Hong Kong Sets Forth ‘Responsible’ AI Usage Rules with an Eye on Disruptive Technology: A Strategic Approach towards AI Governance

Hong Kong releases guidelines for 'ethical' application of AI to preempt potential disruption caused by this technology. The government stipulates that any organization intending to employ AI 'needs to establish a management plan to guide the deployment of these systems.'

"Blockchain and AI represent the cutting edge of financial technology innovation," declared Financial Secretary Paul Chan Mo-po at the start of FinTech Week. He emphasized that Hong Kong's finance sector is both open-minded and cautious when it comes to adopting AI, and stated they would keep a close eye on progress while learning from both domestic and international experiences. This is due to the ever-changing nature of the technology, he explained.

Kenneth Hui, who leads Hong Kong regulations at the global law firm Simmon Simmons, made this comment during a period of growing governmental legislation and control over AI. This includes the recent implementation of the European Union's AI Act and the release of guidelines by Singapore.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Record-Breaking December EV Sales in China: BYD, Nio, Xpeng, Li Auto, Leap, and Zeekr Benefit from Government Subsidy

Sales of electric vehicles (EVs) from BYD, Nio, Xpeng, Li Auto, Leap, and Zeekr skyrocketed in December due to a shopping frenzy in China. All these companies, including Leapmotor backed by Stellantis and Geely's Zeekr, reported record-breaking EV deliveries last month.

The incentive of 20,000 yuan (approximately US$2,740) for swapping gas-guzzling cars with electric vehicles, which represented about 10 to 20 percent of the cost of half of the electric vehicles on China's roads, was offered from July to December. This led to a flurry of eager customers securing deals before the close of the year, according to Zhao Zhen, a sales director at Wan Zhuo Auto, a dealership located in Shanghai.

In this manner, they can "take advantage of the grant", she pointed out, adding that the sales trend might not continue in 2025 due to the end of the grant. This is because economically careful Chinese buyers might avoid purchasing high-cost products in the face of a decelerating economy.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Intel Veteran Bai Peng Takes Reins as New President of China’s No.2 Chip Foundry, Hua Hong, Amid Management Reshuffle

Hua Hong, China's second largest chip foundry, appoints an ex-Intel stalwart as their new president

With more than three decades in the semiconductor manufacturing industry, Bai has served in leadership roles in numerous chip-making companies, including Intel.

The second-largest chip manufacturer in China, Hua Hong Semiconductor, has recruited a former veteran from Intel to be its new president during a recent restructuring of management.

Hua Hong Semiconductor, a chipset producer headquartered in Shanghai and known for its advanced node technology, announced via a stock filing on Thursday that they have appointed Intel's ex-global vice-president, Bai Peng, 62, as their new president under a three-year agreement. Bai is replacing Tang Junjun in the presidential role, however, Tang will continue as the chairman and executive director of the firm.

Bai boasts more than three decades of expertise in the field of semiconductor manufacturing and has served in high-ranking roles at several chip-producing companies, including the American powerhouse, Intel. Bai's educational journey began at the esteemed Peking University in China and he subsequently achieved his undergraduate degree in physics in 1985 from the University of Bucharest in Romania. His physics doctorate was granted by New York's Rensselaer Polytechnic Institute, as stated in his official biography.

Bai previously served as the CEO of Rong Semiconductor (Ningbo) Co, a company that produces image sensors, power management chips, and display drivers utilizing well-established node technology ranging from 28- to 180-nanometer. Prior to this, Bai held several roles at Intel, including process integration engineer, director of yield engineering, R&D director, vice-president, and finally global vice-president, as stated in the report.

Bai's induction comes shortly after Hua Hong initiated operations at a new facility in Wuxi, a city close to Shanghai in Jiangsu province. This comes on the heels of a decision by the state-owned Hua Hong Group, the parent company of Hua Hong Semiconductor, to name Qin Jian as the new chairman, taking over from Zhang Suxin, who held the position since 2016.

The reorganization of leadership occurs as China's chip-making sector confronts fresh challenges, amid the US initiating a commerce probe into China's manufacturing of traditional semiconductors – a significant area of concern for Hua Hong.

In the third quarter of 2024, the Hua Hong Group secured a position as the world's sixth largest global foundry, propelled by the needs of domestic chip design firms. Based on information from the Taiwanese IC research firm TrendForce, the Group's market share for the quarter stood at 2.2 per cent, a slight decrease from the 2.6 per cent it held during the equivalent period the previous year.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Debunking 2025 Market Forecasts: Unraveling 5 Prevailing Myths from US Stocks to China’s Growth

Perspective | From American shares to China's economic expansion, 5 misconceptions obscure the predictions for 2025

While there are predictions of a 10 per cent increase for the S&P 500 and a lagging China this year, crucial factors make these results complex.

Every legend carries a measure of truth within it. When expressing these, there's a chance that a portion of the legend may indeed be accurate.

Predictions for the market in the upcoming year will be influenced by unpredictable events, which ex-US defense secretary Donald Rumsfeld would describe as "unknown unknowns" – factors we can't anticipate yet still upset established trends. Therefore, I measure the accuracy of my 2024 predictions not in fixed terms, but in relation to how correct I was.

The top five misconceptions prevalent in the markets for 2025 are listed below.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China Records 21% Surge in Sovereign Investments, Dominated by Middle East Funds: A 2024 Global SWF Report

China experiences a 21% increase in government investments, primarily driven by Middle Eastern funds. According to Global SWF, $10.3 billion was invested in China by state-owned investors last year, with 62% of this amount originating from nations in the Persian Gulf.

China's significance in the portfolios of sovereign investors has increased, with a 21 percent annual surge in inflows in 2024, as per a monitor of approximately 750 globally owned state investors.

The globe's second biggest economy drew in $10.3 billion from investments managed by central banks, sovereign wealth funds, and public pension funds. This is an increase from the $8.5 billion in 2023, as reported by Global SWF. The surge in investments can be attributed to the improving relationship between China and the Middle East, as well as the amplified diversification objectives among investors.

"China is becoming increasingly significant to sovereign investors due to their desire to broaden their portfolios beyond developed markets," shared Diego López, the creator and chief executive of the data platform, with the Post on Thursday. "We anticipate this pattern to persist in both equity capital markets and private investments."

Last year, Persian Gulf countries, such as Saudi Arabia's Public Investment Fund (PIF), Abu Dhabi's Mubadala and Investment Authority (ADIA), and the Qatar Investment Authority (QIA), were responsible for 62% of the total investments made by sovereign wealth funds in China. Meanwhile, Singapore, including entities like Temasek and GIC, contributed to 24% of these investments.

The investors showed interest in sectors such as real estate, financial services, and technology, to name a few.

"The two agreements came about due to sell-offs that occurred in the midst of China's property market crisis. This situation led to a significant increase in borrowing expenses and triggered Beijing's strict regulation of the real estate industry," stated Global SWF in a Wednesday report.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s Increasing Appetite for Catastrophe Bonds: Taiping Re Joins as Sixth Issuer, Total Issuance Reaches US$748 Million

The demand for catastrophe bonds in Hong Kong is increasing, with Taiping Re emerging as the sixth issuer. The most recent transaction has raised Hong Kong's total issuance to US$748 million since the inception of insurance-linked securities in 2021.

Hong Kong investors are demonstrating increased interest in catastrophe bonds after the most recent issuance by Taiping Reinsurance. This is the city's sixth offering of insurance-linked securities since the inception of the regulatory system in 2021.

Taiping Re has successfully garnered $35 million from private investors via a specially designed entity known as Silk Road Re, as per an official announcement. In this deal, Silk Road Re is set to offer Taiping Re protection for several years against the risk of earthquakes in mainland China and specific windstorm threats in the United States.

Asia's first three-year bond, which includes two types of risks and two payout triggers, has been oversubscribed and priced at the lower spectrum of the unspecified indicative offer price range, according to the reinsurer. The five transactions prior to this only included coverage for a single nation and one class of natural calamity.

The issuance of bonds has successfully provided the firm with a varied approach to managing risks related to potential disasters, stated CEO Yu Xiaodong. He also noted that it fosters the linkage between the insurance sector and the capital market.

Disaster bonds, often referred to as cat bonds, are insurance-related securities utilized by insurance companies to shift severe risks to bond investors. Ever since China Reinsurance (Group) launched the first of these bonds in October 2021, the total amount has grown to $748 million. King & Wood Mallesons delivered legal counsel for all the transactions.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Apple Slashes Prices on iPhones in China Amidst Rising Huawei Competition: Short-term Promotions and Steeper Discounts on Other Products Announced

Apple is introducing new price reductions on iPhones in China due to intensified rivalry with Huawei. From January 4th to 7th, there will be a promotion that gives Chinese buyers a $68 price drop on the premium iPhone 16 Pro models.

A discount of 400 yuan will be provided for the standard iPhone 16 and iPhone 16 Plus models. Previous versions, such as the iPhone 15 and iPhone 14 series, will receive a reduction of up to 300 yuan.

The MacBook Air will have significant price reductions of up to 800 yuan. Additionally, the company's website indicates that there will be slight price decreases for iPads, Apple Watches, AirPods, and Apple Pencils.

The reductions in price will also be available at the company's physical Apple Stores, however, the promotional items will be restricted in numbers, with just 29,300 discounted iPhones on offer.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Hong Kong’s Struggle for Gender Diversity: 85 Listed Companies Fail to Meet Women-on-Board Deadline

85 companies listed in Hong Kong fail to meet the deadline for including women in their boards

HKEX data indicates that the percentage of firms with only male boards has dropped from 40 per cent to 3 per cent since the rule was initially introduced in 2022.

The proportion of firms with exclusively male boards has dropped from 40 per cent to 3 per cent since the rule was first implemented in 2022, as per HKEX data.

According to the operator of Hong Kong's stock exchange, 85 companies listed in Hong Kong have not adhered to the regulation necessitating the presence of at least one female in their board of directors.

Approximately 3% of the 2,650 companies listed on the exchange do not have any female representation on their boards, as per data from HKEX. Additionally, over 40% of these listed companies have more than a single female board member.

"2025 represents a significant turning point for companies listed in Hong Kong, as boards consisting of only one gender are no longer permitted on HKEX's markets," stated Katherine Ng, the head of listing at HKEX. "Our community of listed issuers has largely welcomed this new era, leading to the creation of hundreds of positions for women directors. However, we believe this is merely the start."

Out of the 85 firms that failed to comply, merely 12 did not have any female board members throughout the three-year transition period. The remaining companies initially had women in these positions, who subsequently resigned.

The majority of firms which did not fulfill the requisite communicated through stock-exchange documents to clarify the circumstances. Many have suggested their intentions to incorporate a female member into their board of directors in a timeframe of three to six months.

TravelSky Technology, China Railway Signal & Communication, and Century Sunshine Group are some of the publicly traded firms that are not meeting compliance standards.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s Drive Towards Tech Self-Reliance: Kingsoft’s WPS Surpasses Microsoft Office with 100 Million Daily Users

China's competitor to Microsoft Office, Kingsoft Office's WPS, hits 100 million daily users in the midst of push for independence

Even with the widespread use of Microsoft Office, WPS from Kingsoft Office has gained increased usage in key industries within China.

China's initiative to substitute foreign hardware and software with homegrown versions has reached a significant marker with WPS Office. This domestic alternative to Microsoft Office, which has been in existence for a long time, has now garnered 100 million daily active users.

Kingsoft Office Software, the developer behind WPS, boasts that its desktop version, which is touted as being extremely compatible with Microsoft Word, Excel, and PowerPoint, is used by over 100 million devices in China daily, as per a Monday post.

Microsoft Office continues to be widely utilized in China. However, as the capital city Beijing's worries about cybersecurity intensify due to disputes with Washington, WPS is gaining more traction, particularly in critical areas like government, finance, and telecommunications.

WPS, a Chinese-language word-processing system developed in China, was introduced in 1988, five years subsequent to Microsoft's launch of Word. Microsoft didn't begin operations in China until 1992, which gave WPS a considerable amount of time to build a dedicated user base.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China Accelerates Nuclear Power Ambitions: Major New Hualong One Reactor Begins Large-Scale Operation

China's push for nuclear power is gaining momentum as a significant new reactor starts operating. The initiative in Fujian province represents the inaugural large-scale commercial use of China's third-generation Hualong One reactor.

China's quickly growing nuclear power sector achieved a significant landmark on the first day of the year, with the inaugural reactor at a vast new facility on the nation's southeastern shore beginning to supply power to the national network.

This is the inaugural instance of a Hualong One, China's third-generation nuclear reactor, being deployed for widespread commercial use, says its creator. This step intensifies China's drive to become a dominant force in the nuclear energy arena.

The Zhangzhou facility in the Fujian province is slated to be China's biggest nuclear plant employing third-generation tech. It is planned to house six reactors, each with a potential output exceeding a million kilowatts.

The initial reactor at the facility cleared safety checks and commenced operations on the first day of January, with four more presently being built.

In recent times, China has been heavily investing in the advancement of its nuclear power facilities. This move is largely driven by China's goal to lessen its dependence on overseas technology, while simultaneously increasing its capacity for green energy.

Every single reactor has the capacity to reduce China's yearly coal usage by 3.12 million tons, which translates to a decrease of 8.16 million tons in carbon dioxide emissions annually.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

Exponential Boom in AI Apps Predicted by Baidu Founder, Robin Li: Anticipates Investments to Bear Fruit in 2025

Robin Li, the founder of Baidu, forecasts a dramatic surge in AI applications by 2025. The CEO anticipates that Baidu's investments in AI will begin to yield profits this year, as mentioned in his New Year's message to the team.

Robin Li Yanhong, CEO of China's leading search engine company, Baidu, conveyed in a New Year's message to his employees on Wednesday that the company's investments in Artificial Intelligence are predicted to yield profits this year.

"AI technologies that can create new content, driven by base models, are swiftly being implemented in different sectors and situations," he stated in a document of 1,200 words. "While no 'ultimate application' has been developed yet, the rate of AI adoption is not minimal and we should anticipate a surge in growth by 2025."

We are hopeful that the seeds sown in 2023 and 2024 will germinate, bloom, and yield results in 2025 as the market begins to appreciate and recognize their value more," stated the letter, which referred to "AI" on 11 occasions.

Baidu, despite being a pioneer in China's AI industry, is up against stiff rivalry from numerous large tech firms and emerging businesses pushing their own LLMs. Li has previously expressed concern over the surplus of LLMs in China, urging tech heads to concentrate on developing AI-driven applications.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

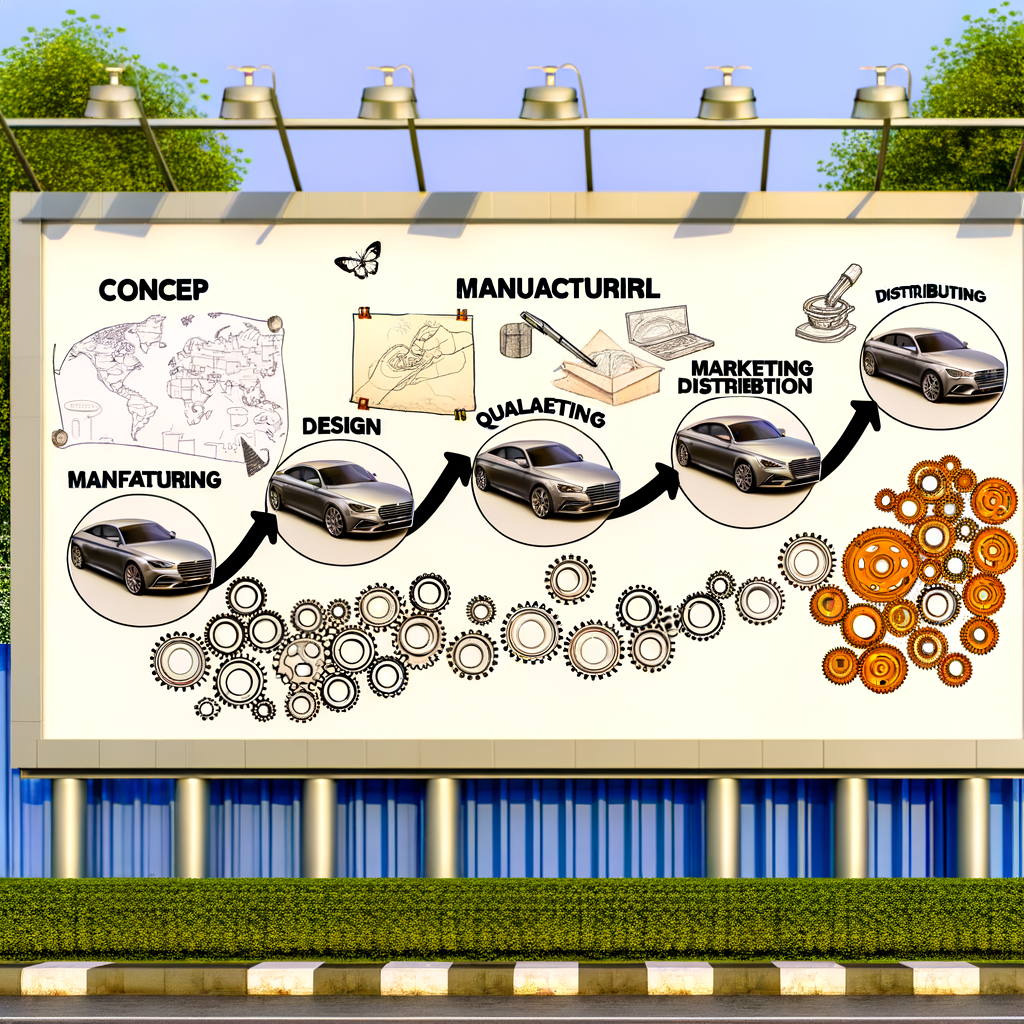

Driving Forward: Mastering Market Trends and Innovations for Success in the Automobile Industry

The Automobile Industry is witnessing transformative trends across Vehicle Manufacturing, Automotive Sales, Aftermarket Parts, Car Dealerships, and Vehicle Maintenance. Driven by top market trends, consumer preferences for sustainability, and regulatory compliance demands, businesses are leveraging Automotive Technology and digital platforms to enhance customer experiences and improve operations. Supply Chain Management and strategic Automotive Marketing are crucial for navigating challenges and seizing opportunities in automotive repair, car rental services, and sales. Industry Innovation, adapting to electric vehicle demands, and prioritizing customer satisfaction through service excellence are essential strategies for success in the competitive landscape.

In the fast-paced world of the automobile industry, where vehicle manufacturing, automotive sales, aftermarket parts, and car dealerships constitute the backbone of transportation and mobility, staying ahead of the curve is not just an option—it's a necessity. The automotive business, encompassing a wide array of services including vehicle maintenance, automotive repair, and car rental services, plays an indispensable role in meeting the diverse needs of consumers and businesses alike. As this sector drives forward, propelled by automotive technology, market trends, consumer preferences, and regulatory compliance, understanding the dynamics at play becomes crucial for anyone looking to navigate or excel in this competitive landscape.

This article delves into the heart of the automobile industry, shedding light on the top trends and innovations steering the future of vehicle manufacturing and related services. From the latest in industry innovation to the strategies that ensure success in automotive marketing, supply chain management, and customer satisfaction, we explore the key components that businesses must master to thrive. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry" offers a comprehensive look at what's shaping the future of mobility, while "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Service Excellence" provides actionable insights for businesses aiming to boost their performance in automotive sales, leverage aftermarket opportunities, and elevate the quality of vehicle maintenance and repair services.

Join us as we embark on a journey through the evolving landscape of the automotive sector, where the integration of cutting-edge technologies and strategic foresight is driving success in one of the world's most dynamic and vital industries. Whether you're involved in vehicle manufacturing, run a car dealership, supply aftermarket parts, or offer automotive repair services, this article is your guide to understanding and capitalizing on the opportunities that lie ahead in the automotive market.

- 1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

- 2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Service Excellence"

1. "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry"

In the ever-evolving landscape of the automobile industry, navigating the road ahead requires a keen understanding of the top trends and innovations shaping its future. From vehicle manufacturing to automotive sales, and from aftermarket parts to car dealerships, every facet of the industry is undergoing transformation. This transformation is driven by advancements in automotive technology, shifts in consumer preferences, and the need for regulatory compliance, all of which are redefining the way businesses operate within this dynamic sector.

One of the most significant trends in the automobile industry is the shift towards electric vehicles (EVs). As global emphasis on sustainability intensifies, vehicle manufacturers are investing heavily in EV technology, leading to a surge in the production and sales of electric cars. This shift not only reflects changing consumer preferences but also aligns with regulatory mandates aimed at reducing carbon emissions. Consequently, automotive sales channels are evolving, with car dealerships increasingly showcasing electric and hybrid models to meet market demand.

In the realm of aftermarket parts and vehicle maintenance, there's a growing trend towards the use of advanced diagnostics and telematics technology. These innovations enable automotive repair services to offer more precise and efficient troubleshooting, enhancing overall customer satisfaction. Additionally, the integration of digital platforms in car rental services and automotive sales processes is streamlining operations and improving the consumer experience, from vehicle selection to final purchase and maintenance scheduling.

Another key area of focus is supply chain management, especially in the wake of recent global disruptions. Automotive businesses are reevaluating their supply chains to ensure resilience and continuity. This involves diversifying sources for critical components, adopting just-in-time manufacturing practices, and leveraging technology to enhance supply chain visibility. Such measures are essential for maintaining steady vehicle manufacturing rates and ensuring the timely availability of aftermarket parts.

Automotive marketing is also witnessing a transformation, with a shift towards digital channels and personalized advertising strategies. Businesses are leveraging data analytics to understand consumer preferences and tailor their offerings accordingly. Social media platforms and digital showrooms are becoming increasingly important in engaging potential customers, showcasing industry innovation, and driving automotive sales.

Furthermore, the push for regulatory compliance continues to shape the automotive landscape. Vehicle manufacturers and automotive repair services alike must adhere to stringent standards regarding safety, emissions, and data security. Compliance not only mitigates legal risks but also reinforces consumer trust in automotive brands.

In conclusion, the automobile industry is at a pivotal juncture, with top trends and innovations such as EV technology, digital transformation, robust supply chain management, and strategic automotive marketing guiding its path forward. Businesses that adapt to these trends, prioritize customer satisfaction, and embrace industry innovation are well-positioned to navigate the challenges and opportunities that lie ahead.

2. "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Service Excellence"

In the fast-paced world of the automobile industry, businesses are constantly exploring strategies to drive success in automotive sales, aftermarket parts, and service excellence. The key to thriving in vehicle manufacturing, sales, and maintenance lies in understanding and leveraging the latest market trends, consumer preferences, and technological advancements. Here, we delve into effective strategies that top industry players are adopting to stay ahead in the competitive automotive sector.

Firstly, automotive sales have witnessed a significant transformation, thanks primarily to the integration of advanced automotive technology and innovative automotive marketing strategies. Car dealerships are now focusing on creating a seamless customer experience, combining online platforms with traditional in-person sales. This approach not only caters to the digital-savvy consumer but also aligns with the current demand for convenience and efficiency. Additionally, understanding consumer preferences has become crucial. Dealerships that offer personalized solutions and flexible financing options see higher sales conversions, proving the importance of customer-centric strategies in boosting automotive sales.

The aftermarket parts segment of the automobile industry is another area ripe with opportunities for growth. Success in this domain requires a robust supply chain management system and a keen eye on industry innovation. Businesses that can quickly adapt to new automotive technologies and offer a wide range of quality aftermarket parts at competitive prices are more likely to capture market share. Furthermore, regulatory compliance plays a significant role. Companies that stay ahead of regulations and offer parts that meet or exceed standards can gain a competitive edge, building trust with consumers and professionals in automotive repair.

When it comes to vehicle maintenance and automotive repair, service excellence is paramount. The top automotive businesses invest in continuous training for their technicians to ensure they are up-to-date with the latest automotive technology and repair techniques. Moreover, transparency in service operations and clear communication with customers about the repair process and costs can significantly enhance customer satisfaction. Implementing customer feedback loops to continually improve service offerings is another strategy that leading businesses use to maintain high standards of service excellence.

Finally, the car rental services sector is leveraging industry innovation to enhance operational efficiency and customer experience. From streamlined online booking systems to offering a diverse fleet of vehicles that meet various consumer needs, car rental services are revamping their business models. Incorporating automotive technology, such as telematics, allows these businesses to offer personalized customer experiences, improve vehicle maintenance, and manage their fleets more effectively.

In conclusion, success in the automobile industry, be it in automotive sales, aftermarket parts, or service excellence, hinges on a business's ability to adapt to evolving market demands, embrace industry innovation, and maintain a steadfast commitment to customer satisfaction. With the right strategies in place, businesses can rev up their success and navigate the dynamic automotive market with confidence.

In conclusion, the journey through the automotive industry landscape reveals a path marked by innovation, strategic business practices, and an unwavering commitment to meeting the evolving needs of consumers. The sections on "Navigating the Road Ahead: Top Trends and Innovations in the Automobile Industry" and "Revving Up Success: Strategies for Automotive Sales, Aftermarket Parts, and Service Excellence" underscore the importance of staying abreast of top market trends, emerging automotive technology, and shifting consumer preferences. As vehicle manufacturing continues to evolve with advancements in automotive technology, businesses in the automobile industry—from car dealerships and automotive repair shops to aftermarket parts suppliers and car rental services—must leverage effective automotive marketing strategies and supply chain management to drive success.

Moreover, industry innovation, coupled with a deep understanding of automotive sales dynamics and a dedication to quality in vehicle maintenance and automotive repair, will be crucial for businesses aiming to thrive. Regulatory compliance also remains a key factor, ensuring that operations align with current standards and practices within the automotive sector. As the landscape of vehicle manufacturing and the broader automotive market continue to shift, businesses that prioritize customer satisfaction, adaptability, and a forward-looking approach to industry innovation will navigate the road ahead with confidence. Whether it's through enhancing automotive sales, optimizing car dealerships operations, or elevating the standards of aftermarket parts and vehicle maintenance services, success in this competitive and dynamic market demands excellence, innovation, and a keen eye on the future of automotive technology and consumer needs.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

Business

China’s Short Video Market Hits Plateau: User Numbers Decline for the First Time Amid Slowing Growth

China's brief video market could have reached its peak as the overall user count drops for the first time. The short video application user base in China hit 1.05 billion by the end of June, marking a decrease of approximately 300 million compared to December 2023.

However, the yearly user growth rate decreased from 19 per cent to 4 per cent within the same timeframe.

"Whether the user numbers in the market decline or keep increasing, the main takeaway is that the industry has reached a sizable scale and it's inevitable that overall growth will decelerate for everyone involved," stated Ma Shicong, a market analysis expert at the research company, Analysys.

Two seventeen

Performers on China's Douyin platform are live streaming outdoors at night to secure more generous tips.

Data from Analysys revealed that the count of short video consumers in the mainland slightly increased to 1.059 billion by the end of November.

Discover more from Automobilnews News - The first AI News Portal world wide

Subscribe to get the latest posts sent to your email.

-

AI2 months ago

AI2 months agoNews Giants Wage Legal Battle Against AI Startup Perplexity for ‘Hallucinating’ Fake News Content

-

Tech2 months ago

Tech2 months agoRevving Up Innovation: Exploring Top Automotive Technology Trends in Electric Mobility and Autonomous Driving

-

Tech3 months ago

Tech3 months agoRevving Up the Future: How Top Automotive Technology Innovations are Accelerating Sustainability and Connectivity on the Road

-

Tech3 months ago

Tech3 months agoRevving Up Innovation: How Top Automotive Technology is Shaping an Electrified, Autonomous, and Connected Future on the Road

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology Innovations Are Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoRevving Up the Future: How Top Automotive Technology is Paving the Way for Electric Mobility and Self-Driving Cars

-

Tech2 months ago

Tech2 months agoDriving into the Future: The Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Revolution

-

Tech1 month ago

Tech1 month agoRevolutionizing the Road: Top Automotive Technology Innovations Fueling Electric Mobility and Autonomous Driving