforts of Financial Secretary Paul Chan Mo-po to either balance the budget or prevent excessive withdrawal from its reserves.

12:40 PM

What measures can Hong Kong take to recover from its almost HK$100 billion shortfall?

In May 2023, the government disclosed several tax incentives, featuring a cash-for-residency scheme, aimed at attracting affluent business proprietors. Family offices are in pursuit of investment profits, succession planning, and philanthropic endeavors. As per a report from Deloitte, last year, over 2,700 single-family offices were established in Hong Kong.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong and Gulf Nations Explore Financial and Infrastructural Synergies to Strengthen Economic Ties

Hong Kong and Gulf countries aim to strengthen connections through financial and infrastructural collaborations

Representatives from Saudi Arabia, UAE, Oman, and Qatar believe Hong Kong could significantly contribute to broadening their economic bases.

Government representatives announced on Tuesday that Hong Kong and Middle Eastern nations are exploring ways to enhance cooperation in areas such as finance, artificial intelligence (AI), logistics, and large-scale infrastructure projects.

The robust financial market of the city could assist nations in the Gulf Cooperation Council (GCC) in securing funds for projects, as they aim to broaden their economic bases, according to Gulf authorities, who are open to investments from Hong Kong. The GCC includes countries such as Saudi Arabia, United Arab Emirates, Oman, Qatar, Bahrain, and Kuwait.

"According to the country's investment plan, Saudi Arabia is ready to strengthen its partnership with Hong Kong," stated Faris Algarni, the assistant deputy minister of investment for Saudi Arabia, during a panel discussion at the Asian Financial Forum held in Hong Kong.

Saudi Arabia's Vision 2030 plan is designed to decrease the nation's dependence on oil and enhance industries such as manufacturing, tourism, renewable energy, digital infrastructure, and healthcare. According to Algarni, this plan presents abundant possibilities for businesses in Hong Kong.

Hong Kong is aiming to build connections with countries in the Gulf region. Paul Chan Mo-po, the Financial Secretary, headed a team to the Future Investment Initiative (FII) conference in Riyadh towards the end of October. The Public Investment Fund, which is Saudi Arabia's sovereign wealth fund, and the Hong Kong Monetary Authority have consented to initiate a US$1 billion fund. This fund is designed to assist companies based in Hong Kong in expanding their operations in the Middle East.

During the FII summit, Saudi Arabia's Tadawul stock exchange listed two exchange-traded funds (ETFs) worth a total of US$1.8 billion. This marked the first time investors from the Middle East could trade stocks from Hong Kong. This completes a reciprocal flow of capital, following the listing of an ETF that tracks Saudi's leading stocks in Hong Kong in November 2023.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Apple Dominates Q4 2024 Smartphone Market Despite China Setback: A Look into iPhone’s Global Surge and Chinese Decline

Apple topped the smartphone market in the last quarter, despite a downturn in China. iPhone deliveries skyrocketed, seizing 23% of the market in the last quarter of 2024, even as the recovering market began to witness a slowdown in growth.

The tech behemoth from Cupertino, California secured a 23% share of the worldwide market in the last quarter. This surge was fueled by the release of their iPhone 16 series in mid-September, which saw a rise in sales over the festive shopping period, as per a Tuesday report from market research firm Canalys.

Sales for Apple in China dropped during the first three quarters of the previous year, with a decrease of 25% and 6% in the first and third quarters respectively compared to the previous year, according to Canalys. This resulted in Apple ranking fifth among smartphone suppliers in those quarters. In the second quarter, Apple did not even make it to the top five.

Two fifty-three

Huawei's Mate XT trifold smartphone triggers a mad rush, leading to soaring reselling prices.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

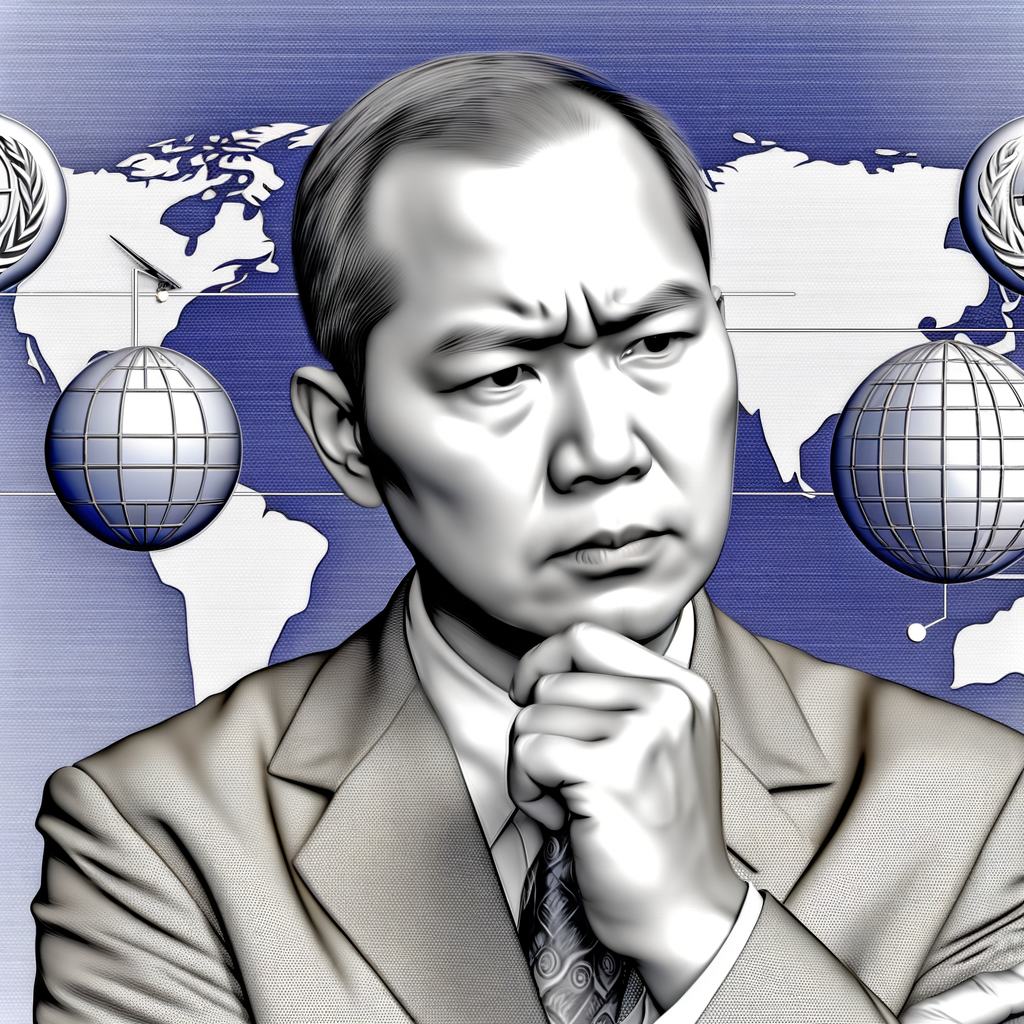

Alibaba’s Joe Tsai on Navigating Unprecedented Geopolitical Strains: Chinese Firms Brace for Harsh Realities Amid Rising Tensions

Joe Tsai of Alibaba: Chinese companies grappling with tough conditions amidst escalating geopolitical conflicts

Alibaba's co-founder and chairman claims that the current geopolitical climate is the most hostile it has ever been.

Joe Tsai, co-founder and chairman of Alibaba Group Holding, has indicated that Chinese businesses are encountering the toughest geopolitical circumstances they've seen in many years.

"At this moment, it's safe to assert that we're in the harshest geopolitical climate we've ever experienced," Tsai expressed during a casual conversation at the Asian Financial Forum in Hong Kong on Tuesday. "Being a Chinese corporation, intending to conduct business in the US subjects us to potential obstacles, such as tariffs."

This is due to the perception among Americans that Chinese exporters and manufacturers are overly dominant and they are trading an excessive amount of goods, he further explained.

Alibaba, the operator of China's biggest online commerce platform, Taobao, has been broadening its global presence despite a sluggish domestic economy and political conflicts. Alibaba is also the owner of the South China Morning Post.

The President-elect of the United States, Donald Trump, who is set to return to the White House in the coming week, has declared his intent to implement a 60 per cent tariff on goods exported from China. This follows Trump's initiation of a trade conflict with China during his initial term as president, where he levied taxes on over US$300 billion in Chinese merchandise.

In 2022, the United States administration examined Alibaba's cloud services to evaluate if they could be a threat to the nation's security. This corporation is among numerous Chinese tech firms impacted by the US's restrictions on exporting high-tech semiconductors.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Chinese TikTok Merchants Eye Amazon and Shein Amid Impending US Ban: Adapting Strategies as Tech War Intensifies

Technology Battle: Chinese TikTok Vendors Consider Amazon and Shein Amid Potential US Prohibition

Chinese international traders are preparing for a possible TikTok ban in the US.

Qian Liu, an entrepreneur operating 12 shops on TikTok aimed at American customers, has been reducing stock prices and postponing the acquisition of fresh inventory, as she anticipates the final judgment of the US Supreme Court regarding the app's future.

Qian, who operates out of Zhuhai city in the southern Guangdong province, indicated that her US venture had yielded such remarkable returns that she intended to lease a workspace and employ local personnel. However, she has yet to do so due to her perception of TikTok's US operations as unstable.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Country Garden’s Financial Woes Ease in H1 2024: Revenue Decline and Offshore Debt Challenges Persist

Struggling Chinese property developer Country Garden experienced a reduction in losses for the first half of 2024. The developer, based in Foshan, also reported a 55% decrease in revenue for the same period, totaling 102 billion yuan.

The company, based in Foshan, announced that its revenue for the first six months of 2024 decreased by 55 per cent compared to the same period in the previous year, amounting to approximately 102 billion yuan. In a press release on Tuesday, the company expressed optimism that its performance would enhance throughout the entirety of 2024.

Country Garden announced that its net loss for 2023 expanded to 178.4 billion, a significant increase from the 6.1 billion yuan loss experienced the previous year. The company's revenue also dropped by 6.8 per cent, declining from 430.4 billion yuan in 2022 to 401 billion yuan. Additionally, its total obligations decreased to US$164 billion at the close of 2023, a reduction from the US$195 billion recorded a year ago.

According to the data collected by S&P Global (China) Ratings, the company is due to repay offshore bonds valued at US$2.8 billion and onshore bonds worth 6.6 billion yuan this year.

The developer is also dealing with a bankruptcy claim from a subsidiary of the Hong Kong-based company, King Board Holdings. The claim was made in February due to the non-repayment of a US$205 million loan. The court hearing in Hong Kong is now set for January 20.

Country Garden's sales continued to decline in December, even though there were indications of overall market recovery due to stimulus efforts from Beijing.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Navigating the Trust Gap: Insights from Robert Hormats on China-US Relations and the Prospect of Decoupling

Inquiring Minds | Kissinger's protege Robert Hormats explores ways for China and the US to bridge their 'trust deficit'

Experienced diplomat and economist dissects the complexities of a complete China-US separation, emphasising that disagreements must be handled with caution.

Experienced diplomat and economist dissects the complexities of a complete China-US separation, emphasising that disagreements must be handled with caution.

Robert Hormats initiated his professional journey at the US National Security Council in 1969. Here, he held the position of chief consultant to Henry Kissinger on economic matters and was instrumental in rebuilding ties with China in the early 1970s. He transitioned to Goldman Sachs in 1982, where he devoted 25 years and ultimately rose to the rank of vice-chairman.

Hormats was named the Undersecretary of State for Economic and Energy Affairs in 2009 by Hillary Clinton. His role involved conducting high-level discussions with several countries, prominently with top-ranking Chinese officials. In 2013, he assumed the position of vice-chairman at Kissinger Associates. Presently, he shares his knowledge as a lecturer at Yale University's School of Management.

Forecasting Trump's actions on any specific topic, including this one, proves challenging. However, it's important to mention that several legislative proposals in Congress are also targeting the abolition of PNTR, and their fate remains uncertain as well.

Instead, I suspect that Congress will pass some sort of law. The real question is – what will that be? If they decide to remove PNTR, or if Trump does, it will result in the US returning to the tariff rates that were applied to all Chinese goods prior to the 1990s.

Essentially, for a substantial portion of the mid to late 20th century, our import taxes on China were significantly higher than those imposed on most other nations. This scenario underwent a dramatic shift, with a marked reduction in tariffs once the PNTR was granted. Hence, if the PNTR were to be revoked, the US would revert to the previous tariff conditions.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s Digital Banks Weigh Potential for Physical Branches Following HKMA Rule Change

Digital banks in Hong Kong are contemplating opening physical branches following a modification in HKMA regulations. WeLab Bank, ZA Bank, and Mox Bank view in-person engagements as a beneficial enhancement, whereas Livi Bank doesn't perceive the necessity.

Several of the eight online banks in the city are considering establishing brick-and-mortar branches. This follows the Hong Kong Monetary Authority's (HKMA) decision to support such an expansion as part of its ongoing commitment to assist the growth of these lenders.

WeLab Bank, ZA Bank, and Mox Bank are contemplating the establishment of physical branches. Conversely, Livi Bank has confirmed that it has no intentions of opening such branches, according to individual responses to queries directed to them by the Post.

"Based on industry responses, the HKMA believes that allowing digital banks to operate using non-electronic methods, albeit to a limited extent, will bolster their transaction systems and boost client satisfaction," said a representative from the HKMA.

"The HKMA will diligently assess the reasoning and grounds while handling requests from digital banks to establish a brick-and-mortar location."

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Surge in Mainland Chinese Buyers Driving Hong Kong Housing Market in 2025: A Record-Breaking Year in Property Transactions

Analysts predict that Hong Kong's real estate market will remain popular with buyers from mainland China in 2025. In 2024, these buyers were responsible for 11,638 property transactions, marking a 90% surge from the previous year.

In 2024, their participation in primary and secondary real estate dealings amounted to 11,638, marking a 90 per cent surge compared to the previous year, as per data provided by Centaline Property Agency. The overall worth of these transactions escalated by 67 per cent, reaching HK$130.5 billion (US$16.7 billion), setting unprecedented levels for both indicators.

The last high point of property purchases in Hong Kong by individuals from the mainland came in 2010, when there were 10,079 deals on record. However, this only made up roughly 9 per cent of all transactions. In comparison, the number of transactions last year made up 24 per cent of total property deals.

In February 2023, Hong Kong eliminated the Buyer's Stamp Duty, previously levied on non-permanent residents, and also put a stop to the New Residential Stamp Duty for those buying a second home. Additionally, homeowners were granted relief from the Special Stamp Duty if they decided to sell within a two-year period. The authorities also eased the loan-to-value ratio to help homeowners manage their mortgage payments amidst rising interest rates.

The elimination of real estate restrictions, together with a more than 20% decrease in property prices from their highest point, and the government's launch of various strategies to attract skilled individuals and improve immigration processes, have increased the interest of mainland inhabitants in buying Hong Kong properties," stated Louis Chan Wing-kit, Chief Executive Officer of Centaline Property Agency.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI3 months ago

AI3 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevolutionizing the Road: Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Driving

-

Tech1 month ago

Tech1 month agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Sustainability and Safety on the Road

-

Tech1 month ago

Tech1 month agoDriving into the Future: Top Automotive Technology Innovations Transforming Vehicles and Road Safety

-

Tech3 months ago

Tech3 months agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road

-

Tech3 months ago

Tech3 months agoRevving Up the Future: How Top Automotive Technology Innovations are Accelerating Sustainability and Connectivity on the Road

-

Tech3 months ago

Tech3 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

Tech1 month ago

Tech1 month agoRevving Up Innovation: How Top Automotive Technology is Driving Us Towards a Sustainable and Connected Future